Summary:

- Americans are at risk of falling into a “cash trap” as interest rates peak, leading to a search for new investment opportunities.

- Energy Transfer (ET) is a high-quality value stock with an 8% yield, strong performance, growth potential, and solid financials.

- ET’s mix of income and growth makes it a compelling investment choice as investors seek alternatives to falling high-yield money market returns.

ozgurdonmaz/iStock via Getty Images

Introduction

Have you ever heard of the “cash trap?”

It’s OK if you haven’t, as it’s a topic I will spend a lot of time on in the weeks and months ahead.

On June 25, The Wall Street Journal wrote an article titled “Americans Chasing High Interest Rates Risk Falling Into a ‘Cash Trap'”

This is what a cash trap entails (I added emphasis):

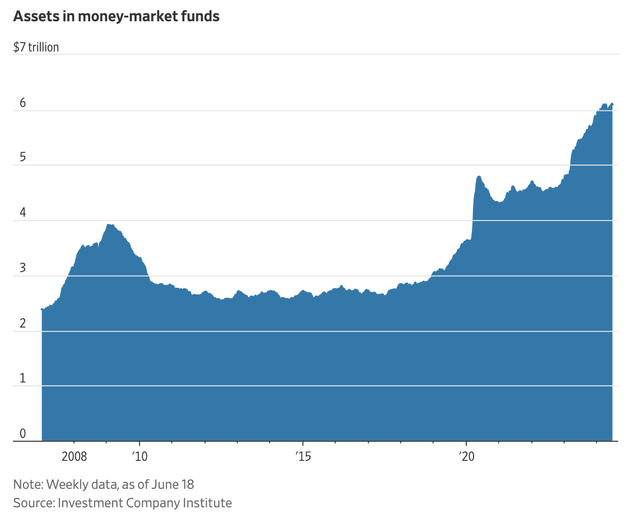

Americans have poured money into cash-like investments since the Fed began raising interest rates, driving assets in money-market funds to a record $6.12 trillion earlier this month, according to the Investment Company Institute. Now, Wall Street traders are betting rates have peaked and those investors face a choice: keep sitting on their cash as interest payments shrink, or figure out how to redeploy the money. – The Wall Street Journal

If we ignore the debate about whether rates have peaked or not, every good investment eventually comes to an end, which means a good exit strategy is important.

At some point, a big part of the $6 trillion in high-yielding money market funds will find its way into other investments.

Where will it go?

Anyone who can answer this question correctly can make a lot of money.

I cannot predict the future, but I can make an educated guess.

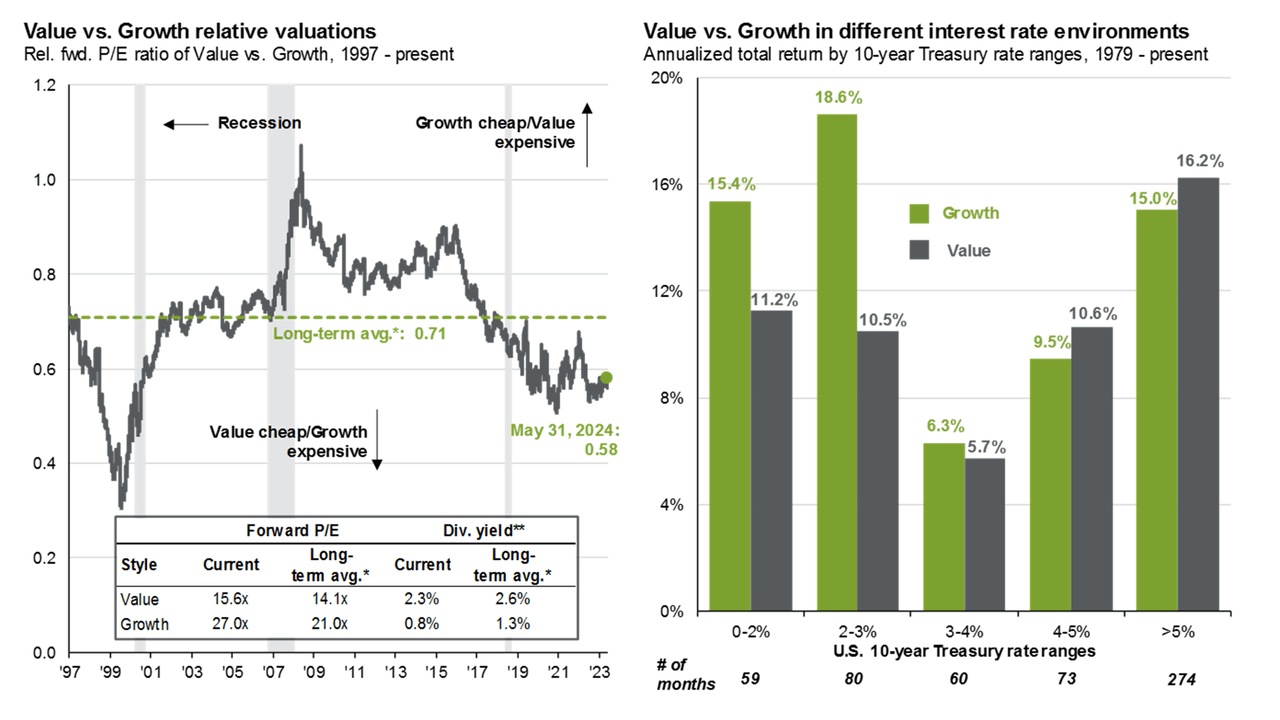

Personally, I believe a lot of money will flow into high-quality value stocks that come with a decent yield.

Value stocks are extremely attractive relative to growth stocks, which indicates a high likelihood of outperformance in the years ahead, especially if money from high-yield, risk-free investments like government bills starts to look for a new home.

One of my all-time favorite value stocks that comes with a very juicy yield, income growth, and a great valuation is Energy Transfer (NYSE:ET), the Master Limited Partnership with an 8% yield.

I have often said if the company weren’t an MLP, which makes it hard for a non-American to invest, I would have become a unitholder many years ago.

My most recent article was written on March 3, when I called it “An 8.4% Yielding Value Stock To Buy During Sticky Inflation.“

Since then, units have returned roughly 9%, beating the 7% return of the S&P 500.

In this article, I’ll update my thesis and explain why I stick to a Strong Buy rating, expecting the company to benefit from money looking for value/income.

So, let’s get to it!

This Mix Of Income And Growth Is Hard To Beat

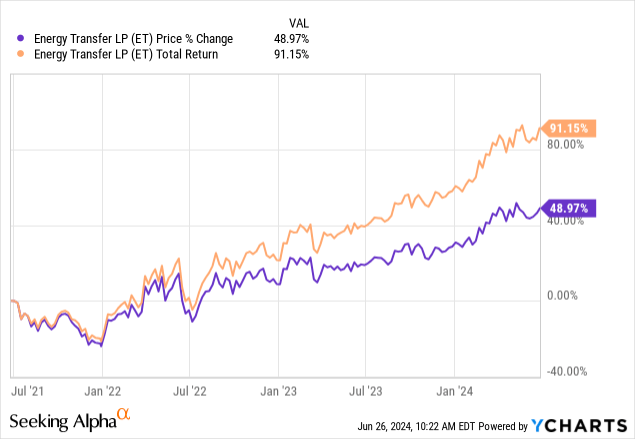

Over the past three years, investors in ET have made 91%, which includes distributions (when dealing with MLPs, dividends are called distributions). Even excluding distributions, units have gone up almost 50%.

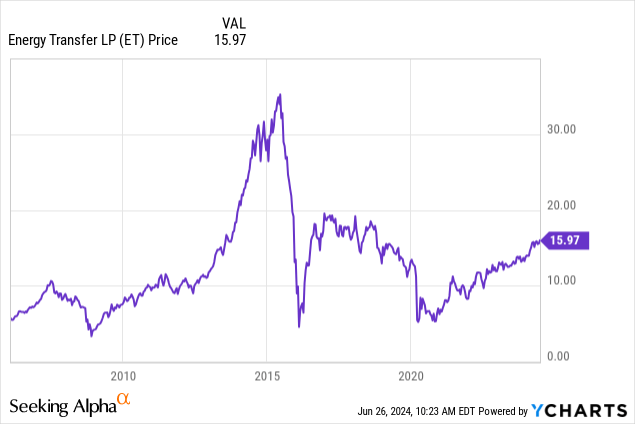

However, this wasn’t always the case.

ET investors have been through a lot over the past two decades. Ignoring the Great Financial Crisis, which dragged down almost anything, the 2014/2015 energy crash was devastating. The same goes for the pandemic.

Both these events happened at a time when the entire midstream industry was dealing with elevated capital spending (negative free cash flow and rising debt).

While midstream companies are usually not prone to energy price fluctuations, investors dumped midstream, fearing that subdued oil and gas prices would result in a lower need for pipelines.

Luckily, that did not happen.

Since the pandemic, the industry has been red-hot, benefitting from rising free cash flow, as major infrastructure projects of the past are now profitable. We have also found out that fossil fuel demand is not weakening, providing fertile ground for consistent growth in the midstream industry.

It’s why I have often said that midstream may be one of the best places for income, as I still believe this industry is flying under the radar.

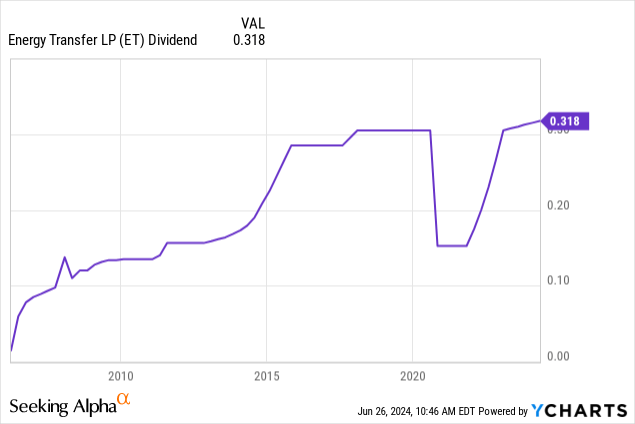

Especially Energy Transfer, as it lost some trust from investors when it cut its distribution during the pandemic. Investors preferred to seek shelter in peers like Enterprise Products Partners (EPD), which has a history of uninterrupted multi-decade distribution growth.

However, after hiking its distribution by 0.8% on April 24, it’s now back at an all-time high. This implies an 8.0% yield.

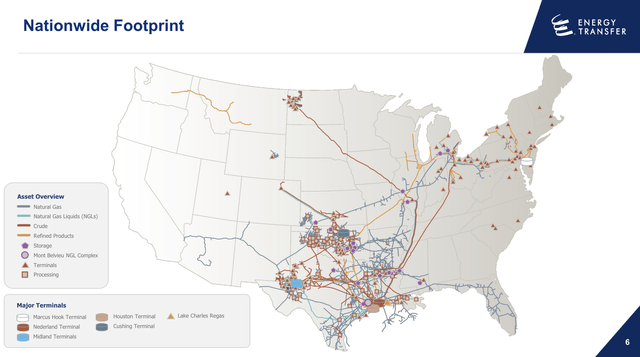

Not only is Energy Transfer one of the most critical parts of the North American energy sector, but it also has plenty of growth left.

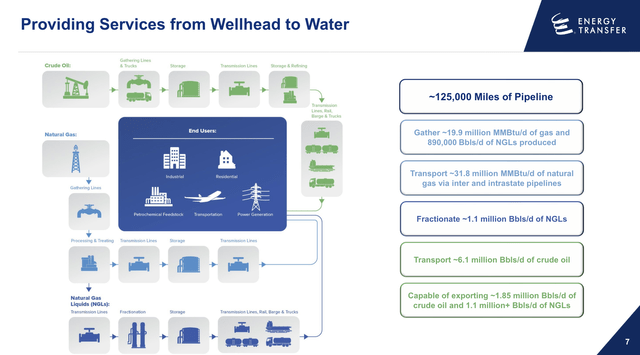

Regarding its size, the company owns roughly 125 thousand miles of pipeline. In addition to natural gas and natural gas liquids (“NGL”), these pipelines ship more than 6 million barrels of oil every day.

The company also is capable of exporting close to 2 million barrels of crude oil per day and more than 1 million barrels of NGLs.

It also gathers and processes natural gas and engages in a wide range of other services that have turned the United States into one of the most dominant energy markets on the planet.

This business is 90% fee-based, which tremendously lowers commodity price risks.

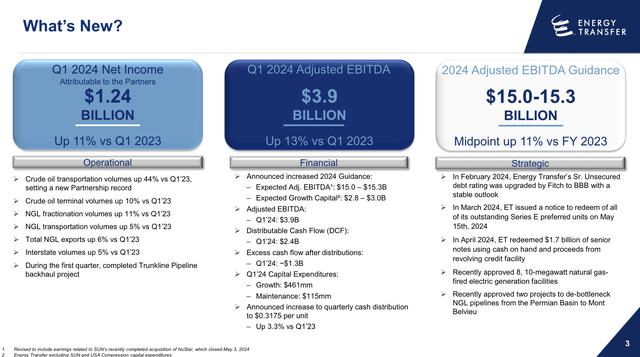

With that in mind, in the first quarter, the company reported an adjusted EBITDA of $3.9 billion, which is a major increase from $3.4 billion in the first quarter of 2023.

This performance was driven by record volumes and pushed distributable cash flow (“DCF”) to $2.4 billion. That’s up from $2 billion in the prior-year quarter.

As a result, the company had $1.3 billion in excess post-distribution cash flow, which shows the sustainability of its current distributions.

On top of this strong performance, the company was rewarded by rating agencies.

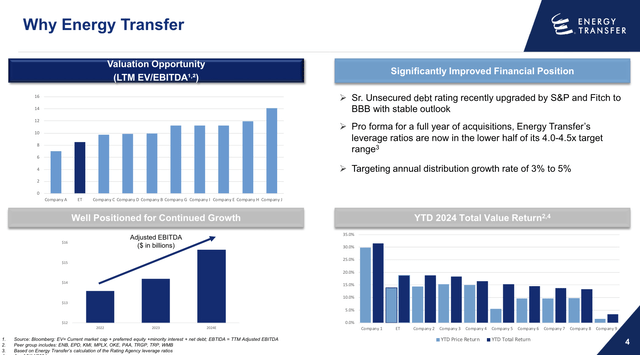

In February 2024, Fitch upgraded Energy Transfer’s senior unsecured credit rating to BBB with a stable outlook after a similar upgrade from Standard & Poor’s to BBB in 2023.

At the end of the first quarter of 2024, Energy Transfer had no outstanding borrowings under its revolving credit facility, and it redeemed $1.7 billion of senior notes using cash on hand and proceeds from its revolving credit facility.

Because the company’s leverage ratios are now in the lower half of its 4.0-4.5x target range, it targets annual distribution growth of at least 3% (3-5% range).

Needless to say, this bodes very well for unitholders, as the company is also using its healthier balance sheet and better free cash flow profile to fuel growth.

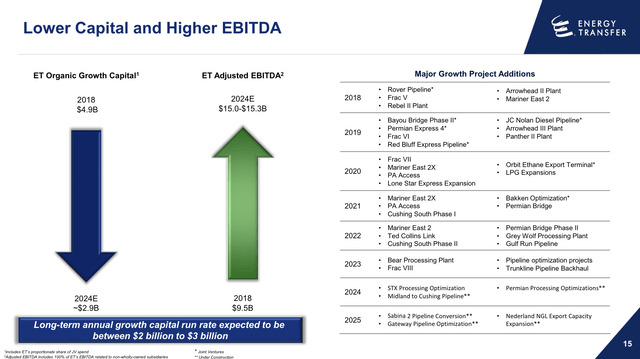

To add some color here, in the first quarter, the company invested roughly $460 million in organic growth capital. This was mainly targeted at the Midstream and NGL and refined products segments, like the expansion of NGL export capacity at the Nederland terminal, which is expected to be in service by mid-2025.

It also made major upgrades to the Lone Star NGL pipelines, which are expected to be completed by 2026.

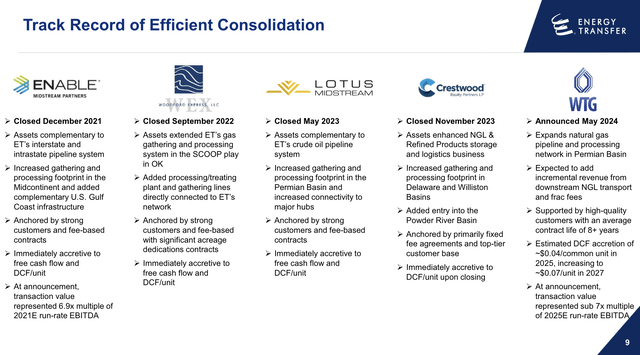

On top of that, ET is known for value-adding M&A, which is inorganic growth.

Currently, Energy Transfer is working on several projects to greater post-acquisition synergies. In this case, the company is working on synergies from the Crestwood acquisition, which closed in November of last year.

These projects include upgrades to the West Texas Gateway and Lone Star Express pipelines.

These upgrades are expected to increase NGL takeaway capacity from the Permian Basin. The company is also working on the conversion of the Sabina 2 pipeline to provide additional natural gasoline service.

The company is also increasing its crude oil transportation capacity with a new direct connection from Midland to its pipeline flowing from the Permian Basin to Cushing. This is expected to be completed by the fourth quarter of this year.

Additionally, please note that the chart above perfectly shows that since 2018, (organic) growth capital has declined from $4.9 billion to $2.9 billion, allowing adjusted EBITDA to rise by almost 60%, using the lower end of 2024 guidance.

This is the major benefit of past investments that are now paying off, allowing ET to grow free cash flow and invest in new projects with support from a much healthier balance sheet.

Speaking of guidance, please note that the company raised its full-year adjusted EBITDA guidance from the $14.5-$14.8 billion range to the new range of $15.0-$15.3 billion.

Among operational improvements, this is supported by strong global demand for crude oil, natural gas, LNGs, and refined products, which I already briefly mentioned earlier in this article.

Valuation

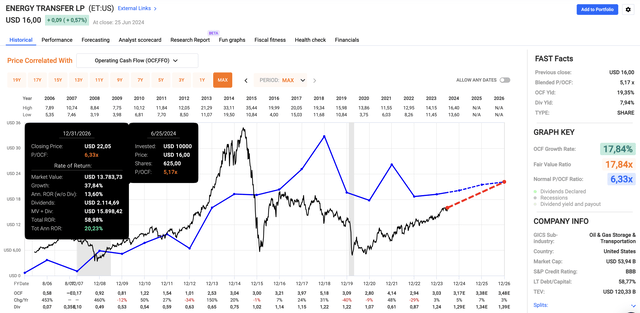

I continue to believe that ET should not trade a penny below $22, which would imply a 38% upside.

Currently, ET units trade at a blended P/OCF (operating cash flow) ratio of just 5.2x, which is below the company’s long-term normalized P/OCF ratio of 6.3x. EPD, which I briefly mentioned as a peer with a less volatile history, has a normalized P/OCF ratio of 10.5x!

Moreover, using the FactSet data in the chart above (at the bottom), analysts expect the company to grow per-share OCF by 5% this year, potentially followed by 7% and 4% in 2025 and 2026, respectively.

However, as these numbers may be hard to see, here’s a table version:

| Year | Per-Share OCF | Y/Y Growth |

| 2023 | $3.03 | 3% |

| 2024E | $3.17 | 5% |

| 2025E | $3.38 | 7% |

| 2026E | $3.48 | 3% |

As such, I expect ET’s future to be very bright, fueled by post-M&A synergies, organic growth, and an increasingly healthy balance sheet, allowing the company to potentially reach a much higher valuation in the future, supported by returning investor confidence.

Moreover, with regard to the introduction, I have little doubt ET will be a major winner in a scenario where bond yields fall and people try to avoid the “cash trap.”

Takeaway

Navigating the “cash trap” means making smart investment decisions, and I believe high-quality value stocks, like Energy Transfer, could be the answer.

ET, with its juicy 8% yield and solid growth, stands out in the midstream sector.

The company has proven its resilience through market downturns and now enjoys strong cash flow, growth opportunities, and a healthy balance sheet.

Moreover, despite past challenges, ET’s strategic moves and attractive valuation make it a compelling investment.

As investors seek alternatives for potentially falling high-yield money market returns, ET’s mix of income and growth positions it as a major winner.

This is why I maintain a Strong Buy rating on ET.

Pros & Cons

Pros:

- High Yield: ET offers an impressive 8% yield, providing elevated income for investors.

- Strong Performance: Over the past three years, ET investors have seen a 91% return, including distributions.

- Growth Potential: With 125,000 miles of pipeline and expanding infrastructure, ET is set for continued growth, backed by strong oil and gas demand.

- Solid Financials: ET’s adjusted EBITDA and distributable cash flow are both up significantly, supporting distribution growth and financial health.

- Value Stock: Trading below its long-term normalized P/OCF ratio, ET is a deep-value stock.

Cons:

- Past Volatility: ET has seen significant drops during the 2014/2015 energy crash and the pandemic. It also cut its distribution. While the company is back on track, it does not enjoy the kind of investor trust a company like EPD enjoys. Not yet, anyway.

- MLP Structure: As a Master Limited Partnership, ET can be less accessible for non-American investors.

- Economic Growth: Although ET is not directly dependent on commodity prices, fears of a recession could hurt its stock price. A real recession could hurt throughput volumes.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.