Summary:

- Energy Transfer has outperformed the S&P 500 since my last ‘Buy’ upgrade on the security. However, I am now downgrading my stance to a ‘Neutral/Hold’:

- Operating performance continues to be stable and healthy, especially in the crude oil pipelines business.

- ET’s acquisition of WTG Midstream is at a good price, and I am optimistic about management’s ability to make more reasonable midstream M&A deals.

- Valuation discounts have shrunk since my last update in January 2024; today, Energy Transfer trades closer to its long-term median valuation multiples.

- Relative technical analysis vs the S&P 500 suggests increased chances of sideways movement followed by a breakdown.

KittisakJirasittichai

Performance Assessment

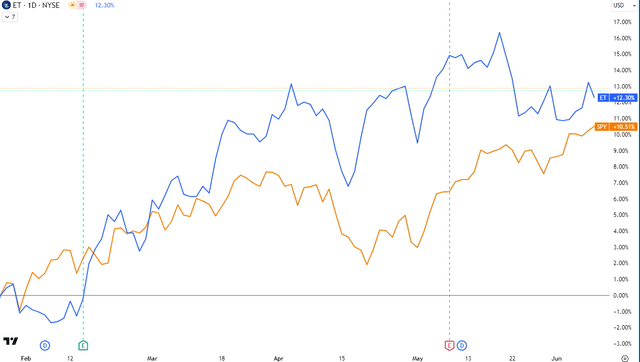

In my last article on Energy Transfer (NYSE:ET), I had a bullish outlook with an initial ‘Neutral/Hold’ rating, which soon got upgraded to a buy (see pinned comment in my last article) on 26 Jan 2024. Since then, ET has generated +12.30% vs the S&P 500’s (SPY) (SPX) +10.51%, outperforming the market index by +1.79%:

ET vs SPY Performance since my Buy Upgrade (TradingView)

Thesis

In this update, I am downgrading my stance back to a ‘Neutral/Hold’ based upon these considerations:

- Operating performance continues to be stable and healthy

- More midstream M&A is expected

- Valuation discounts have shrunk

- Relative technical analysis shows slowing progress by buyers

All of my analysis is focused on the operating performance of Energy Transfer; which comes before the claims of both preferred unitholders and equity unitholders. Hence, my analysis and conclusions are applicable to both the common units and the preferred units (NYSE:ET.PR.I).

Operating performance continues to be stable and healthy

ET’s EBITDA growth is healthy at 13% YoY as of the last quarter, which posted almost $3.9bn:

Total EBITDA (USD mn) (Company Filings, Author’s Analysis)

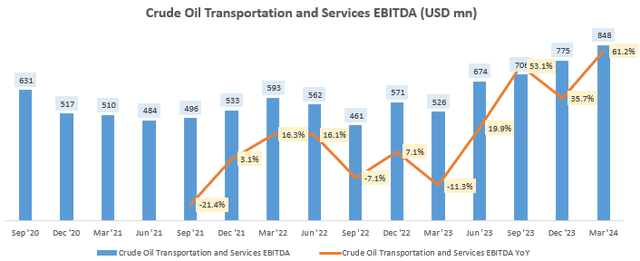

This double-digit EBITDA growth was driven partly by a strong show in the crude oil segment, which has seen a sharp uptick in growth over the past few quarters:

Crude Oil Transportation and Services EBITDA (USD mn) (Company Filings, Author’s Analysis)

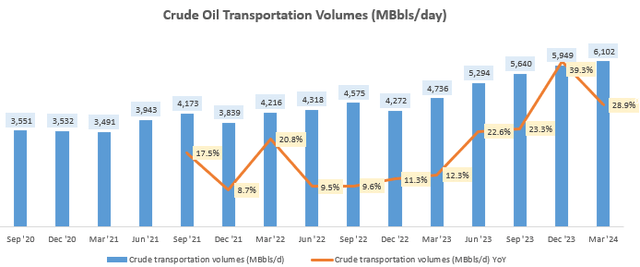

A key driver of this growth has been record high volumes through crude pipelines, leading to almost 30% YoY volumes growth in Q1 FY24:

Crude Oil Transportation Volumes (MBbls/day) (Company Filings, Author’s Analysis)

Now, these figures are impacted by recent acquisitions; namely Crestwood (which I discussed in more detail in my last update) and LOTUS Midstream. However, it is pleasing to note that even on an organic basis, EBITDA and volumes growth in this segment was strong:

Excluding the additions of Crestwood and LOTUS, adjusted EBITDA and crude oil transportation volumes on our base business increased 47% and 14%, respectively, compared to the first quarter of 2023.

Co-CEO Thomas Long in the Q1 FY24 earnings call

More midstream M&A is expected

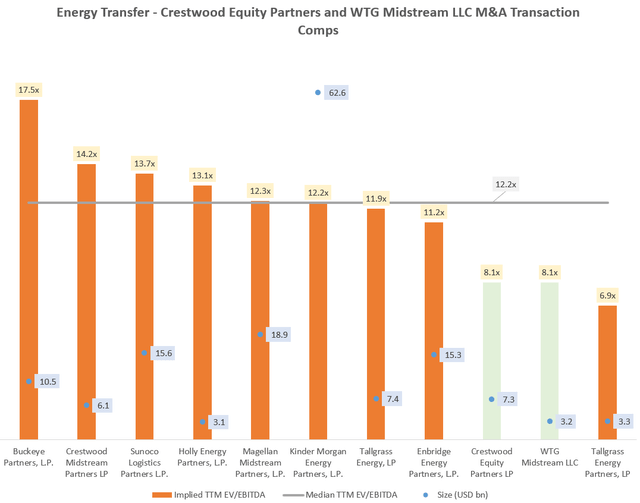

Energy Transfer is expanding its footprint in the natural gas pipelines via its acquisition of WTG Midstream for $3.25 billion. According to Bloomberg Intelligence analyst Talon Custer, this deal is expected to add ~$400 million to Energy Transfer’s annual EBITDA. Given this data point, I compute the implied transaction multiple to be 8.1x EV/EBITDA. This is the same valuation they paid for Crestwood Equity Partners. And a look at the sector M&A transaction comps reveals that these multiples are at a 34% discount to the median multiples of 12.2x, suggesting that management has made a good deal once again:

Energy Transfer M&A Transaction Comps (Capital IQ, Bloomberg, Author’s Analysis)

Energy Transfer has commented that the midstream sector is ripe for more M&A. Given the track record of reasonable M&A, and the fact that credit rating agency Fitch Ratings also views these transactions as a “positive bolt-on acquisition“, I am optimistic about management’s ability to continue making good asset purchases.

Valuation discounts have shrunk

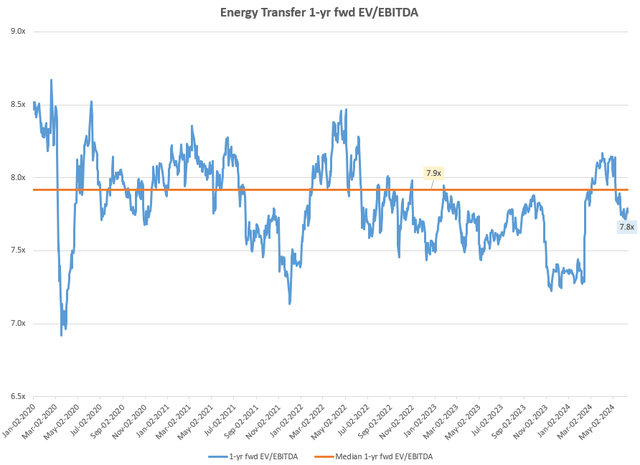

Energy Transfer 1-yr fwd EV/EBITDA (Capital IQ, Author’s Analysis)

Compared to early 2024, then the 1-yr fwd EV/EBITDA was less than 7.5x, the valuation multiple today is closer to the longer-term median of 7.9x. I believe this makes incremental buys relatively less attractive at this stage.

Relative technical analysis shows slowing progress by buyers

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. Also, please note that my charts always reflect total shareholder return as they are dividend-adjusted.

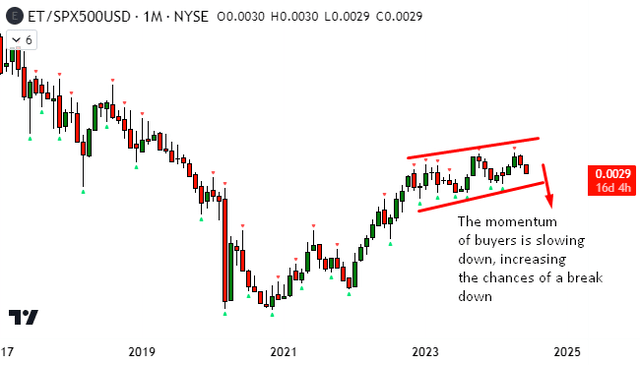

Relative Read of ET vs SPX500

ET vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

On the relative monthly chart of ET vs the S&P 500, I see the momentum of the buyers is slowing down. I believe this increases the chances of further sideways actions and subsequent break downward from the current channel. This would correspond to neutral to negative alpha in ET.

Key Monitorables to Turn Bullish

For me to turn incrementally bullish again, I would like to see a discount in the 1-yr fwd EBITDA multiples to below 7.5x, and potentially a strong buy reaction from the bottom of the trading channel. Fundamentals-wise, I am satisfied with the company’s performance. New M&A would not surprise me, unless they are at transaction multiples above the sectoral median levels since management has so far bought assets at a discount.

Takeaway

Energy Transfer has generated modest outperformance vs the S&P 500 since my last change in stance on the security. I am satisfied with its operating performance, as the numbers show this to be both stable and healthy in growth, particularly on the crude oil side. I believe its recent acquisition of WTG Midstream is a good move to further bolster earnings growth at a reasonable purchase price; a 34% discount to sectoral transaction multiples.

However, I am downgrading my stance from a ‘Buy’ to a ‘Neutral/Hold’ as the valuation multiples offer less of a discount now and the technicals vs the S&P 500 indicate a slowdown of buyer momentum.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis, with higher than usual confidence

Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P 500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to around a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.