Summary:

- Energy Transfer LP is a “Strong Buy” due to its robust financials, strategic acquisitions, and undervaluation, offering significant growth and income potential.

- The company’s Q2 FY2024 results showed strong adjusted EBITDA growth, driven by record pipeline volumes and strategic asset optimization.

- Energy Transfer’s expansion into AI and data center markets presents a new revenue stream, leveraging its extensive natural gas infrastructure.

- My calculations suggest an undervaluation of 49.8% for the next 2 years. And that’s without the dividend payouts.

- Despite risks like integration challenges and market volatility, ET’s strategic initiatives and undervaluation make it an attractive investment for growth and stability.

imaginima

Intro & Thesis

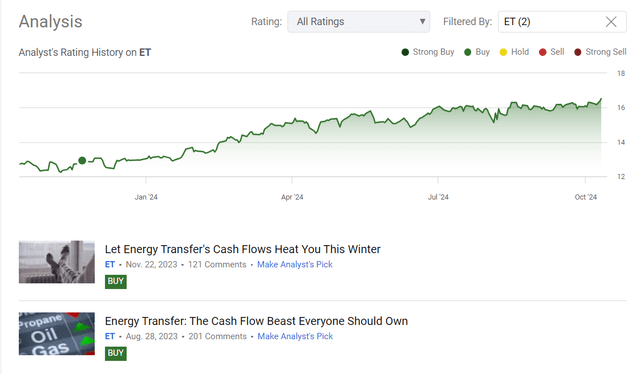

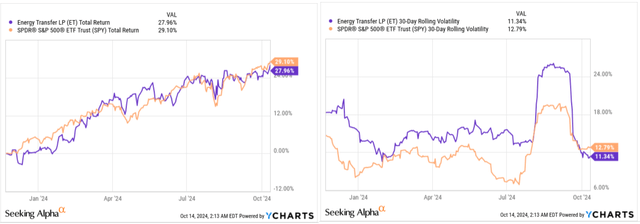

I initiated coverage of Energy Transfer LP Common Units (NYSE:ET) in August 2023 with a “Buy” rating, which I reaffirmed in November 2023, and I haven’t updated my coverage since. Overall, I’m pleased with how my bullish call has performed over the past year: Despite having lower volatility than the broader S&P 500 index (SP500) (SPX), Energy Transfer units have total delivered returns roughly in line with the index. This is impressive, considering the company is not a tech giant or a chip manufacturer but is solely focused on transporting hydrocarbons, operating one of the largest pipeline networks across the United States.

Seeking Alpha, the author’s coverage of ET

YCharts data

Although Energy Transfer didn’t surpass analysts’ consensus forecasts in the last quarter, I believe ET’s growth potential will only increase in the future: Interestingly, beyond the fundamental needs for energy consumption, the new wave of AI should, in my opinion, provide an additional boost to volumes and, consequently, the firm’s profitability. ET is still a “Buy” today.

Why Do I Think So?

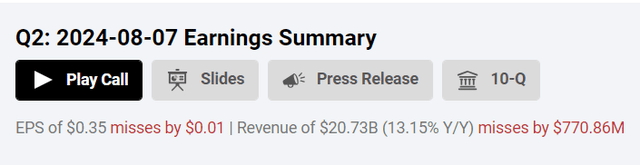

ET’s Q2 FY2024 (released on August 7, 2024) actually showed quite strong financials and growth plans, despite missing on both the top and bottom lines slightly:

Seeking Alpha, ET

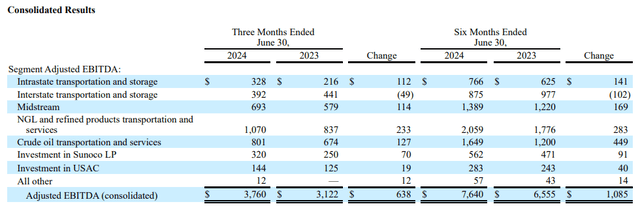

The firm posted an adjusted EBITDA of $3.76 billion, up significantly from $3.12 billion during the same quarter of 2023. This amount excludes transaction expenses of >$80 million, without which the adjusted EBITDA would have topped $3.8 billion. That growth was fueled by record crude oil and NGL pipeline volumes and record NGL exports, according to the press release’s notes.

The distributable cash flow (DCF) attributable to partners of the company was $2 billion compared to $1.6 billion in the second quarter of 2023, driven by the company’s enhanced cash-generation base with strong performance across its NGL fractionators and refined products pipelines and terminals. As far as I see it, Energy Transfer’s proactive strategy of optimizing its asset base and reducing costs has enabled it to remain successful in the energy space.

Talking about particular segments, I’d like to note that the NGL and Refined Products segments were clear outperformers with adjusted EBITDA of $1.07 billion compared to $837 million a year ago. This was driven by growth in transportation, fractionation, and terminal activities with record Mariner East and Permian Pipeline volumes as well as higher revenue from optimization of hedged NGL inventory. In the Midstream, adjusted EBITDA also rose to $693 million due to acquisitions of Crestwood assets and higher volumes in the Permian Basin. In Crude Oil, Adjusted EBITDA was $801 million versus $674 million last year thanks to “record crude oil transportation throughput and 11% increase in crude oil total exports on the back of Lotus and Crestwood acquisitions.” Including these acquisitions, segment adjusted EBITDA increased by 4% and crude oil transportation volumes increased by 8% compared to base business. Energy Transfer’s Interstate business saw a reduction in adjusted EBITDA, down to $392 million from $441 million last year, due to “lower operating gas sales and project maintenance expense.” However, the Intrastate segment enjoyed a strong gain in adjusted EBITDA to $328 million due to “pipeline efficiency and favorable storage optimization.”

ET’s 10-Q

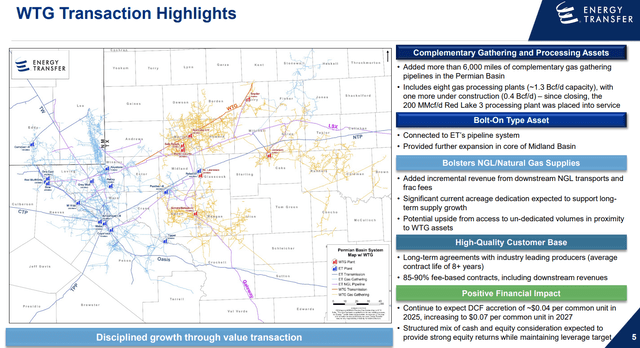

As we know, Energy Transfer acquired WTG in July 2024 thereby increasing access to natural gas and NGL volumes and improving its Permian capability. These assets are being combined, and the management hopes that this space can be developed quite shortly. With the addition of >6,000 miles of gas gathering pipelines and 8 gas processing facilities, Energy Transfer can actually double the amount of gas it processes, according to the IR materials. The deal also adds to Energy Transfer’s NGL and natural gas resources, with new revenue from downstream NGL transports and frac fees. Talking about numbers, this acquisition is expected to bring a DCF accretion of ~$0.04 per common unit in FY2025, which will likely increase to $0.07 per common unit in FY2027. With term agreements of an average of 8 years and 85-90% fee-based contracts, I believe investors can anticipate predictable revenue streams as this move expands not only Energy Transfer’s portfolio but also consolidates its balance sheet and position the company as an attractive proposition for growth-and-stability-oriented investors.

ET’s IR materials

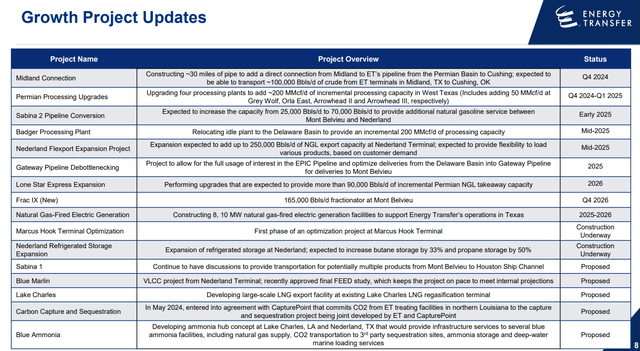

In addition to that, Energy Transfer is going to invest in growth initiatives such as Nederland and Marcus Hook export terminal expansions, Lone Star Express expansion, and Mont Belvieu’s new fractionator. They’re also looking into power generation investments, including the construction of natural gas-fired electric generation stations, to help sustain its operations in Texas. These plants will increase system reliability and serve an ever-increasing electricity need. So I think Energy Transfer’s extensive natural gas pipeline infrastructure positions it well to take advantage of the predicted increase in natural gas demand.

ET’s IR materials

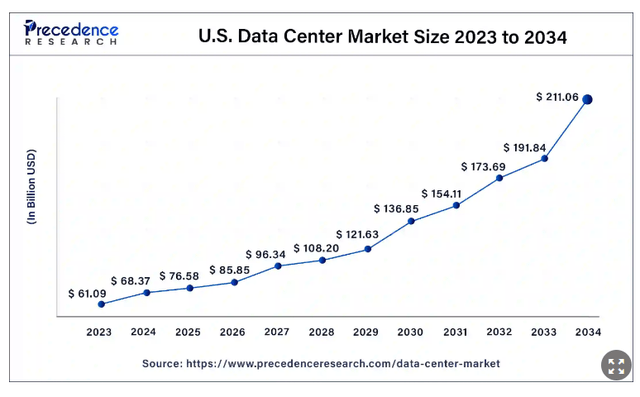

One of my theses today is the opportunity for Energy Transfer to monetize the hype around artificial intelligence. Since data centers need constant and reliable power to reduce the intermittency of solar and wind generation, natural gas provides a valuable backup source. This is where Energy Transfer has a great advantage with its wide network, having the ability to respond to the rising need for consistent power for data centers through its natural gas infrastructure. ET’s vast footprint, currently available to gas-fired power plants in 15 states, places it well positioned to service this demand. As Morningstar’s analyst Stephen Ellis noted recently (proprietary source), ET is also in negotiations with multiple data centers in 5 states to offer on-site generation services – that fits the overall picture of electricity consumption, particularly in Texas where officials expect to add 30,000 or 40,000 megawatts each year over the next six or eight years.

So again – The combination of AI & data center requirements offers a new, significant opportunity for Energy Transfer. With its proven infrastructure and natural gas knowledge, the company can provide tailored solutions that enhance grid resilience and the growing data center market, which is projected to grow by 12% annually for the next decade in the U.S.

Precedence data

Also, I think this end-market’s growth prospects and ET’s engagement in monetizing this opportunity should further diversify Energy Transfer’s revenue streams and ensure that it remains competitive within the burgeoning energy market.

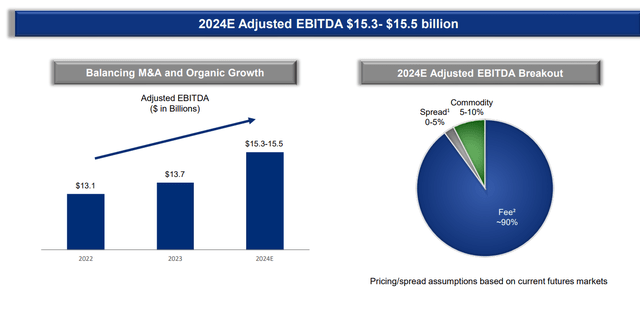

Anyway, Energy Transfer has increased its 2024 adjusted EBITDA guidance to $15.3-$15.5 billion based on the WTG acquisition and base business outperformance. The company remains focused on maximizing organic growth with a combination of downgrading leverage and improving the return on equity for unit holders. The recent Moody’s upgrading of its senior unsecured credit rating to Baa2 further validates the strength of the firm’s balance sheet and strong financial position.

ET’s IR materials

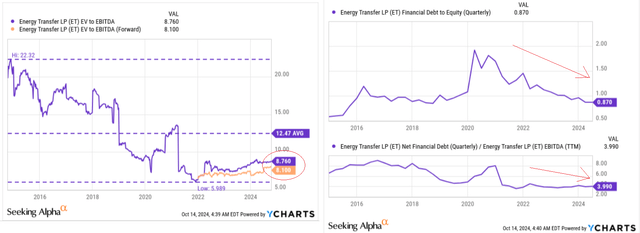

In my opinion, the company can’t be considered expensive based on valuation multiples. If we examine the current and historical data, we see that the market expects the EV/EBITDA multiple to decrease by 7.5% next year, while the current level is 29.75% below the long-term ten-year average. Additionally, as evidenced by recent trends, the leverage on the ET’s balance sheet has been decreasing significantly since 2020, with net debt relative to EBITDA declining and the debt-to-equity ratio below 1, which generally supports management’s assertion that the balance sheet is relatively strong at the moment.

YCharts, the author’s notes

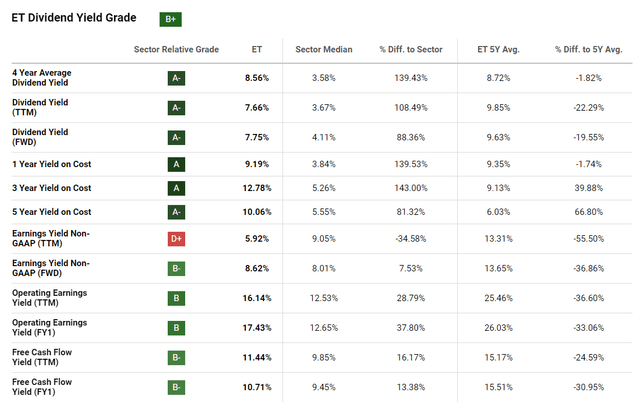

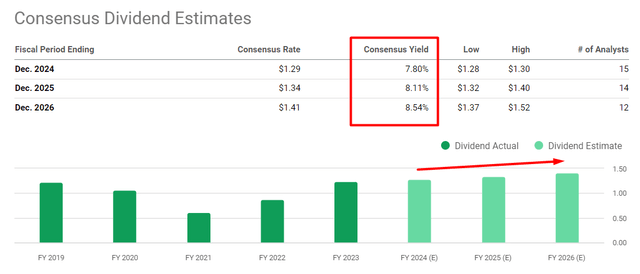

From a dividend yield perspective, the company is very appealing to investors seeking income. The consensus forecast for FY2024 predicts a dividend yield of approximately 7.80%. If the current unit price remains unchanged, this yield could increase to 8.54%. Given the likelihood of continued easing of the Fed’s monetary policy, the current dividend yield is expected to become even more attractive to investors – at least, that’s what financial theory suggests.

Seeking Alpha, ET

Seeking Alpha, notes added

Assuming that next year the EV/EBITDA ratio remains around 8.76x and analysts’ current EBITDA forecast of $16.27 billion proves accurate, the company’s enterprise value should be ~$142.5 billion. After adjusting for the company’s net debt of $50.78 billion, the estimated market cap would be $84.74 billion – this suggests an undervaluation of 49.8% for the next 2 years. And that’s without the dividend payouts that income-seeking investors will receive while they wait for the nominal price increase.

Based on all that, I expect that Energy Transfer is going to keep rising in the medium term. Given the undervaluation, I think it’s fair to assign a “Strong Buy” rating today.

Where Can I Be Wrong?

There are a lot of risks investors should be aware of before buying ET units today.

For example, Energy Transfer’s new acquisitions of WTG and Crestwood present growth potential – of course – but they also carry integration risks. Integration of these assets is essential to deliver synergies and business value. If this goes poorly, it will cause inefficiencies and may be detrimental to the financial health of the firm. Additionally, the extra capital investment of $3.1 billion could drain resources if expected returns are not achieved.

Also, the profitability of Energy Transfer depends on the energy markets: While the pipeline has hit new highs, commodity prices and demand volatility may impact revenues and margins. Since energy is cyclical, any drop in throughput may bring lower rates and charges. Not only that, but the future of ET’s operations and expansion may be at stake due to regulatory shifts and a move toward renewable energy.

In addition, I should note that the AI and data center promise is clouded. It’s very important that Energy Transfer is able to secure long-term contracts and remain competitive. Negotiations with data centers must still be completed to lock in the revenues expected; at the same time, increasing electricity demand, especially in Texas, might not catch up fast enough for ET to take advantage of this potential.

Another risk is my valuation assumptions. If the multiple contraction continues, we could see a noticeable fall in the unit price instead of the rise described above.

The Bottom Line

Despite the significant risks mentioned, I believe the company keeps delivering strong results, significantly expanding its infrastructure through new acquisitions. I think the management’s strategic steps should lead to growth and efficient cash distribution, even though debt might increase slightly from here.

Additionally, there’s an opportunity arising from the expansion of artificial intelligence, as the enormous computing power required demands substantial energy consumption. Energy Transfer could be a key player in supporting tech companies’ development in this area. At the same time, based on my calculation, Energy Transfer’s business remains undervalued: Even without its impressive dividend yield, the nominal price of ET units is still too low. Therefore, I assign a “Strong Buy” rating today.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ET over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!