Summary:

- Williams Companies obtains a permanent injunction against Energy Transfer, preventing Energy Transfer from blocking access to “right-of-way” areas.

- Energy Transfer has a poor record in court cases and may face penalties for frivolous filings (eventually) if the losses keep up.

- Shareholders should be concerned about the increasing number of cases Energy Transfer has lost and the potential for ballooning costs from future losses.

- The Dakota access pipeline dispute is on hold until sometime in 2025.

- Energy Transfer announced the acquisition of WTG Midstream Holdings.

onurdongel

Williams Companies (WMB) just received a permanent injunction to stop Energy Transfer (NYSE:ET) from blocking its access to some “right-of-way” areas that Energy Transfer has access to. This is the second court decision to go against the company when it comes to not sharing its “right-of-way” acreage. Common Unit holders need to be concerned as these decisions pile up because enough rulings in one direction should cause a company policy change that makes the rest of the processes moot. Otherwise, the courts may well take additional action that could cost the company a significant amount of money. For that reason, I prefer to watch this situation from the sidelines until I see a material change in the unfolding story.

Seeking Alpha Article On Court Decision About Right Of Way Access Between Energy Transfer And Williams (Seeking Alpha Website June 5, 2024)

As the last article I wrote noted, once the losses begin piling up, courts do have the option of penalizing something regarded as frivolous. This is in addition to any avenues the winners may have for extra costs due to delays involved in filing an action that becomes obvious will not succeed. At what point this happens is anyone’s guess. However, Williams is a company worth listening to. If Williams management felt this was a winning case and then the court agrees, then the remaining cases in the pipeline need to be reviewed for viability.

DT Midstream (DTM) was the other ruling that has gone against the company. These are not fly-by-night operations that are winning court cases. Energy Transfer has had a poor record in court for about as long as I have been following them. The partnership does have some wins. But the losses appear to overwhelm those few wins.

Courts do get tired of the same type of case coming before them when the outcome is clear before the case was ever filed. When that happens, the options of the court can be from no cash effect to considerable cash effect to discourage the filings.

As Energy Transfer management noted in the release quoted above, they feel that the other companies are being unreasonable. But so far, the courts do not agree and evidently, there are a fair number of law firms agreeing with the other side. To me, this is “playing with fire” and it’s only a matter of time before something somewhere down the line burns common unit holders.

Dakota Access Pipeline Dispute

Recently, this dispute resolution was also delayed until fiscal year 2025. As I discussed in previous articles, the proposed solutions range from removing the pipeline to allowing operations to continue as they have been. The resolution could cost the company nothing, or it could cost the company a substantial amount of money.

What This Means

What has changed from the last article is that there is now a specific announcement about a delayed deadline here (that replaces predictions), while the outcome of cases in the other dispute is now becoming much clearer. The change here is neutral for shareholders in that there is no more future clarity than there was before.

But the dispute with Williams clearly indicates that those cases are heading in one direction, and it is not a direction that favors the company. How many more of the same cases will try the court’s patience and lead to still more costs is anyone’s guess. But it is becoming clear that a change in strategy is needed before costs balloon (if they are going to balloon).

Shareholders should already be concerned about the sheer number of cases that this company has lost over the years since I began following them. Administrative courts cases can lead to project delays that result in the low return of capital cited previous times. There has to be a less costly way to go about these types of potential disputes.

Acquisition of WTG Midstream Holdings

The announcement of plans to issue up to 51 million common units to acquire WTG Midstream Holdings from its owners is hopefully a good move for the company. Diamondback Energy (FANG) was one of the sellers.

Of concern here is the fact that a lot of these acquisitions do not appear to have resulted in enough per share earnings progress. What they would do is make Energy Transfer a larger company to better withstand any unfavorable judgements in some of the disputes.

In the latest quarter after the latest acquisition, earnings per share remained basically the same while other measures like cash flow per share made some single digit percentage gains (because shares outstanding gained as well as the absolute gain in some cash flow measures).

Compare this to Enterprise Products Partners (EPD) which made an acquisition back in fiscal year 2022. Not only did the common units jump on the announcement of the acquisition, but that was followed by a full year of double-digit percentage growth. That one acquisition has done better than anything I have seen on a per common unit basis for Energy Transfer.

Total Return

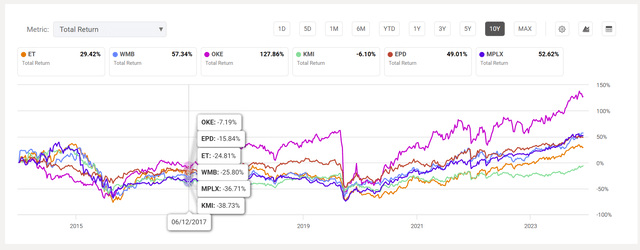

The latest 10-year period impacted all midstream stocks, as the 2015 big oil price decline led to a revaluation of the industry. 2018 further ingrained in the market that growth was going to be very different if at all going forward.

Energy Transfer Total Return Compared To Other Midstream Companies (Seeking Alpha Website June 5, 2024)

Even so, the total return shown above is below the average midstream return for the period as calculated by the Seeking Alpha Website. Investors can obviously get better returns without the risk that all the court cases pose for Energy Transfer common units going forward.

A ten-year period is instructive because any company can have a good one year. A longer period of time is probably a better indication of management abilities to return cash to common unit holders.

Readers would be well advised to read the latest 10-Q on pages 21 to 31 to get some idea of potential future liabilities should the company end up with an unfavorable outcome after all appeals are exhausted. 10 pages is quite a list for any company. I follow many companies that do not have anything close to a list of possible contingencies that long in the 10-Q.

But note that management believes it has meritorious defenses in each case and does not believe it has significant liability. Also note that as was the case at the beginning of the article, at least the disputes associated with Williams are currently not in the company’s favor.

That means the range of possibilities is continued legal expenses to an unfavorable outcome in each case.

Summary

Energy Transfer is a company with investment grade debt. Now, there is a significant amount of preferred stock between that investment grade debt (even though some preferred stock has been called) and that debt that can elevate the financial leverage in regard to common unit holders.

Unlikely in many companies, there is a good possibility that the contingencies part of the 10-Q contains information that is likely holding back the action of the common unit’s price. For the foreseeable future, that is expected to continue.

As the Seeking Alpha website graph shows, there are plenty of other opportunities to get a better return without all the drama here. At the very least, I would consider a well-run partnership like Enterprise Products Partners because it does not have all the contingencies listed here.

For me, this is not a suitable investment for an income-oriented investor until the legal issues clean up a whole lot more. For those that want to speculate with a small position, then by all means have at it. Just realize you could suffer a significant loss of principal in the future if this issue is not closely monitored.

For me, this is a sell until the legal risk comes down.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EPD, FANG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation for the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits its own investment qualifications. I may initiate a position in TTE without further notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies and related companies like Energy Transfer in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.