Summary:

- Energy Transfer LP, a major energy transporter, has significant growth potential driven by strong performance, strategic acquisitions, and a healthy balance sheet, making it a “Buy” ahead of Q3 earnings.

- The company’s adjusted EBITDA rose to $3.76 billion, supported by record pipeline volumes and exports, with distributable cash flow reaching $2 billion.

- Despite market skepticism about traditional energy, Energy Transfer’s undervaluation and high distribution yield present a lucrative investment opportunity, with a fair value target of ~$21.7 per unit.

- The supplies of petroleum products have reached a five-year high, and the integration of recently acquired assets is expected to yield cost savings, making it likely that ET will beat.

- Based on all that, ET seems to be a “Buy” ahead of its upcoming Q3 earnings.

Andy Andrews/DigitalVision via Getty Images

Introduction

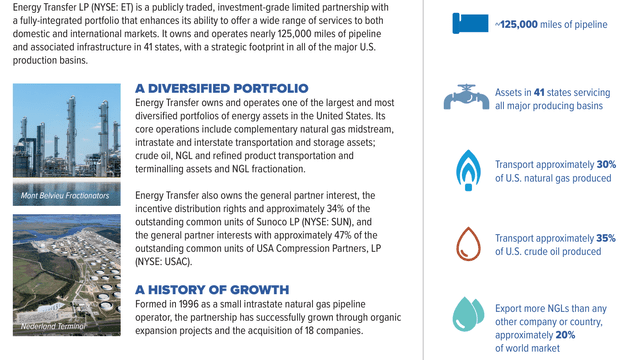

Energy Transfer LP (NYSE:ET) is one of the biggest energy transporter companies in the US and is predominantly involved in transporting and holding natural gas, crude oil, and refined fuels. The firm maintains a vast network of pipelines and terminals throughout the country, which help transport energy resources from sources to consumers. Based on recent data, Energy Transfer’s revenue stood at $83.6 billion on a TTM (with a net income per common unit of ~$0.35). It has also been pursuing acquisitions, including the recently completed acquisition of WTG in July 2024, which helped it grow its bottom line quite meaningfully.

As of important note, Energy Transfer operates as an MLP that combines the tax advantages of a partnership with the marketability of publicly traded securities. In this arrangement, the shares are called “units,” and the holders of those units are called “unitholders.” As a limited partnership, Energy Transfer uses common units that represent limited partner interests to offer unitholders a percentage interest in the partnership and limited liability. So taxation of ET LP common units is pass-through, meaning the partnership doesn’t pay federal income taxes. Instead, these profits, deductions, and credits are distributed to the unitholders, who report these in their personal tax returns on a Schedule K-1 form.

My Thesis

In my opinion, the ET units, which have grown by ~25% over the past year in nominal terms, still have significant growth potential. I believe that in the foreseeable future, these units can keep rising further, driven by the business’ strong performance: I expect ET to easily surpass the current pessimistic consensus forecasts. ET seems to be a “Buy” ahead of its upcoming Q3 earnings (set to be published after market close on November 6, 2024).

My Reasoning

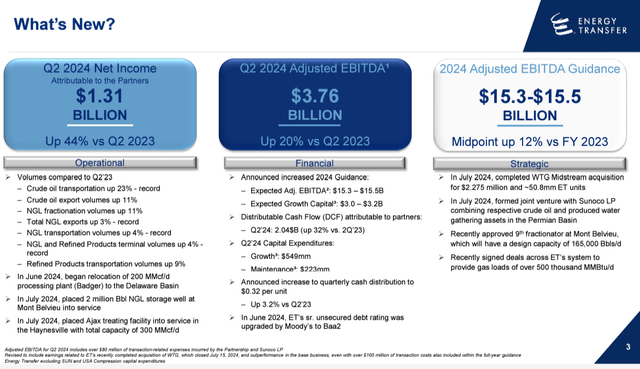

In Q2 2024 we saw an adjusted EBITDA of $3.76 billion, up from $3.12 billion in the previous quarter of 2023 – this increase was supported by more than $80 million in transaction expenses, which I find indicative of high-quality fundamental business performance. The increase in EBITDA was driven by record crude oil and NGL pipeline volumes and record NGL exports. As a result, ET’s distributable cash flow (aka DCF) stood at $2 billion, up from $1.6 billion the year prior.

Particularly striking among ET’s segments was the NGL and refined products segment, where adjusted EBITDA rose from $837 million in the second quarter of 2023 to $1.07 billion. This expansion was supported by “higher transportation, fractionation, and terminal volumes, including records in the Mariner East and Permian Pipeline networks,” according to the press release. The Midstream business unit also expanded adjusted EBITDA to $693 million from $579 million, primarily due to the acquisition of Crestwood assets and higher volumes in the Permian Basin. The Crude Oil business delivered adjusted EBITDA of $801 million compared with $674 million, driven by “higher transportation throughput and exports and the sale of Lotus and Crestwood assets.”

In my opinion, ET’s acquisition of WTG in July 2024 further cemented the firm’s presence in the Permian Basin and opened up new natural gas and NGL volumes. The acquisition is expected to expand Energy Transfer’s downstream businesses and support future expansion. WTG assets are being incorporated, and the firm looks forward to the synergies and growth that this acquisition will offer. Additionally, Energy Transfer’s partnership with Sunoco LP (SUN) in the Permian Basin should allow for further market and service growth, underscoring the ET’s focus on leveraging partnerships to support growth. Another project – the Lone Star Express expansion (expected to start operation by 2026) – will take NGL’s transportation capacity from the Permian Basin to more than 1 million barrels per day, according to the CEO. The firm also announced the commissioning of its 9th fractionator at Mont Belvieu, increasing the total fractionation capacity to over 1.3 million barrels per day by Q4 2026.

As I see it, Energy Transfer has a healthy balance sheet and Moody’s upgraded its senior secured rating to Baa2 in June 2024. The company has paid off more than $3 billion in debt since 2020 and reached the lower end of its 4.0-4.5x goal for leverage.

Recently, many analysts have held the popular opinion that oil has taken a back seat to the development of renewable energy sources. In many respects, this is indeed true. If we examine the latest data from UBS (proprietary source), we find that global investments in traditional energy sources are more than three times less than those directed toward the energy transition (wind turbines, solar energy, and other renewable technologies):

UBS [proprietary source], October 2024![UBS [proprietary source], October 2024](https://static.seekingalpha.com/uploads/2024/11/4/53838465-17307373861168509.png)

In my opinion, however, this skepticism creates market opportunities for investors. Oil and gas companies are not going anywhere; they will remain an integral part of the energy landscape for years to come. The existing infrastructure for these traditional energy sources doesn’t require the same level of investment as renewables. Moreover, a significant part of the energy users still rely on traditional sources, which are often more efficient and simpler than renewables. The growing skepticism about the energy transition means that many companies in the oil and gas industry aren’t too expensive for investors – this is logical, as, without the expectation of strong business growth, investors are less inclined to pay a premium for an investment instrument, focusing instead on its profitability and distribution potential.

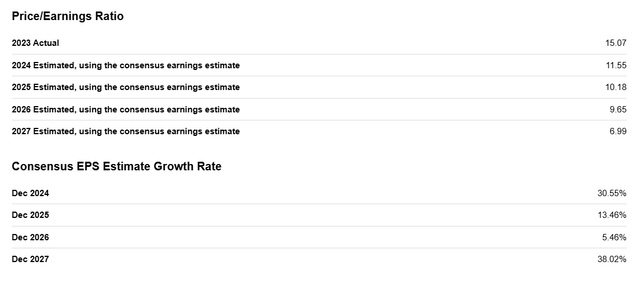

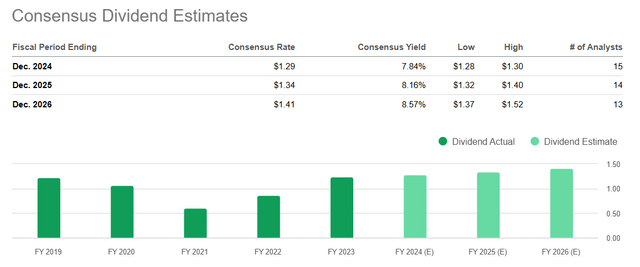

Energy Transfer serves as a striking example in this context. If we examine its price-to-earnings ratio for 2025, which stands at only 11.6x, we can see a clear case of undervaluation. Despite this low multiple, Wall Street analysts still predict that the company’s distribution yield will exceed 8% in 2025 (based on consensus data). In my opinion, this represents a significant discount, highlighting the potential for investors to capitalize on the market’s underestimation of Energy Transfer’s value.

Seeking Alpha, ET Seeking Alpha, ET

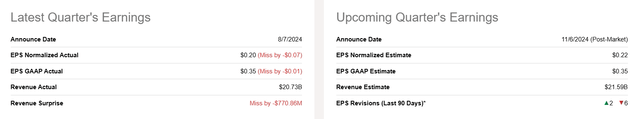

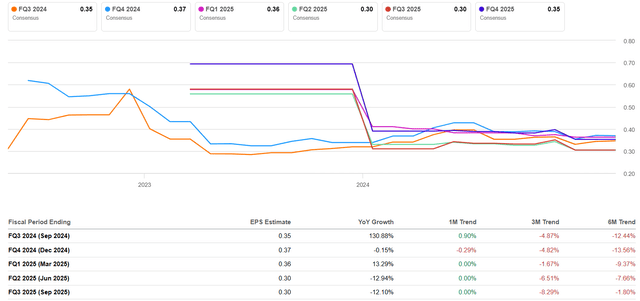

I believe that the existing discount in Energy Transfer’s valuation persists because the company continues to increase its EPS massively (even outpacing its nominal stock price growth). This valuation discount acts as a buffer, preventing the stock from declining even when the company reports weaker results, such as in Q2 2024 when Energy Transfer significantly missed consensus expectations.

Despite that miss, ET units’ price didn’t decrease; instead, it began to rise. Meanwhile, analysts from the Street have become more pessimistic about the upcoming third-quarter results, which are due to be published in the coming days (we see 6 out of 8 analysts downgrading their estimates).

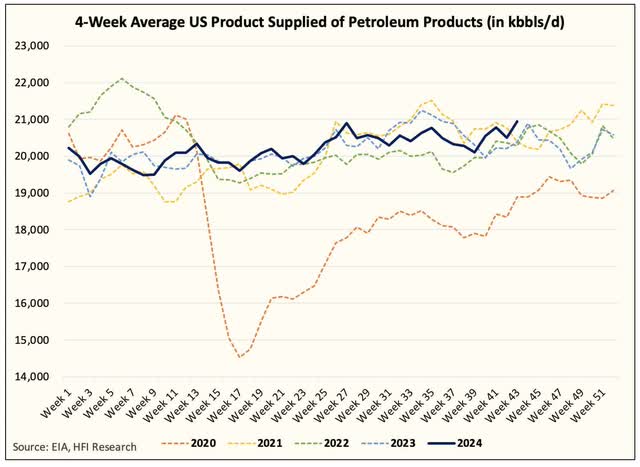

Perhaps the lowering of estimates was justified given the recent volatility in the oil market and uncertainty over Energy Transfer’s ability to maintain its margins and volumes. However, data released just a few days ago on the supply of petroleum products in the US suggests that the situation isn’t as dire as it might seem. While the production figures may be disappointing, demand for petroleum products is currently the highest it has been in 5 years when seasonality is considered.

So I believe this strong demand could provide Energy Transfer with a buffer that could offset some challenges caused by market volatility.

Last quarter the company raised its FY2024 adjusted EBITDA forecast to $15.3-15.5 billion based on the value-add WTG acquisition and strong base business performance, so the analysts’ estimates reductions don’t match here as well. ET’s management anticipates future demand for their products and services, domestically and globally, on the back of optimization and expansion initiatives. Some analysts cite the company’s broad asset base and strategic growth plans as key business drivers. The benefits from the rising demand for natural gas, especially data centers and power generation are anticipated to drive Energy Transfer’s growth path in the coming quarters. So, in terms of prospective business expansions, I don’t see a serious problem for ET.

Energy Transfer expects its 2024 growth capital spending to be ~$3.1 billion in the NGL and refined products and Midstream business. The company has also dedicated up to $1.5 billion to unit buybacks per year, with $880 million on its buyback authorization as of mid-2024. This allocation model reflects Energy Transfer’s dedication to delivering value back to unitholders while investing in growth, so its valuation discount is unlikely to be sustained. In my opinion, the ET units should be repriced to at least 13-14x in terms of P/E ratio by the end of 2025. This would bring the fair value per unit to ~$21.7, which is over 31% higher than the unit price I see on screen today.

While my price target is certainly worth arguing about, I find it interesting that the Morningstar analysts’ valuation modeling (proprietary source, September 2024) supports my price target, even though it was derived in an entirely different way:

We are maintaining our $21 fair value estimate.

We expect $15.4 billion of consolidated EBITDA in 2024, in line with management’s guidance. This incorporates growth investments related to the Enable deal; acquisitions of WTG, Lotus, Crestwood; NuStar (via Sunoco) contributions; and numerous short-cycle projects. Our fair value estimate implies 8 times EV/EBITDA and a 6% distribution yield for 2024.

So, based on all the data discussed above, I conclude that ET deserves a “Buy” rating right before its Q3 release on November 6th.

Risks To My Thesis

One threat is the volatile nature of oil and gas prices that can negatively impact Energy Transfer’s margins and volumes. Despite being resilient to market volatility, continued uncertainty on the O&G market may weigh on ET’s earnings, particularly if oil prices drop or supply chains are disrupted. Additionally, although demand for petroleum products remains strong, a change in global economic or energy policies may change demand and potentially impact the revenue and profitability of Energy Transfer.

A second danger comes from regulatory and environmental issues. Energy Transfer operates in a highly regulatory, environmentally challenged industry. Any regulatory changes, such as increased emission limits or renewable energy policies, could raise the cost of operations or reduce the potential for expansion. The company’s involvement in the Dakota Access Pipeline has already faced legal challenges, and it might find its next project facing similar challenges. These regulatory risks may hinder Energy Transfer’s ability to execute its growth plan and realize the expected synergies of these new acquisitions.

Lastly, although Energy Transfer’s balance sheet is healthy and the credit ratings are upgraded, aggressive investment plans and acquisition-based financing threaten to put Energy Transfer in debt. Acquisitions like WTG and Crestwood need to be able to fit into each other in a way that will yield value. If these acquisitions fail to go off smoothly or the anticipated synergies don’t occur, this could put the firm under pressure and impact its profitability.

The Bottom Line

Despite the above risks, I stand by my thesis that the current undervaluation of the Energy Transfer units serves as a form of protection in case the company fails to beat its Q3 2024 consensus. However, I think it is very likely that ET will actually exceed expectations. Analysts have significantly lowered their estimates after the company failed to meet expectations for Q2 – this lowering has been quite pronounced and widespread over the last 3-6 months. Meanwhile, recent statistics indicate that nationwide supplies of petroleum products are increasing and have reached a five-year-high. In addition, the integration of the recently acquired assets into Energy Transfer’s ecosystem is expected to result in operational cost savings and therefore improved margins. And it seems that even a modest improvement in margins could enable the firm to significantly exceed third-quarter forecasts. That’s what I expect and hope to see on November 6, after the market closes.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ET over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.