Summary:

- LLY has delivered top/ bottom line beats in the FQ4’23 earnings call, while delivering impressive FY2024 guidance and reporting promising updates to its pipeline.

- Most notably, we expect its obesity candidates/ therapies to be its long-term top/bottom line drivers, with the next-gen Retatrutide already delivering nearly doubled weight loss than Zepbound and NVO’s CagriSema.

- However, the growing exuberance embedded in LLY’s stock valuations and sustained hype by market analysts have already propelled the stock to dangerous levels, one unseen before in the pharmaceutical industry.

- Readers beware. The potential crash and burn may be very painful indeed, with investors advised to size their portfolios according to their risk appetite.

MicroStockHub

We previously covered Eli Lilly and Company (NYSE:LLY) in October 2023, discussing its robust pipeline, with the diabetes/ obesity drugs likely to outperform AbbVie Inc.’s (ABBV) Humira with FY2022 global revenues of $21.23B and Merck & Co., Inc.’s (MRK) Keytruda worth $20.93B.

However, these had also contributed to its premium valuations and inflated prices, with the stock’s exponential momentum nearing its peak optimism levels, resulting in our reiterated Hold (Neutral) rating.

In this article, it is apparent that we have missed LLY’s upward momentum, with the stock further rallying by +35.28% over the past few months, thanks to its promising pipeline, upbeat FQ4’23 earnings, and impressive FY2024 guidance.

Even so, we maintain our view that there is a minimal margin of safety at these levels, with the optimism surrounding its prospects already nearing fever pitch and its stock valuations at dangerous levels, one rarely seen in the pharmaceutical sector.

We shall further discuss why we are reiterating our Hold rating here, with investors advised to size their portfolios according to their risk appetite, also known as, taking some profits now.

The LLY Investment Thesis Remains Overly Lofty Here

For now, LLY has delivered an excellent FQ4’23 earnings call, with revenues of $9.35B (-1.4% QoQ/ +28.1% YoY) and adj EPS of $2.49 (not comparable QoQ due to multiple write-downs/ +19.1% YoY), with FY2023 bringing forth revenues of $34.12B (+19.6% YoY) and adj EPS of $6.32 (-20.4% YoY).

Much of its tailwinds are attributed to the robust demand for its diabetes/ obesity offerings, namely Mounjaro with revenues of $2.2B (+56.1% QoQ/ +89.9% YoY) and Zepbound at $175.8M despite the recent US FDA approval in November 2023.

With Mounjaro rapidly being its topline driver comprising 24% (+9.2 points QoQ/ +20.2 YoY) of its sales, it is unsurprising that LLY offers an optimistic FY2024 guidance with revenues of $41B (+20.1% YoY), gross margins of 32% (+0.3 points YoY), and adj EPS of $12.45 (+96.9% YoY).

This is thanks to the robust demand for its diabetes/ weight loss therapies and the slight easing in supply availability, with 2025 likely to bring forth expanded manufacturing capacity attributed to the management’s increased capex thus far.

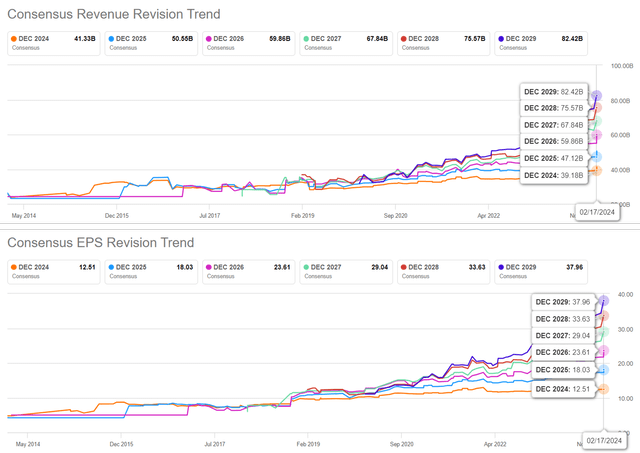

The Consensus Forward Estimates

The promising FQ4’23 results and higher FY2024 guidance have directly contributed to LLY’s raised consensus forward estimates, with a top/ bottom line CAGR of +20.6%/ +55.2% through FY2026.

This is compared to the previous estimates of +11.6%/ +42% and historical growth of +7%/ +8.7% between FY2016 and FY2023, respectively.

With some already projecting an ambitious $70B in Zepbound sales by 2030, expanding at an accelerated CAGR of +69.2% from FY2023 levels of $175.8M, it is unsurprising that LLY has been touted as a candidate to be the first ever trillion dollar drug company.

This is attributed to Zepbound being able to deliver a weight loss of up to -15% by week 72 and up to -20.9% at the highest dosing.

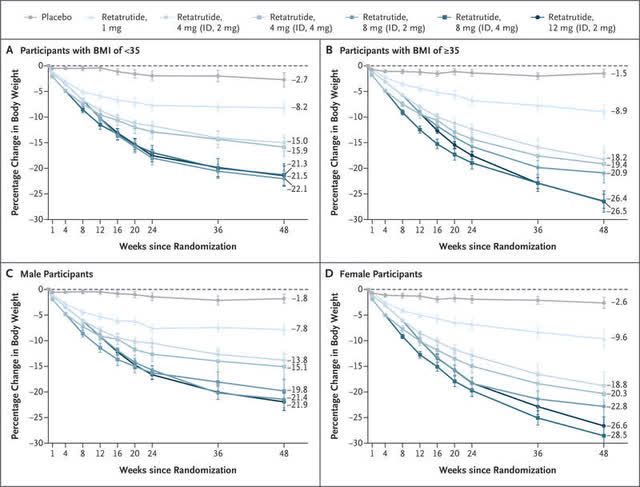

Retatrutide Clinical Phase 2 Trial Result

The New England Journal of Medicine

The ambitious projection is also attributed to LLY’s robust pipeline, with the company already announcing exemplary Clinical Phase 2 results for its next-gen Incretins (gut-derived peptide hormones that are rapidly secreted in response to a meal, including GLP-1), Retatrutide.

The obesity/ cardiovascular candidate has recorded excellent weight loss of up to -17.3% in the 8-mg group/ -17.5% in the 12-mg group by week 24 and up to -23.9% in the 8-mg group/ -30% in the 12-mg group by week 48.

With the weekly injectable Retatrutide already advancing to Clinical Phase 3 Trials and first results expected by 2025, it is unsurprising that market analysts are increasingly optimistic about LLY’s long-term prospects, assuming a similar Accelerated US FDA Approval Program as Zepbound.

This is especially since Retatrutide’s early results have proven that it may easily trump over Novo Nordisk A/S’s (NVO) next-gen obesity candidate, CagriSema, with the latter only recording a weight loss of up to -15.6% by week 32 of treatment in the phase 2 clinical trials.

Combined with the Pfizer Inc. (PFE) CEO’s projection in the obesity TAM of $150B by the end of the decade, expanding at an accelerated CAGR of +58.1%, it appears that LLY remains well positioned for immense growth, for so long that supply can match demand.

So, Is LLY Stock A Buy, Sell, or Hold?

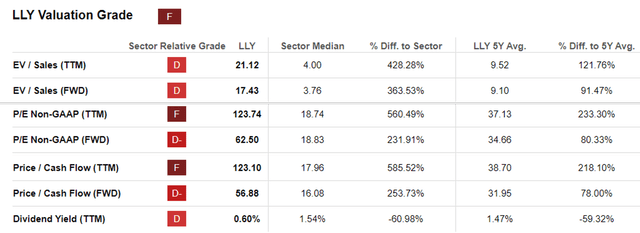

LLY Valuations

As a result of the promising prospects and the management’s impressive FY2024 guidance, the market has awarded LLY with an immense growth premium at an FWD P/E valuation of 62.50x and Price/ Cash Flow valuation of 56.58x.

This is compared to its 1Y mean of 49.88x/ 84.20x, 3Y pre-pandemic mean of 18.98x/ 19.40x, NVO at 37.50x/ 40.60x, and the sector median of 18.83x/ 16.08x, respectively.

However, we are skeptical of how sustainable LLY’s premium valuations may be.

For context, the world’s two most profitable drugs, Humira at $21.23B and Keytruda at $25B at their peak sales, came from ABBV and MRK, respectively. Even so, these two stocks only traded at peak FWD P/E valuations of 17.82x and 18.69x, respectively.

This historical trend effectively places LLY’s and NVO’s currently inflated valuations at dangerous levels, one rarely seen in the pharmaceutical sector.

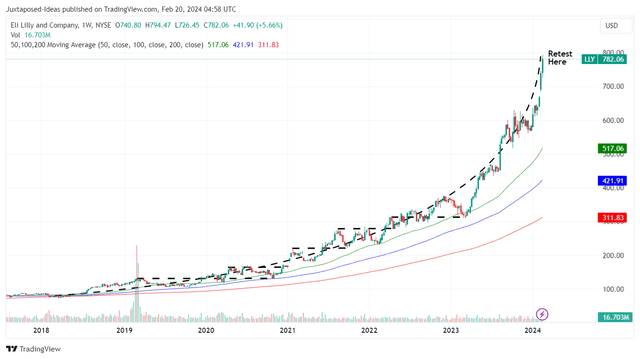

LLY 5Y Stock Price

For now, LLY has already charted new heights beyond reasonable levels, with the stock trading way above our fair value estimates of $395 at an immense premium of +97.9%, based on the LTM adj EPS of $6.32 and FWD P/E valuations of 62.50x.

At the same time, it appears that the stock has also pulled forward part of its upside potential to our intermediate-term price target of $1,126.80, based on the FY2025 adj EPS of $18.03.

Naturally, this is assuming that LLY is able to sustain the eye-watering growth premium embedded in its stock valuations, with that price target firmly placing it above the trillion mark.

Author’s Historical Rating On LLY

While it is apparent that LLY is one that got away, with us missing out on the +66.77% rally since our first coverage in July 2023 here, as opposed to the wider market (SPY) at +8.64%, we are not usually one to chase a rally at dangerous levels.

As a result of the potential volatility, we believe that it may be more prudent to maintain our previous Hold (Neutral) rating while looking for other more reasonably priced stocks.

While some analysts continue to reiterate their Buy rating for LLY, the stock needs to experience a deep pullback for anyone looking to add, due to the minimal margin of safety at current levels.

Do not chase this rally.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.