Summary:

- Energy Transfer remains a compelling high-income investment with a 7.9% yield, strong operational performance, and robust growth prospects through strategic acquisitions and high demand.

- ET’s asset base includes extensive midstream infrastructure, with 90% fee-based Adjusted EBITDA, minimizing commodity price exposure and supporting stable financial performance.

- ET’s recent acquisitions and organic growth have driven significant EBITDA and distributable cash flow increases, positioning it for continued success and potential for market-beating total returns.

MarsBars

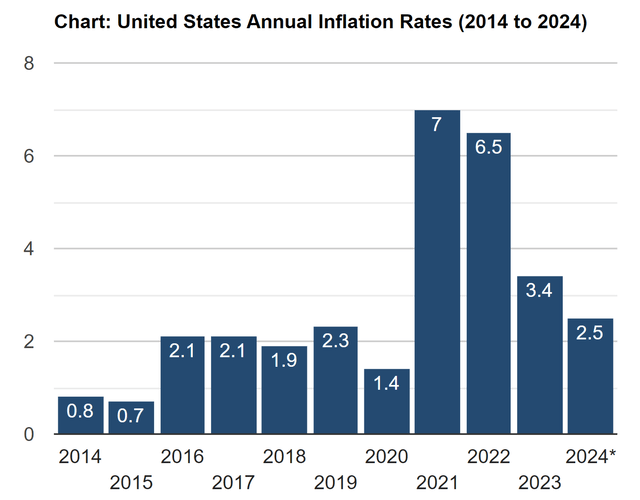

Americans are making more in wages than ever, but that’s only in nominal terms, considering the higher cost of living over the past 5 years. For example, getting a 5% increase in pay every year may sound good on paper, but that’s simply more or less kept up with the higher cost of goods and services since 2020, as shown below.

As shown in the above chart, Inflation is like a steamroller that doesn’t stop for anyone. But fortunately, you can do something about it by either upleveling your skills in the workforce and / or putting new capital to work so that you can make money while you sleep.

This brings me to Energy Transfer (NYSE:ET), which I last covered a while back in December of 2022, when it was seeing record volume growth and strong demand for its NGL both domestically and internationally.

The stock has done very well for investors since then, due to both share price appreciation and growing distributions, with the stock giving a 60% total return since my last piece, far outpacing the 41% rise in the S&P 500 (SPY) over the same timeframe.

In this article, I revisit ET and discuss why it remains an appealing high-income pick in which to put new money to work, so let’s get started!

ET: Put New Money To Work

Energy Transfer is a master limited partnership (issues K-1) with a sizable network of midstream assets across the U.S. This includes natural gas and liquids pipelines that transport NGL, crude oil, and refined products.

Beyond pipelines, ET’s assets also include storage, export terminals, and processing facilities, and touch oil and gas formations in the Permian Basin of Texas, Marcellus in Pennsylvania, and Bakken in North Dakota.

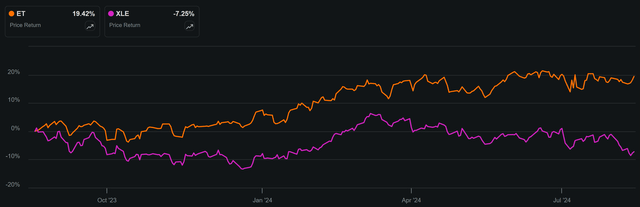

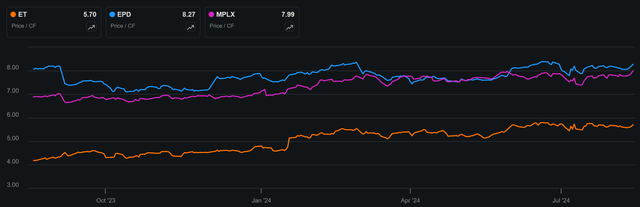

Most of ET’s Adjusted EBITDA (90%) is fee-based, with just 5-10% commodity-price exposure. This has helped ET and its midstream peers better weather the recent decline in oil prices. As shown below, ET’s share price has increased by 19% over the past 12 months and its performance since the start of September has been relatively even compared to the downturn in SPDR Energy Select Sector ETF (XLE).

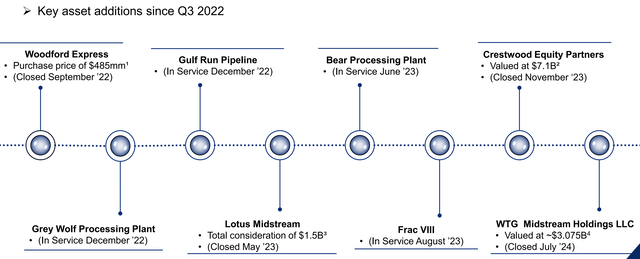

Over the past 2 years, ET has materially grown its asset base through a series of key acquisitions, as shown below, including Crestwood Equity Partners and WTG Midstream for a combined deal value of $10.2 billion, greatly enhancing ET’s natural gas storage and NGL and crude oil services businesses.

Meanwhile, ET continues to demonstrate robust growth, with Adjusted EBITDA growing by 21% YoY to $3.76 billion during Q2 02024. Distributable Cash flow also grew by an impressive 25% YoY to $2 billion, driven by contributions from acquired assets and cost management. It’s worth noting that excluding $80 million in transaction expenses related to the WTG Midstream acquisition, adjusted EBITDA would have surpassed $3.8 billion.

ET is also seeing strong demand, with crude oil transportation and export volumes up by 23% (a company record) and 11% YOY, respectively during the second quarter. Plus, NGL fractionation, transport, and export volumes grew by 11%, 4%, and 3%, respectively.

Encouragingly, management raised full-year guidance on adjusted EBITDA by $250 million to $15.4 billion with expected contributions from both organic growth and external projects, which are expected to meet growing needs on the electric grid from data centers across ET’s network.

This includes ET’s Lone Star Express expansion, which is expected to increase NGL transport capacity to 1 million barrels per day by 2026 and ET’s ninth fractionator at Mont Belvieu that’s expected to boost fractionation capacity to over 1.3 million barrels per day by Q4 2026.

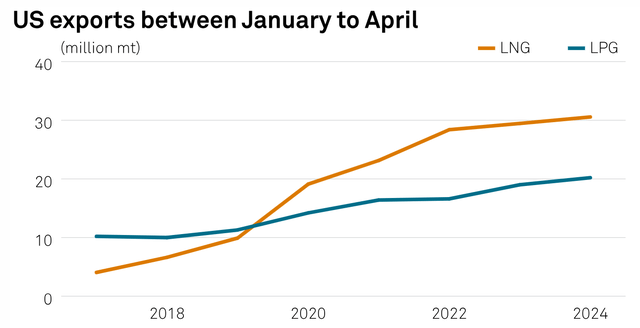

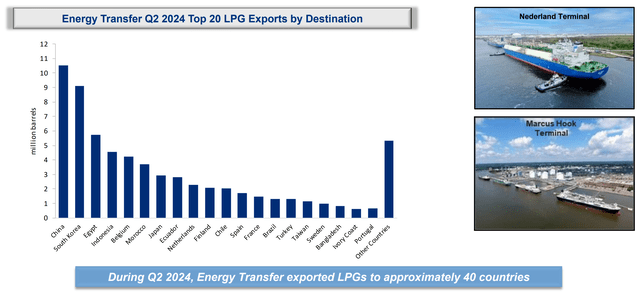

ET is also well-positioned to benefit from growing LPG exports to worldwide markets. As shown below, US exports of LPG have steadily grown over the past 6 years, reaching a record this year at 20.2 million metric tons.

ET exports LPG to 40 countries, with China, South Korea, and Egypt being the Top 3, as shown below.

Importantly, ET carries a strong balance sheet with a BBB credit rating from S&P, and equivalent ratings from Moody’s and Fitch. While its net debt-to-TTM EBITDA of 4.2x is higher than the low 3x range of Enterprise Products Partners (EPD) and MPLX LP (MPLX), it remains within a reasonable range of sub 4.5x as considered safe for midstream companies.

ET yields an appealing 7.9% at present, and has raised its distribution every quarter since Q1 2022, and the current quarterly distribution of $0.32 sits 3.2% higher than the prior year period. ET’s distribution is also very well-covered by a 170% DCF to Distribution coverage ratio.

At the current price of $16.17, ET trades at an appealing Price-to-Cash Flow of 5.7x, which, as shown below, represents a meaningful discount to that of MLP peers EPD’s 8.3x and MPLX’s 8.0x.

With a near 8% yield, my reasonable expectations for low-to-mid single digit DCF per share growth driven by internal growth and acquisition synergies, and potential for a closer valuation to its midstream peers, ET could potentially deliver market-beating total returns from here.

Risks to the thesis include the potential for commodity price volatility, which could negatively impact producers that a rely on ET’s midstream services. In addition, a slowdown in the global economy, particularly in China, the largest importer of LPG, serves as another risk. Moreover, ET carries more leverage than its MLP peers EPD and MPLX, therefore subjecting it to more interest rate risk. Lastly, government and environmental regulations could place uncertainties on future projects.

Investor Takeaway

Energy Transfer remains a compelling high-income investment with its vast midstream network, strong operational performance, and robust growth prospects. It has successfully expanded its asset base through strategic acquisitions and continues to benefit from high demand for its crude oil and natural gas services. With a well-covered 7.9% yield, distribution growth, and a discounted valuation compared to peers, ET offers attractive total return potential for investors, making the stock a good candidate in which to put new capital to work.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Read The Full Report on iREIT+Hoya

iREIT+HOYA Capital is the premier income-focused investing service on Seeking Alpha. Our focus is on income-producing asset classes that offer the opportunity for sustainable portfolio income, diversification, and inflation hedging. Get started with a Free Two-Week Trial and take a look at our top ideas across our exclusive income-focused portfolios.

With a focus on REITs, ETFs, Preferreds, and ‘Dividend Champions’ across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.

With a focus on REITs, ETFs, Preferreds, and ‘Dividend Champions’ across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.