Summary:

- Energy Transfer LP’s robust fee-based model and diversified pipeline network support strong earnings visibility and growth.

- ET has continued outperforming its energy sector peers over time, corroborating the market’s optimism.

- Energy Transfer has several growth drivers underpinning its volume growth prospects, including in AI.

- ET’s attractive distribution yield should appeal to income investors looking to reallocate to a high-quality energy infrastructure play.

- I explain why ET seems ready to recover from its recent underperformance, bolstered by its reasonable valuations.

spooh

Energy Transfer: Solid Fee-Based Model Lends Clarity In Its Earnings

Energy Transfer LP (NYSE:ET) and its energy infrastructure peers have continued to outperform the energy sector (XLE), given their less cyclical business profile and robust volumes across their critical business segments. In my previous bullish ET article, I urged investors to capitalize on its consolidation and add more aggressively. I highlighted the Energy Transfer’s solid positioning in benefiting from the AI upcycle, attributed to its vast natural gas pipeline footprint. Hence, I assessed that ET unitholders should closely monitor the developments underpinning the AI growth inflection, as they could impact ET’s buying momentum.

ET’s continued outperformance (relative to sector peers) underscores the robustness of its business model. Investors are likely aware its business model is mainly predicated on long-term fee-based earnings visibility (90% fee-based, 10% commodity, and spread exposure). Underlying crude oil futures (CL1:COM) (CO1:COM) have experienced recent volatility attributed to the strength of the global economy, China’s stimulus, and the intensified Middle East (Israel-Iran) headwinds. Despite that, the futures remain far below their April 2024 highs, highlighting the underlying challenges in demand/supply dynamics. Therefore, ET’s relative strength has corroborated the market’s optimism on its growth profile, even as it raised its CapEx outlook for 2024 in its Q2 earnings.

Energy Transfer Has Several Growth Drivers Supporting Optimism

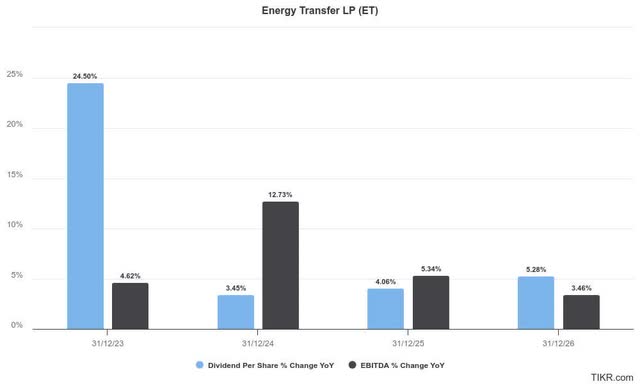

Energy Transfer estimates (TIKR)

Energy Transfer is scheduled to report its Q3 earnings on November 6. Given the strength in ET’s buying sentiments (“B” range momentum grade over the past six months), investors are likely anticipating another solid release by ET. Accordingly, the LP expects to report a midpoint adjusted EBITDA of $15.4B (about 12% YoY growth) for FY2024. Wall Street’s estimates are slightly ahead, raising the bar for management, but not too much. It should also continue to support management’s confidence in its 3% to 5% annual distribution target, as seen above. Therefore, I assess the market as increasingly confident in the clarity of Energy Transfer’s cash flow and distribution payouts over the next two FYs.

In my previous update, I discussed the robust data center AI growth drivers as critical to sustaining ET’s growth prospects. Additionally, investors should consider ET’s ongoing investments in export and infrastructure developments to drive increased volume growth through 2025. Coupled with the capacity upgrade in its processing facility, it should continue to drive strong utilization of its assets.

In addition, its well-diversified pipeline network bolsters access to the resurgence in natural gas demand, supporting power generation assets. Therefore, a re-rating underpinned by stronger-than-anticipated growth prospects in AI infrastructure investments could drive further upside for ET unitholders. Coupled with the LP’s confidence in improved operating leverage, income investors will likely provide more robust valuation support, aligned with the Fed’s more dovish outlook through 2025.

ET Units: Still Relatively Attractive

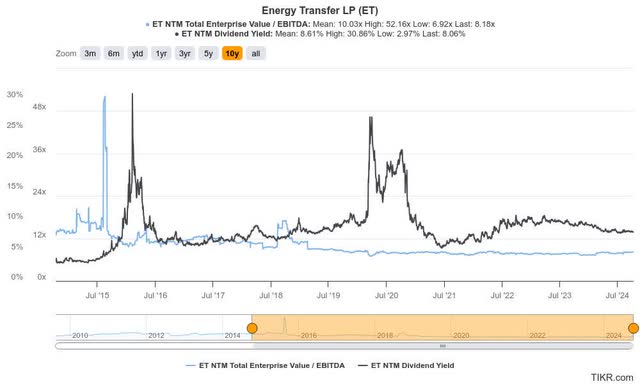

Furthermore, ET’s forward adjusted EBITDA multiple of 8.2x is still markedly below its 10Y average of 10x. The market’s pessimism is justified, as investors must reflect on long-term structural risks as the energy transition thesis continues in earnest.

Despite that, ET boasts a best-in-class “A” profitability grade, suggesting it deserves to trade at a relative premium. However, based on its industry peer median of 9.7x suggests, ET trades at a relative discount. Therefore, I assess that the market still seems too pessimistic about its growth prospects, even as it raises its bullish proposition through its natural gas exposure to the AI upcycle.

Are ET Units A Buy, Sell, Or Hold?

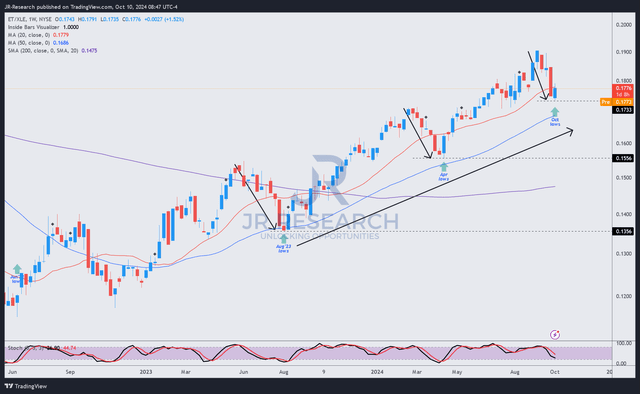

ET/XLE price chart (weekly, medium-term, adjusted for distributions) (TradingView)

ET has underperformed XLE over the past few weeks, although ET/XLE remains firmly in a medium-term uptrend. Past pullbacks that led to sustained bottoms in August 2023 and April 2024 were decisively defended by dip buyers. Hence, I’ve not assessed significant risks from its recent underperformance, suggesting it could be susceptible to an unforeseen trend reversal.

I’ve assessed ET’s distribution yield of more than 8% as appealing to income investors rotating from cash as the Fed potentially reduces interest rates through 2025. In addition, solid volume growth underpinned by increased CapEx spending should bolster its earnings and cash flow profile.

Notwithstanding my optimism, Energy Transfer isn’t immune to macroeconomic headwinds that could affect its volume growth opportunities. However, that isn’t my base case for now, although the market will likely reflect these uncertainties. Also, AI overinvestment risks must be considered by ET investors looking to capitalize on the AI growth inflection prospects, even as AI training and inferencing opportunities could surge.

In addition, a more robust transition to renewable energy (particularly solar energy) as interest rates potentially decline further could also limit future growth prospects. A looming oversupply in natural gas could also limit valuation re-rating prospects, suggesting investors must continue paying close attention to the developments. While ET’s cash flows are largely fee-based, investors must not understate the cyclical volatility in underlying energy prices.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!