Summary:

- Energy Transfer’s stock has hit a 52-week high, up 30.2% from its lows, and remains undervalued with potential for additional upside.

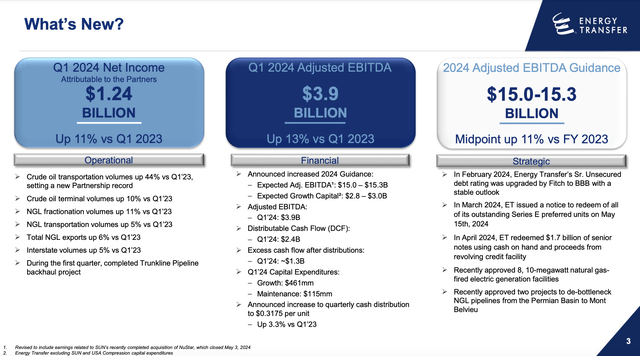

- The company’s first-quarter results showed a 13.9% increase in revenue and an 8.6% rise in net income compared to the previous year.

- Management’s updated guidance for the fiscal year 2024 suggests further growth, with EBITDA expected to increase and additional investments planned.

Travel Ink/DigitalVision via Getty Images

If you follow my work closely, there is a high chance that you know that one of my favorite companies on the market is none other than midstream/pipeline giant Energy Transfer (NYSE:ET). In fact, as of this writing, the company is my third-largest holding in my portfolio, accounting for 13.4% of said assets. Obviously, times have been pretty good for me when you consider that shares just hit a fresh 52-week high point. In fact, even though the stock has pulled back ever so slightly, shares are still up 30.2% compared to their 52-week lows.

This is just the beginning, however. While shares are up 8.9% since I last reiterated my ‘strong buy’ rating on the stock in February of this year, which beats out the 2.5% increase seen by the S&P 500, they are actually up 98.2%, inclusive of distributions, since I initially upgraded the stock from a ‘buy’ to a ‘strong buy’ in November of 2019. By comparison, the S&P 500 is up 68.9% over the same window of time. Clearly, the company has turned out to be a fantastic opportunity for those who listened.

Just because an investment opportunity turns out well, does not mean that upside is unlimited. At some point, shares become fairly valued or, even worse, overvalued. Given how much the stock has moved up, I was very open-minded that this might be a possibility. But after revisiting the company and looking at updated guidance provided by management, I remain as fervent in my optimism as I had previously been. In fact, while it’s obvious that the easy money has been made, shares do still look to be tremendously undervalued. Given the quality of the company and how cheap the stock is, I would argue that additional upside is most certainly on the table. And because of that, I have decided to keep the ‘strong buy’ rating I have had on the stock for all these years.

A fantastic business at a fantastic price

It’s rare, in any market other than the most depressed, that we can find fantastic companies at fantastic prices. But Energy Transfer is one firm that has met this description for a long while. To understand why I think this, we need only look at the most recent financial results provided by management. These results cover the first quarter of the company’s 2024 fiscal year, which would be the only fresh data that’s available since I wrote about the firm in February. Revenue for this time came in at $21.63 billion. That’s an increase of 13.9% compared to the nearly $19 billion generated one year earlier.

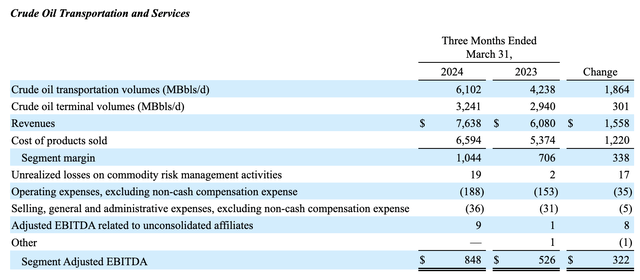

There were a couple of key operations that drove most of this upside. For starters, the company’s Crude Oil Transportation and Services segment reported revenue of $7.64 billion. That was up from the $6.08 billion generated one year earlier. This increase, amounting to 25.6%, was driven largely by increased volumes associated with these assets. Crude oil transportation volumes, for instance, rose by 44% from 4.24 million barrels per day to 6.10 million barrels per day. Management attributed this to a variety of causes, such as growth associated with its gathering systems and contributions from assets that the firm acquired. That primarily affected its pipelines throughout Texas. Meanwhile, Bakken pipeline volumes increased because of more timid winter weather this year compared to the same time one year earlier. Midcontinent systems also increased year over year because of acquisitions, while volumes associated with the Bayou Bridge pipeline improved modestly.

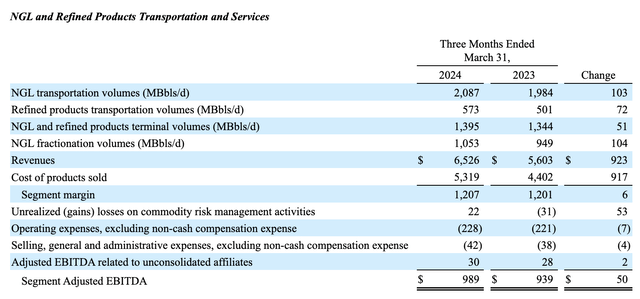

This wasn’t the only bright spot for that segment. Crude oil terminal volumes also managed to rise, climbing from 2.94 million barrels per day to 3.24 million barrels per day. The company benefited from increased production in both the Permian and Bakken basins. Higher Gulf Coast refinery utilization rates, as well as contributions from assets the company acquired, also aided on this front. This wasn’t the only segment that saw strength. The other one that saw a lot of upside was the NGL and Refined Products Transportation and Services segment. Revenue of $6.53 billion translated to an increase of 16.5% compared to the $5.60 billion reported one year earlier. This was driven in part by a 5.2% increase in NGL transportation volumes, a 14.4% rise in refined products transportation volumes, a 3.8% increase in NGL and refined products terminal volumes, and an 11% increase in NGL fractionation volumes. Higher energy production volumes in the Permian Basin, as well as more activity when it came to export pipelines in the Gulf Coast, were instrumental in pushing these volumes up.

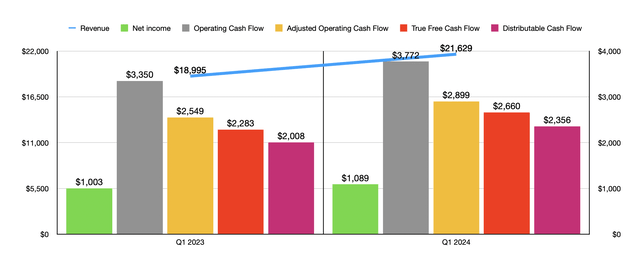

The increase in revenue brought with it only a nice improvement in net income, with profits rising by 8.6% from $1 billion to $1.09 billion. Other profitability metrics also fared well. Operating cash flow, for instance, jumped by 12.6% from $3.35 billion to $3.77 billion. If we adjust for changes in working capital, we get an increase of 13.7% from $2.55 billion to $2.90 billion. DCF, or distributable cash flow, rose by 17.3% from $2.01 billion to $2.36 billion. And EBITDA for the company jumped 13% from $3.43 billion to $3.88 billion. When I look at companies like this, I also have my own special metric that I refer to as ‘true free cash flow.’ I strip out preferred distributions and maintenance capital expenditures to arrive at the amount of extra cash flow that the company has for its core operations that it can allocate any way that it wants. Year over year, this metric managed to climb by 16.5% from $2.28 billion to $2.66 billion.

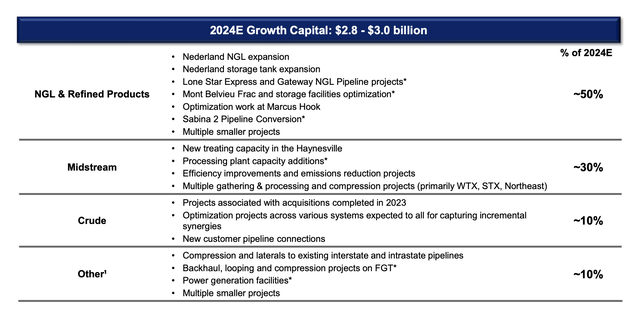

If management is to be believed, this is only the start of great things for the 2024 fiscal year. At present, management expects EBITDA to come in at between $15 billion and $15.3 billion. This is up from initial guidance of between $14.5 billion and $14.8 billion. It also stacks up nicely against the $13.8 billion generated in 2023. There’s no doubt that some of this is due to organic opportunities. This year, for instance, management is planning to spend between $2.8 billion and $3 billion on growth initiatives. About half of that will be spent on NGL and refined products opportunities. Another 30% will involve midstream opportunities. 10% will be attributable to crude projects. And the remaining 10% will be allocated to other miscellaneous projects. Having said that, some of this is also due to the acquisition the company made last year of Crestwood Equity Partners in a deal initially valued at $7.1 billion.

We don’t know what to expect when it comes to other profitability metrics. But if we assume that they will increase at the same rate that EBITDA is expected to at the midpoint, then adjusted operating cash flow should be around $11.07 billion. DCF should come in at around $8.38 billion. And true free cash flow should be roughly $10.22 billion if management holds true to their midpoint guidance of $850 million worth of maintenance capital expenditures.

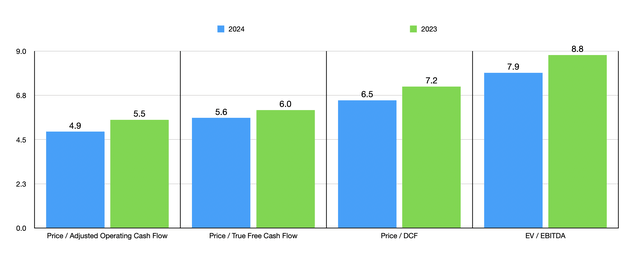

Using these results, I decided to value the company as shown in the chart above. As you can see, the stock does get a lot cheaper using the 2024 estimates. In terms of valuing the company compared to similar enterprises, the picture does get complicated if we don’t use the forward estimates. And that’s simply because of the impact of not only the Crestwood acquisition, but also other changes that the company has made over the past several months such as preferred stock redemptions and various investments. But in the table below, I took the rationale that, if shares are attractive even leaving out certain cash flows, then they must really be attractive with them.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Energy Transfer | 5.5 | 8.8 |

| Kinder Morgan (KMI) | 6.6 | 11.5 |

| The Williams Companies (WMB) | 8.5 | 10.3 |

| Enbridge (ENB) | 7.3 | 11.8 |

| Enterprise Products Partners (EPD) | 8.5 | 10.6 |

| MPLX (MPLX) | 7.7 | 10.2 |

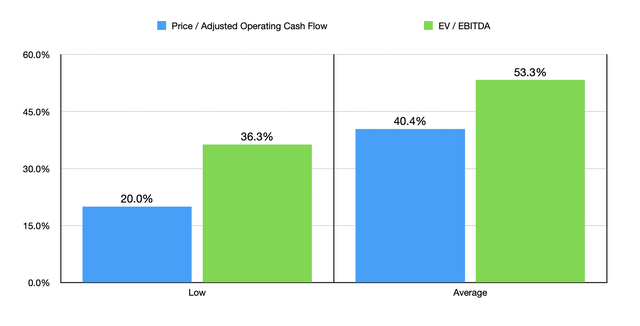

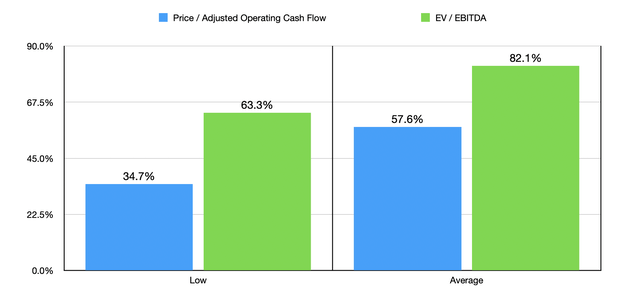

As you can see in the table, Energy Transfer ends up being the cheapest of the group using both the price to operating cash flow approach and the EV to EBITDA approach. This allows us to do another interesting exercise. In the first chart below, you can see how much upside the company should experience if it is to trade at the multiple of the cheapest of the competitors I looked at. This is based on 2023 figures. It also then looks at the same thing assuming that Energy Transfer should trade at the average of the multiples of the five firms. What we end up with here is upside of between 20% and 53.3%. In the subsequent chart, I did the same thing using the forward estimates for 2024. In this case, upside is even greater at between 34.7% and 82.1%.

Author – SEC EDGAR Data Author – SEC EDGAR Data

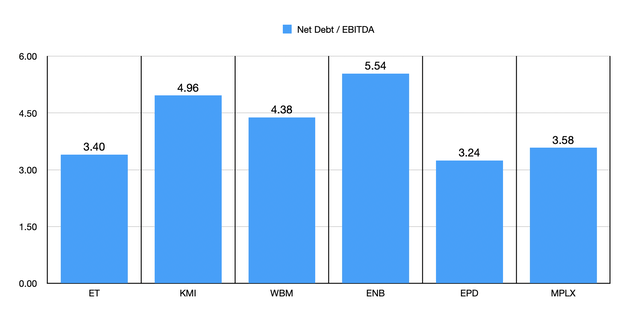

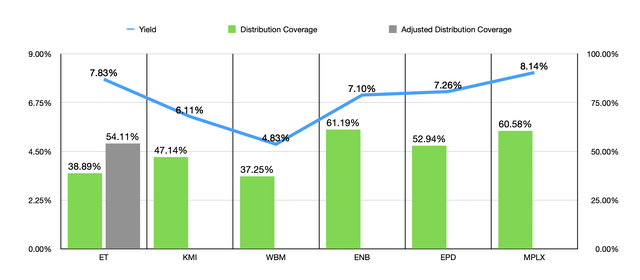

A case could be made that Energy Transfer deserves to trade at a discount to its peers. But I would disagree with that. I say this for two reasons. First, in the first chart below, you can see the net leverage ratio of it compared to the same five firms I valued it against. It’s a net leverage ratio is lower than all but one of the five. In the second chart below, I then looked at both the yield and the payout ratio, relative to adjusted operating cash flows, of each of the businesses. I did this using results from 2023. At the present moment, with the exception of MPLX, Energy Transfer boasts the highest yield. It also has the second-lowest payout of the group. That math does change if we strip out preferred distributions and non-controlling interests. But in that case, it’s still in the range of the other players. All said and done, this shows that the company has debt under control, a hefty payout, and the ability to boost that payout if management so desires. And on that side, they have done that recently. Leading up to the first quarter earnings release, management did increase the dividend by 3.3% year over year, with an annual payout now of $1.27 per unit.

Author – SEC EDGAR Data Author – SEC EDGAR Data

Takeaway

From all that I can see, Energy Transfer appears to be a fantastic opportunity for investors. Are we going to see the same kind of upside that we saw already? Perhaps not. But we should see double-digit increases. The best thing is that this doesn’t even factor in the benefit that the continued cash payout should bring to shareholders. Add on top of this the prospect of additional growth through investments that management is making, and it is difficult to be anything other than incredibly bullish on the business at this time.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!