Summary:

- I reiterate my “Strong Buy” rating for Energy Transfer LP (ET) due to a myriad of strong bullish catalysts.

- The financial performance is improving, Wall Street and insiders are quite bullish, the monetary environment is becoming softer, and there are industry tailwinds.

- The dividend discount model suggests that ET is almost 50% undervalued.

CHUNYIP WONG/iStock via Getty Images

Investment thesis

My previous bullish thesis about Energy Transfer LP (NYSE:ET) aged somewhat well with a modest 1.8% return. On the other hand, the broader U.S. stock market demonstrated about the same performance as well over the last three months.

Today I want to reiterate my “Strong Buy” rating for ET. The stock offers a 7.98% forward distribution [dividend] yield, which is a no-brainer compared to the current risk-free rate. The dividend is safe as ET demonstrates stable profitability and the management cares a lot about proper capital allocation. Industry trends also look quite positive for ET. In my analysis I also explain why I would recommend risk averse investors to pay attention to Energy Transfer’s Series I Fixed Rate Perpetual Preferred Units (NYSE:ET.PR.I).

Recent developments

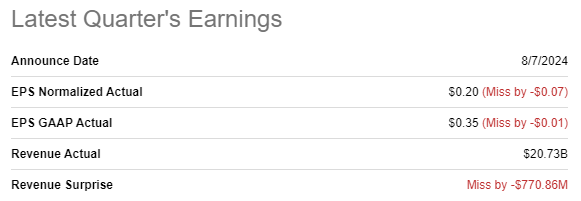

The latest quarterly earnings were released on August 7, when ET missed consensus estimates both for revenue and the EPS. Revenue grew by double-digits once again with a 13% YoY increase. The adjusted EPS also improved notably being up YoY from $0.25 to $0.35.

Seeking Alpha

The bullish sign is that the company continued demonstrating operating leverage in Q2 2024. The operating margin expanded from 10.07% to 11.33% year-over-year, powered by the improvement of the gross margin by almost 170 basis points. For a large-scale mature midstream business like ET driving profitability expansion is challenging and these improvements look very impressive, in my opinion.

Seeking Alpha

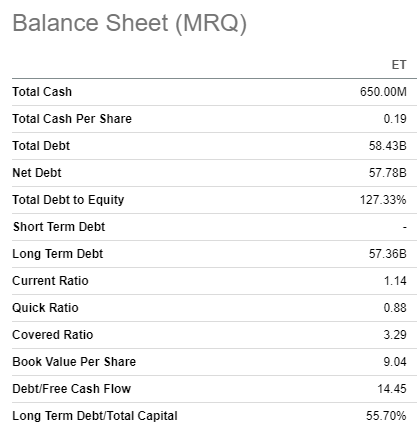

ET’s balance sheet is highly leveraged, but this factor is inherent for the midstream industry as expansion requires heavy capital spending. Payback periods for these capital projects are usually long, which makes debt financing the best option to drive growth. Therefore, I do not see a problem in ET’s substantial leverage levels. Moreover, ET has a solid investment-grade “BBB” credit rating from Fitch. Last but not least, the major portion of debt matures in 2027 and thereafter, which is a long-term horizon.

ET’s FY2023 10-K

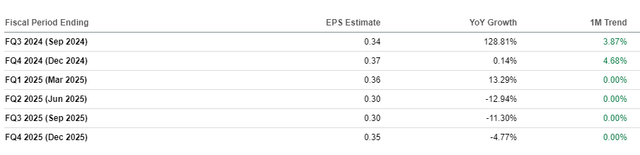

The upcoming earnings release is scheduled for November 1. Consensus projects ET to generate $21.8 billion revenue in Q3. This indicates a 5% YoY growth. This is a notable growth deceleration compared to Q1 and Q2, but the pullback is temporary. The topline growth is expected to reaccelerate in Q4 and through 2025.

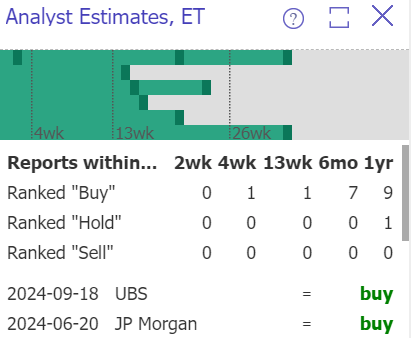

The EPS is expected to follow the top line and expand YoY from $0.15 to $0.23. Quarterly EPS revisions look quite positive over the last month as well. Wall Street analysts are quite bullish about the stock and UBS (UBS) has recently reiterated its “Buy” rating for ET with a target price upgrade. JPMorgan Chase (JPM) analysts are also quite bullish with a “Buy” rating.

TrendSpider

Apart from ET-specific reasons, industry trends also look favorable. The U.S. energy consumption is expected to set new records in 2024 and 2025, which means more volumes for the midstream industry. We also see that technological behemoths continue to pour billions into data centers across the U.S., which is another long-term growth driver for the energy demand. Goldman Sachs’ (GS) analysts forecast that AI will drive a staggering 160% increase in data center power demand. As a company that commands a robust 21% market share in the gas pipeline transportation industry, ET is poised to benefit from the growing energy demand.

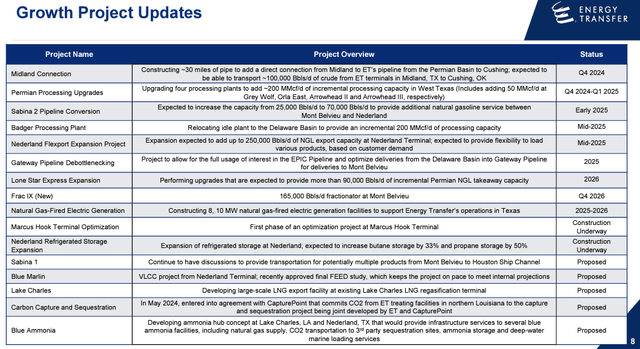

The Fed’s recent shift in monetary policy serves as another positive catalyst for ET. As mentioned earlier, midstream businesses inherently rely heavily on debt financing. Lower interest rates make it more affordable for ET to secure new debt financing, particularly given its ambitious pipeline of growth capital projects outlined below. This pipeline appears robust and well-rounded, as it encompasses a diverse range of assets, including pipelines, terminals, and processing facilities.

ET’s latest earnings presentation

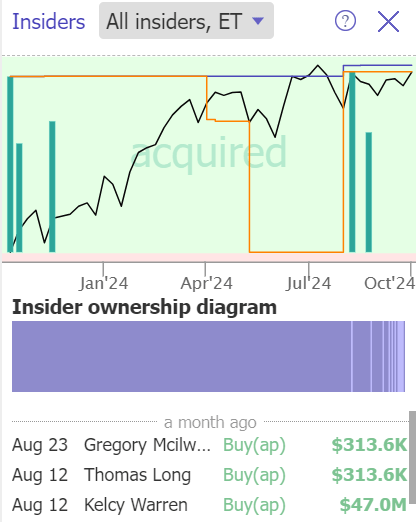

Another solid bullish sign is that insiders were only buying ET over the last twelve months, with no selling. According to the below screenshot, there were buying activity in summer 2024. The absence of insider selling is bullish and indicates that the management considers the stock is too cheap to sell. The remarkable fact is that Kelcy Warren, the Chairman, bought ET worth $47 million on August 12.

TrendSpider

Thus, ET is fundamentally strong and looks interesting for investors. I think that there is also another opportunity with the Series I Fixed Rate Perpetual Preferred Units. ET.PR.I currently trades at $11.95. These units offer a cumulative quarterly distribution of $0.2111, providing a steady and legally binding income stream. The preferred units rank senior to common units in terms of distributions and liquidation preferences, providing more security. I believe this combination of reliable income and enhanced security makes the Series I Preferred Units an attractive option for investors with lower risk tolerance.

To summarize, it appears that the set of catalysts around ET is quite bullish. The financial performance is solid, and favorable industry trends together with lower interest rates should support further sentiment improvements.

Valuation update

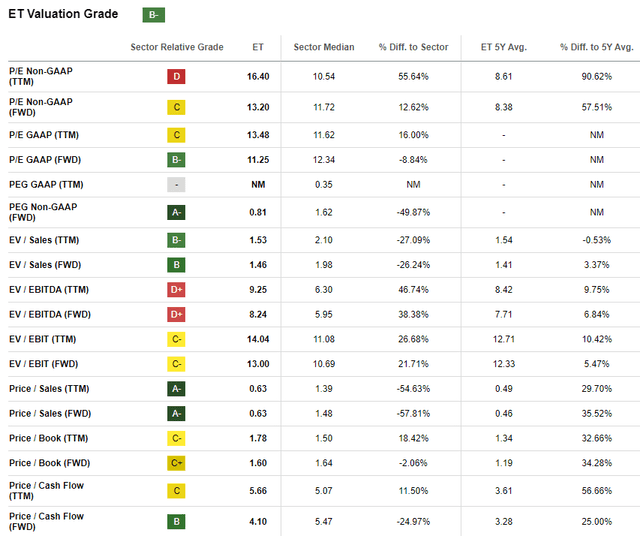

The share price appreciated by 20% over the last twelve months, underperforming the broader U.S. market. On the other hand, the YTD performance is close to the S&P 500 with an 18% rally. ET has a an about average “B-” valuation grade from Seeking Alpha Quant, meaning that valuation ratios look mixed.

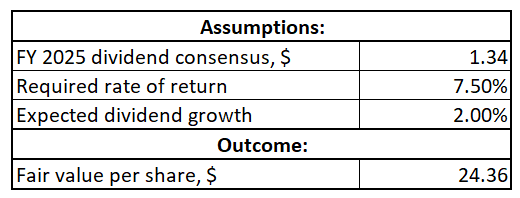

To figure out the fair share price, I must update my dividend discount model [DDM] simulation. I use a 7.5% required rate of return also aligns with the cost of equity range suggested by valueinvesting.io. Since I am figuring out the target price for the next 12 months, I also use FY 2025 dividend consensus estimate, which is $1.34. A 2% dividend growth rate looks fair since it aligns with long-term inflation averages.

Author’s calculations

Fair share price is around $24, which is almost 50% higher than the current market price. The upside potential is extremely attractive, in my opinion.

Risks update

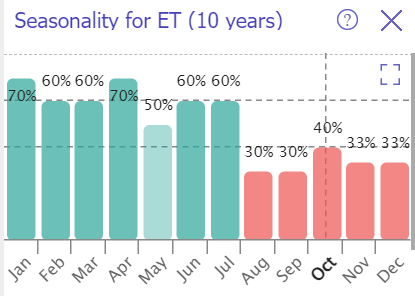

Potential investors should be aware that ET’s historical seasonality trends suggest that the stock usually performs much better during the first half of a year. The below bar chart suggests that performance has been historically weak in October-December, and this can be a big headwind through the end of 2024.

TrendSpider

As a midstream energy company, Energy Transfer’s environmental impact is closely monitored. The company could incur environmental fines and penalties, leading to unexpected costs. Beyond the potential negative impact on the company’s profit and loss statement, breaching environmental regulations is also likely to damage the company’s reputation. A loss of reputation could trigger a stock sell-off, putting downward pressure on the share price.

Bottom line

To conclude, ET remains a no-brainer “Strong Buy”. The financial performance is improving, Wall Street and insiders are quite bullish, the monetary environment is becoming softer, and there are industry tailwinds. The company’s Series I Fixed Rate Perpetual Preferred Units should be a good option for less risky investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.