Summary:

- Energy Transfer LP has been producing strong growth over the past few years due to a substantial number of growth projects.

- These acquisitions have contributed to cash flow growth, which has been one reason why the company has outperformed the S&P 500 Index over the past five years.

- The announced acquisition of WTG Midstream Holdings is expected to boost distributable cash flow and provide growth opportunities in the Permian Basin.

- Energy Transfer currently trades at a discount to its peers and to the market as a whole.

- The company continues to look like a good way to earn an attractive yield from the energy sector.

abadonian

Energy Transfer LP (NYSE:ET) is a giant midstream master limited partnership that has managed to earn itself a very good reputation over the past few years. This is probably at least partially due to the strong growth that the company has managed to deliver via a series of acquisitions in the energy sector. According to Mergr.com, a website that tracks mergers & acquisitions activities in the United States, Energy Transfer has acquired twelve companies throughout its history. It has ramped up its acquisition activities ever since the pandemic, though, as the company has acquired six companies in the past five years alone. The largest of these was the Enable Midstream acquisition in 2021, which greatly expanded Energy Transfer’s operations in Oklahoma, Arkansas, and Louisiana.

As might be expected, these acquisitions have contributed to the company’s cash flow growth over the past few years. As I stated in my last article on Energy Transfer, the company reported an adjusted EBITDA of $3.9 billion in the first quarter of 2024. That was a 13% increase from the equivalent quarter of last year and the continuation of a pretty impressive growth trend:

|

FY 2019 |

FY 2020 |

FY 2021 |

FY 2022 |

FY 2023 |

|

|

Adjusted EBITDA |

$11,214 |

$10,531 |

$13,046 |

$13,093 |

$13,698 |

(all figures in millions of U.S. dollars)

This has, undoubtedly, been one of the reasons why Energy Transfer’s common units have outperformed the S&P 500 Index (SP500) over the past three years:

As this chart shows, investors who purchased Energy Transfer’s common units three years ago are now sitting on a 55.64% gain. That is a fairly impressive return when we consider that the S&P 500 Index is only up 28.49% over the same period. However, the truth is that Energy Transfer’s unitholders have outperformed the index by a greater margin than this chart suggests. This comes from the fact that Energy Transfer boasts a substantially higher yield than the large-cap common stock index. As of today, the S&P 500 Index only yields 1.30%, which is certainly not an impressive figure for anyone who wishes to derive some level of income from their assets. Energy Transfer, on the other hand, boasts a 7.80% yield at the current price. The fact that this company boasts a higher yield than the index means that it provides an excess return that the index does not. When we take this into account, we see that unitholders of Energy Transfer have nearly doubled their money over the past three years:

Including the distributions paid by the company, Energy Transfer’s common unitholders have realized a 99.15% return on their money over the course of three years. That is just under the 100% return needed to double your money. The S&P 500 Index has not come anywhere close to that. The fact that this company has managed to deliver such a strong return in recent years might partially explain why some investors have been willing to take a closer look at it. This group includes those investors who might ordinarily not have any interest in an income-focused play such as this one.

There is no reason to expect that Energy Transfer’s growth trajectory will change in the near future. In fact, there have been a few developments since our last discussion about this company in early May that could drive further growth. We will focus specifically on these changes in this article and see what, if anything, about our thesis needs to be changed.

About Energy Transfer

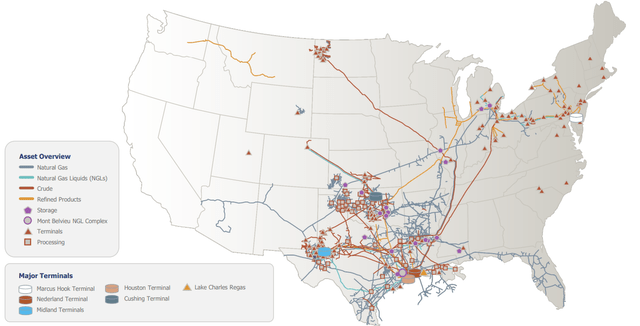

Energy Transfer is one of the largest midstream companies in the United States, boasting operations stretching from North Dakota to Texas and eastward:

It is interesting to note that the company has nearly no operations in California or the other Pacific Northwest states, despite these states’ huge populations. This is not uncommon, as there are very few midstream companies that do build further west than Texas and Colorado. Indeed, there are no pipelines entering California from any other state. This is generally blamed on a combination of geographic factors and difficulty obtaining approval from the California government. This is unfortunate, as the state’s large population consumes a significant amount of energy, and it could be profitable to transport resources to the state. As it is now, though, Energy Transfer is unable to take advantage of that opportunity.

We do see that the company has operations in most of the major basins in which hydrocarbons are produced, including:

- The Permian Basin, in West Texas,

- The Anadarko Basin, in Oklahoma,

- The Williston Basin and Bakken Shale, in North Dakota,

- The Arkoma Basin, in Arkansas and Oklahoma, and,

- The Marcellus Shale, in Pennsylvania.

This last one is especially interesting because Energy Transfer is one of only a few national midstream companies that provide service to the Marcellus Shale. This area is historically underserved by most midstream companies and has generally been forced to rely on companies like Antero Midstream (AM) and Equitrans Midstream (ETRN) that were actually established for the sole purpose of increasing the hydrocarbon takeaway capacity of the region.

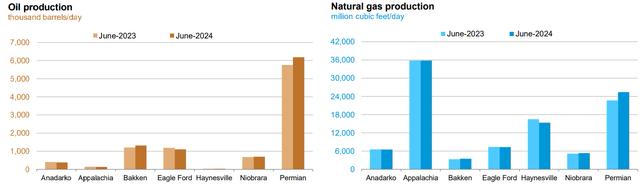

The reason that this is important is that these basins have somewhat different fundamentals. For example, the Permian Basin, and to a lesser extent the Bakken Shale, have been responsible for all of the oil and gas production growth in the United States over the past year:

U.S. Energy Information Administration

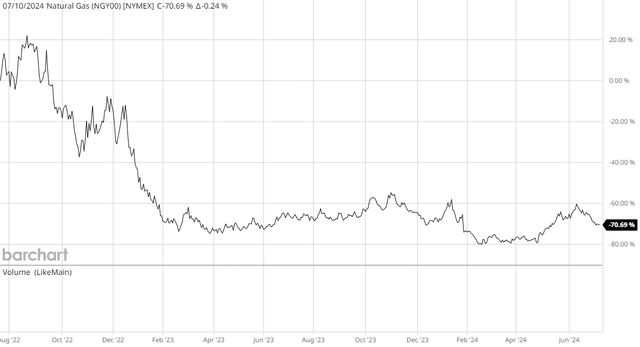

The other basins have seen next to no growth, and indeed the Eagle Ford and Haynesville Shales have even seen production declines. This was not always the case. Appalachia was previously a strong growth play as companies were boosting their output to try and take advantage of the strength of natural gas prices that occurred following the outbreak of war in Ukraine. I discussed this in a previous article published here at Energy Profits in Dividends. However, natural gas prices have yet to recover from the steep decline that occurred in the winter of 2023:

The companies that operate in the gas-producing Appalachia and Haynesville Shale regions have no incentive to boost production as long as natural gas prices remain low and natural gas supplies remain relatively high. Thus, there has been minimal growth in these regions recently, despite the fact that production in them was rising at a fairly decent rate in past years. It is possible that gas production will once again start rising if market prices start to justify that. There is, however, no near-term catalyst to boost natural gas prices higher.

The point though is that Energy Transfer’s presence in all of the major basins in which resources are produced allows it to take advantage of any opportunities that arise. It is already positioned with infrastructure that can carry incremental resources when and if production does start to increase in Appalachia, the Haynesville Shale, or any other basin. Until that time happens, its already existing contracts guarantee it a relatively stable level of cash flow that it can pass through to the shareholders.

With that said, though, production growth is generally going to be the driving factor for Energy Transfer’s organic growth. The reason for this is the company’s business model, which I described in a previous article on Energy Transfer:

In short, Energy Transfer enters into long-term (typically five to fifteen years in length) contracts with customers under which the company provides transportation for the customer’s hydrocarbon products using its network of pipeline infrastructure. In exchange, the customer compensates Energy Transfer based on the volume of resources that the partnership handles, not on their value.

As Energy Transfer’s cash flows directly correlate with the volume of resources that it transports, the only real way for it to grow is to increase the volume of resources that it moves through its infrastructure. The only real way that transported resources will increase is if production of these same resources increases, as the long-term nature of midstream contracts and the fact that pipeline infrastructure is only located at fixed points makes it rather difficult to take customers from other midstream companies. Thus, the fact that the low natural gas prices have been hurting production growth in the Appalachian and Haynesville Basins, and oil production growth has been negligible outside of the Permian Basin has resulted in far fewer opportunities for growth than existed prior to 2020.

This is one reason why we have been seeing an upswing in merger and acquisition activity in the energy sector over the past few years. As mentioned in the introduction, Energy Transfer has acquired six companies in the past five years. We have also seen large deals conducted by ONEOK (OKE), Targa Resources (TRGP), Enterprise Products Partners (EPD), Pembina Pipeline (PBA) and others in recent times. These deals not only result in the acquiring company obtaining more infrastructure that has resources moving through it, boosting the company’s overall total volumes, but also allows for the elimination of duplicative functions. The combined company will not usually need double the number of corporate employees, after all. This allows for lower costs per volume of resources transported and ultimately allows more money to make its way down to the bottom line. This is what is meant by “synergies” that companies so often claim to seek through their merger activities.

Acquisition Of WTG Midstream

A few moments ago, I stated that Energy Transfer does not appear to be showing any signs of reducing its merger and acquisition activities. This is supported by an announcement that the company made about a month ago on May 28, 2024. From the summary posted on Seeking Alpha:

Energy Transfer up pre-market Tuesday after saying it agreed to acquire WTG Midstream Holdings from affiliates of Diamondback Energy (FANG), Stonepeak, and the Davis Estate for approximately $3.25 billion, comprised of $2.45 billion in cash and ~50.8 million newly issued Energy Transfer common units.

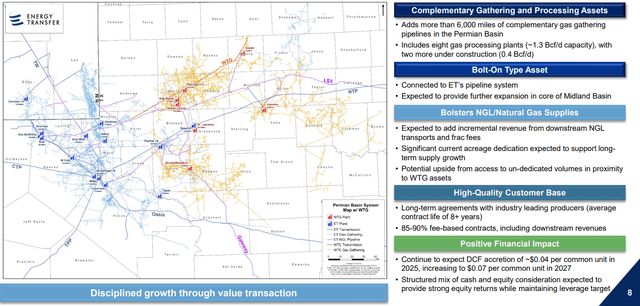

WTG’s 6,000-mile pipeline network serves significant operators in some of the most active areas of the Midland Basin, operates eight processing plants with a total capacity of 1.3 billion cubic feet per day, and is constructing two new plants with 400 million cubic feet per day of additional capacity; the first new plant is expected to be in service in Q3 2024 and the second plant in Q3 2025.

Energy Transfer said it expects the addition of WTG assets to provide increased access to growing supplies of natural gas and natural gas liquids volumes enhancing its Permian Basin operations and downstream businesses.

The partnership expects WTG will add $0.04 per unit of distributable cash flow in 2025, growing to $0.07 per unit in 2027; it said WTG’s cash flows are supported by a high-quality customer base, predominantly investment-grade, with an average contract life of more than eight years.

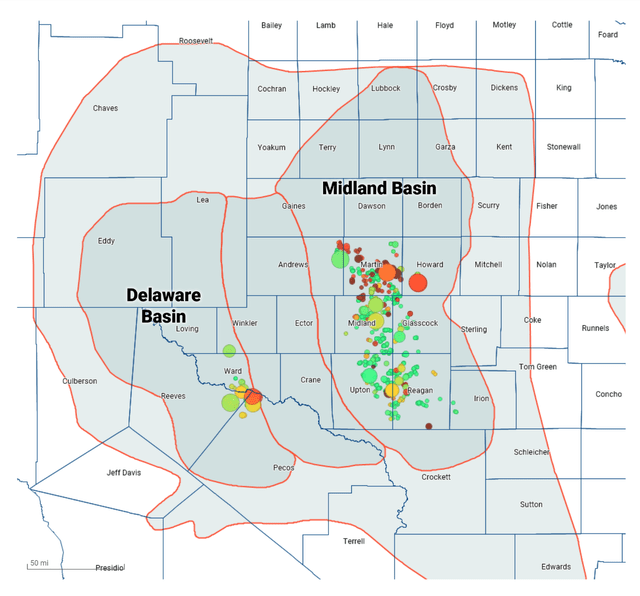

The Midland Basin is one of the two main hubs of the Permian Basin in West Texas. It is the more developed of the two and is generally located east of the Delaware Basin (the other major hub of the Permian):

As we discussed earlier in this article, the Permian Basin is one of the only regions of the United States that has seen any significant increase in hydrocarbon production activity in the past year. This production growth applies to both the Midland Basin and the Delaware Basin. As we also saw, the production of both crude oil and natural gas has been increasing in that region. Thus, it makes sense that WTG Midstream would be constructing two natural gas processing plants, as there is adequate demand for new processing capacity to justify this.

It is standard practice in the midstream industry for a company to obtain contracts for at least most of the total nameplate capacity of new infrastructure before constructing it. There are a variety of reasons for this, including the fact that having contracts in place ensures that the company is not spending a substantial amount of money to construct something that nobody needs to use. It also means that we can be relatively certain that the project will begin to generate cash flow as soon as it becomes operational. It is likely that WTG Midstream has done this with the two gas processing plants that are under construction due to the simple fact that Energy Transfer is expecting that the company will deliver growth over the next few years. As stated in the quote, the expectation is that WTG Midstream’s assets will increase the partnership’s distributable cash flow by $0.04 per unit in 2025 compared with what Energy Transfer will have if this transaction does not go through. However, WTG Midstream’s assets are expected to deliver a $0.07 per partnership unit increase compared to the baseline by 2027. This must mean that the distributable cash flow generated by WTG Midstream’s assets is expected to increase over the three-year period. If the natural gas plants under construction come online as scheduled, this sort of growth over the 2024 to 2027 period is exactly what we would expect to see. Thus, it appears that the two natural gas processing plants under construction already have at least some contracts in place to secure this cash flow growth.

In its June 2024 investor presentation, Energy Transfer confirmed at least some of these conclusions:

While this does not outright confirm that the two natural gas processing plants already have contracts, it does state that WTG Midstream has contracts in place for much of its capacity. Thus, the conclusion here seems to be that Energy Transfer’s own adjusted EBITDA and distributable cash flow will increase once the acquisition is completed. It will then grow further as the two new natural gas plants come online.

Admittedly, $0.04 per unit incremental distributable cash flow does not really seem like much for a company like Energy Transfer. The company reported a distributable cash flow per unit of $0.70 in the first quarter alone. That works out to $2.80 per unit annualized, which means that this acquisition will only result in the company’s distributable cash flow increasing by 1.43% above the current baseline next year. The 2027 figure is a bit better, as it would be a 2.50% increase over the baseline 2024 figure. That still seems pretty meager, though. Nevertheless, we are in an environment in which growth is difficult to come by, so this is still better than nothing.

Valuation

As of the time of writing, Energy Transfer has an enterprise value of $107.17 billion. The company’s adjusted EBITDA over the twelve-month period that ended on March 31, 2024, was $14.145 billion. This gives the company an enterprise value-to-adjusted EBITDA ratio of 7.58 right now. That is remarkably cheap, especially when compared to the 13 to 17 average range for the S&P 500 Index.

Here is how Energy Transfer’s valuation compares to some of its peers:

|

Company |

EV/EBITDA Ratio |

|

Energy Transfer |

7.58 |

|

Enterprise Products Partners |

9.77 |

|

Kinder Morgan (KMI) |

9.92 |

|

ONEOK |

14.20 |

|

MPLX (MPLX) |

9.96 |

|

Enbridge (ENB) |

8.52 |

(all figures based on trailing twelve-month adjusted EBITDA)

As we can see, Energy Transfer’s valuation appears to be not only lower than that of the broader market but also lower than that of its peers. This is something of a recurrent theme for this company, though, as Energy Transfer usually offers a better value proposition than most other midstream companies. This might be due to the market’s perception about its management, as the comment sections of most Energy Transfer articles include at least a few people who are highly critical of it.

In any case, Energy Transfer does appear to be offering a very reasonable valuation right now.

Conclusion

In conclusion, Energy Transfer has delivered remarkable growth over the past few years, primarily through acquisitions. The company got much more aggressive about this following the COVID-19 pandemic and the collapse of the energy industry that accompanied this event. The company shows no signs of stopping this trend, as it recently announced yet another acquisition that will expand its footprint in the Midland Basin of Texas. While this acquisition will not move the needle very much in terms of the company’s distributable cash flow, it is still better than nothing and overall, it will serve to provide a further source of growth for Energy Transfer.

In addition, Energy Transfer trades at a very reasonable price right now. Overall, the company still appears to be worth owning.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MPLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article was originally published to Energy Profits in Dividends on July 11, 2024. Subscribers to the service have had since that time to act on it.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!