Summary:

- In a recent Wolfe Research report, ET was named a top beneficiary if Donald Trump returns to office, with Saturday’s shooting likely boosting those odds.

- The fact that the U.S. is expected to continue breaking energy consumption records is favorable for the largest midstream players like Energy Transfer.

- Fair value of the stock is estimated at $20.6 with a 27% upside potential. Moreover, the stock offers a compelling 7.8% forward distribution yield.

AlexanderImage/iStock via Getty Images

Investment thesis

My previous bullish thesis about Energy Transfer (NYSE:ET) aged well as the stock delivered a total 5% return since early April. The company’s fundamentals continue improving, in my opinion. ET’s financial performance consistently demonstrates improvements, and its balance sheet is strong enough to balance between investing in business expansion and ensuring safety of its generous forward 7.8% distribution yield. Secular trends are positive for the largest U.S. midstream players like ET, as the country is expected to beat power use records again and again as the digital revolution fuels the demand. Political developments also look quite positive for ET, and insiders were not selling the stock over the last twelve months. Furthermore, there is still a solid upside potential, according to my valuation analysis. All in all, I reiterate a “Strong Buy” rating for ET.

Recent developments

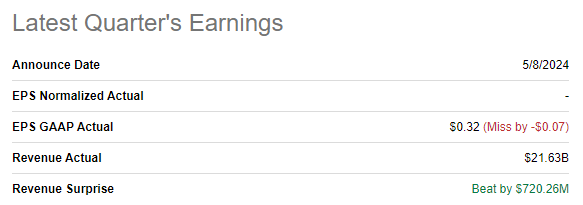

The latest quarterly earnings were released on May 8, when ET surpassed revenue consensus estimates but a negative EPS surprise. Revenue grew by about 14% YoY and the adjusted EPS was stable at $0.32.

Seeking Alpha

The bullish sign is that despite a flat EPS, other crucial profitability metrics demonstrated stronger performance in Q1 2024. The operating margin expanded from 10.86% to 11.00% on a YoY basis, partially due to the improvement of the gross margin by 30 basis points. Pessimists might say that these improvements are not worth the attention. However, I believe that for a mature and historically profitable business like ET driving profitability expansion is challenging and even marginal improvements are bullish.

Seeking Alpha

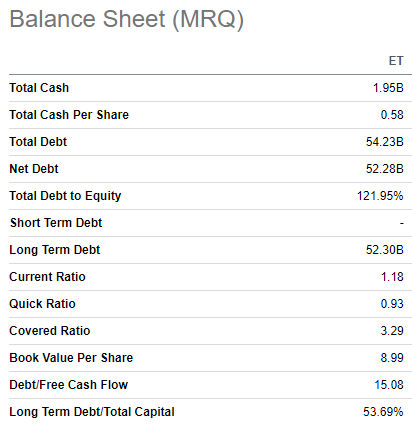

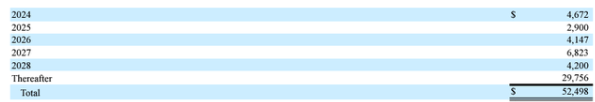

ET’s balance sheet is highly leveraged, which is inherent for the midstream industry. High debt levels are normal for the industry because expansion requires substantial CAPEX amounts, and payback periods are usually long. Therefore, I do not see a problem in ET’s elevated leverage. Moreover, ET boast and investment-grade “BBB” credit rating from Fitch. Last but not least, the major portion of debt matures in 2027 and thereafter, which is a long-term horizon.

ET’s latest 10-K report

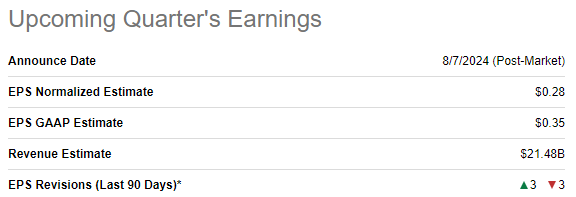

The upcoming earnings release is scheduled for August 7. Wall Street analysts expect quarterly revenue to be $21.48 billion, which means a 17% YoY growth. The EPS is expected to follow the top line and expand YoY from $0.25 to $0.35. Wall Street’s sentiment around the upcoming earnings release looks neutral with the same number of EPS upgrades and downgrades over the last 90 days.

Seeking Alpha

That said, from the financial perspective, everything goes well for ET. The P&L demonstrates positive trends, and ET’s financial position positions the company well to ensure safety of its stellar 7.8% distribution yield.

Industry trends also look quite positive for ET and all other large midstream players. U.S. energy consumption is expected to set new records in 2024 and 2025, which is beneficial for the midstream industry. I think that the AI phase of digital revolution will likely fuel consistent energy consumption growth beyond 2026 as well. My optimism around the midstream industry is backed by the recent bullish report from Wells Fargo (WFC) as well. I am especially bullish about ET in the digital revolution because it commands a staggering 21% market share in the gas pipeline transportation industry. Being such a vital player in the U.S. energy industry means that ET successfully absorbing this tailwind is almost inevitable.

The company prepares itself to absorb secular tailwinds by solidifying its strategic position in the market. A large $3.25 billion deal to acquire WTG Midstream announced about a month ago. This combination is expected ET to expand its footprint in the vital Permian Basin. The partnership expects WTG will add ~$0.04/unit of distributable cash flow in 2025, growing to ~$0.07/unit in 2027. The potential positive effect looks material compared to ET’s $1.88 FCF per share in FY 2023. To finance the deal, ET priced a $3.5 billion debt offering. The amount might look massive without context, but it is less than a third of ET’s TTM EBITDA.

Let us also not forget that 2024 is the presidential election year in the U.S. According to Wolfe Research, defense sectors are the ones to likely rally if Donald Trump returns to the Oval Office. In the report, Chris Senyek, chief investment strategist of Wolfe Research, named ET as one of the most likely potential stock winners if Trump wins the election. According to some experts, the odds of Donald Trump winning back the White House have increased following Saturday’s shooting. I am not an expert in politics, but in my humble opinion, the first photo shared here is absolutely iconic and will likely boost Trump’s political image significantly.

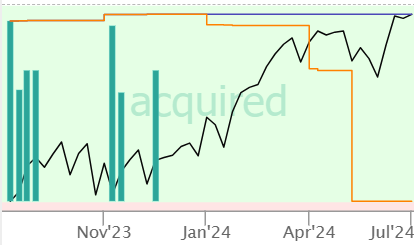

TrendSpider

Another bullish factor is that insiders were only buying over the last twelve months, with zero selling. According to the above chart, buys occurred in 2023, but the management was awarded stocks in 2024 as well. The absence of insider selling is bullish and indicates that the management considers the stock is too cheap to sell.

Valuation update

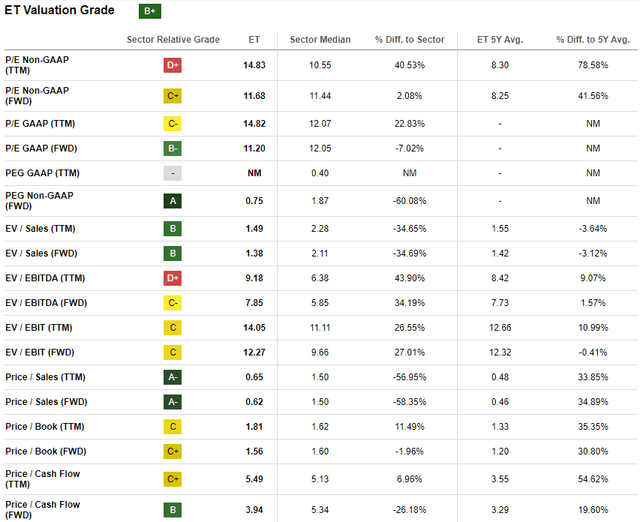

The stock rallied by 25% over the last twelve months, the performance is almost identical with the broader U.S. market. YTD performance is also very strong with an 18% rally. ET has a solid “B+” valuation grade from Seeking Alpha Quant as most of the ratios look attractive compared to the sector median and historical averages.

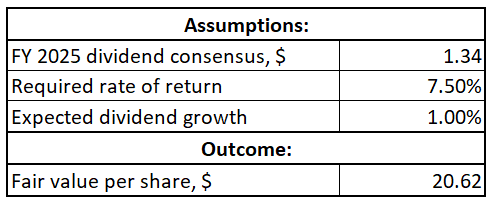

To figure out the fair share price, I must update my dividend discount model [DDM] simulation. I use a 7.5% required rate of return also aligns with the cost of equity range suggested by valueinvesting.io. Since I am figuring out the target price for the next 12 months, I also use FY 2025 dividend consensus estimate this time, which is $1.34. I am still conservative about the long-term dividend growth rate, so I reiterate a 1% CAGR.

Author’s calculations

According to my DDM simulation, the fair value of the stock is around $20.6. This represents a 27% upside potential, which looks very attractive in my opinion. The valuation looks especially compelling if we recall that ET offers a massive 7.8% distribution yield.

Risks update

As the whole developed world is investing vast amounts in clean energy, we can say that the oil and gas industry is in a secular decline. While it is impossible to imagine our world as 100% carbon-free, it is also difficult to expect sudden rapid leaps in volumes for energy midstream. Therefore, rapid growth in ET share price is quite unlikely. Since we see that technological giants are currently driving the new AI revolution and some companies’ revenues and profits are soaring, it is highly likely that shares from legacy industries will lag behind in terms of share price growth.

As an energy midstream company, Energy Transfer’s operations’ effect on the environment is under thorough scrutiny. The company might face environmental fines and charges, which is likely to result in unplanned expenses. Apart from the potential adverse effect on the company’s P&L, violating environmental regulation will also highly likely undermine the company’s reputation. Reputation loss might lead to the stock sell-off, which will pressure the share price down.

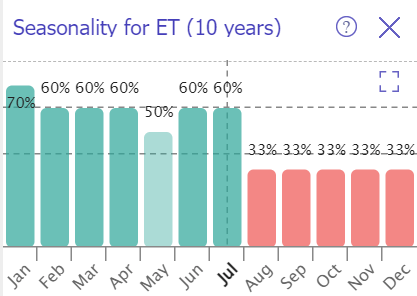

TrendSpider

The stock’s seasonality analysis for the last ten years suggests that we will enter ET’s historically weakest season in August, which will last over the year-end. Past performance is not a guarantee that it will repeat again in future, but I have to warn my readers about this warning historical seasonality trend.

Bottom line

To conclude, ET is still a “Strong Buy”. Revenue continues growing and the profitability profile keeps improving as well. The balance sheet positions ET well to fuel business expansion while maintaining its attractive dividend yield. Industry and political developments are quite positive for ET investors as well. Last but not least, the valuation is still very attractive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.