Summary:

- Energy Transfer unitholders have continued outperforming the market since my last bullish update.

- ET remains attractively valued, even as it expands its volume growth opportunities.

- Energy Transfer’s 90% fee-based revenue model provides significant earnings and cash flow stability.

- Income investors should find ET’s forward distribution yield above 8% appealing.

- I explain why ET unitholders should continue letting their winners run longer.

bjdlzx

Energy Transfer Maintains Solid Volume Growth

Energy Transfer LP (NYSE:ET) unitholders are rocking it. Even though the underlying energy futures (CL1:COM) (CO1:COM) have suffered a pullback from their early April 2024 highs, ET’s price action has maintained its robust uptrend continuation.

As a result, ET has outperformed the S&P 500 (SPX) (SPY) on a total return basis since my previous bullish ET article in early March 2024. ET’s attractive “B” valuation relative to its energy sector (XLE) peers has underpinned ET’s bullish price action. Furthermore, Energy Transfer’s recent earnings scorecard bolstered investor confidence in its well-diversified portfolio in energy infrastructure.

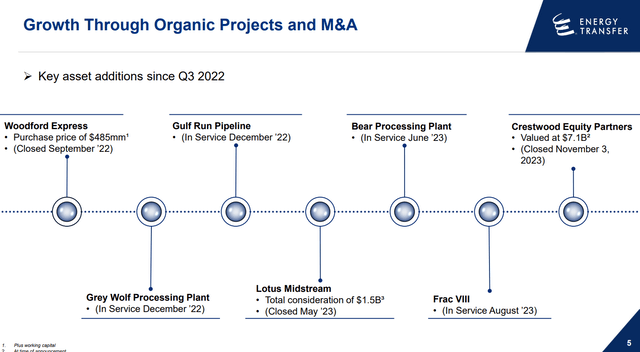

ET growth strategies (Energy Transfer filings)

Detractors might be concerned whether Energy Transfer has invested too aggressively in its organic and M&A growth opportunities, intensifying potential execution risks. Moreover, these investors could point out that Energy Transfer could be more vulnerable to unpredictable volatility swings in its revenue model, impacting its adjusted EBITDA and distributable cash flow generation.

However, Energy Transfer’s revenue model remains stable. Accordingly, fee-based revenue accounts for about 90% of its revenue base. As a result, commodity-linked and spread-based revenue comprises a low minority of its revenue trajectory, providing unitholders with significant earnings visibility.

As a result, I believe the bullish thesis on ET is justified, given the energy infrastructure leader’s ability to generate robust volume growth. Accordingly, Energy Transfer’s Q1 earnings release indicated broad-based growth across its critical segments. ET saw its crude oil transportation segment scoring a “new partnership record,” with volume increasing 44%. Crude oil terminal volumes also increased 10% YoY in Q1, accompanied by an 11% uptick in NGL fractionation volumes.

Energy Transfer Benefits From The AI Growth Spurt

Notably, Energy Transfer sees continued growth opportunities moving ahead, targeting the data center and AI demand. Energy Transfer emphasized its AI opportunities in its earnings conference, as the partnership “has been connecting its assets to power plants located within 10 miles of its intra-state pipelines.” As a result, Energy Transfer has confidence that it sets up ET well to benefit “from an expected 8 billion cubic feet per day of new data center demand by 2030.” Given ET’s infrastructure leadership in Texas, it is expected to position the partnership well “with Dallas emerging as a key data center hub.”

Furthermore, recent reports suggest that the surging energy demand requirements to power data centers require the participation of fossil fuel players. While the transition toward renewable energy in powering data centers remains the long-term strategy, the AI growth inflection behooves urgent solutions leveraging the current energy infrastructure. As a result, I assessed it reasonable to expect ET to benefit from these growth opportunities.

Moreover, Energy Transfer could also benefit from subsequent authorization if the Biden Administration decides to remove the moratorium imposed on LNG export approvals. As a result, ET management sees its Lake Charles LNG project as a viable long-term growth driver, bolstering its LNG opportunities outside of the US. In addition, a favorable regulatory response for ET’s Blue Marlin project could also lift its growth momentum. Management anticipates the commencement of commercial operation within two and a half to three years post-license approval.

Are ET Units A Buy, Sell, Or Hold?

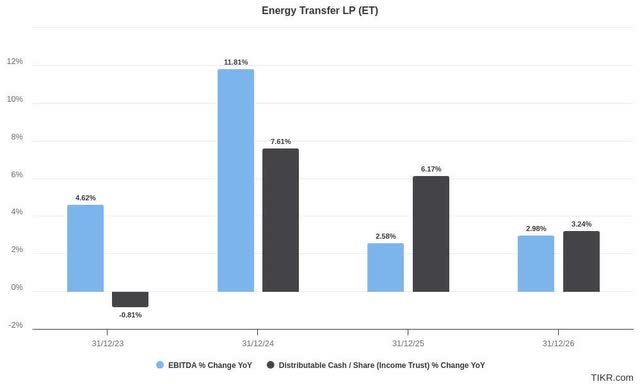

ET adjusted EBITDA and DCF per share growth estimates (TIKR)

As a result, it should continue to underpin Energy Transfer’s earnings and cash flow growth momentum after it laps the accretive inflection from its recent acquisitions.

In addition, income investors should find ET’s forward distribution yield of 8.2% attractive, given that interest rates have likely peaked. Underpinned by ET’s attractive valuation, I’m increasingly confident that ET’s medium-term volume growth opportunities should remain intact. Given ET’s well-diversified business model and its earnings stability, I currently view ET as one of the top energy infrastructure plays in the market for energy investors.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!