Summary:

- Overall, insider transactions are currently dominated by selling for good reasons, such as the elevated valuation of the overall equity market.

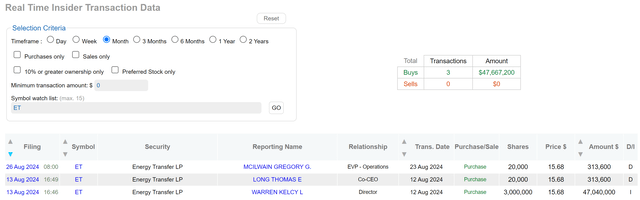

- Recent insider transactions for Energy Transfer LP show rare and significant insider buying.

- These activities suggest a favorable return/risk curve from the insiders.

Ildo Frazao

ET stock: Recent insider transactions

My last article on Energy Transfer LP stock (NYSE:ET) was published on Seeking Alpha about a month ago, on July 25, 2024, as you can see from the chart below. The article, entitled “AI Is Hungry For Power, Energy Transfer Will Deliver It,” argued for a strong buy rating based on the power demands from AI-related technologies. Quote:

All told, my conclusion is that ET offers a very skewed return/risk profile under current conditions, and thus reiterated my strong buy rating. I expect a secular tailwind thanks to the surging power demand from digital technologies and ET’s strategic position to help meet such demand. And finally, despite all these growth catalysts, the valuation is quite reasonable as reflected in its ~11x FWD P/E ratio and an ~8% dividend yield.

Seeking Alpha

In this article, I want to examine the thesis from a completely different angle: Insider transactions. ET’s recent insider activities show a few rare buying transactions, and it’s the goal of this article to examine these activities in more depth.

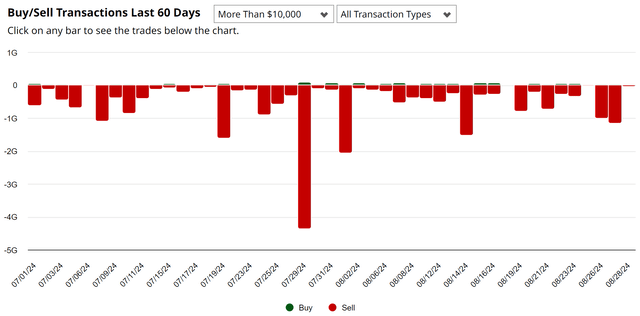

The operative word here is rear and let me start by justifying this word. We monitor insider activities for all of our investment decisions and our overall impression is that recent insider activities are dominated by selling. Our impression is consistent with data provided by other sources and an example is shown below. The following chart shows the number of buy and sell transactions of more than $10k made by insiders in the past 60 days. The red bars indicate sell transactions, and the green bars indicate buy transactions. The picture is dominated by the red bars and you can barely see the greens. I see good reasons for the dominance of insider selling with the elevated valuation of the overall equity market and also the uncertainties surrounding the hard landing vs. soft landing scenarios.

Against this background, the insider buys of ET shares really caught my attention, as elaborated on next.

Source: www.barchart.com

ET’s insider transactions: A closer look

The chart below provides a summary of insider transactions for ET stock in the past month. As seen, a total of three transactions were disclosed. In contrast to the dominance of selling in the overall market seen above, all three ET insider transactions were purchases by insiders. The total amount purchased is also sizable, totaling more than $47M. The most recent purchase was made on August 26, 2024, by Gregory G. McIlwain (and EVP at ET), who bought 20,000 shares at a price of $15.68 per share. The other two purchases were also made at the same price.

Next, I will argue why this price (and ET’s current price is $15.88 as of this writing, quite close to their purchase price) is indeed an excellent entry point.

DataRoma

ET stock: Growth and return potential

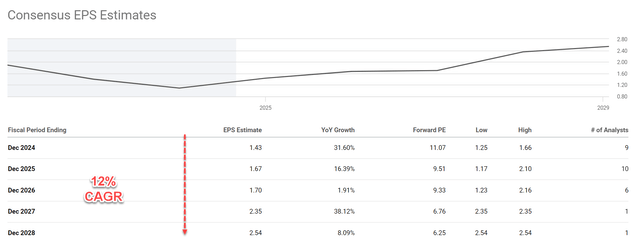

The chart below shows the consensus EPS estimates for ET in the next five years, which point to a significant EPS increase in the years to come. To wit, its EPS is projected to grow 31.6% from the previous year to $1.43 in FY 2024. This positive trend is expected to continue in the coming years, with EPS estimated to reach $2.54 by the end of fiscal year 2028. The implied compound annual growth rate (CAGR) for EPS over this period is about 12%.

Seeking Alpha

I think the projected growth is very plausible given the potential of its throughput volumes in crude oil and liquid natural gas pipelines, its ongoing expansion projects, and also external acquisition. Notably, ET recently completed the acquisition of Lotus Midstream in Q2 of 2024. I expect this acquisition to further strengthen its presence in the Permian Basin through additional gathering and transportation pipelines for crude oil. This acquisition is on the heels of the Crestwood acquisition. Judging by the latest financials the company has released, the integration of the acquired assets progressed well and already showed a sizable throughput ramp-up.

In the meantime, the company is investing heavily in expansion plans geared toward long-term growth. Catalysts on this front on the top of my list include the project to increase export terminals at Nederland and Marcus Hook. Both expansions are on schedule for mid-2025 operation. The expanded fractionation capacity at Mont Belvieu is also on schedule for 2027. These expansion projections position ET well to capitalize on the elevated domestic demand surge that I expect in the years to come. As detailed in my last article, I consider energy consumption very likely to increase substantially over the next few years because new digital technologies (artificial intelligence technology, data centers, cloud computer servers, etc.) all command significant additional energy resources.

Despite robust growth potential, the forward P/E ratio for ET stock is only about 11x currently. With a 12% CAGR growth projection, this translates into a PEG (P/E growth ratio) of only 0.92x, noticeably lower than the ideal 1x threshold most GARP (growth at a reasonable price) investors seek.

Other risks and final thoughts

The generous dividend yield is another upside risk. No article on ET is complete without mentioning its dividend yields (currently at 8.1% as of this writing). As a textbook dividend growth stock, the use of PEG above drastically understates its attractiveness. And the so-called PEGY ratio is a much better metric for the following reasons Peter Lynch promoted:

For dividend stocks, Lynch uses a revised version of the PEG ratio – the PEGY ratio, which is defined as the P/E ratio divided by the sum of the earnings growth rate and dividend yield. The idea behind the PEGY is very simple and effective (most effective ideas are simple). If a stock pays out a large part of its earnings as dividends, then investors do not need a high growth rate to enjoy healthy returns. And vice versa. And similar to the PEG ratio, his preference is a PEGY ratio of 1x or below.

For ET, with an FWD P/E of 11x, a growth projection of 12%, and a yield of 8%-plus, the PEGY ratio is only 0.55x.

In terms of downside risks, as a well-covered stock on the Seeking Alpha’s platform, most of the common risks surrounding ET have been thoroughly discussed by other SA articles already. As such, here I will only mention a risk that is less discussed on the platform. ET’s LNG (Liquefied Natural Gas) segment could be impacted by U.S. export policies. In particular, the U.S. has recently paused export project approvals for LNG (see the announcements from DOE below).

On January 26, 2024, the U. S. Department of Energy announced it is taking a temporary pause in reviewing applications to export Liquefied Natural Gas to non-free trade agreement (non-FTA) countries while the Department works to update the economic and environmental analyses that inform DOE’s determination whether such applications are in the public interest.

On the positive side, the pause is only temporary, and the existing export capacity is also enough to make the U.S. the number one LNG exporter globally.

To conclude, my view is that the recent insiders’ buying activities should be part of the potential investors’ decision. To me, these activities suggest that the insiders see a favorable return/risk curve, which is also what my analysis points to. Notably, the discrepancy between the market valuation and ET’s EPS growth potential is too large to ignore in my view, as reflected in its 0.92x PEG ratio and only 0.55x PEGY ratio.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.