Summary:

- Energy Transfer’s Q3 report shows a 12% YoY growth in adjusted EBITDA, driven by strong crude oil transportation and NGL production.

- The company is expanding with projects like Lone Star Pipe optimizations and Lake Charles LNG, ensuring future growth and operational leverage.

- ET’s high 7.4% dividend yield is protected by a solid balance sheet and the valuation is very attractive.

MenzhiliyAnantoly/iStock via Getty Images

My Thesis

The high-yield play that I highlighted in August, Energy Transfer LP (NYSE:ET), is doing well. The stock grew by around 7%, very close compared to the S&P 500. The company released its Q3 report earlier this week, and I am still bullish after the release.

The financial performance is solid, and the management’s endeavors are aimed at building more value for shareholders with new projects. I think that driving new projects is sound due to favorable industry trends for the U.S. midstream domain. The management’s prudent capital allocation approach is beneficial to ensure high distribution yield safety. The stock’s intrinsic value is significantly higher compared to the last close, meaning there is a substantial potential upside. Therefore, ET remains a strong buy for me.

ET Stock Analysis

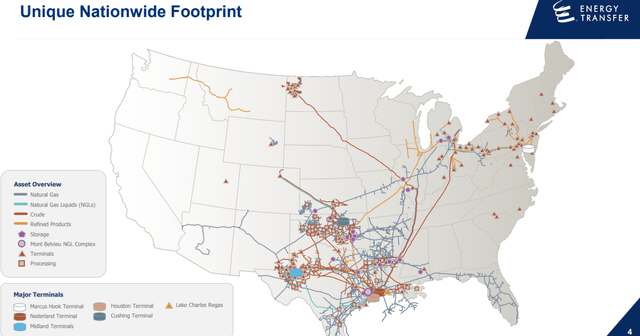

The company released Q3 earnings earlier this week, but before I delve into the latest report, I want to remind that ET is one of the largest U.S. midstream companies with the largest footprint across the entire midstream value chain. Therefore, the company has a strong strategic position to benefit from positive trends in the American midstream industry.

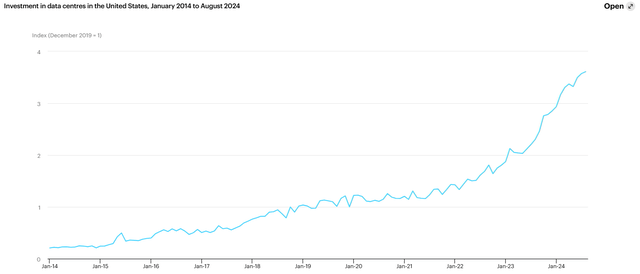

The U.S. is the country that drives the current AI revolution, and it is certain that high-performance computing (HPC) requires a lot of energy. Despite hardware companies working hard on improving the energy efficiency of data centers, capital investments in HPC are soaring in absolute terms. As a result, Goldman Sachs’ analysts forecast AI to drive a 160% increase in data center power demand.

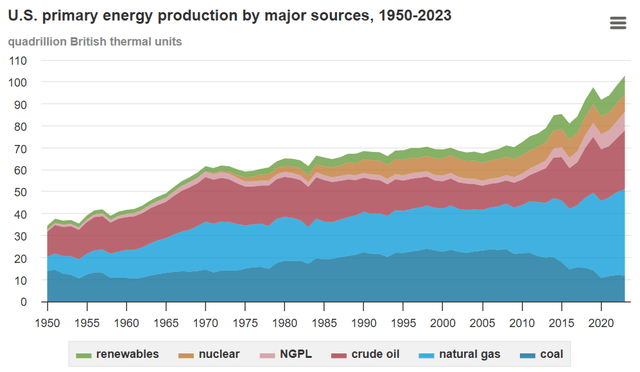

Despite governmental incentives to boost the development of clean energy, it is not an overnight process. According to the U.S. Energy Information Administration, hydrocarbons remain the largest source of energy in the U.S., with petroleum and natural gas together accounting for 72% of the country’s energy balance. The share of alternative energy sources is expanding slowly, suggesting that midstream services will likely remain in high demand for several decades. Consequently, industry trends are very favorable for ET and other large midstream players.

U.S. Energy Information Administration

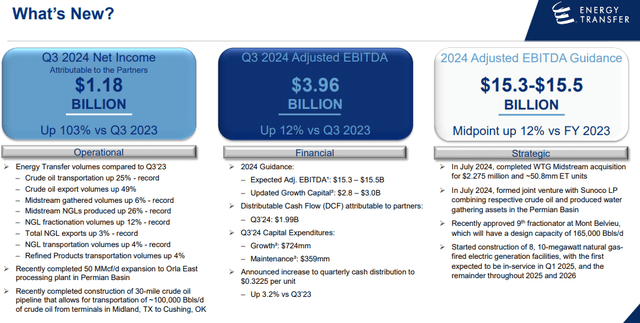

If we refer to the fresh Q3 report, ET performs really well in the current favorable environment. The adjusted EBITDA grew by 12% YoY to $3.96 billion. The growth was driven by strong volumes in crude oil transportation, NGL production, and exports. The performance has been strong so far in the current FY, and the management expects to close the year with a $15.4 billion adjusted EBITDA. This will be 12% higher compared to a $13.7 billion adjusted EBITDA in FY2023.

According to the earnings call transcript, the management is quite optimistic about the company’s future prospects. ET is pursuing opportunities to serve the growing demand from new customers across its pipeline network. For example, the company has received requests to connect to approximately 45 power plants and over 40 data centers. These prospective projects could significantly increase ET’s gas throughput.

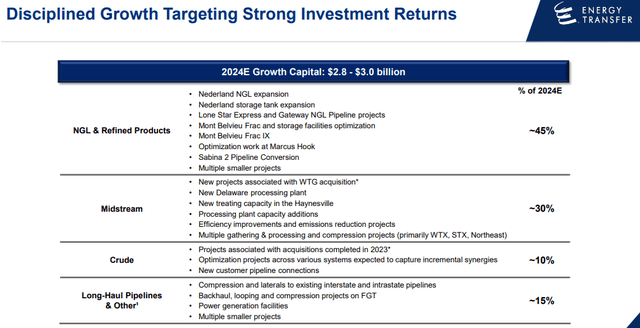

The management understands that the environment is favorable, and the demand is growing. As a result, the company is making solid progress in its expansion projects including the Lone Star Pipe optimizations, Warrior, Blue Marlin offshore oil project, Lake Charles LNG, and a carbon capture and sequestration project with Capture Point. These projects are expected to expand the company’s operational capabilities and provide new potential growth drivers.

The Warrior pipeline project aims to utilize underused capacity to meet the increasing demand from new power plants and data centers. This project is expected to provide a good rate of return and significant operational leverage, according to the management. In addition, ET is expanding its NGL and refined products segment, with projects like the Mont Belvieu Frac IX and the Nederland NGL expansion. These projects are designed to optimize existing facilities and increase capacity, positioning the company to capture a larger share of the growing NGL market.

The company looks strong in allocating capital. All growth projects in the midstream industry are capital-intensive and require raising debt. According to the 10-Q report, ET’s long-term debt grew by around $7.5 billion to $59 billion since the beginning of 2024. This is almost equal to the company’s market capitalization, which looks like a prudent leverage proportion, in my opinion. Moreover, it is vital that the company’s net property, plant and equipment grew faster than debt, from $85.3 billion to $95 billion. The liquidity position looks healthy, with ET’s current assets higher than current liabilities by a billion. With a solid balance sheet, ET’s 7.4% distribution yield looks protected.

Intrinsic Value Calculation

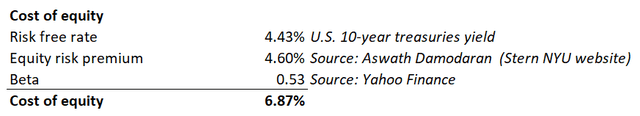

Cost of equity is the most suitable discount rate for the dividend discount model (DDM). ET’s cost of equity is 6.87%, according to the below working, which is based on the CAPM approach.

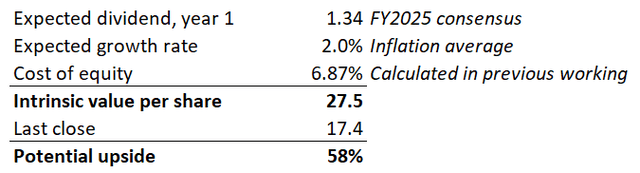

Dividend growth rate is another crucial assumption for the DDM. I reiterate the same 2% growth rate because the long-term inflation average looks like a reliable benchmark for a company operating within a mature industry. The expected dividend is from consensus, which is also reliable based on ET’s solid dividend consistency. The potential upside is 58% because the intrinsic value per share is $27.5. The valuation is very attractive with such a potential upside.

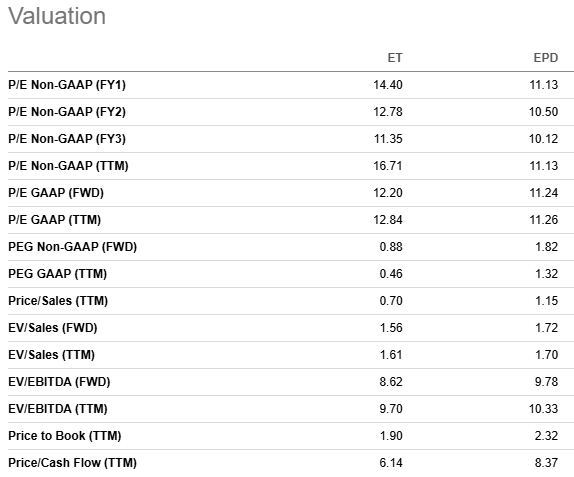

ET’s closest peer is Enterprise Products Partners L.P. (EPD). This company’s market cap is not far from ET’s, making it a reasonable benchmark to compare valuation ratios. While ET’s P/E ratios are slightly higher compared to EPD, other vital ratios look very attractive. The forward non-GAAP PEG ratio is more than two times lower to EPD’s. ET’s Price-to-Book and Price/Cash Flow ratios also look much more attractive than EPD’s. Therefore, I think that peer ratios analysis confirms ET’s attractive valuation.

Seeking Alpha

What Can Go Wrong With My Thesis?

Regulatory and environmental challenges remain significant concerns. A project like the Dakota Access Pipeline continues to face legal and regulatory scrutiny. Adverse regulatory developments around the project could disrupt operations, impacting profitability. This uncertainty around one of ET’s largest projects might explain the substantial potential upside derived in the previous section of my analysis. Investors might be cautious about ET due to potential financial and reputational risks around the project.

ET’s expansion initiatives do not guarantee success while these projects are costly and require substantial debt levels. Any disruption at the macro level (for example, a recession) might lead to a temporary dip in hydrocarbons transfer and processing levels, which will weigh on the profitability of prospective projects.

Summary

ET is very attractively valued, with a significant potential upside and quite low valuation ratios compared to the benchmark. The business is expanding and capitalizing on positive industry trends. The management has a clear vision of how to capitalize on favorable trends more which I see it from the company’s capital projects. ET’s high dividend yield looks protected as well.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.