Summary:

- Energy Transfer reported strong Q3 earnings, with significant growth in oil and steady performance in NGL and natural gas volumes.

- New demand from power plants and data centers could significantly boost ET’s natural gas infrastructure, enhancing its growth prospects.

- Despite strong fundamentals and exceeding pre-COVID distribution rates, ET remains undervalued, trading below pre-COVID highs.

- ET’s stable cash flows and high yields offer low volatility gains, with potential for market revaluation due to rising power generation demand.

Monty Rakusen

Energy Transfer Third Quarter Review

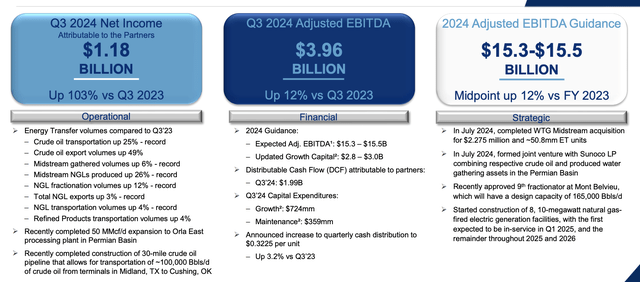

Energy Transfer (NYSE:ET) reported strong Q3 earnings on Wednesday (Nov. 6). Growth occurred in all categories. The headline-grabbing numbers occurred in the oil segment. NGL and natural gas volumes, the company’s real bread and butter, were more muted and similar to those at Enterprise Products (EPD).

Quarterly Breakdown and Guidance (Q3 Presentation)

Like EPD, ET has been a steady grower of its core franchises of NGL processing, fractionation, and export and natural gas trunklines from major basins, especially the Permian. To date, no one has been particularly excited about the natural gas infrastructure, as demand growth has been muted and extremely impacted by the weather. Cool summers or warm winters lead to inventory builds, which compress volumes.

It appears, however, that the tame demand environment for natural gas could be near an end. Like EPD, ET called out the demand it’s seeing from power plants and data centers.

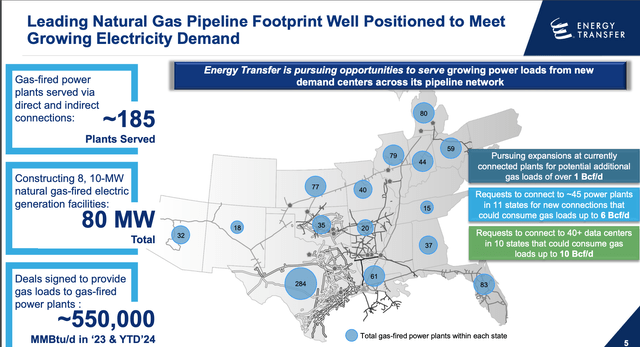

Energy Generation Capacity (Q3 Presentation)

The company called this new demand out specifically during the conference call.

We have never seen this level of activity from a demand pull standpoint and these opportunities are truly spread across our natural gas footprint from Arizona to Florida and from Texas to Michigan. We currently serve gas-fired power plants in 15 states with approximately 185 plants served via direct or indirect connections throughout these states and our opportunities have only increased since our last call.

We have had requests to connect to approximately 45 power plants that we do not currently serve in 11 states that in aggregate could consume gas loads up to 6 Bcf per day.

In addition, we have had requests from over 40 prospective datacenters in 10 states. These datacenters in aggregate, could consume gas loads up to 10 Bcf per day.

Many nuclear plays such as Talen Energy (TLN) have already garnered huge attention for their ability to service AI or data centers. Even companies like Oklo (OKLO), which have zero revenues, have ripped higher and achieved multi-billion dollar market caps.

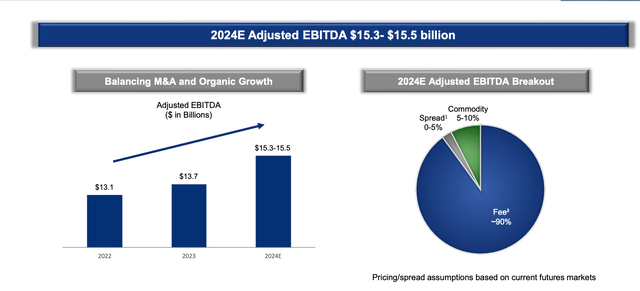

ET is not a rookie supplier of energy. There’s no “potential” here. It has current capacity with budgets and plans to keep expanding. This company would and will continue to grow regardless of AI/data center power demand. Any increased demand from these new power hogs would only add upside to the ET story. However, at 12-14% fcf yield, sub 4x leverage and 7.5% distribution yield, the company is still valued as a slow-growing income play rather than one with a large growth angle.

EBITDA growth and breakdown (Q3 Presentation)

Valuation:

Despite exceeding its pre-COVID distribution rate, deleveraging and growing cash flows, this company still trades below near pre-COVID highs.

| Market cap (@$17.38 | $59.22 billion |

| Debt | 60.07 billion |

| Minority Interest | 15.25 billion |

| Cash | 299 million |

| Enterprise Value | 134.25 billion |

| EV/2024 EBITDA midpt. (15.4 billion) | 8.7x |

| FCF Yield (using $8 billion estimate) | 13.5% |

Risk:

The main risk with any MLP is oil prices. This is a risk for unit price, not actual fundamentals. At 90% fees, commodity price fluctuations just don’t move the actual cash flows much here. Differentials within the natural gas and NGL complex can also move numbers around a little.

Conclusion:

Like EPD, ET is a massive cash generator whose cash flows from its core businesses are growing in mid single digits. The stocks are valued as boring, steady growers. Their yields are such that steady, low volatility gains can be booked without much fear. The power generation demand craze could turn the market’s attention to the value embedded within ET’s (and EPD’s) ability to deliver natural gas far and wide. A multiple reset could be in the cards here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Members of Catalyst Hedge Investing had early access to this article. They have exclusive access to many other articles every month as well as an active chat board with regular updates on ideas and a best ideas portfolio.