Summary:

- Storage is growing faster than autos.

- The total addressable market for storage is greater than that for autos.

- In the short term, auto growth should continue to make Tesla, Inc. a Buy until energy storage revenues fully ramp up.

- New announcement of “Megapack” factory in China is a game changer for Tesla.

Xiaolu Chu

My article in February detailed the ways in which energy storage is opening up huge new revenue streams for Tesla, Inc. (NASDAQ:TSLA). The growth in production and sales is continuing apace in 2023. The total market is growing strongly.

The company itself has given little publicity to this. We see a lot of talk about the growth potential for autos, for insurance, for “Optimus,” for “Dojo,” and so on. Energy storage has been low profile.

This may have just changed. The new announcement on Twitter over the Easter weekend confirmed the construction of a new megafactory in China. This provides the means for energy storage almost to match autos in revenue for the company. The event is illustrated below:

It is expected that the facility will be up to full production at the start of 2024 and supply customers worldwide.

Energy Storage Numbers

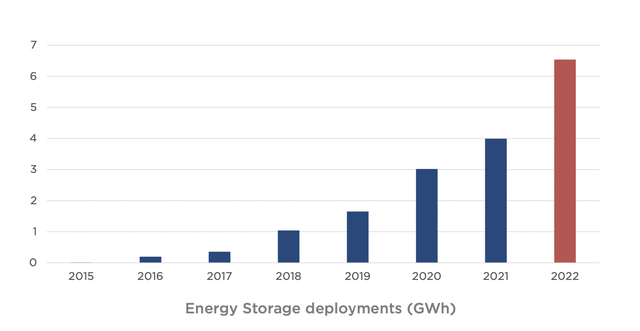

As my previous article detailed, auto revenue increased 40% in 2022. That strong growth has continued into 2023. Energy storage, however, increased 64% in 2022, and its strong growth continues even more strongly in 2023.

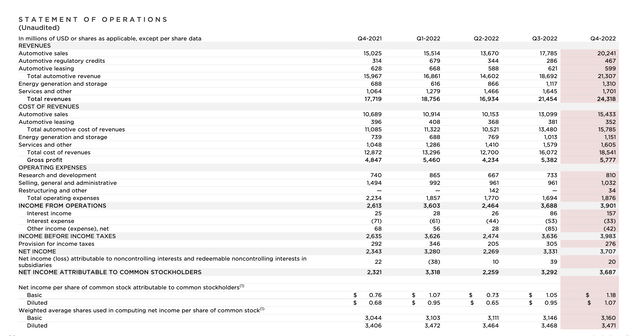

As per the numbers from Tesla’s Q4 report, the 4th quarter saw an increase in the imbalance. Auto revenues increased by 35% to $20.24 billion. Energy storage revenues increased 90% to $1.31 billion. The financial statement below illustrates this:

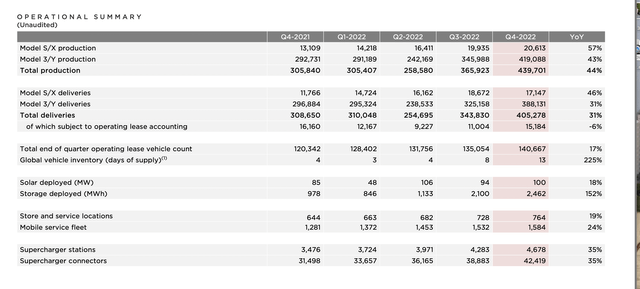

On a quarter-to-quarter comparison in Q4 2022, storage deployed increased by 152%, as illustrated below.

In comparison, autos delivered increased 31%.

On a full-year basis, storage deployed rose 64% to 6,541 MWh (total auto deliveries increased 40%).

The history of storage deployments from the same report was illustrated as follows:

As my January article detailed, revenue from storage this year, on current trends and manufacturing capacity, should come out to $19 billion for Megapacks and $3 billion for Powerwalls. This is just the supply value. It does not take into account continuing software service revenues from “Powerhub” building up from previously completed projects. Storage revenue of $22 billion would contrast with Tesla’s auto revenue in 2022 of about $62 billion.

It appears the residential Powerwall product is really taking off this year as well as the Megapack. Previously the company had restricted its supply in combination with solar panels and solar roofs. This was due to restricted supply and very long lead-times. However this year they have launched “Powerwall Direct” for supply of the Powerwall alone.

This residential product is not really a solely residential application product. As with the massive project encompassing 50,000 homes they are setting up in Australia, this can turn customers in their combinations of houses into being part of their own distributed utility.

This will in time be reinforced by Tesla vehicles themselves. The company’s energy storage and auto divisions have many inter-active parts. Tesla vehicles will at some stage be fitted with bidirectional charging. This is otherwise known as V2G (vehicle to grid) technology and has been much discussed in recent years. Major California utility PG&E Corporation (NYSE:PCG) has been initiating V2E (vehicle to everything) and V2G incentives.

At the recent Investor Day, CEO Elon Musk, however, spoke about this and saw it as more of a “supplemental energy source” to the Powerwall, rather than a stand-alone way of selling energy back to the grid. That may become more of a priority now.

The launch of Powerwall Direct” is a sign of ramped up supply to meet the over-weaning demand. However the product is still not yet available in most countries. Increased production should now open up the whole world to the Powerwall product.

Energy Storage Growth Narrative

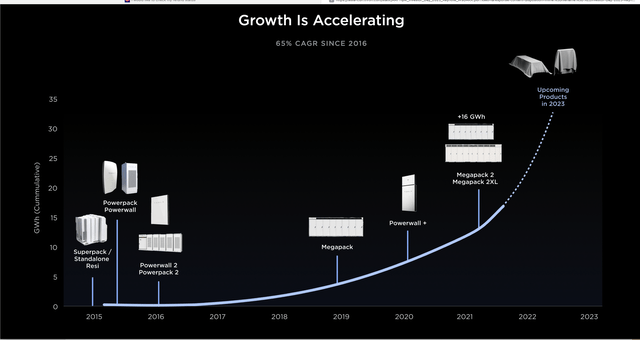

Previously the growth has always been held back by capacity restraints. The company has prioritized auto growth in the past. This will now change, though the huge backlog will take time to clear. The lead-time for Megapacks is currently up to Q1 2025 as overwhelming demand builds up for the product.

The 40 GWh capacity being built up at the new dedicated factory at Lathrop, and soon to be from Shanghai, shows Tesla’s energy storage business has reached take-off point. As with Lathrop, the Shanghai plant is stated to build to a capacity of 40 GWh per annum (for comparison each Megapack represents about 3MWh storage capacity). The visual below from Tesla illustrates growth so far:

The Lathrop plant had been somewhat overlooked by analysts. Work on Megapacks there is illustrated below:

Lathrop seems already to be getting close to full capacity as this report shows.

It is remarkable but not untypical, that at the Q4 2022 analyst call, management made every little mention of the energy storage division. Yet, in reply to one analyst question, Elon Musk did state they were looking at ways to build up annual production to 1000 Gwh.

That would represent a startling 20 more Megapack factories of the size of Lathrop and Shanghai. Were that to happen, it would dwarf Tesla’s auto business. The ramifications of this would be enormous if they came to pass. He stated there would be more news on this production ramp up later this year and next year.

In their recent investor day, the company explained in detail the vision they have for the future. In this they saw a massive 240TWh of storage for a fully sustainable energy economy. This would provide a 35% reduction in fossil fuel usage. In comparisons fully EV auto world would provide a 21% reduction.

Projects

My recent articles gave details of some of the major projects in which Tesla is currently involved. These keep coming on-stream at a rapid rate. There have been various new developments so far in 2023. The list below shows just a fraction of the new projects.

* Bouldercombe Battery site at Rockhampton, Queensland. This 50 MW/100 MwH project is using 40 Megapacks. Supply value would be about $64 million. Observers however often under-rate the software service value of such contracts. Tesla’s “autobidder” software is a factor that differentiates Tesla from the competition. In this instance they have a co-operation agreement with developer Genex to share the software revenues over coming years. Such revenue streams will increasingly become very meaningful for Tesla.

Australia has approximately 130,000 MWh of battery projects planned, and Tesla has been a major player there ever since its first well-reported “world’s biggest battery” at Horndale. The company is currently working on the country’s largest battery project with French developer Neoen, the Western Downs Battery. Tesla have worked with Neoen on several projects and one can almost guarantee the two will co-operate on major projects for years to come.

* In an example of the diversity of project opportunity, the Santa Barbara City Council awarded Tesla the supply and management of its operations at their Cater Water Treatment Plant. It is not just to replace polluting gas speaker plants that there is great opportunity for energy storage.

* Vikings Energy Farm at Holville California is being developed by major player Arevon Energy. Work started in February. This 150 mW/600 MWh project will use Megapacks and have the ability to power 50,000 homes. Tesla is the suppler of choice in many such projects in the State of California.

* Oxnard development in California. This is another development in the State being installed with 142 Megapacks. Supply value would be about $227 million. This has been developed after local government had planned a natural gas plant at the location but local consumer action forced them to change it to a non-polluting alternative.

* Canada’s largest ever such project, Oneida Energy Storage, has been awarded to Tesla by Northland Power. As with most such projects, the contract from Northland Power encompasses not just battery supply but also a long-term service agreement. That provides a further long-term revenue stream.

* In Belgium Tesla are installing two new projects. These comprise one in Deux-Acren for 50 MW/100 MWh and one in Utrecht for 14 MWh, detailed here.

* In England, they are installing the largest such project in Europe, for 196 MWh in East Yorkshire. This is illustrated below:

Conclusion

The announcement concerning the construction of the new factory in China will in time be seen as a seminal event for the company. Auto revenues for Tesla in 2022 ran at about $62 billion. The new Megapack factory in California had already brought revenue potential up to about $22 billion. A second one on China should bring that up to about $44 billion. Tesla’s total revenues in 2022 were approximately $81.5 billion.

If energy storage thus becomes approximately 30% of Tesla revenues in 2023-24, then Tesla skeptics might finally understand that Tesla is not solely an auto company.

Energy storage is an undoubted secular growth market. Battery costs are decreasing. Renewable power capacity is increasing rapidly. Most governments are increasing incentives, such as the ITC (Investment Tax Credit) in the USA. There is no doubt that the new world model saves cost, saves the environment, and improves reliability of the power grid.

EV’s are also a secular growth market. In the long term, though, energy store should become a greater market than autos. Tesla is uniquely positioned in both markets. The new plants at Lathrop and Shanghai show that its energy storage component will fire up rapidly now. It serves to reinforce Tesla, Inc.’s attraction as a bullish investment. Tesla have always stated they expect energy storage revenues to equal auto revenues for the business, and now we can see exactly how this can happen.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.