Summary:

- A couple of dynamics are anticipated to lead to a significant spike in electricity demand, which will be powered by natural gas.

- Energy Transfer has a host of growth projects set to come online in the quarters ahead to drive continued growth.

- The partnership’s credit rating was upgraded by Moody’s to Baa2 (BBB equivalent) in June.

- Units of Energy Transfer could be trading 15% below fair value.

- The partnership offers a safe and growing 8% yield, modest DCF growth prospects, and valuation multiple upside from here.

Engineers working at a pipeline construction site. Dejan Marjanovic/E+ via Getty Images

When I’m investing in businesses, I like to be sure that the overall industry has elements working in its favor. That’s because it is easier for a company to grow when overall demand for its industry is rising.

One of my favorite industries for the foreseeable future is midstream. The industry is set to benefit from increased investments in manufacturing due to the U.S. reshoring trend. The advent and anticipated rise of artificial intelligence is fueling increased data center demand and is another tailwind for the industry.

That is because these two factors are expected to drive nationwide power demand higher by 4.7% over the next five years per Utility Dive. This would be an acceleration from the previous year’s five-year forecast of 2.6% growth. That surge in electricity demand will require an all-of-the-above approach to energy, with natural gas at the forefront of powering this demand. This should lead to more of the commodity flowing through the pipelines of midstream operators in the years to come.

One company that I expect to cash in on this opportunity is Energy Transfer (NYSE:ET). Accounting for 1% of my portfolio, ET is my portfolio’s 39th-biggest portfolio position. The midstream operator is my third-largest midstream holding, behind ONEOK’s (OKE) 2.1% weighting and Enterprise Products Partners’ (EPD) 1.6% weighting.

When I last covered ET with a buy rating in May, I liked that the company had growth projects set to come online soon. The company’s balance sheet was improving and becoming another source of strength. ET’s distribution was also growing at a healthy clip. Finally, units of the partnership were trading at an enticing valuation.

Today, I’m going to be reiterating my buy rating. As was shared in its second-quarter earnings results yesterday afternoon, ET set a variety of new partnership records during the quarter. The midstream operator also upped its adjusted EBITDA guidance for 2024. In June, ET’s credit rating was upgraded by Moody’s to Baa2. Lastly, units still present an attractive value proposition.

Another Quarter, Another 2024 Guidance Raise

ET Q2 2024 Earnings Presentation

Each time I cover ET, it seems like déjà vu all over again. New partnership records, more projects coming online, and raised guidance. The second quarter results released on August 7th were no different.

ET’s total revenue surged 13.1% year-over-year to $20.7 billion during the second quarter. This topline growth was fueled by impressive growth throughout the business.

For one, crude oil transportation volumes grew by 22.6% over the year-ago period to a partnership record of 6.5 million barrels per day in the second quarter. This was driven by both organic growth (8%) and the acquisitions of Lotus and Crestwood assets completed last May and November.

Per Co-CEO Tom Long’s opening remarks during the Q2 2024 Earnings Call, ET’s total crude oil exports also rose by 11%. NGL exports increased by 3% for the second quarter to a new partnership record. Finally, NGL transportation volumes edged 4% higher during the quarter to a new partnership record.

Thanks to these results, adjusted EBITDA roared 20.4% higher to nearly $3.8 billion in the second quarter. Even accounting for the 7.3% increase in the outstanding unit count, that is undeniably strong growth. ET’s DCF climbed 31.2% year-over-year to top $2 billion for the quarter.

The partnership upped its adjusted EBITDA guidance for 2024 from a midpoint of $15.15 billion to $15.4 billion ($15.3 billion to $15.5 billion). This wasn’t just because of ET’s organic results, either. In July, the company completed its $3.25 billion acquisition of WTG Midstream. That added eight gas processing plants (and two under construction) to its processing network in the Permian Basin, as well as over 6,000 miles of complementary gas processing pipelines.

Nearly six months of results from this acquisition for 2024 are expected to provide a modest boost to ET’s results. Beyond this year, management projects the acquisition will be accretive to DCF/unit by $0.04 in 2025 and to the tune of $0.07 in 2027.

ET Q2 2024 Earnings Presentation

If the incremental uptick in growth from this acquisition wasn’t enough, ET also has plenty of growth projects of its own under construction.

The Midland Connection, adding 30 miles of pipe to connect ET’s pipeline from the Permian Basin to Cushing is expected to come into service in the fourth quarter of this year. This could transport an additional 100K barrels a day of crude from ET terminals.

Processing upgrades in the Permian to four plants are anticipated to come online between the fourth quarter of this year and the first quarter of 2025. That could add a total of 200 million cubic feet per day to the company’s processing capacity in the region.

Third, ET is increasing the capacity of the Sabina 2 Pipeline from 25,000 barrels a day to 70,000 barrels a day of natural gas between Mont Belvieu and Nederland. This is on schedule to be completed early next year.

In the long term, ET has a variety of projects in the proposal stage. That includes carbon capture and sequestration projects, blue ammonia hubs in Lake Charles, Louisiana, and Nederland, Texas, and a large-scale LNG export facility at the existing Lake Charles LNG regasification terminal. Put another way, there is no shortage of projects for ET to maintain decent growth for many more years to come.

Financially, the partnership is also in excellent standing. In June, ET’s credit rating was upgraded by Moody’s to Baa2 or BBB equivalent. That means the company now possesses BBB credit ratings from all three major rating agencies.

These investment-grade credit ratings allowed ET to issue $3.5 billion of senior notes in June. Of that amount, $1 billion of notes due 2029 were issued at 5.25%. Another $1.25 billion of notes due 2034 were issued at 5.6%. The remaining $1.25 billion of notes due 2054 were issued at 6.05%. For this high-rate environment, these are arguably attractive terms for ET (unless otherwise hyperlinked or sourced, all details in this subhead were according to ET’s Q2 2024 Earnings Press Release and ET’s Q2 2024 Earnings Presentation).

A Safe And Growing Distribution

ET’s 8% forward distribution yield registers at nearly double the energy sector median forward yield of 4.4%. That’s sufficient for an A- grade from Seeking Alpha’s Quant System for forward distribution yield.

Even within the midstream industry, few peers offer comparable or higher yields. The only two major midstreams offering greater yields with which I’m familiar are MPLX LP (MPLX) and Western Midstream Partners LP (WES).

From my perspective, ET’s distribution is also reasonably sustainable. That’s because, in the first half of 2024, the partnership generated $4.4 billion in total DCF. Against nearly $2.2 billion in distributions paid to unitholders, this was a distribution coverage ratio of 2.

That means ET retained $2.2 billion in DCF to fund its growth capex and maintenance capex. Even considering the $1.4 billion in capex ($1 billion growth capex and ~$400 million maintenance capex), this left the partnership with a roughly $800 million surplus through the first half (details sourced from ET’s Q2 2024 Earnings Press Release and ET’s Q1 2024 Earnings Press Release).

In other words, ET’s business model is self-sustaining. It is paying for its distribution, building out new infrastructure, and maintaining its existing infrastructure from the DCF that it generates. This means that ET doesn’t depend on capital markets via equity issuances/debt issuances to pay unitholders and fund growth (besides completing bolt-on acquisitions).

That is why it didn’t come as a surprise to me when ET once again upped its quarterly distribution per unit by 0.8% to $0.32. Of note, the partnership increases its distribution each quarter. So, this pace of growth remains consistent with the 3% to 5% annual distribution growth that it is targeting over the long haul.

Overall, I think ET is well-positioned to keep delivering distribution growth in the years ahead. This could provide unitholders with an intriguing mix of starting income and growth potential.

Fair Value Could Be $19 A Unit

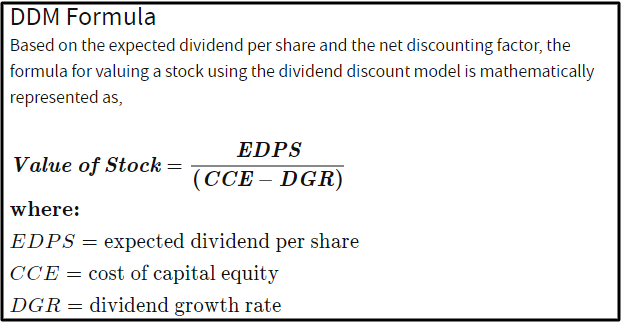

Investopedia

Since my previous article, units of ET have been flat as the S&P 500 index (SP500) has gained 1%. Contrasted to a slight uptick in my fair value estimate, this makes the midstream operator a marginally better buy now than it was three months ago.

Since the return of capital provided by ET to unitholders provides the bulk of capital appreciation, I still believe the distribution discount model is a relevant valuation method.

The first input for the DDM is the expected dividend per share or annualized distribution per unit in this case. That amount is now $1.28.

The next input into the DDM is the cost of capital equity, which is another term for the required annual total return rate. My preference is for at least 10% annual total returns, so that is what I’ll assume for this input.

The final input for the DDM is the annual distribution growth rate. Erring on the side of caution, I’m reaffirming my expectation of 3.25% annual distribution growth over the long run. This is a bit less than the annual midpoint distribution growth of 4%.

Using these variables for the inputs yields a fair value of $18.96 a unit. From the current $16.05 unit price (as of August 8, 2024), this represents a 15% discount to fair value.

Risks To Consider

ET is a business that’s thriving, which is evidenced by its new partnership records in the second quarter. That doesn’t mean it is free from risks, however.

One risk to ET is the potential for natural disasters like hurricanes and wildfires to damage its infrastructure. Aside from disruptions to its operations, the partnership would likely incur some out-of-pocket costs to repair these damages. If this happened on a significant enough scale, damages could reach levels beyond ET’s commercial insurance coverage. That could impair the company’s fundamentals.

Another risk to the partnership is regulatory/legal. If ET’s projects currently under construction were delayed or canceled due to activist lawsuits, this could hurt its growth prospects.

A final risk is one that I highlighted in my previous article. ET’s business is stable in that approximately 90% of its adjusted EBITDA is derived from fee-based contracts. This provides a relatively secure source of adjusted EBITDA for ET. The only risk to this adjusted EBITDA is that it is contingent on customers remaining going concerns. If any major and prolonged industry downturns like the 2015/2016 energy bear market happened, some customers could experience financial difficulties. That could temporarily impact ET’s financial results.

Summary: A No-Brainer Pick For Income And Value

In my view, ET is just shy of being a strong buy right now. The fundamentals of the business point to a bright future ahead. The credit rating upgrade by Moody’s was another recent positive event. ET also looks to be materially undervalued from the current unit price. Even if the partnership’s valuation multiple remained flat, the 8% yield and modest future growth potential alone could deliver double-digit annual total returns. Throw in moderate valuation multiple upside, and it becomes easy to see why I remain bullish toward units of ET.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET, OKE, EPD, MPLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.