Summary:

- Energy Transfer identified as a hidden gem at $16/share, offering an 8.5% dividend return and strong prospects in the energy sector.

- ET operates in the midstream energy business, focusing on transporting and processing energy products, with revenue recovering and minimal volatility.

- Analyst consensus price target for ET is $19.29, showing potential for growth and consistent profits, making it an attractive investment opportunity.

onurdongel

Above: Liquid gold surges through ET lines every hour, every day.

Here’s a one-off quick note on an energy stock we noticed out of plain sight at a very interesting price. We will immediately turn back to our usual gaming/entertaining coverage after covering this one. But because this stock seemed to be rising in visibility after a Barron’s article, we decided to follow the yellow brick road, mainly because we see a rare special situation we wish to share regardless of sector.

This is a one shot for us in the sector, but we see money here, so let’s go.

The Barron’s article said there was lots to like about Energy Transfer (NYSE:ET) stock at $16 a share. What the article did not cover, and why we’re just passing the word outside of our regular sector coverage, is that we feel compelled to share it with you.

There’s a small personal element to this story

As it turns out, I recall a fellow student in my Columbia B school class who focused on learning about spotting sifting markets for hidden bargains. This classmate was from a quiet Texas oil and gas town who kind of grew up around the oil business started by his grandfather in the 1930s. It went bust during the depression and the family scattered. It wound up owning a handful of 7-lls around Texas and Oklahoma.

Cut to just a week ago, when alumni of our Columbia classes met at a charity golf tournament.

Above: We like this because it’s a relatively easy to understand stock, which is not the case with most energy midstream operators.

After our usual patter of shared military days at the golf dinner, the chatter moved off to business. I just happened to mention the Barron’s piece about ET I read the other week and he laughed. It seemed he knew some of the early partner families who worked in gas pipeline companies over the years, decades ago. And he was very much in agreement with the Barron’s bullish take. He’s lived out of Texas for 30 years and his memory peaked, so he made a few calls to old friends.

We revved up our iPads looking at what we could find on the company and were impressed. It immediately looked like a strong buy to us. But we both concluded that Baron’s exposure might eat up some of the bargain price. By dessert, we’d come to the conclusion that even with a bit of a spike, it was still worthwhile. The 8.5% dividend return looked very sweet. My friend opened a position. I’m waiting to move some other money before I make my final decision. Meanwhile, it’s tops on my watch list for the next quarter.

Our prime reason was quite simply that a company doing that well with its prospects focused on moving energy supplies looked very solid. We saw it as a heavy-duty business and balance sheet and an 8.5% dividend, operating in a space (pipelining energy) that was virtually immune to major downturns to every possible contingency. In brief, ET was invulnerable because it was the business that would be needed no matter the economic headwinds.

Here’s what we liked a lot. We strongly recommend you do a bit of homework on ET, and think you might come to a similar conclusion. It’s not for everyone, but it’s money waiting for anyone with an understanding of just a bit of how the energy business works. If you like what you see, think about starting to follow the stock. If you feel stronger, a buy might make a nice return this quarter. Up to you.

Here’s the basics at writing:

The Company: Energy Transfer, NYSE: ET

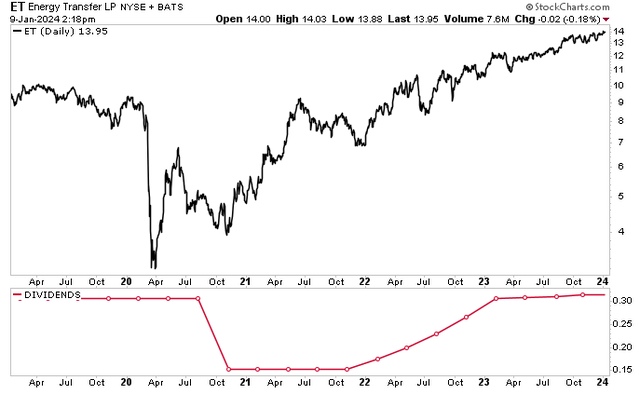

Price at writing: $16.11

Common unit distribution price: $0.3175

Rank: Fortune 500 #51

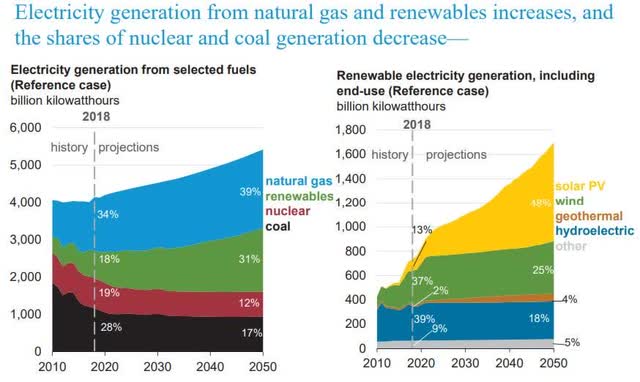

One of the biggest transporters of crude oil, natural gas, and liquid national gas on the globe.

Key: ET has a built-in structural advantage in its position that’s virtually unchallengeable. It’s a midstream energy business, not part of producing crude or endgame selling energy products to consumers. That means it’s in the business of transporting and processing energy products by storage, pipeline or truck. That gives the company a built-in strong situation as most of its profits come out of fee-based contracts, which avoid the overly competitive commodity volatility for peers wherever possible.

Revenue recovered from dips before 2024. 1Q24 revenue (March 31) was $1.269b, up 13.87% Prior year. Declines were at low double figures related to general industry conditions.

Average analyst consensus PT is $19.29 based on expected rises in ’24 volumes. But if you look at the one-year trading range, it shows minimal volatility. A year ago, early August price was $12.98, and price at writing is $16. That shows downside protection because it’s mostly likely bought on its ability to produce consistent profits that sustain an attractive 8.5% return.

We see a stock market roiling in a lot of “AI what ifs,” lover valued stocks and iffy tech entries. It would appear that savvy energy holders have long had their positions on ET when it was a partnership. But those investors operate in something of an esoteric space. I think the ET story is fundamental. And investors get the point that the stock can hold its price and slowly build value — as a high-yield stock. While, at the same time, it can offer investors a return that will hold up against most Fed upside moves. Regular energy investors may look at this as old news. But I hope investors get educated about what’s out there and turn a nice few bucks in the process if they’re impressed with the ET story. Money goes where opportunity shows. This story is all about low-risk yield. That is ET in spades.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The House Edge is widely recognized as the only marketplace service on the casino/gaming/online sports betting sectors, researched, written and available to SA readers by Howard Jay Klein, a 30 year c-suite veteran of the gaming industry. His inside out information and on the ground know how benefits from this unique perspective and his network of friends, former associates and colleagues in the industry contribute to a viewpoint has consistently produced superior returns. The House Edge consistently outperforms many standard analyst guidance with top returns.

According to TipRanks, Klein rates among the top 100 gaming analysts out of a global total of 10,000.