Summary:

- ET’s recent P/E expansion has factored in some – but not all the – growth potential ahead.

- Market projects a 11.7% CAGR for its EPS growth through 2028 for good reasons.

- Potential catalysts include Trump’s energy policies, ET’s strategic investments in the Permian Basin, and higher energy demand from digital technologies.

- Even with a much more conservative growth projection, the stock still features a favorable return/risk ratio under its current P/E.

Motortion/iStock via Getty Images

ET stock: still attractively valued

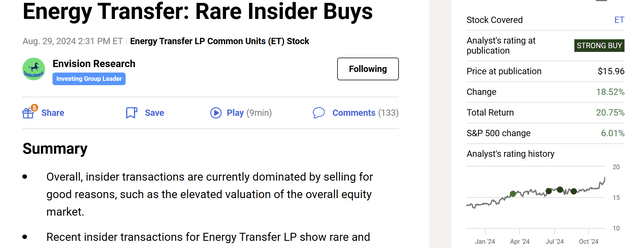

My last work on Energy Transfer LP stock (NYSE:ET) was published back in August 2024 As you can see from the screenshot below. The article was entitled “Energy Transfer: Rare Insider Buys”. As already hinted by the title, I argued for a STRONG BUY rating on ET stock based on the consideration of insider activities. To be more explicit, that article explained:

Overall, insider transactions are currently dominated by selling for good reasons, such as the elevated valuation of the overall equity market. Recent insider transactions for Energy Transfer LP show rare and significant insider buying. These activities suggest a favorable return/risk curve from the insiders.

Since then, there have been a few new catalysts surrounding ET shares. In this article, I will focus on the top changes on as I see it: the implications of Donald Trump victory in the presidential election and also ET’s expanded valuation. In the end, you will see that these changes have made the stock less attractive than it was when I last analyzed it. But I am still seeing a skewed return/risk ratio under its current conditions and thus rate it as a BUY (vs. my earlier strong buy rating).

Seeking Alpha

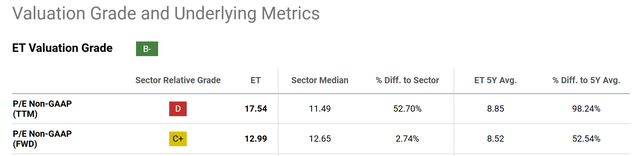

Let me start with the valuation expansion. As seen in the screenshot above, the stock has gained more than 20% in terms of total return since my last writing, far outpacing the overall market (which returned a robust 6% already). The sharp price rally has pushed up its P/E multiples considerably. For instance, its FWD non-GAAP P/E ratio now hovers around 12.99x. It is moderately above the sector median of 12.65 (by about 2.7%) and substantially above its own historical average of 8.5x (by more than 52%).

Next, I will explain that such valuation expansion admittedly has priced in some – but not all of – the expected tailwinds from the incoming Trump administration.

Seeking Alpha

ET stock: EPS growth outlook

Looking ahead, the market has a very upbeat outlook for ET’s growth as reflected in the consensus EPS estimates below. The estimates project a compound annual growth rate (OTC:CAGR) of 11.7% for the next five years between FY 2024 and 2028. At this rate, ET investors will enjoy a significant increase in EPS, growing from $1.46 in FY 2024 to $2.54 in 2028. Notably, consensus expects 33.52% YOY EPS growth in FY 2024.

Seeking Alpha

Indeed, with Trump’s vision for our energy landscape, the market has good reasons to be optimistic. For example, in his victor speech,

Donald Trump underscored his plans to further boost U.S. oil and natural gas production, currently both at record levels. Trump asserted that the U.S. has more “liquid gold” than other nations, including Saudi Arabia and Russia. Trump’s reelection positions him to enact significant policy shifts to further increase U.S. fossil-fuel production.

My projection is a bit more conservative but should already support a healthy total shareholder return under its current valuation multiple already, as detailed next.

ET stock: my estimated EPS growth rates

My approach for analyzing long-term growth rates is detailed in my earlier articles. So, here I will just quote the final results:

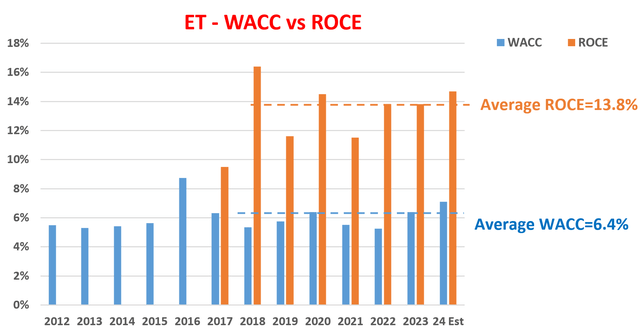

The method involves the return on capital employed (“ROCE”) and the reinvestment rate (“RR”). The ROCE for ET has been around 13.8% in recent years as seen in the chart below. I expect its RR to be around 40% on average in the next few years. With these inputs, ET’s growth rate would be ~5.52% (13.8% ROCE x 40% RR = 5.52% growth rate).

The RR estimate is based on the company’s plans in its expansion projects. In particular, ET has placed an emphasis on the role of the Permian Basin recently and has made sizable acquisitions in this area. Meanwhile, the company has many new facilities under construction. Notably, it is building several natural gas-fired electric generation facilities. There are eight currently under construction and each has a capacity of 10 megawatts. I expect these facilities to align well with the expected policies under the Trump administration and also the expansion of high-performance computing centers. As argued in my earlier articles, I expect artificial intelligence, data centers, and cloud computers to drastically increase energy demand and ET is well positioned to help meet such demand.

Seeking Alpha

ET stock: valuation reexamined

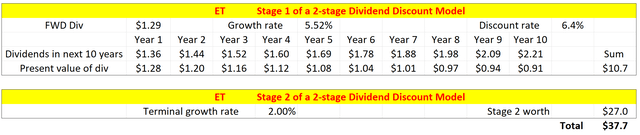

Given such growth potential, my assessment, as mentioned earlier, is that the recent valuation expansion has price in some – but not all – of ET’s growth ahead. Given ET’s status as a dividend champion, it is very reasonable to apply a discounted dividend model (“DDM”) to make my point. More specifically, I will use a 2-stage DDM model to be more conservative, with a more aggressive growth rate first to reflect the policy tailwinds ahead and a lower terminal growth rate afterward.

For the dividend growth rate in the 1st stage, I will just use the 6.9% EPS growth rate I estimated above and assume its dividend growth in tandem at the same pace. Note that the DDM model also requires a discount rate as an input. Here, I applied the WACC model (i.e., the weighted average cost of the capital model) and its discount rate was on average 6.4% as seen in the chart above. For its terminal growth rates, I assumed a 15% reinvestment rate (estimated from the average in the sector). At this RR, its terminal growth rate would be about 2% assuming it maintains the same level of ROCE of 13.8% (13.8% ROCE x 15% RR = 2% of terminal growth rate).

With these estimates, the table below shows the final results from my 2-stage DDM. The fair price for ET shares under these parameters worked out to be about $38, still leaving a wide margin of safety compared to its current market price (of around $19 as of this writing).

Author

Other risks and final thoughts

In terms of downside risks, there are a few uncertainties worth mentioning. As aforementioned, the company has been active on the acquisition front, especially in the prized Permian Basin area. As the latest example, it recently completed the acquisition of West Texas Gas in July 2024. How well and how quickly these acquisitions can integrate into ET’s vast network remains to be seen. In the meantime, commodity prices remain uncertain. In its recent quarters for example, the company enjoyed higher volume throughput. But the boost here was largely offset by low commodity prices across the energy sector. As a measure to hedge commodity price volatility, the company enacted some fixed-rate contracts for transportation volumes. Such hedging strategies of course come at the cost of limited profits.

Despite these downside risks, my conclusion is that the upside outweighs the downside by a good margin. Admittedly, the return/risk profile has shifted somewhat since my last writing given the substantial valuation expansion. However, my assessment is that the P/E expansion has not factored in all growth potential in the next few years due to my expectation for more friendly policies and also drastically higher power demand due to the deployment of digital technologies.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.