Summary:

- Energy Transfer LP is a leading midstream MLP with extensive infrastructure, primarily in the Gulf Coast, Bakken Shale, and Marcellus regions, offering growth potential.

- The company has shown strong growth, with a 30.53% increase in operating cash flow since 2021, driven by acquisitions and organic projects.

- Energy Transfer is bringing a new natural gas processing plant that it acquired from WTC Midstream into operation. This will begin contributing to the company’s cash flow in Q3 2025.

- Energy Transfer’s 7.75% yield is attractive, and its distribution is well-covered with a 1.86x coverage ratio, making it appealing for income-focused investors.

- Despite rising debt and interest expenses, Energy Transfer maintains a solid financial position with a leverage ratio of 3.82x, indicating strong debt management.

halbergman

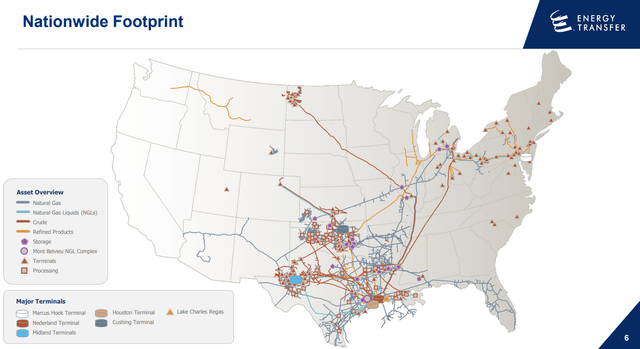

Energy Transfer LP (NYSE:ET) is a midstream master limited partnership that operates an extensive network of pipelines and other energy infrastructure facilities that stretch across most of the United States:

We do see though that the company’s infrastructure is somewhat lacking in the Western states, particularly California and Oregon. This is not surprising, and it is certainly not unusual. There are no oil pipelines entering into California, and the state itself is generally isolated from the rest of the United States as far as the energy sector is concerned. Oregon does have pipelines and other infrastructure, but they are not owned by Energy Transfer. Overall, this company mostly focuses on the Gulf Coast, Bakken Shale, and the Marcellus. This makes Energy Transfer one of the few large pipeline partnerships to have a significant presence in the Marcellus Basin, and this might provide the company with some growth potential going forward. After all, as we have discussed in a number of previous articles on Energy Profits in Dividends, the fundamentals point to fairly strong growth for natural gas demand over the coming years.

In fact, as Reuters explains in an article from last month, the demand for natural gas is expected to cause prices to surge this coming winter. From that article:

Gas use is also set to scale new heights going forward.

Power production, industrial processes and liquefied natural gas exports are the key drivers of U.S. natural gas use.

The power sector accounts for around 38% of total U.S. gas demand, while industry consumes an additional 32%, according to EIA.

The LNG export sector accounts for an additional 10%, according to the Institute for Energy Economics & Financial Analysis.

The power and industrial demand sectors look primed for further growth in 2025 and beyond, as total national electricity consumption continues to climb and output of manufactured goods and chemicals rises.

Gas use in U.S. power generation is likely to accelerate over the coming decade as more inefficient coal-fired power plants are replaced by gas-fired units, which emit around 77% less carbon dioxide per unit of electricity than coal plants.

The Marcellus shale is the largest source of natural gas in the United States, with the region producing more natural gas than even the well-known Permian Basin in West Texas. It also has enormous reserves of natural gas, so companies that operate in the region can increase their output to meet demand growth. Energy Transfer’s operations in this region could thus allow it to experience growing volumes of natural gas moving through its pipelines. Energy Transfer’s cash flows directly correlate with the volume of natural gas that it moves through its infrastructure, so obviously this represents a very real opportunity for the company.

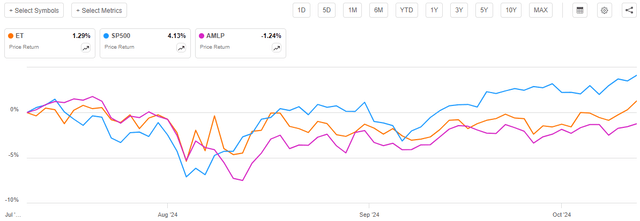

As regular readers can likely remember, we previously discussed Energy Transfer around the middle of July 2024. The equity markets in general have been fairly strong since that time, at least if we exclude the “Magnificent 7” technology stocks that have lagged. For example, Apple (AAPL), Microsoft (MSFT), and Alphabet (GOOG) are all slightly down since the middle of July versus a 4.13% gain in the S&P 500 Index (SP500). Unlike these stocks, midstream partnerships like Energy Transfer have actually held up pretty well, which represents a very nice change compared to the poor performance that these companies all delivered during the 2010 to 2020 period.

Energy Transfer is up 1.29% since our last discussion:

This is, unfortunately, worse than the S&P 500 Index delivered over the same period. However, the partnership has managed to outperform the Alerian MLP Index (AMLP) over the period, which is nice. This is, in fact, a fairly remarkable feat considering that Energy Transfer is 12.75% of the Alerian MLP Index.

As I have noted in various previous articles, though, master limited partnerships typically deliver a significant proportion of their investment return via the regular distributions that they pay out to their unitholders. As such, we should probably include the distributions whenever discussing the performance of a company like Energy Transfer. When we do that, we get this alternative chart for the period in question:

As we can see here, the distribution that Energy Transfer paid out in August raised the total return that its investors actually received to 3.32% since our last discussion. This is still slightly below the total return performance of the S&P 500 Index, but it once again manages to beat the Alerian MLP Index. As many investors who are focused on income are willing to accept a slightly lower return in exchange for a high yield, this performance will probably be satisfactory for many of the company’s unitholders.

Speaking of the distribution, Energy Transfer yields a respectable 7.75% at the current unit price. This is not as high as it has been in the recent past, but it is still quite good when compared to the rest of the market. It is also better than several of the company’s peers:

|

Company Name |

Current Yield |

|

Energy Transfer |

7.75% |

|

Enterprise Products Partners (EPD) |

7.13% |

|

Western Midstream Partners (WES) |

8.80% |

|

MPLX LP (MPLX) |

7.67% |

|

Kinder Morgan (KMI) |

4.66% |

|

The Williams Companies (WMB) |

3.76% |

|

ONEOK (OKE) |

4.10% |

We can see that while Energy Transfer does not have the highest yield that is available among the master limited partnerships, it still does pretty well against those. The company’s current yield substantially beats all of the midstream corporations. This is something that is likely to appeal to those investors who are seeking to earn a high level of current income from their assets, especially because Energy Transfer’s distributions have tax advantages compared to the dividends that are paid by the corporate midstream firms. Energy Transfer has long been a favorite holding for investors who are in search of a high level of current income, and it appears to continue to be so given its still-high distribution yield.

About Energy Transfer

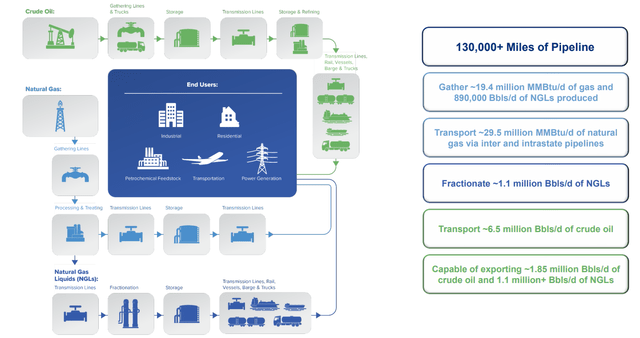

As mentioned in the introduction, Energy Transfer is a very large midstream master limited partnership that operates a network of pipelines and other infrastructure throughout much of the central and eastern United States. Overall, the company owns more than 130,000 miles of pipelines along with the facilities to produce approximately 890,000 barrels of natural gas liquids:

As we can see from the chart above, Energy Transfer has a presence in nearly all parts of the midstream value chain. This could provide some efficiency advantages over having multiple companies, each specializing in only one specific function. The midstream sector itself has been focused on improving its overall efficiency over the past few years, due at least in part to the fact that the entire energy industry nearly collapsed twice over the 2014 to 2020 period. This is one of the reasons why we have been seeing a wave of consolidation in the sector during recent years.

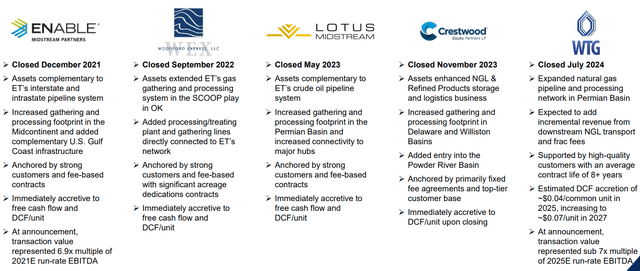

Energy Transfer itself has been participating in this consolidation wave, as the company has been a party to five major acquisitions since 2021:

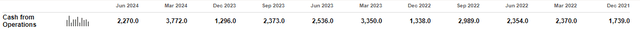

This is the reason why we have seen this company generate strong growth over the period. We can see this growth by looking at the company’s operating cash flows. Here they are from December 31, 2021, until June 30, 2024 (the most recent quarter for which the company has released its results):

(all figures in millions of U.S. dollars)

As we can see, Energy Transfer reported an operating cash flow of $1.739 billion in the final quarter of 2021. This was the final quarter before the Enable Midstream acquisition (which closed in December 2021), so it works very well as a starting point. The company’s operating cash flow came in at $2.270 billion in the most recent quarter, which represents a 30.53% increase over the December 2021 level. Admittedly, that may not seem very impressive for those investors who are used to investing in very high-growth companies. However, that was still an 11.24756% compound annual growth rate over the period. Midstream companies historically are not known for delivering strong growth, so that is a very solid figure for a company in this sector.

We can see even stronger growth if we look at the company’s adjusted EBITDA. This is a non-GAAP figure that is often used by midstream companies as a proxy for pre-tax cash flow. It is the primary performance metric used by companies in this sector, even though it is not a GAAP-defined figure.

For the fourth quarter of 2021, Energy Transfer reported an adjusted EBITDA of approximately $2.81 billion. The second quarter 2024 figure was approximately $3.76 billion. That is a 12.35505% compound annual growth rate, which is very impressive for a company in this sector.

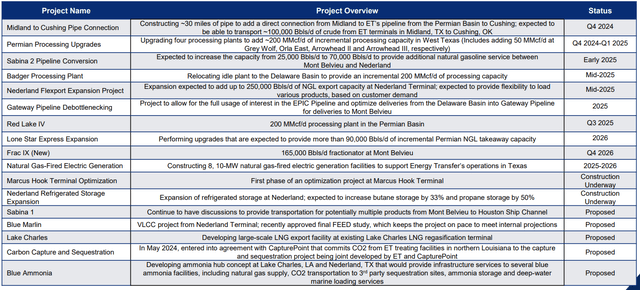

Energy Transfer has some potential to continue this growth trajectory going forward. The company currently has several projects under construction, several of which are expected to be completed in 2025:

We can see one project that is expected to be completed by the end of the year (the Midland to Cushing Pipe Connection). This will add approximately 100,000 barrels of crude oil to the transportation capacity out of the Permian Basin and to the hub in Cushing, Oklahoma. That should provide a bit of a cash flow boost to Energy Transfer once it starts operating, but we may not see the effect of this project’s start-up until the first quarter of 2025. This is because if the project starts late in the fourth quarter, then it will not have time to meaningfully contribute to Energy Transfer’s results during the fourth quarter of 2024.

Red Lake IV Natural Gas Plant

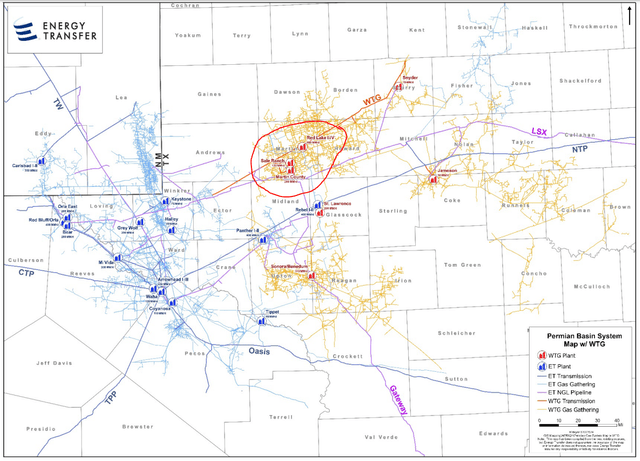

A few of the projects with a 2025 start-up date are worth discussing in detail. One of these is the Red Lake IV natural gas processing plant that is under construction in the Permian Basin:

Energy Transfer/Edits by Author

The Red Lake facility is a group of four natural gas processing plants located in Martin County, Texas. This county is close to the New Mexico border (I circled the area in the map above) and is located in the heart of the Permian Basin. The complex was owned by WTG Midstream prior to Energy Transfer’s takeover of that company back in July. We discussed this merger in great detail in my previous article on this company, and will revisit it later in this article.

From an article on the acquisition:

WTG provides comprehensive midstream services including wellhead gathering, intra-basin transportation and processing services. The company’s 6,000-mile pipeline network serves significant operators in some of the most active areas of the Midland Basin including Martin, Howard, Upton, Reagan, and Irion counties. WTG also operates eight processing plants with a total capacity of 1.3 Bcf/d and is constructing two new plants with an additional capacity of approximately 0.4 Bcf/d. The first new plant is expected to be in service in the third quarter of 2024 and the second plant the third quarter of 2025.

Please notice that the above quote makes mention of two new plants under construction. These two plants are Red Lake III and Red Lake IV, each of which has a design capacity of 200 million cubic feet of natural gas per day. It is not uncommon for a company to use identical plant designs when constructing a new natural gas processing facility, particularly when they are constructed in close proximity to each other both geographically and chronologically. Red Lake III has since come online and is already contributing to Energy Transfer’s cash flow. We will see the impact of this plant’s new capacity in the company’s third-quarter results, although it will only have a few weeks of operation before the close of the quarter. That plant will deliver a much stronger contribution to Energy Transfer’s fourth quarter results as it will operate for the entire quarter and thus generate significantly higher revenue and cash flow than it did in the third quarter of 2024.

Red Lake IV, meanwhile, is an identical plant that is still under construction and is expected to come online in the third quarter of next year. As was the case with its sister plant, the impact of this plant’s operation will be felt most heavily in the fourth quarter of 2025 due to the fact that it will not be operating for the entire third quarter of 2025. Admittedly, though, an additional 200 million cubic feet of processing capacity will not have a very large impact on the financial performance of a company the size of Energy Transfer. As I have stated in the past though, every little bit helps, so it is nice to see that the company has this growth project coming online in the near future.

In my previous article on Energy Transfer, I made the following statements with respect to the Red Lake III and Red Lake IV natural gas processing plants:

It is standard practice in the midstream industry for a company to obtain contracts for at least most of the total nameplate capacity of new infrastructure before constructing it. There are a variety of reasons for this, including the fact that having contracts in place ensures that the company is not spending a substantial amount of money to construct something that nobody needs to use. It also means that we can be relatively certain that the project will begin to generate cash flow as soon as it becomes operational. It is likely that WTG Midstream has done this with the two gas processing plants that are under construction due to the simple fact that Energy Transfer is expecting that the company will deliver growth over the next few years.

I went on to conclude that WTG Midstream probably had some sort of agreement in place with customers who wanted to use the new capacity of the Red Lake III and Red Lake IV plants. As such, we can probably be fairly certain that each of these plants will contribute to Energy Transfer’s results once they come online, as discussed above. The overall effect will likely be pretty meager, though, as I calculated in the previous article on this company.

Financial Considerations

As I stated in a previous article:

It is always important to investigate the way that a company is financing its operations before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt needs to be repaid at maturity. That is typically accomplished by issuing new debt and then using the proceeds to repay the existing debt. After all, very few companies have sufficient cash on hand to completely repay their debt as it matures. This process of rolling over debt can cause a company’s interest expenses to increase following the rollover in certain market conditions.

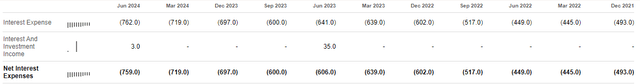

Energy Transfer has seen its interest expenses increase fairly significantly over the past few years, which is due both to a rising debt load and higher interest rates. As we can see here, the company’s net interest expenses were only $493.0 million in the fourth quarter of 2021 compared to $759.0 million in the most recent quarter:

(all figures in millions of U.S. dollars)

This is a 53.40% increase over the period, which is sufficient to give any investor pause. After all, interest expenses are a drag on a company’s net income and cash flow. In addition, any money that a company has to pay for debt service is not available to distribute to its unitholders. As income investors, one of our interests is receiving money from the companies that we own, so obviously a rising interest expense detracts from the company’s ability to pay us.

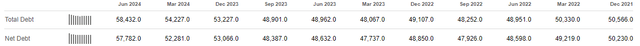

As just stated, this surge in the company’s net interest expenses accompanied an increase in its debt load. At the end of 2021, Energy Transfer had a net debt of $50.230 billion, but this rose to $57.782 billion by June 30, 2024:

(all figures in millions of U.S. dollars)

Obviously, an increase in debt will cause a company’s interest expenses to increase, all else being equal. Unless interest rates are declining, an increase in debt will cause an increase in debt service expenses. If interest rates are rising, it causes the debt service costs to increase at a faster rate than the debt increases. In this case, the company’s net debt increased by 15.03% and interest rates increased over the period. The increase in debt was due to a combination of the company’s aggressive merger and acquisition activity and the need to fund its own organic growth projects. We would expect the company’s debt to increase given its strong growth over the period and the overall capital-intensive nature of its business, so overall what we see with the company’s debt and interest expenses over the period is not particularly surprising.

As I stated in my review of Energy Transfer’s first-quarter 2024 financial performance:

The most important thing for our analysis though is to determine how well the company can carry its debt. The usual way that we judge this is by looking at the company’s leverage ratio, which is also known as the consolidated debt-to-adjusted EBITDA ratio. This ratio basically tells us how many years it would take the company to completely pay off its debt if it were to devote all of its pre-tax cash flow to that task.

As of June 30, 2024, Energy Transfer had a total consolidated debt of $58.432 billion. The company’s adjusted EBITDA for the first half of 2024 was $7.640 billion, which works out to $15.28 billion annualized. This is very slightly less than Energy Transfer’s guidance of $15.3 billion to $15.5 billion for the full-year 2024 period, so it should work pretty well for our purposes right now. These figures give Energy Transfer a leverage ratio of 3.82x, which is very reasonable. As I have stated in the past, Wall Street analysts usually consider anything under 5.0x to be acceptable. Most of the better-financed midstream companies have reduced their ratios to under 4.0x in recent years though, and we can see that Energy Transfer is among this group.

Overall, the company’s financial position looks very strong. Risk-averse investors should not have anything to worry about here.

Distribution Analysis

Energy Transfer currently pays a quarterly distribution of $0.32 per common unit ($1.28 per unit annually). As noted in the introduction, this gives the company a 7.75% yield at the current unit price. This compares reasonably well with many of the company’s peers.

The most important thing for our purposes as income investors is determining how well the company can sustain its distribution going forward. Let us have a look at its distributable cash flow to make this determination.

For the second quarter of 2024, Energy Transfer reported a distributable cash flow of $2.038 billion. The company’s declared distribution, meanwhile, only costs it $1.096 billion. This gives the company a distribution coverage ratio of 1.86x, which is quite reasonable. Wall Street analysts usually consider anything over 1.20x to be sustainable over the long term. Personally, I prefer that this ratio is above 1.30x in order to add a margin of safety to the position. As we can clearly see, Energy Transfer meets even my stricter criterion.

The company’s distribution should be pretty safe right now.

Conclusion

In conclusion, Energy Transfer continues to look like a very solid midstream master limited partnership for those investors who are in need of a high level of income. The company has managed to achieve a very high growth rate over the past few years, and its recent acquisition and project pipeline should allow it to continue that growth going forward. The company’s balance sheet continues to be strong, and its distribution is well covered. Overall, investors should be reasonably satisfied with the company right now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MPLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article was originally published to Energy Profits in Dividends on Saturday, October 12, 2024. Subscribers to the service have had since that time to act on it.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!