Summary:

- Eli Lilly’s weight loss treatment Zepbound might be a blockbuster in the making, but it wasn’t without its challenges.

- The company faced criticism for high prices, supply blockages and the rise of counterfeits. It has now addressed all these concerns.

- Zepbound’s price cuts can make at least some customers happy, its latest packaging allows for bigger supplies, and the online portal can reduce the use of non-prescription medication.

- All of this, while it upgraded its guidance earlier in the year. While its P/E is still rather high, the latest moves encourage faith in it over a longer time.

Michael Vi

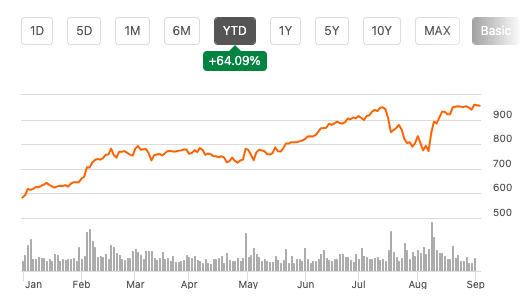

Since I last wrote about the weight management treatments provider Eli Lilly (NYSE:LLY) in June, its price has inched up by another 5.3%. This isn’t one bit surprising, even as the stock pulled back in early August before returning to its upward trajectory (see chart below).

But make no mistake, the continued rise is despite significant recent developments. Namely, price cuts for the weight management drug Zepbound. Here, I discuss what this means for the company and the stock.

Price Chart (Source: Seeking Alpha)

Zepbound price cuts

Zepbound showed much promise in garnering revenues from the word go, since its launch late last year. And that has borne out. As of the second quarter (Q2 2024), it brought in 11% of Eli Lilly’s revenues, up from 6% in Q1 2024, indicating the significant market for weight loss treatments.

The criticism

But this success hasn’t come without criticism, and from no less than President Biden. He called out both Eli Lilly and its main competitor, Novo Nordisk (NVO) a few months ago, for “unconscionably high prices” in an opinion piece for USA Today, along with Senator Bernie Sanders.

As a background, the company has seen a significant jump in operating margin recently. The figure was at 39.1% in Q2 2024, a big rise from even the 31.2% in Q1 2024. But it’s even more so from the 28.1% in Q2, 2023. With Zepbound being the fast-growing treatment, it can be speculated that at least some contribution to margin expansion comes from it.

The action

Two months after it got the rap, Zepbound prices were slashed for the 2.5mg and 5mg single doses (the doses go up to 15mg) to almost half their earlier levels. Eli Lilly also points out that the treatment is now priced at 50% below rival products. It has managed to reduce prices by replacing the injectable pen for a vial that comes sans an injecting device, with patients free to buy their own syringes.

The impacts

The move has once again elicited a response from President Biden, who called it a “welcome first step”. But it does more than just win approval, it can also reduce the risk from counterfeit and non-prescription usage, something Eli Lilly had expressed concern over in an open letter in June.

Not only do the reduced prices make it more accessible, but with Zepbound is available for self-pay customers online through LillyDirect, further helping in countering the sales of fakes. Further, it will help in easing the treatment’s supply shortage. As it happens, the fill and finish aspect of injectable pens is time-consuming. By allowing patients to get their own syringes, Zepbound can become more readily available.

Can price cuts impact earnings?

So far, so good. However, the question arises as to whether the price cuts can have an adverse earnings impact. Here are three points to consider in this regard:

- Zepbound is available in six doses ranging between 2.5mg and 15mg, with each succeeding dose 2.5mg stronger than the previous one. As noted earlier, the price cuts are only for the lowest two doses. How much the price cuts affect revenues depends on their contribution to total revenues from the treatments.

- The price cuts are only for self-paying patients. It turns out, that for some patients on health insurance, the price has actually increased by over 10%. So, besides the contribution of the lowest two doses, the revenues garnered from different groups of patients matters too in determining the earning impact.

- Finally, there’s also the cost benefit from replacing injection pens with vials, that might protect the margins anyway.

Essentially, it’s likely that so far, lower prices might not have a significant earnings impact.

Upgraded guidance

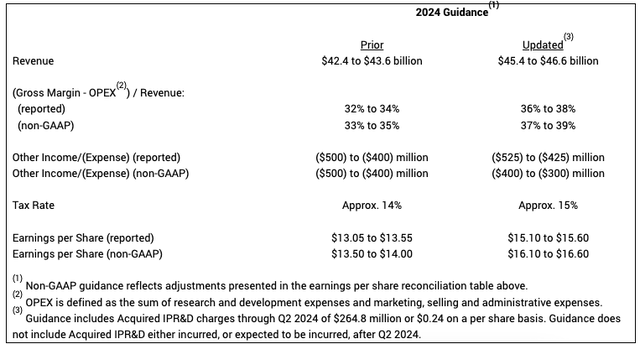

This is also borne out by an upgrade in Eli Lilly’s latest guidance, for both revenue and income (see table below), following a 36% year-on-year (YoY) increase in revenues in Q2 2024 and a whole 86% YoY rise in non-GAAP earnings per share [EPS].

At the midpoint of the guidance range, it now expects a ~35% revenue growth for 2024, compared to the earlier 26.1%. Interestingly, it actually expects a slightly higher operating income margin from earlier, which ties in with the earlier point on its expanding margin.

With the latest expectation of 37% reported operating margin at the midpoint proves that even with the price cuts, the company expects to show robust numbers going forward as well. It does need to be mentioned, though, that the Q2 2024 results were released prior to the price cuts, so whether these forecasts take them into account remains to be seen.

Further, it now expects a 2.6x YoY increase at the midpoint of the guidance in both reported and non-GAAP EPS now, from the earlier 2.3x YoY expected rise in reported EPS and 2.2x YoY rise in non-GAAP EPS.

What next?

With this upgrade, LLY’s forward non-GAAP price-to-earnings (P/E) ratio is now at 60x, which is actually lower than the 67.8x level it was at the last I checked. It’s still significantly higher than the five-year average of 39.1x, to be sure, but with Zepbound and Mounjaro, its diabetes treatments as its winning tickets, LLY’s prospects can offer some justification for the premium.

It’s not just the treatments, though, but also its business management that works in its favour right now. Eli Lilly has found a solution to lower Zepbound’s prices without necessarily impacting margins, while also reducing the potential usage of counterfeit treatments with sales through LillyDirect. As a result, it has gained approval from the US government, addressed its earlier concern about the rise of non-prescription usage as well as supply blockages for the treatment and has at least some patients have happier wallets now.

All this, even as it upgraded its earnings forecast earlier in August. Whether the price cuts will impact these projections remains to be seen, though it appears unlikely, especially since the cuts are restricted to limited doses and only to some patients. All in all, the Eli Lilly story has improved in more ways than one in the past couple of months. I’m retaining a Buy rating on the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in LLY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—