Summary:

- Energy Transfer reported lower revenue and earnings per share than expected but increased guidance for the year due to recent acquisitions.

- Despite falling short of analysts’ expectations, the company saw strong profitability metrics across most operating segments.

- Management expects EBITDA to continue to improve, and the shares offer an upside of up to 89.9% based on valuation comparisons with similar companies.

Travel Ink/DigitalVision via Getty Images

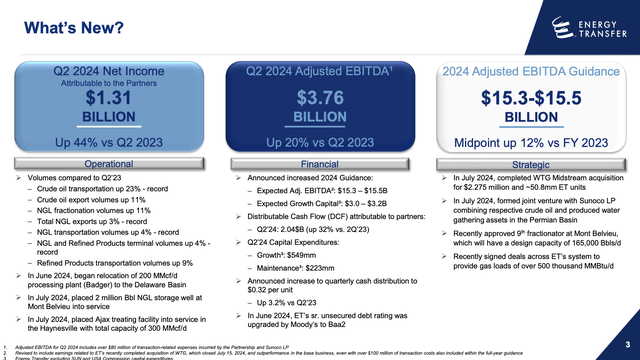

Just the other day, on August 5th, I wrote an earnings preview article for one of my absolute favorite companies. That happens to be pipeline/midstream firm Energy Transfer LP (NYSE:ET). In that article, I talked about what analysts were anticipating and what investors should keep an eye on. When management announced results for the quarter, they reported revenue and earnings per share that fell short of expectations. But thanks in part to a recent acquisition, they increased guidance for the year. At the moment, the stock looks incredibly cheap and investors would be wise to work with the company in a favorable light. After all, it is currently my third-largest holding, accounting for 14% of my overall portfolio.

A great quarter, all things considered

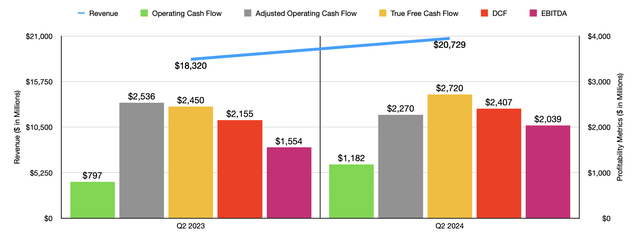

If you ask analysts how well Energy Transfer fared during the second quarter, they would likely be disappointed. But I don’t fit into that category. I say that they would be disappointed because top line and bottom line performance came in lower than anticipated. Take revenue as an example. Overall sales came in at $20.73 billion. Even though this was 13.1% above the $18.32 billion the company reported one year earlier, it fell short of analysts’ expectations by $770 million. The same thing is true on the bottom line. Earnings per share for the quarter totaled $0.35. That was $0.01 per share lower than anticipated. As a result of this, net income still came in at $1.18 billion. That happened to be comfortably above the $797 million reported for the second quarter of 2023.

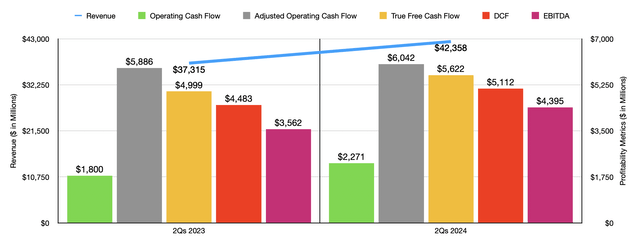

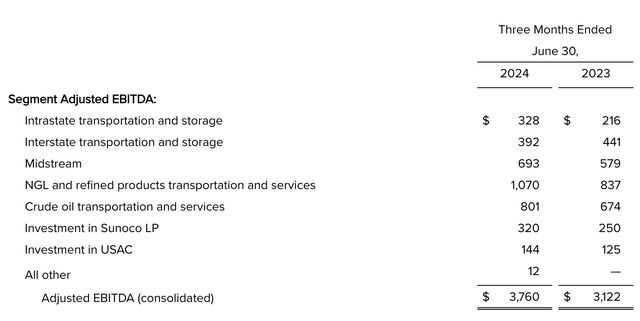

Even though the company fell short of what analysts were expecting, I consider the second quarter to have been a good time for the company. Most profitability metrics came in strong. The one exception was operating cash flow, which dropped from $2.54 billion to $2.27 billion. If we adjust for changes in working capital, however, we would get a nice increase from $2.45 billion to $2.72 billion. One metric that I like to look at is what I refer to as ‘true free cash flow’. This strips out certain things, such as maintenance capital spending and preferred distributions. Doing this, we arrive at a reading of $2.41 billion for the second quarter. That’s well above the $2.16 billion reported last year. DCF, or distributable cash flow, shot up from $1.55 billion to $2.04 billion. And lastly, EBITDA for the company managed to grow from $3.12 billion to $3.76 billion.

Energy Transfer Energy Transfer

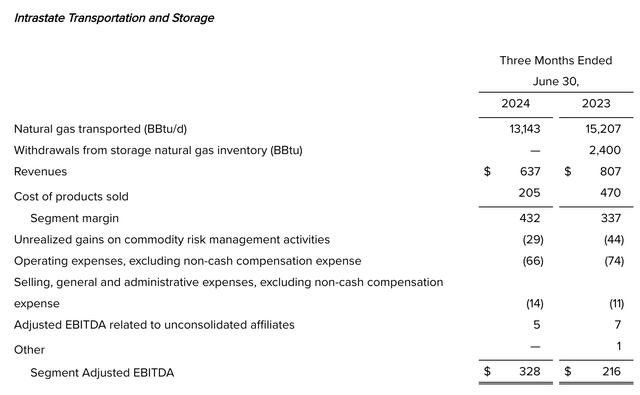

When it comes to profitability, the company saw strength across most of its operating segments. One of these was the Intrastate Transportation and Storage segment. The firm did experience a decline in the amount of natural gas transported from 15,207 BBtu per day to 13,143 BBtu per day. Overall revenue dropped from $807 million to $637 million. But costs plummeted, especially the cost of products sold. Profits were boosted by a number of factors, including higher pipeline optimization from physical sales, a growth in storage margin driven by the timing of financial and physical gains, and a slight increase in transportation fees as a result of the company’s ability to recover certain disputed fees it earned last quarter in Texas. All said and done, EBITDA popped up from $216 million to $328 million.

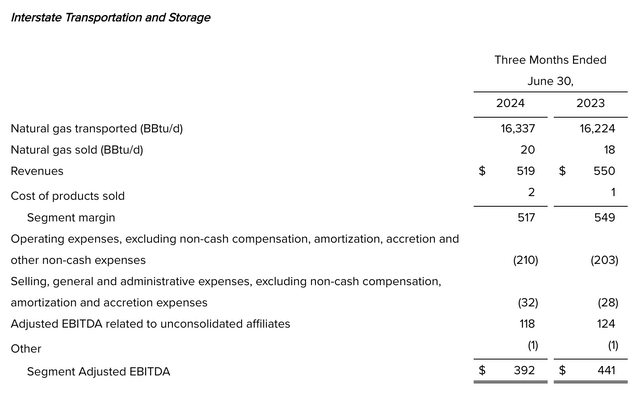

Meanwhile, the Interstate Transportation and Storage segment did see a slight increase in natural gas transportation from 16,224 BBtu per day to 16,337 BBtu per day, and it saw an uptick in natural gas sold from 18 BBtu per day to 20 BBtu per day. But that didn’t stop revenue from dropping from $550 million to $519 million. That, combined with certain higher costs, particularly operating expenses, impacted profits, with EBITDA declining from $441 million to $392 million.

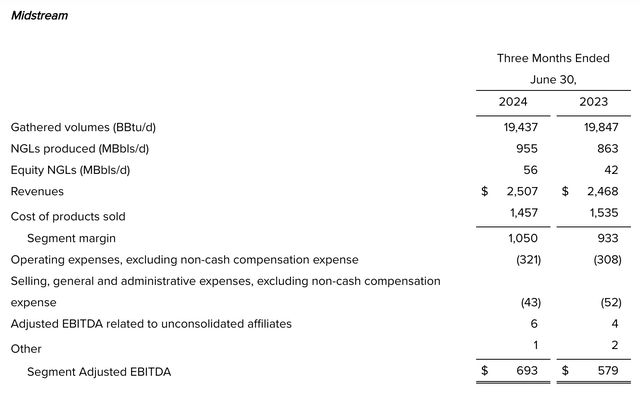

Most other segments performed quite well, though. The Midstream segment, for instance, did see gathered volumes drop from 19,847 BBtu per day to 19,437 BBtu per day. But because of a 10.7% rise in NGLs produced, on top of a 33.3% jump in equity NGLs produced, revenue grew from $2.47 billion to $2.51 billion. This rise in sales, combined with margin growth, helped EBITDA shoot up from $579 million to $693 million. It is worth noting that the largest contributor to segment EBITDA here was $121 million from assets the business had acquired only a short time ago, and because of higher volumes in the Permian Basin.

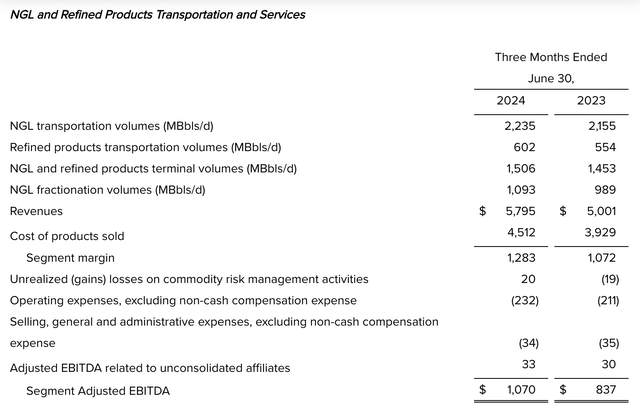

Another segment that saw surprising strength during the quarter was the NGL and Refined Products Transportation and Services segment. For the quarter, NGL transportation volumes increased by 3.7%. Refined products transportation volumes grew an even more impressive 8.7%. The company benefited from a 3.6% rise in NGL and refined products terminal volumes. And it enjoyed a 10.5% jump in NGL fractionation volumes. These helped to push revenue up from $5 billion to $5.80 billion. And with most costs staying range bound year over year, EBITDA rose from $837 million to $1.07 billion.

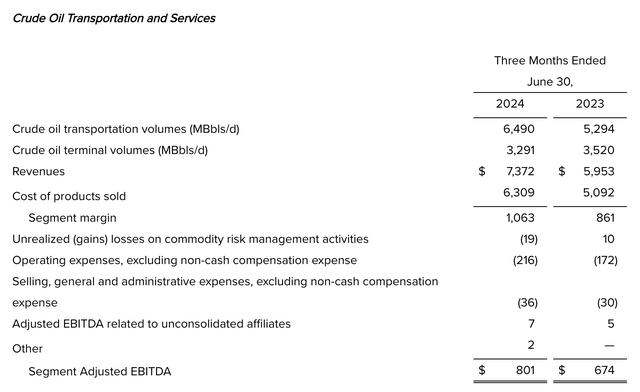

A similar increase in profitability came from the company’s Crude Oil Transportation and Services segment. A 22.6% surge in crude oil transportation volumes more than offset a 6.5% drop in crude oil terminal volumes, allowing revenue to jump from $5.95 billion to $7.37 billion. Even though some costs increased, like operating expenses, that didn’t stop EBITDA from popping 18.8% from $674 million to $801 million. As was the case with the Midstream segment, the company benefited significantly, to the tune of $124 million to be precise, from recently acquired assets.

In truth, an entire article could be written dedicated solely to these revenue and EBITDA changes. But by this point, you get the idea. Across most operating segments, the overall picture for the company has only gotten better. As you can tell by looking at the chart above, the second quarter of 2024 was not the only bright spot for the company. For the first half of 2024 as a whole, revenue, profits, and cash flows, all without exception, improved nicely.

Management expects this trend to continue. In fact, in my earnings preview on the company, I detailed how management had been guiding for EBITDA this year of between $15 billion and $15.3 billion. But because of solid operating performance, not to mention the company’s acquisition of WTG Midstream Holdings last month, EBITDA is now expected to be somewhere between $15.3 billion and $15.5 billion. We don’t actually know exactly how much of this improvement should be because of the aforementioned acquisition. But seeing my goal is to understand how the company in its entirety should perform as opposed to just how it should perform this year, I’m going to use a pro forma estimate that puts EBITDA on a forward basis at $15.65 billion.

We don’t have any estimates regarding other profitability metrics. But if we assume that the others will increase at the same rate that EBITDA is forecasted to, then we should anticipate adjusted operating cash flow of about $11.43 billion, true free cash flow of $10.21 billion, and DCF of $8.66 billion. Using these figures, you can see in the chart how the stock is valued. As part of my analysis, I then compared it to five similar firms as shown in the table below. I did this using two of the four profitability metrics. What I found was that, in each case, Energy Transfer was the cheapest of the group by a substantial margin.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Energy Transfer | 4.9 | 8.1 |

| Kinder Morgan, Inc. (KMI) | 7.2 | 12.2 |

| The Williams Companies, Inc. (WMB) | 9.5 | 11.3 |

| Enbridge Inc. (ENB) | 8.7 | 12.8 |

| Enterprise Products Partners L.P. (EPD) | 7.9 | 10.6 |

| MPLX LP (MPLX) | 7.4 | 9.8 |

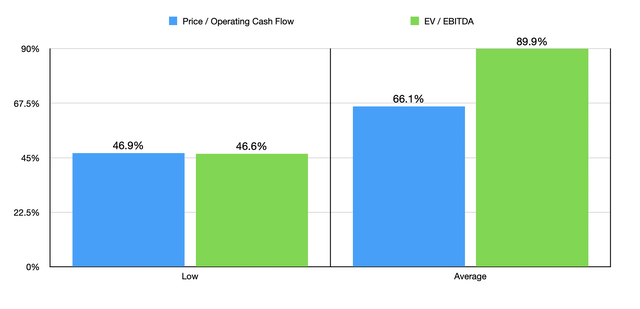

To see what I mean, I decided to perform a thought experiment where I assumed that a fair value for Energy Transfer would be the trading multiple of the cheapest of the five companies that I decided to compare it to. In the chart below, you can see that this implies an upside of between 46.6% and 46.9%. I did the same thing in the same chart using the assumption that our candidate should instead trade at the average of the multiples of these five businesses. In this case, the upside would be between 66.1% and 89.9%. Even at the low end of the scale, this implies a meaningful upside. And it doesn’t even factor in the distributions that investors will capture while waiting for this upside to be realized.

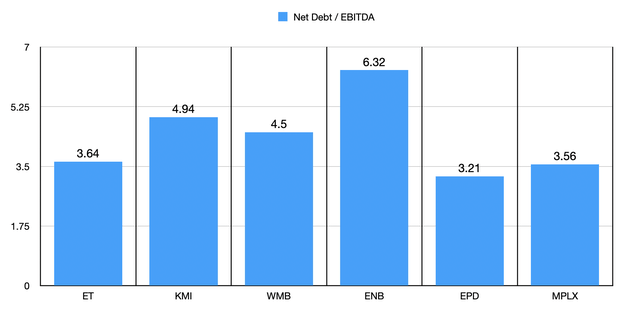

One could reasonably argue that there is some reason for this disparity. But in all my time analyzing Energy Transfer, I have yet to find it. Perhaps the most important thing to point out here would be overall leverage. In the chart below, you can see the net leverage ratio for Energy Transfer, as well as for the same five companies I have already compared. With a forward multiple of 3.64, Energy Transfer is quite close to two of these five companies. But the other three have net leverage ratios that are quite a bit higher than what ET’s is. If anything, Energy Transfer should perhaps be trading at a premium to some of these businesses.

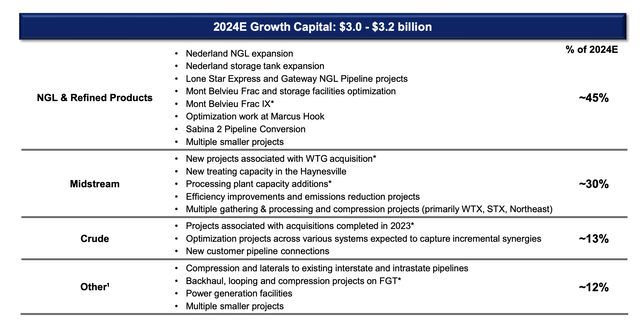

Another great thing about the company is that it continues to focus on growth opportunities. This year, management is forecasting growth in spending of between $3 billion and $3.2 billion. About 45% of this will be focused on its NGL and refined product operations. Another 30% would be attributable to the midstream business. 13% will go to crude. And the remaining 12% will go to other miscellaneous projects. As these investments eventually come online, Energy Transfer should see revenue, profits, and cash flows, expand.

As I’ve mentioned already, pipelines are great companies because of their stable cash flows, and their consistent growth. But this isn’t to say that they are without risks. In the case of Energy Transfer specifically, there are certain litigation risks. One example came in April of this year when the State of Oklahoma filed a petition on behalf of the Grand River Dam Authority against Energy Transfer For gains that it captured during Winter Storm Uri back in February 2021. The allegation is that the company’s subsidiaries violated state antitrust laws by hiking prices. On its own, Energy Transfer saw a $2.4 billion boost in profits as a result of the inclement weather. Risks also extend to the environmental side of things. For instance, for years now, there’s been significant pushback against the Dakota Access Pipeline, in which Energy Transfer owns a sizable stake in. This could still take a good amount of time to resolve as well. At present, the US Army Corps of Engineers is still working on completing its final Environmental Impact Statement and will not be completed with that until December 2025. A Record of Decision won’t be issued until sometime in early 2026. But at the end of the day, these types of risks, while being company-specific, are spread throughout the industry.

Takeaway

Based on the data provided, I must say that Energy Transfer still strikes me as a phenomenal prospect. I see very little risk here, and it’s one of the few companies that I would feel comfortable putting a good chunk of my money into if I knew I were going into a 10-year coma tomorrow. I pray that doesn’t have to happen. But as things stand, I believe that the valuation of the company, combined with its recent continued growth, justifies the ‘strong buy’ rating I have had on it for some time.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!