Summary:

- Energy Transfer offers a compelling 7.9% forward distribution yield and has a 44% upside potential, according to my valuation analysis.

- ET benefits from robust U.S. energy production, increased export potential, and solid domestic energy demand, ensuring stable volumes and financial performance.

- ET’s financial stability is underscored by improved operating margins, expected EBITDA growth, and a recent credit rating upgrade, ensuring the safety of its distribution yield.

Art Wager/E+ via Getty Images

Introduction

I shared a ‘Strong buy’ recommendation for Energy Transfer (NYSE:ET) in July. I am slightly disappointed because ET lagged behind the S&P 500 and delivered around a 1% return to investors after my recommendation.

However, this is the only reason to be disappointed because ET’s fundamentals are consistently improving. The company demonstrates solid operating leverage even despite revenue still being below the 2022 peaks. Moreover, there are several strong secular trends which will highly likely support the midstream industry over the next several years. Since ET is a midstream company with a massive impact and footprint, I remain firmly bullish about its prospects. The stock’s 7.9% distribution yield looks extremely strong, and there is a 44% upside potential. All these positives mean that I am inclined to reiterate my ‘Strong buy’ recommendation for ET.

Fundamental analysis

I consider ET as one of the best dividend picks because the stock offers a compelling 7.9% forward distribution yield. Therefore, my fundamental analysis will focus mostly on trends that will help to assess sustainability and safety of payouts to equity investors.

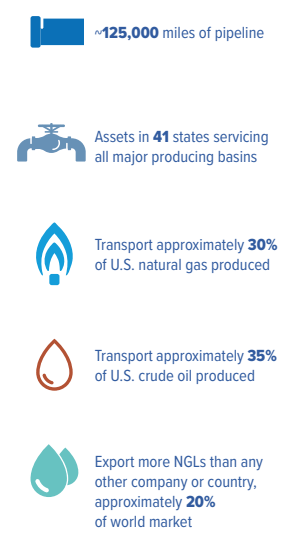

Let me remind readers that ET is one of the largest energy midstream companies in the U.S., which owns a vital infrastructure for the world’s largest economy. According to the factsheet for investors, ET transports about one third of the natural gas and oil produced by the country. With that being said, it is certain that the largest players are usually the ones that are affected by industry trends the most.

energytransfer.com

The financial performance and stability of a large midstream company significantly depends on volumes of hydrocarbons transported, exported, and processed. Therefore, to understand ET’s prospects, it will be useful to look at the broader picture related to the whole U.S. energy industry. From this perspective, there are a few robust tailwinds for midstream behemoths like ET.

The U.S. economy was traditionally significantly dependent on oil imports, but crucial technological advancements in oil production (shale oil, fracking) which emerged over the last decade, helped the U.S. to become an undisputed global leader in oil and gas production. According to Goldman Sachs, the country is expected to remain an oil and gas powerhouse through at least 2026. This is a strong indication that volumes for midstream companies will also remain robust for at least the next 18 months.

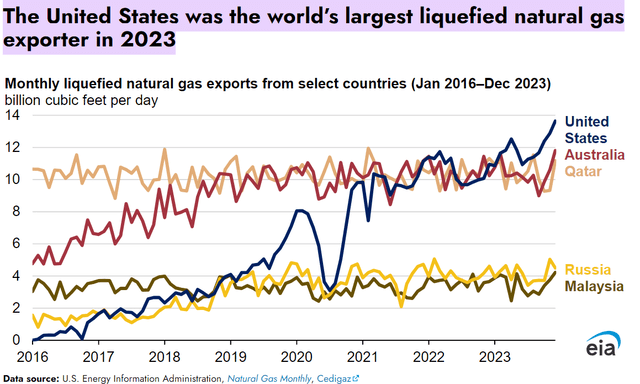

Apart from becoming the world’s largest natural gas producer, sanctions against Russian gas also opened European market for the U.S. Several Asian countries are also large importers of the American LNG. As a result, the country became an undisputed largest LNG exporter by 2023. Increased export potential is also beneficial for large midstream players like ET. Moreover, the company has a solid direct exposure to LNG as it owns and operates several large terminals across the country. This is a robust secular trend, considering the projected 5.1% CAGR for Asian LNG demand by 2040.

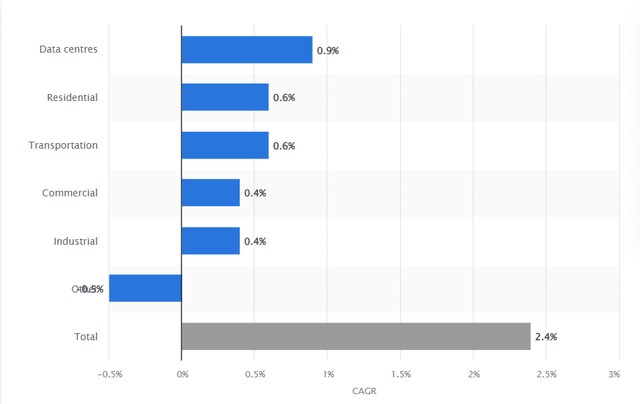

Last but not least, the overall energy demand in the U.S. is expected to remain robust as well. According to Statista, the U.S. energy demand will deliver a 2.4% CAGR by 2030. Data centers are expected to be the major contributor, which looks sound given the pace of adoption of AI capabilities by businesses and individuals.

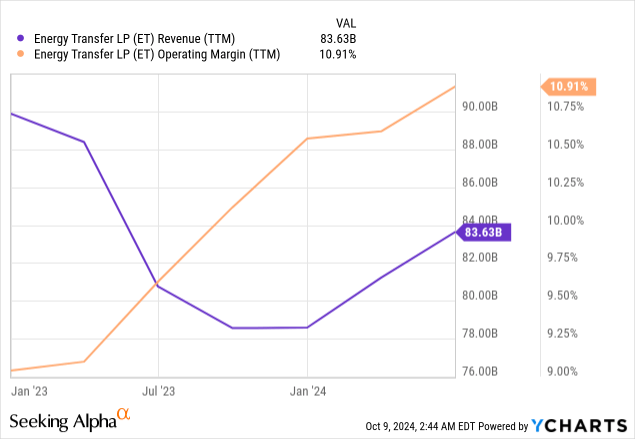

I think that all these three reasons are quite strong and bullish for the U.S. midstream industry. As one of the largest players in the industry with a diversified portfolio of assets, ET is certainly well-prepared to absorb these positive trends and create value for shareholders (or unitholders). The company’s recent financial performance is a good indication that the management is committed to maximizing value for investors. As we see below, the operating margin has improved significantly in 2023-2024 even despite a revenue dip after a big spike of 2022.

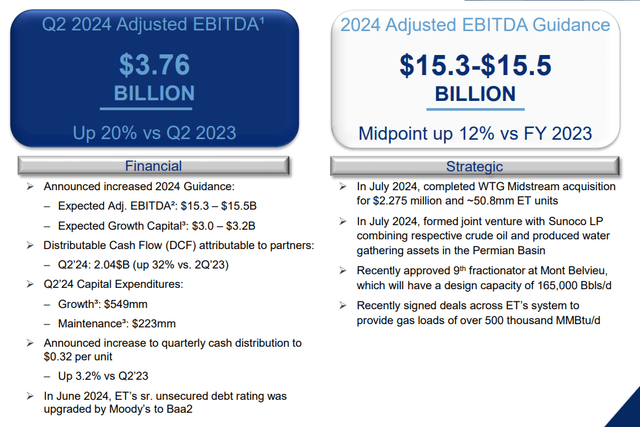

The management expects a robust adjusted EBITDA growth in FY2024 compared to FY2023, which also adds optimism about sustainability of a 7.9% distribution yield. The June 2024 Moody’s upgrade to Baa2 for ET’s senior unsecured debt is another positive development underscoring strength of the company’s financial position.

Wrapping up, I believe that all these factors are strong indications that ET’s stellar distribution yield is safe. Moreover, in the next section I will explain why ET is attractively valued.

Valuation analysis

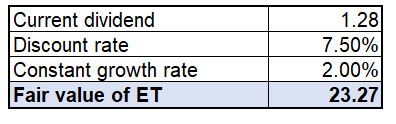

For a dividend stock like ET, the best fit is a dividend discount model (‘DDM’). The forward annual payout is $1.28. Cost of equity is the discount rate for the DDM approach, which is 7.5% for ET. I use the same 2% constant growth rate as it aligns with long-term U.S. inflation benchmarks.

Calculated by the author

The stock’s fair value is $23.3, indicating a substantial 44% upside potential from the current levels. That being said, the upside potential is compelling, especially considering ET’s strong fundamentals.

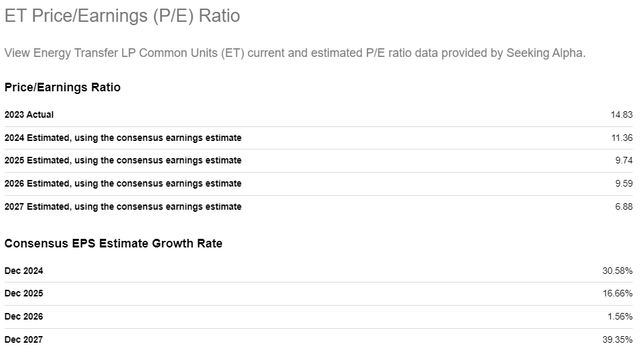

ET’s undervaluation can also be seen by the forward P/E ratio trajectory. As we can see below, the FY 2027 forward P/E is expected to fall to as low as 6.9.

Wall Street analysts expect solid EPS growth over the next four fiscal years, which will lead to a substantial EPS contraction. Considering three strong secular trends that I have mentioned in my fundamental analysis, and ET’s strong operating leverage, I am highly confident that it will be able to demonstrate robust EPS growth over the next several years.

Mitigating factors

As a company that operates a vast infrastructure that deals with hydrocarbons, ET faces significant environmental risks and scrutiny from stakeholders. For example, the environmental controversy around one of ET’s largest assets, Dakota Access Pipeline (‘DAPL’) started escalating in 2016 when first construction permits were received. ET suffers from intense pressure from environmental stakeholders who want the pipeline to be shut down. It is difficult to quantify the financial effect of a potential stoppage of DAPL; however, it will certainly be a disruption to ET’s operations and will adversely affect profits. The DAPL environmental review is delayed to 2025.

Being a midstream company also means that there are substantial risks to the physical safety of the company’s assets. For example, in September one of the company’s pipelines exploded and caught fire. In these cases, not only the company’s operations are disrupted due to a damaged pipeline, but also pose significant risks to the health and lives of employees. Apart from apparent ethical concerns of employees suffering harm while on duty, these situations can lead to substantial compensation claims, litigation, and reputational damage.

Conclusion

There are several strong indications that ET’s 7.9% forward distribution yield is safe. As one of the largest midstream companies in the U.S., ET is well-prepared to absorb various positive secular trends. The stock is very attractively valued with a 44% upside potential.

In addition to the stock (or unit) itself, I think that some investors might also be interested in the company’s Series I Fixed Rate Perpetual Preferred Unit (NYSE:ET.PR.I). I am emphasizing it because it also looks compelling. The market price is even lower than the common unit, at $11.84. This will be good for investors who are doubtful about sustainability of a 7.9% forward yield offered by common units because ET.PR.I. offers to lock into a fixed quarterly distribution of $0.211. As experienced investors know, preferred units have priority over common units when we speak about distributions from the company or liquidation preferences. This priority offers even more safety for investors of ET.PR.I.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.