Summary:

- ET is a no-brainer choice for investors seeking a reliable, high-yielding stock amid the anticipated rotation from growth to value in the stock market.

- I am highly confident in ET’s dividend reliability due to its fortress-like positioning in the mature midstream industry, where the risk of new competition is extremely low.

- Apart from the stellar dividend yield, my intrinsic value calculations also indicate substantial potential upside.

thexfilephoto

My thesis

My thesis is about the company called Energy Transfer (NYSE:ET). ET appears to be a compelling investment opportunity in the current stock market when sentiment around growth stocks is cooling down rapidly. I think that there are numerous reasons to believe that ET is a Strong Buy.

ET offers a rare opportunity to earn a massive 7.85% dividend yield. My stock analysis suggests that this dividend yield is safe and sustainable. As one of the largest energy midstream players in North America, ET is a good defensive asset. The demand for energy is poised to continue growing due to several factors, which is a favorable long-term trend for the whole industry. ET’s capital allocation approach is prudent, which is also a positive sign for dividend investors. Intrinsic value of the stock is around $23.8, around 46% higher than the last close.

ET stock analysis

Energy Transfer is a dividend stock offering a 7.85% forward yield, which is a very attractive yield even in the current environment of high yields offered by U.S. Treasury bonds. Before I deep dive into the stock analysis, I would like to emphasize that Energy Transfer is a Limited Partnership (LP). I am not a tax advisor, but I think that potential investors should analyze the difference in tax implications between owning a common stock and an LP unit.

ET is not a stock that will be a multi-bagger due to a few big reasons. Past performance does not guarantee anything, but looking at historical trends is vital. ET appreciated by 21% over the last five years, well behind the S&P 500 Index (SP500). The reason is simple: ET operates in a very mature industry that is growing slowly. First oil pipeline in the U.S. was built in 1865, around 160 years ago.

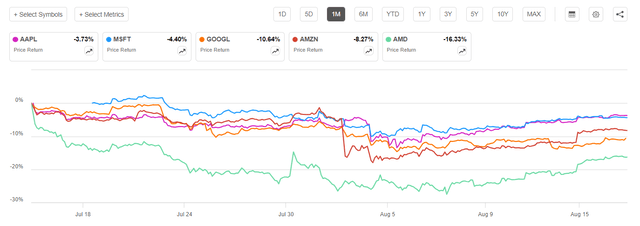

However, ET’s 7.85% dividend yield is the stock’s big advantage. The Q2 earnings season unveiled that expectations around the biggest tech companies are likely too hot. Despite most of the tech giants demonstrating solid growth across key financial metrics, none of their stocks rallied after their latest earnings releases. This is likely a solid indication that expectations of the market were very high.

Moreover, even the largest growth stocks are reacting very nervously even on some minor pullbacks in macroeconomic data. Nvidia (NVDA) is still to release its fresh quarterly earnings, but the stock experienced a few consecutive days of losing more than 5% per day due to a slight uptick in the U.S. unemployment rate. Therefore, I think that there is high probability that investors will start seeking for defensive dividend stocks soon.

With that being said, I want to explain why I believe that ET is a top-choice as a safe dividend stock. High dividend yield is nothing if there is no confidence in safety of payouts. Therefore, the second part of my thesis’ core will explain why I think that ET’s stellar dividend yield is safe.

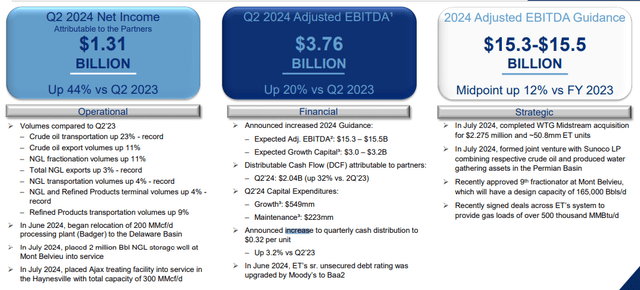

The latest $0.32 per share quarterly dividend declared is a good point to start with. This payout will be 0.8% higher sequentially and 3.2% higher on a YoY basis, which adds confidence in the dividend’s safety. Another fresh reason to be optimistic is the company’s strong financial performance in Q2. Net income and EBITDA demonstrated robust growth against the same quarter of 2023. Moreover, the management expects full year adjusted EBITDA to observe a strong 12% growth compared to 2023.

Energy Transfer’s presentation

Apart from strong P&L, the balance sheet is also improving. On July 1 Moody’s upgraded ET’s credit rating from Baa3 to Baa2 with stable outlook. Earlier in 2024 ET’s credit rating was also upgraded by Fitch Ratings. According to the most fresh presentation, Energy Transfer’s leverage ratios are now within the management’s target range. As a result of the strong P&L and improving financial position, the management targets annual distribution (dividend) growth rates between 3% to 5%.

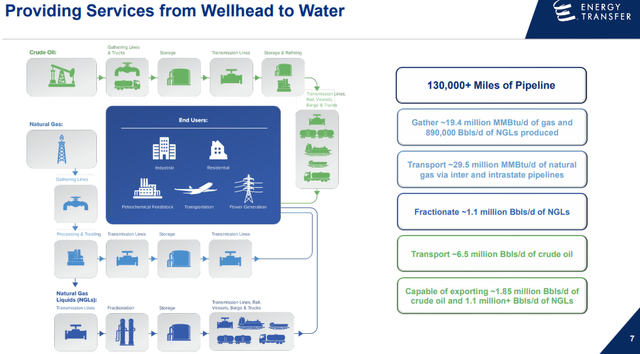

ET’s current financial success is not a one-off event due to the company’s positioning. The midstream industry is very mature, and it is very Capex intensive. It means that competition risks are extremely low, which is beneficial for large players like ET. The company’s footprint is massive, as the company boasts a substantial footprint across all key niches of a midstream market.

Energy Transfer’s presentation

Longer-term trends are positive for the midstream industry. The U.S. has become the world’s undisputed leading oil producer in recent years, which is a positive factor for the country’s midstream industry. Amid the increased geopolitical uncertainty around other largest oil producers like Russia or some of the OPEC members, I think that avoiding dependence on oil imports is one of the America’s strategic priorities. Statista expects the U.S. projected energy production from crude oil and light condensate to be very stable at least by 2050, which adds predictability to the financial performance of midstream giants like ET.

Intrinsic value calculation

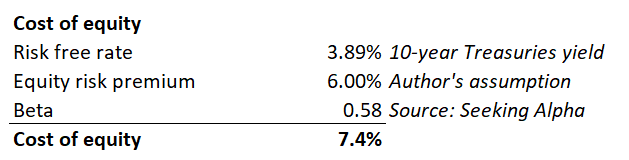

I start my intrinsic value calculation by figuring out the discount rate, which is the cost of equity for the dividend discount model (DDM) approach. The discount rate is 7.4% and below you can see the working where I outline how did I arrive at this figure, including comments regarding sources of the input data.

DT Invest

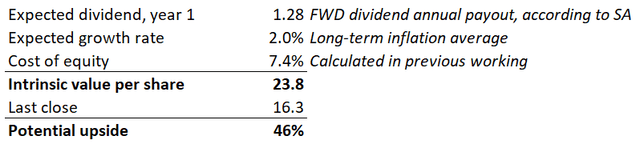

Now I can incorporate this discount rate into the DDM formula and figure out the fair share price for ET. Below, I provide my second working, where I calculate the intrinsic value per share based on DDM. Assumptions and their sources are also described in the second working.

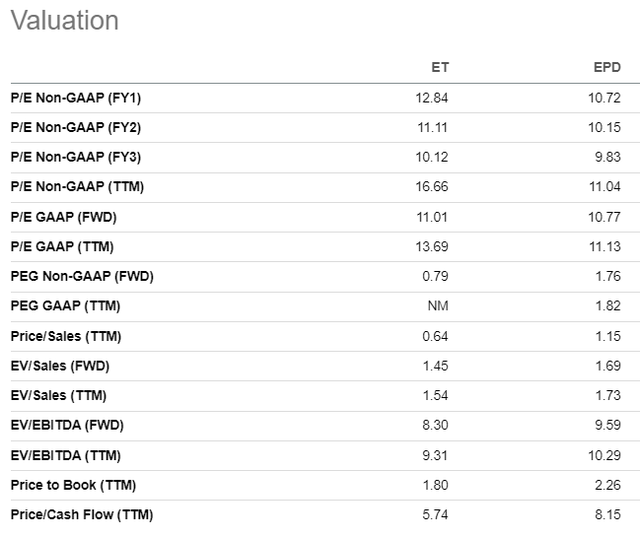

According to my working, the fair share price is $23.8. This is 46% higher than the last close, meaning that ET is deeply undervalued. ET’s closest peer among midstream companies is Enterprise Products Partners LP (EPD) with a comparable market cap. Moreover, both companies are LPs. Therefore, I think that comparing ET versus EPD in terms of valuation ratios is a useful analysis.

Most of the ratios are close to each other, meaning that ET’s valuation is attractive. As an investor who seeks for a safe dividend yield, I want to emphasize that ET’s Price to Cash Flow ratio looks very healthy.

To sum up my analysis of the stock’s intrinsic value, I think that the two methods I have used suggest that ET’s valuation is compelling.

What can go wrong with my thesis?

As a company with operations involving transporting and processing fossil fuels, ET faces significant ESG risks. The company can face a myriad of adverse consequences in the case of environmental hazards like spills and leaks. Unfavorable financial implications include potential penalties, cleanup costs, and reputational damage. The social factor should not be ignored when we speak about risks. Local communities near the company’s pipeline routes or processing plants are likely to be powerful stakeholders, which can also add disruptions to the company’s operations.

Energy Transfer’s balance sheet is highly leveraged, with almost $60 billion in total debt as of the latest reporting date. Total debt is slightly higher than the company’s market cap. High leverage is normal for midstream companies due to the high Capex intensity of the business. I think that ET’s high leverage is not a problem in the normal course of business. However, in case of any black swan event, ET’s high indebtedness might become a big problem. In case of a recession or a credit crunch, the company’s financial flexibility will become very limited, and it will have less potential to refinance. This can adversely affect ET’s capacity to pay out dividends, which will work against my thesis.

Summary

Energy Transfer’s stock is a compelling investment opportunity due to its high and safe dividend yield and very attractive valuation. Recent selloffs in the largest growth companies might indicate that investors are seeking safer harbors, and ET is certainly one of the most attractive ones. ET certainly deserves a Strong Buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET, ET.PR.I either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.