Summary:

- This article upgrades my earlier buy rating on ET to a strong buy due to the acquisition of Crestwood Equity Partners.

- I expect this acquisition to catalyze a higher growth rate than my earlier projection.

- When adjusted by growth rate and yield, valuation metrics approaches absurd levels.

- The P/E growth ratio is only 0.8x and PEGY (P/E to Growth and Dividend Yield) yield is only 0.5x, both far lower than the 1x ideal threshold.

wildpixel

I wrote a few articles in the past year on Energy Transfer (NYSE:ET) starting in a price range of around $13 to $14 (see the chart below). Its shares (or units to be more precise) have indeed delivered strong performance, advancing more than 26% in the past year. Combined with an ~8% dividend yield, the return beat the broader market by a large margin. In my last article, published a bit more than three months ago, I specifically argued that:

Energy Transfer LP stock is still a buy in my view despite a price near multi-year peak levels. Valuation metrics, including Graham’s approach, still suggest that ET is undervalued compared to its market price. At the same time, an ~8% dividend provides non-negligible downside protection in the case of a market downturn.

Seeking Alpha

In this article, I will argue that the stock has become an even stronger buy due to the development with Crestwood Equity Partners. I expect this acquisition to provide sizable top-line and bottom-line contributions in the years to come, and thus a higher growth rate than I projected earlier. Market consensus points to a 12.6% annual growth rate ahead, and I see good catalysts for ET to meet the consensus expectations. With a ~10x P/E, the PEG (P/E growth ratio) Is only about 0.8x, absurdly cheap in my view amid this otherwise very expensive market, as detailed in the next section.

ET stock: Crestwood acquisition and growth catalysts

The recent acquisition of Crestwood Equity Partners provided a good boost to revenues. First quarter revenue of $21.6 billion translated into an annual growth rate of almost 14% as seen in the chart below. The bottom line, however, was pressured by merger-related expenses. Normalized EPS slightly declined by about 2.3% in the past quarter YOY as seen. I consider such merger-related expenses to be temporary only. Actually, I think it’s very likely that Energy Transfer will realize significant cost synergies from this acquisition going forward. Hence, I anticipate bottom-line growth to resume at robust rates starting this fiscal year.

Seeking Alpha

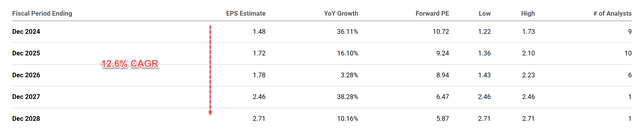

The market consensus seems to share the above view. The chart below shows the consensus EPS estimates for ET stock in the next few years. As seen, analysts expect ET’s earnings to grow at a compound annual growth rate (“CAGR”) of 12.6% over the next five years. Specifically, analysts estimate EPS to be $1.48 in FY 2024 and almost double to $2.71 in FY 2028.

Seeking Alpha

I see good catalysts to support such a growth projection. Besides the Crestwood acquisition, another top catalyst on my list involves its natural gas liquids (“NGLs”) operations. ET focuses not only on traditional natural gas pipelines but also boasts a significant footprint in NGLs transportation infrastructure. In the longer term, this focus on NGLs positions ET well to capitalize on the growing demand for these liquids used in petrochemical production. In the near future, the LNG sales and purchase agreement with Shell NA LNG is set to commence next year and I expect this agreement to provide both revenue stability and growth potential.

ET stock: Valuation is too cheap

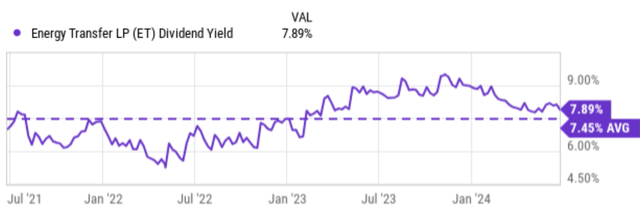

The chart above also shows the forward P/E ratios for ET based on the projected earnings. As seen, ET’s FY1 P/E ratio is only about 10x. Starting in FY2, the implied P/E will drop to the single digits, too cheap both in absolute and relative terms, in my view. As a master limited partnership that pays regular dividends, its dividend yields provide another good valuation metric. The chart below shows the dividend yield for ET stock in the past three years in comparison to its historical mean. As seen, the dividend yield has fluctuated between about 5% to 9.0% with an average yield of 7.45%. The current dividend yield hovers around 7.9%, noticeably above the mean, and indicates an attractive valuation.

Seeking Alpha

When adjusted for growth, the valuation is even more attractive. With a 10x P/E and 12.6% growth rate projection, the implied PEG ratio is only 0.8x, 20% lower than the 1x that most growth investors consider the gold standard. However, in ET’s case, the PEG ratio still underestimates its attractiveness. I think the PEGY ratio is a more reasonable metric here because of the following considerations that Peter Lynch promoted:

For dividend stocks, Lynch uses a revised version of the PEG ratio – the PEGY ratio, which is defined as the P/E ratio divided by the sum of the earnings growth rate and dividend yield. The idea behind the PEGY is very simple and effective (most effective ideas are simple). If a stock pays out a large part of its earnings as dividends, then investors do not need a high growth rate to enjoy healthy returns. And vice versa. And similar to the PEG ratio, his preference is a PEGY ratio below 1x.

Assuming a growth rate of 12.6%, with a P/E of 10x and yield of 7.9%, ET’s PEGY ratio is only about 0.5x.

Other risks and final thoughts

In terms of upside risks, in addition to those positives mentioned above, I should also point out that ET has a diversified asset base. Its asset base spans multiple basins across the United States, including the Permian, Midcontinent, and Gulf Coast regions. My view is that such a diversified geographic spread mitigates geopolitical risks substantially and also helps to smooth out fluctuations in production levels within any one region.

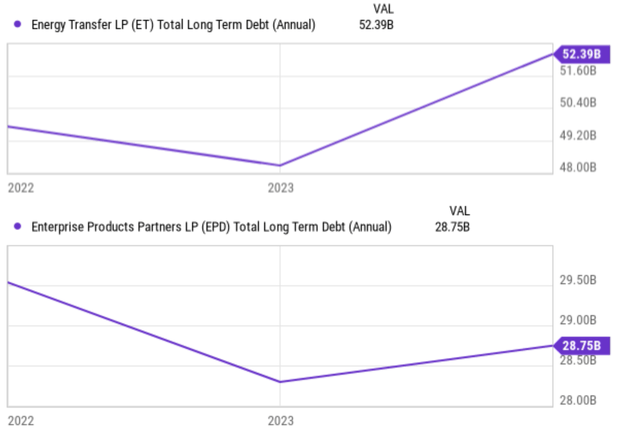

In terms of downside risks, I see the volatile commodity prices and government regulations as the top two risks common to ET and its midstream peers. When natural gas and oil prices swing wildly, it can significantly impact the profitability of pipeline companies like ET. Additionally, stricter environmental regulations could limit pipeline construction or force companies to adopt more expensive technologies, impacting their bottom lines. For ET specifically, I have an additional concern involving its high debt load. ET had a higher debt load to start compared to some of its peers (see the next chart below). The additional debt from the Crestwood acquisition and rising borrowing rates in the recent two to three years have further stretched its balance sheet. Going ahead, I expect management to focus on improving the balance sheet by reducing its leverage, and investors should closely monitor its leverage ratios.

All told, my verdict is that the positives far outweigh the negatives, and thus rate the stock as a strong buy under current conditions. My bullish thesis on ET hinges on a confluence of a few key factors. First, I anticipate EPS growth to resume at robust rates after the Crestwood integration is completed. Analysts are projecting strong EPS growth over the next five years at a CAGR of 12.6%, and I consider this projection to be very plausible. Second, the valuation is too low, as reflected both in its 10x forward P/E and an above-average dividend yield of almost 8%. Finally, when the valuation is adjusted by growth rate and yield, the metrics (0.8x PEG and 0.5x PEGY) approach absurd levels, in my mind.

Seeking Alpha

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.