Summary:

- In the past, ET was viewed as a more aggressive way to invest in midstream infrastructure.

- However, ET has transformed itself over the past several years.

- We detail why it has now become a retiree’s dream investment.

JamesBrey

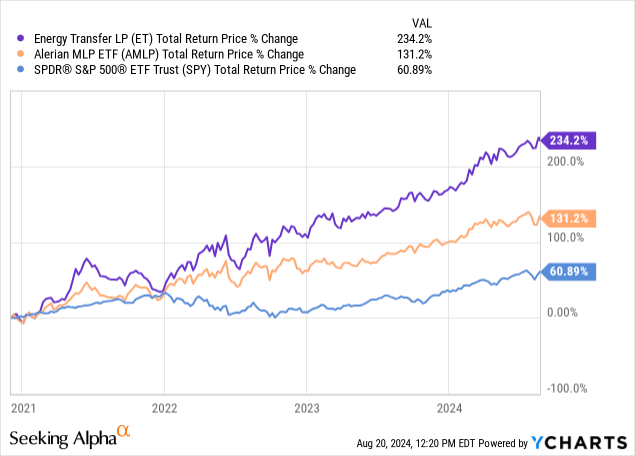

Energy Transfer (NYSE:ET) was once known as a higher-risk, higher-reward MLP due to the shoot-from-the-hip approach of its Texas-based founder, Kelsey Warren, who aggressively deployed capital to chase ambitious growth projects and acquisitions. While there is nothing inherently wrong with this approach, it blew up in the company’s face, especially in the wake of the 2020 COVID-19 energy market crash, prompting the partnership to slash its distribution materially. As a result, Energy Transfer underperformed the sector. However, since then, the company has dramatically changed course in some key ways while still retaining its more aggressive growth-oriented DNA, resulting in massive outperformance of the broader MLP sector as well as the market as a whole.

Fortunately for us, ET was our largest position for much of this period of outperformance, though we recently sold our position once it appreciated to the low end of our fair value estimate and recycled the capital into more promising opportunities. However, since then, long-term interest rates have pulled back meaningfully, which has prompted us to increase our estimate of fair value for the stock and our perceived relative value of its distribution yield. As a result, we have now upgraded it to a Buy.

In this article, I will discuss why I think that ET is now becoming a dream retiree stock and is solidifying its position among some of its blue-chip peers like Enterprise Products Partners (EPD), MPLX (MPLX), and Enbridge (ENB) as other stable, high-yielding income stocks.

#1. Sleep Well At Night Balance Sheet

Probably the most important way in which ET has established itself as a dream holding for retirees is how it has strengthened its balance sheet. Since slashing its distribution, it has aggressively paid down debt and not only secured its investment-grade credit rating but has also earned an upgrade from S&P and Moody’s. On top of that, its pro forma leverage ratio is down in the lower half of its 4 to 4.5 times target range, putting it on more conservative ground.

#2. Well-Diversified Stable Cash Flowing Portfolio

Another way in which it has established itself as a dream retiree holding is that it has continued to diversify its already large asset portfolio, reducing risk associated with any single project or asset while still retaining a very stable cash flow profile. About 90% of its earnings come from fee-based contracts, with only about 10% of its cash flow exposed to commodity prices and spreads. Furthermore, ET’s assets, which include oil, natural gas, and NGLs, are evenly spread across the U.S., giving it a well-balanced asset portfolio.

#3. Increasing Capital Returns To Unitholders

Another reason to be bullish on ET as a retiree is that, thanks in large part to its stable, well-diversified business model and recently fortified balance sheet, it is now able to focus more on capital returns to unit holders. Its current 8% distribution yield is covered by nearly two times with expected distributable cash flow this year, and will likely continue to be covered by about two times moving forward. The company is expecting to grow its distribution at a 3% to 5% annualized CAGR, which is roughly in line with its expected DCF per unit growth.

Beyond that, ET recently announced that it expects to prioritize unit repurchases over debt reduction once its leverage target has been achieved, which it largely already has been. Investors can look forward to unit repurchases playing a bigger role moving forward, which means that distributable cash flow per unit will likely grow at an even faster rate, leading to higher distribution growth and/or faster distribution growth beyond the 3% to 5% rate moving forward.

Additionally, ET also recently redeemed a large number of its preferred units, which further strengthens the balance sheet and the common distribution coverage ratio, as these preferred units had to be paid out before any common distributions could be made.

#4. Strong Growth Pipeline

Last but not least, ET continues to have a strong growth pipeline ahead of it that should continue bringing additional EBITDA online in the coming years, which should naturally deleverage the balance sheet over time, creating additional capacity for ET to accelerate distribution growth and/or repurchase units.

Risks

No investment is risk-free and – while I would classify it as a fairly low-risk investment relative to other common equities – ET’s biggest risks largely lie in either a massive cybersecurity attack on US infrastructure that could shut down/disrupt some of its pipelines or a prolonged downturn in the energy sector. While the highly contracted and diversified nature of its business model and solid balance sheet mitigate some of these risks, they are no guarantee, and ET’s unit price would likely suffer meaningfully should one of these scenarios play out. As a result, investors may want to pursue meaningful diversification as a means of mitigating these risks.

Investor Takeaway

The bottom line here is that ET has become a cash flow machine that will likely continue to deliver dependable and growing distributions for years to come. It has done a lot to change its image by aggressively paying down debt, reducing leverage, and putting its distribution on very stable footing—not only to sustain it but also to grow it for years to come. ET is also continuing to fortify its position through further debt reduction and unit repurchases, which should lead to very sustainable distribution growth as well as additional credit rating upgrades in the years to come. As a result, ET is not only a strong retiree holding today, but it should become even more retiree-friendly in the years to come as its risk profile gradually improves.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EPD, MPLX, ET.PR.I either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Now to Receive our Top Picks for H2/2024

Your timing couldn’t be more perfect! We have just unveiled our top picks for the second half of the year, and by joining us now, you can take advantage of these exciting investment opportunities.

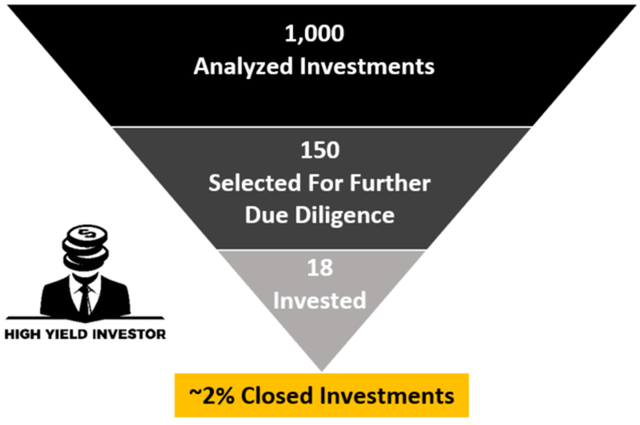

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Our high-yield strategies have garnered 150+ five-star reviews from delighted members who are already reaping the rewards.

Click here to get started!