Summary:

- Energy Transfer LP is a large midstream company with a market cap of over $50 billion and a dividend yield of over 8%.

- The company has seen record earnings, with net income over $1.3 billion for the quarter, and expects adjusted EBITDA in 2024 of $15.4 billion.

- Energy Transfer is focused on strong growth investments, with $3 billion expected in growth capital for 2024, and is committed to generating strong shareholder returns.

Jonathan Kitchen/DigitalVision via Getty Images

Energy Transfer LP (NYSE:ET) is one of the largest midstream companies in the world, with a market capitalization of more than $50 billion, and a dividend yield of more than 8%. The company has continued to generate record earnings, with substantial growth potential, which will enable strong long-term shareholder returns.

Energy Transfer Updates

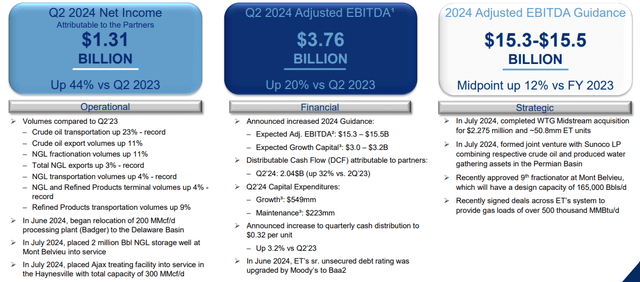

Energy Transfer has a dividend yield of more than 8%, with adjusted EBITDA for the quarter at almost $3.8 billion.

Energy Transfer Investor Presentation

The company recently reported net income of more than $1.3 billion for the second quarter. The company has managed to ramp up volumes substantially, with crude oil transportation up more than 20% and export volumes up by double-digits. NGL exports and refined products have all continued to grow as well, and the company is moving the Badger processing plant.

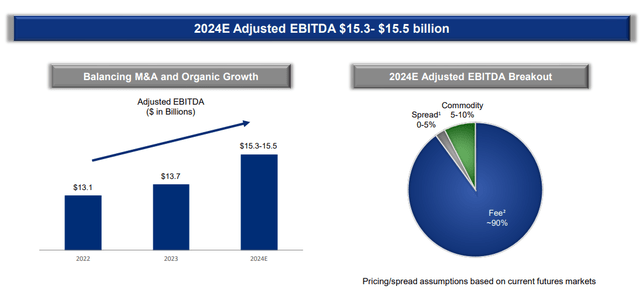

The company is expecting adjusted EBITDA in 2024 of $15.4 billion, and the company’s DCF for the quarter was just over $2 billion. The company has a 16% annualized DCF yield and half of that is a dividend, while the company is spending almost $800 million on capital expenditures. Continued growth investments is something the company can self-fund.

The company wrapped up its WTG midstream acquisition for $3 billion, which will integrate well into its assets. The company also approved a 9th fractionator at Mont Belvieu and is continuing to grow overall. Altogether, the company has continued to execute on all fronts.

Energy Transfer Asset Overview

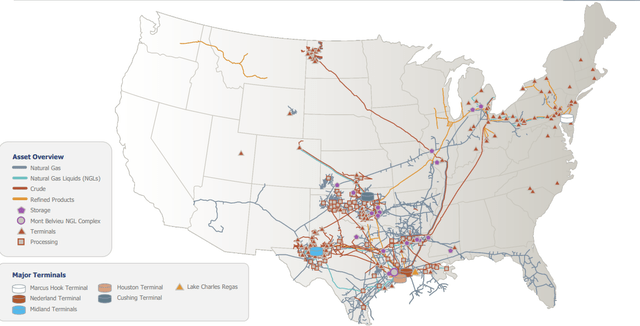

The company has continued to build up an incredibly strong portfolio of assets.

Energy Transfer Investor Presentation

The company has an impressive portfolio of assets focusing across the entire country. This includes major connections to all major producing locations and most major population centers. It also includes a massive network of assets on the energy Gulf coast focused on both exports and the largest producing oil field in the world, the Permian Basin.

Energy Transfer Investor Presentation

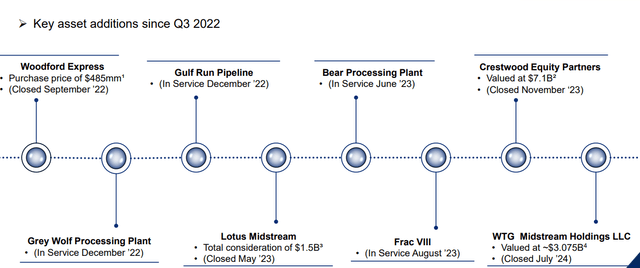

The company has continued to undergo massive acquisitions along with putting major assets into service. In 2023, the company spent almost $10 billion on acquisitions. The company recently closed its acquisition of WTG Midstream Holdings at roughly $3 billion. The acquisitions have strong incremental benefits for the company.

However, to be clear, we’d like to see the company only do acquisitions it can fund with cash, we would rather not see it issuing new shares at its yield of more than 8%.

Energy Transfer Growth Investments

The company is continuing to achieve strong growth, and investing heavily in its business with extra cash.

Energy Transfer Investor Presentation

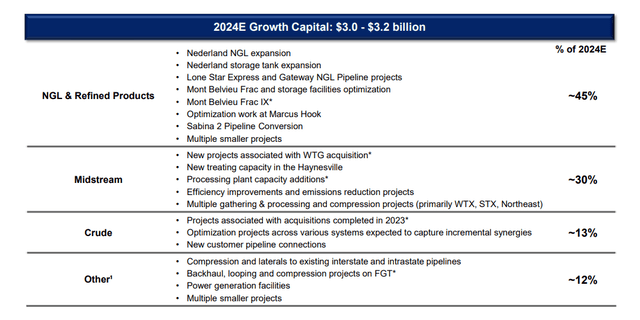

The company expects 2024E growth capital to be roughly $3 billion. The vast majority of that is going to go into NGL & refined products, with a smaller amount going into Crude. NGL has much more long-term potential than other industries, as natural gas demand is expected to remain higher for longer versus crude oil.

The company has $8 billion in forecast 2024 discounted cash flow, or DCF. The company’s dividend consumes just over $4 billion of that DCF, and then the company’s growth capital consumes $3 billion. That puts the company at more than $7 billion in DCF, leaving it with less than $1 billion. This shows the company’s ability to both continue growth and generate shareholder returns.

Energy Transfer Shareholder Returns

The company is committed to generating strong shareholder returns as it continues its growth.

Energy Transfer Investor Presentation

The company saw double-digit EBITDA growth from 2023-2024, supported by its continued acquisitions. That’s pushed the company’s EBITDA to more than $15 billion, although due to continued interest expenditures, the company’s DCF is at more than $8 billion. The company has a 16% DCF yield that can help support overall shareholder returns.

We’d like to see the company ramp up share buybacks with its cash flow, given its current dividend yield. However, regardless of how the company spends its cash, it’s a valuable investment.

Thesis Risk

The largest risk to our thesis is Energy Transfer has a massive amount of debt as it’s continuing to invest in growth capital. The company is well positioned should interest rates decline, but should they remain higher for longer, that will hurt the company’s ability to generate long-term shareholder returns.

Conclusion

Energy Transfer has a strong portfolio of assets. The company has a market capitalization of more than $50 billion, and it has undergone numerous acquisitions over the past year. These bolt-on acquisitions are incredibly profitable; however, we don’t like to see the company issuing additional shares to pay for these acquisitions.

The company has a strong DCF yield of more than 15%. That goes roughly half to its dividend, although it also goes to the company’s growth capital, something that it can comfortably afford. That will help enable long-term growth for the company. Overall, this makes Energy Transfer a valuable long-term investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.