Summary:

- Energy Transfer reported strong second-quarter earnings, with adjusted EBITDA and distributable cash flow increasing by 20% and 32% respectively.

- The company raised adjusted EBITDA guidance for the year and increased capital expenditures, focusing on growth projects in the NGL business.

- Energy Transfer’s balance sheet strength, higher distributions, and low valuation make it a solid long-term investment choice, despite unit price volatility due to oil prices.

Chun han

Energy Transfer Second Quarter Earnings Review

Energy Transfer (NYSE:ET) printed a stellar quarter last night (August 7). The two most important numbers, adjusted EBITDA and distributable cash flow available to common unit holders came in at $3.76 billion and $2.039 billion respectively, and increases of 20% and 32% respectively. This growth is the product of capital investment projects coming online and acquisitions.

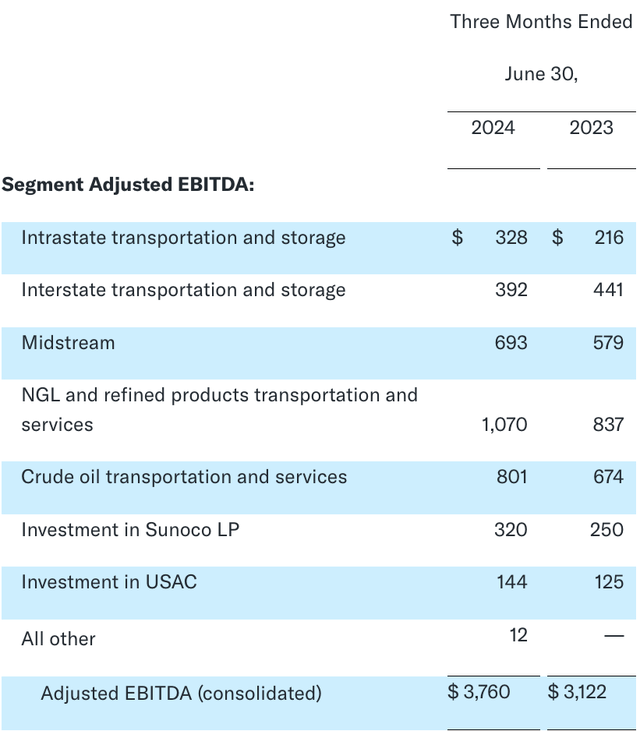

All segments grew nicely year over year, as you can see below.

Energy Transfer EBITDA by Segment (ET Q2 Earnings Report)

The only subsegment that didn’t grow was interstate transportation and storage. That has been challenged for years now, largely because of changing natural gas production. Thankfully, it is just over 10% of adjusted EBITDA vs 14.1% last year.

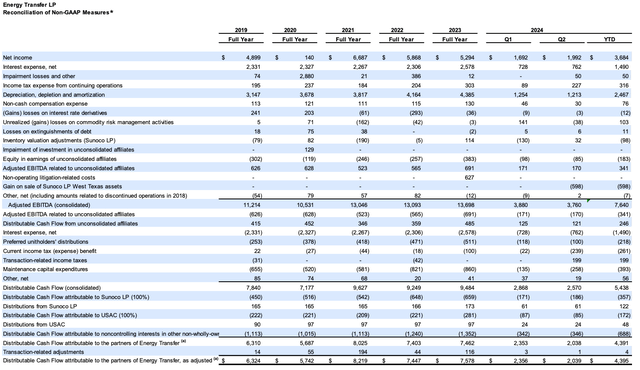

This being ET, with large affiliates such as Sunoco (SUN) and USA Compression (USAC), there are a ton of line items between adjusted EBITDA and distributable cash flow. The good news is that almost $500 million of the $638 million of adjusted EBITDA dropped down to distributable cash. That’s a great level and I don’t see any outlier line items.

Energy Transfer Net Income to Cash Flow Reconciliation (ET Q2 Presentation)

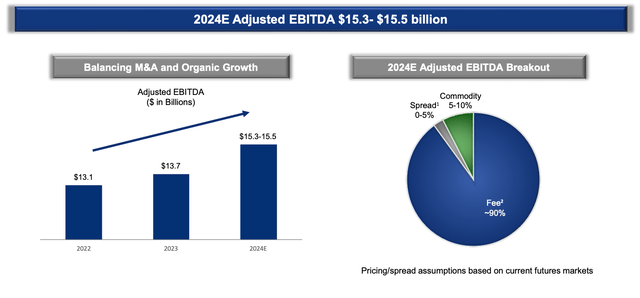

The company raised adjusted EBITDA guidance for the year to a range of $15.3 billion to $15.5 billion, versus between $15.0 billion and $15.3 billion previously. The increase includes strength in the core business plus cash from the WTG Midstream acquisition, which closed in mid-July minus over $100 million of transaction costs that shouldn’t be repeated next year. The midpoint of the new guidance is up 12% versus 2023’s final full-year adjusted EBITDA.

ET EBITDA Growth and Fee Percentage (ET Q2 Presentation)

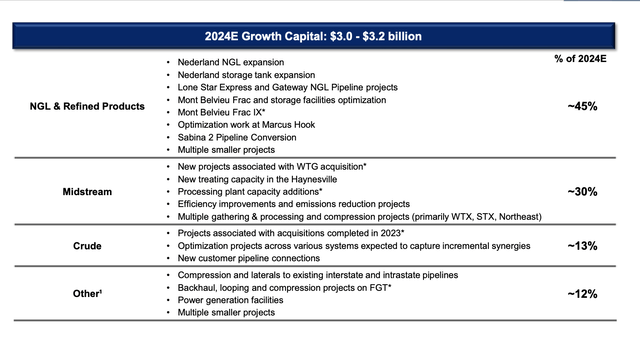

Energy Transfer Capital Expenditures

The cap ex budget was increased to $3.1 billion with about $2.2 billion being growth spending. Much of the increase comes from growth projects at WTG. The biggest component of overall spending is with the NGL business.

ET Cap Ex Breakdown (ET Q2 Presentation)

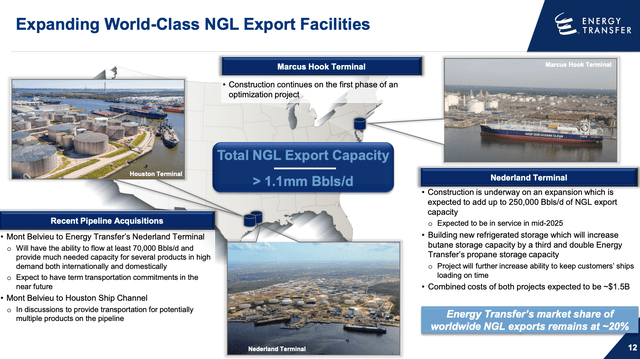

Like Enterprise Products Partners (EPD), I LOVE the NGL fractionization and export business. NGLs will be in demand here and internationally for years to come. The Gulf Coast is a fantastic processing and export point. EPD owns much of the Houston Ship Channel, so ET is building out farther up the coast at Nederland as well as on the East Coast at Marcus Hook.

Energy Transfer NGL Export Infrastructure (ET Q2 Presentation)

Higher Distributions and Balance Sheet Strength

These growth projects lead to steadily higher cash flows and allowed the company to keep its pace of increasing the distribution by a quarter of a penny for the seventh quarter in a row to $0.32. The balance sheet is in great shape and Moody’s raised the credit rating to Baa2 in June. That matches S&P’s BBB rating.

Valuation

Unlike EPD, which has been run pretty conservatively, this is a new look for ET, one I like quite a bit. The stock has appreciated nicely as debt has come down and EBITDA has grown, but the multiple remains pretty low at ~7.9x EBITDA, still over a turn of EBITDA below EPD. ET has recovered its immediate pre-Covid high (which EPD somehow hasn’t), but remains decently below where it was in 2018 and before. Ironically, this is a better company now, with steadier hands in the CEO suite, less leverage, internally funded growth projects, and Kelcy Warren apparently finally showing discipline in corporate structure and dealmaking.

People might criticize the rather slow (3%) distribution growth after the company regained its pre-Covid distribution level, but I prefer a bulletproof balance sheet and flexibility inherent in a better-covered distribution. These MLP structures remain so out of favor that I don’t think a higher distribution would lead to a materially higher unit price. At these valuations, I’d prefer they buy back units if they can’t spend cash on high return capital projects.

Risk

I might sound like a broken record, but the main risk with any energy name is oil prices. Even though, as the slide above shows, only 5-10% of ET’s EBITDA is directly tied to commodities, the unit prices can, have, and likely will move with oil prices, sometimes violently. Those are almost always buying opportunities, but you have to be prepared for them if you own the units.

Conclusion

I consider ET a core holding in any portfolio, but particularly, one that wants some tax-deferred income that can grow over time.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Members of Catalyst Hedge Investing had early access to this article. They have exclusive access to many other articles every month as well as an active chat board with regular updates on ideas and a best ideas portfolio.