Summary:

- Energy Transfer’s deleveraging efforts have successfully reduced leverage ratios, enhancing financial stability and opening the door for potential unit buybacks.

- ET offers a highly attractive dividend yield of nearly 8%, with strong coverage and sustainable growth, making distribution cuts unlikely.

- ET is fairly valued, trading in line with its 5-year average EV/EBITDA ratio, with potential for long-term rerating if current growth continues.

spooh

Energy Transfer (NYSE:ET) is a master limited partnership [MLP] operating in the distribution of oil and gas. This MLP has very limited sensitivity to commodity prices as its earnings are primarily fee-based contracts, earning it revenue even when commodity prices are down. ET offers a highly attractive dividend yield of around 8% and has made significant strides in addressing challenges around high debt levels. The success of its deleveraging efforts now open up the possibility of increased capital returns to unit holders.

The balance sheet

In my previous article on Energy Transfer, I noted that the MLP has increasingly focused on reducing its leverage levels since 2020. This came about as a well-timed focus on deleveraging as interest rates have remained high for quite a bit longer than most had initially expected. ET has targeted a leverage ratio of 4.0 – 4.5 times earnings before interest, taxation, depreciation and amortization (EBIDTA) with a strong focus on having its leverage come in at the lower end of the targeted range. It has now largely achieved its target of maintaining leverage at the lower end of the target range, with Fitch currently expecting ET’s full-year leverage to come in at around 4.0.

The achievement of the lower end of the leverage target is also important for investors in the MLP from the perspective of potential unit buybacks in the future. Management has indicated an increased willingness to consider unit buybacks should the MLP “get to the right place from a leverage standpoint”. This could contribute to an increase in the distributable cash flow per unit in the near future.

Energy Transfer’s ability to avoid a substantial increase in leverage is particularly noteworthy given the various acquisitions ET has made to support growth, including most recently the acquisition of WTG Midstream. In my view, the recent acquisitions showcase a management team committed to responsible acquisitions at reasonable price levels. This view is also supported by the detailed analysis of Hunting Alpha on average multiples paid on acquisitions by ET. In respect of the WTG Midstream acquisition, Hunting Alpha observed that –

I compute the implied transaction multiple to be 8.1x EV/EBITDA. This is the same valuation they paid for Crestwood Equity Partners. And a look at the sector M&A transaction comps reveals that these multiples are at a 34% discount to the median multiples of 12.2x, suggesting that management has made a good deal once again.”

Earnings and the dividend

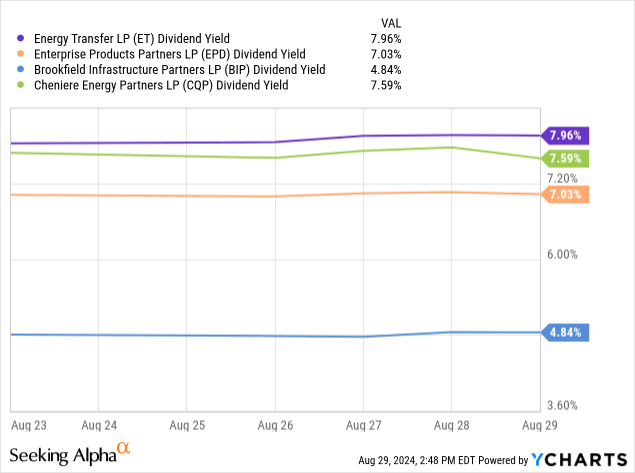

Energy Transfer offers a highly attractive dividend yield of nearly 8%. This is also higher than the dividend yield offered by many other MLPs, as depicted in the chart below. This high dividend yield is also noteworthy in light of ET’s recent dividend/distribution growth trajectory and the indication by management that the distribution is expected to continue growing at a compounded annual growth rate of between 3% and 5% per year.

The recent acquisitions have also contributed substantially to EBITDA growth at ET, with the most recent acquisition of WTG Midstream expected to add around $400 million per year to EBITDA. The continued growth has also contributed positively to an increase in distributable cash flow with ET reporting a 32% year-over-year increase in distributable cash flow in the second quarter this year. This continued growth in distributable cash flow also meant that the $0.32 per unit distribution was fully covered by distributable cash flow at a rate of around 187%. This high dividend coverage ratio makes a dividend cut at ET highly unlikely.

It is also supportive of the sustainability of the distribution in years ahead, as there is quite a bit of a buffer between distributable cash flow and the current distribution. This could be particularly important for investors who have shied away from ET in the aftermath of the substantial distribution cut in 2020. While a reduction in the distribution cannot ever be ruled out completely, the ET of today is not the ET of 2020. The substantial progress in bringing leverage levels under control and more moderate increases in the distribution, at a rate that is generally at or below the growth in distributable cash flow, makes a distribution cut today far less likely. In my view, ET’s distribution is relatively safe.

Valuation

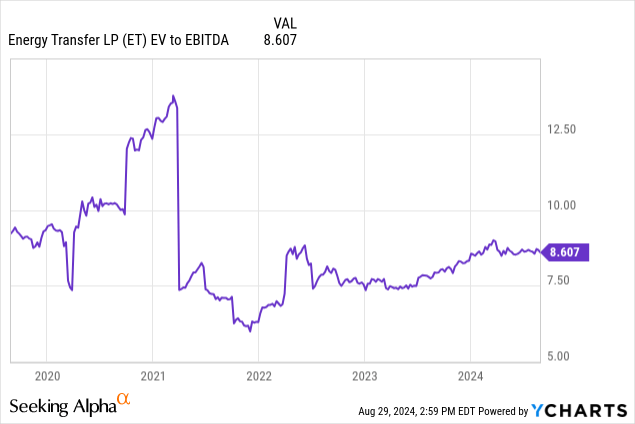

Energy Transfer is currently trading at an enterprise value [EV] to EBITDA ratio of around 8.607 which is broadly in line with its 5-year average EV to EBITDA ratio of around 8.42. This indicates that ET is not currently trading at a substantial premium from a historical perspective.

There is certainly an argument to be made that ET seems undervalued from a historical perspective if one looks further back at the average EV/EBITDA ratio than in the last 5-years. Indeed, the 10-year average EV/EBITDA ratio for ET is substantially higher than its current valuation levels, with the 10-year average EV/EBITDA ratio coming in at around 15.75. Nevertheless, those valuation levels were for an ET that was much more aggressively focused on growth and brought different opportunities for investors than the current ET.

In my view, some long term rerating for ET is justified should it maintain its current trajectory of steady growth in distributions and growth in distributable cash flow. However, in my view, the MLP is unlikely to see valuation levels rising to the highs seen in the years leading up to the Covid-19 pandemic. Given these factors, I currently consider ET to be fairly valued.

Conclusion

Energy Transfer’s recent achievements in deleveraging and maintaining a strong balance sheet contribute substantially to the investment case for this MLP. It’s focus on reducing leverage has placed it in a robust financial position, with current leverage ratios aligning well with management’s targets. This achievement not only enhances financial stability but also opens the door for potential unit buybacks, which could further enhance distributable cash flow per unit and provide additional value to investors.

Moreover, ET’s disciplined approach to acquisitions, as evidenced by the recent WTG Midstream deal, reflects a prudent management strategy that prioritizes value creation without compromising financial health. The acquisitions have significantly bolstered ET’s EBITDA, contributing to substantial growth in distributable cash flow, which is more than sufficient to cover its attractive dividend yield of nearly 8%. This strong dividend coverage, coupled with management’s commitment to sustainable distribution growth, offers a degree of security for income-focused investors, mitigating concerns over potential future distribution cuts. Given these factors, I reiterate my previous buy rating on ET.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.