Summary:

- Q3 2024 adjusted EBITDA rose 11.8% YoY to $3.96 billion, driven by core business throughput expansion.

- $2.9 billion planned for 2024 targets NGL exports, Permian Basin facilities, and pipeline upgrades to boost capacity.

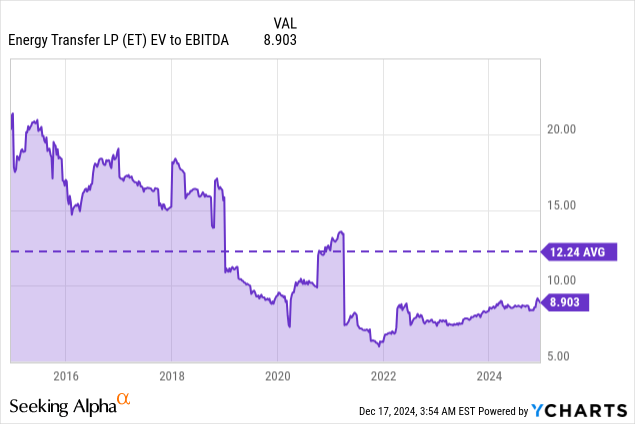

- ET trades below its historical EV/EBITDA average, offering >36% long-term upside based on forward EBITDA growth.

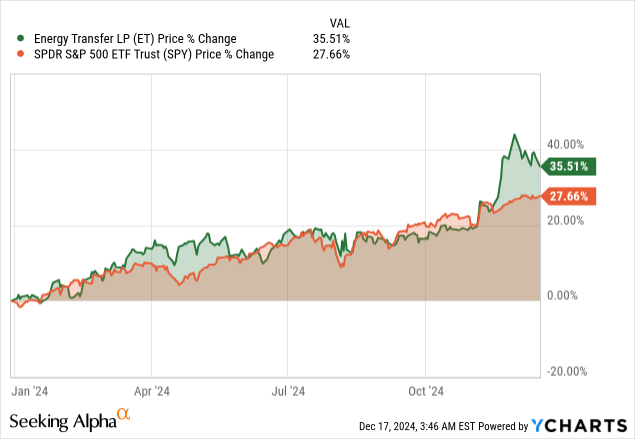

- ET delivered a 35% YTD total return in 2024, outperforming the broader market.

- Emerging power generation and data center demand could add up to 16 Bcf/day across ET’s natural gas network.

spooh

Investment Thesis

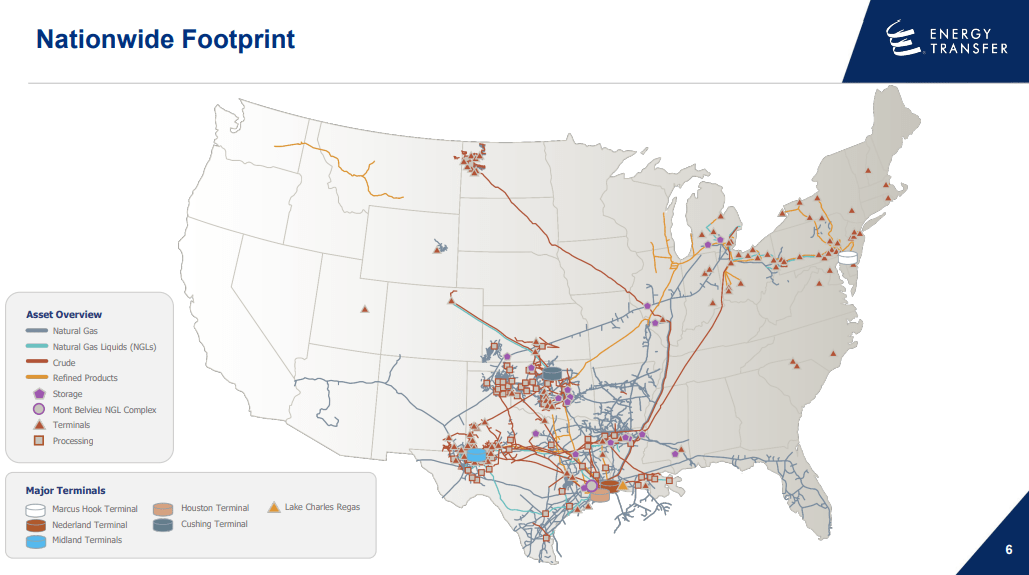

Energy Transfer’s (NYSE:ET) current thesis centers on its rising adjusted EBITDA and strategic CapEx to capitalize on energy demand. The current adjusted EBITDA growth points to the operational strength based on expanding throughput across core segments. Also, the planned investments in NGL export capacity and Permian Basin processing facilities may lead to incremental stock value.

ET stock has already outpaced the market (SPY) with a 35% total return in 2024 to date. Trading below its historical EV/EBITDA average, the stock has reversion potential with >36% long-term upside based on forward EBITDA growth premiums over sector peers.

Adjusted EBITDA Rising Amid Stable Distributable Cash Flow

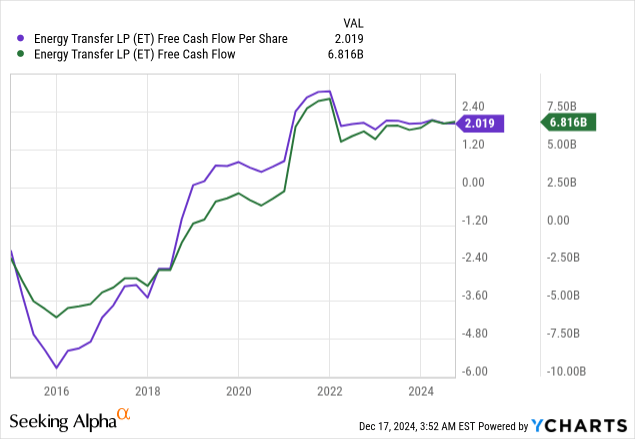

Energy Transfer’s performance in Q3 2024 reflects bottom line progress as Adjusted EBITDA stands at $3.96 billion with an increase of 11.86% against $3.54 billion in Q3 2023. This growth is based on a healthy expansion in Energy Transfer’s core business activities. With that, the company has the capability to extract value from its extensive asset base. Despite macro challenges, the stability in distributable cash flow (“DCF”) at $1.99 billion for both Q3 2024 and Q3 2023 marks stable operational cash. Moreover, for 9M 2024, the company allocated $1.7 billion to organic growth capital and targeted the Midstream and NGL Refined Products. This focused investment is in line with the rise in volumes and throughput across its footprint.

Investor Presentation Dec 2024

In NGL And Refined Products, Adjusted EBITDA came in at $1.01 billion for Q3. This is down slightly from $1.08 billion in Q3 2023. The primary drag was lower optimization gains from hedged NGL inventory. It was $30 million this year against >$100 million last year. However, record throughput volumes and strong NGL exports offset some of the decline. In the Midstream segment, adjusted EBITDA rose to $816 million in Q3 2024 with a sharp 29% jump from $631 million in Q3 2023.

The growth was based on higher volumes in the Permian Basin and Eagle Ford regions, along with the integration of Crestwood and WTG assets acquired in November 2023 and July 2024. Also, the $70 million recognized from a one-time business interruption plan further boosted this segment’s bottom line. Moreover, the crude oil segment also posted gains in adjusted EBITDA at $768 million in Q3 2024 against $706 million in Q3 2023 (+9% YoY increase). Record crude oil transportation throughput and a staggering 49% rise in exports led to this growth. Excluding acquisitions, base business throughput still has a 4% increase.

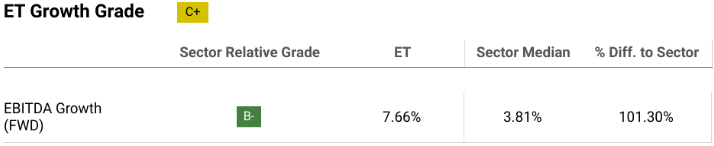

Further, Interstate Natural Gas faced a minor decline (-6.3% YoY) as its adjusted EBITDA dropped to $460 million in Q3 2024 from $491 million in Q3 2023. Lower IT utilization in dry gas areas under weaker gas prices weighed on this segment against higher demand on Pebble, Trunkline, and Gulf Run systems. Whereas the Intrastate Natural Gas segment had a solid 35% rise in adjusted EBITDA and hit $329 million in Q3 2024 against $244 million a year earlier. This increase stemmed from $100 million in pipeline (optimization) gains. All this reflects the company’s sharpness in managing its assets. In short, the Energy Transfer’s adjusted EBITDA is progressive. Following the same metric on the valuation (EV-to-EBITDA, TTM basis) ET’s stock is trading below the long-term average. Based on mean reversion, the stock can yield >36% in the long run. The forward EBITDA growth premium of >1X over the sector median supports this.

seekingalpha.com

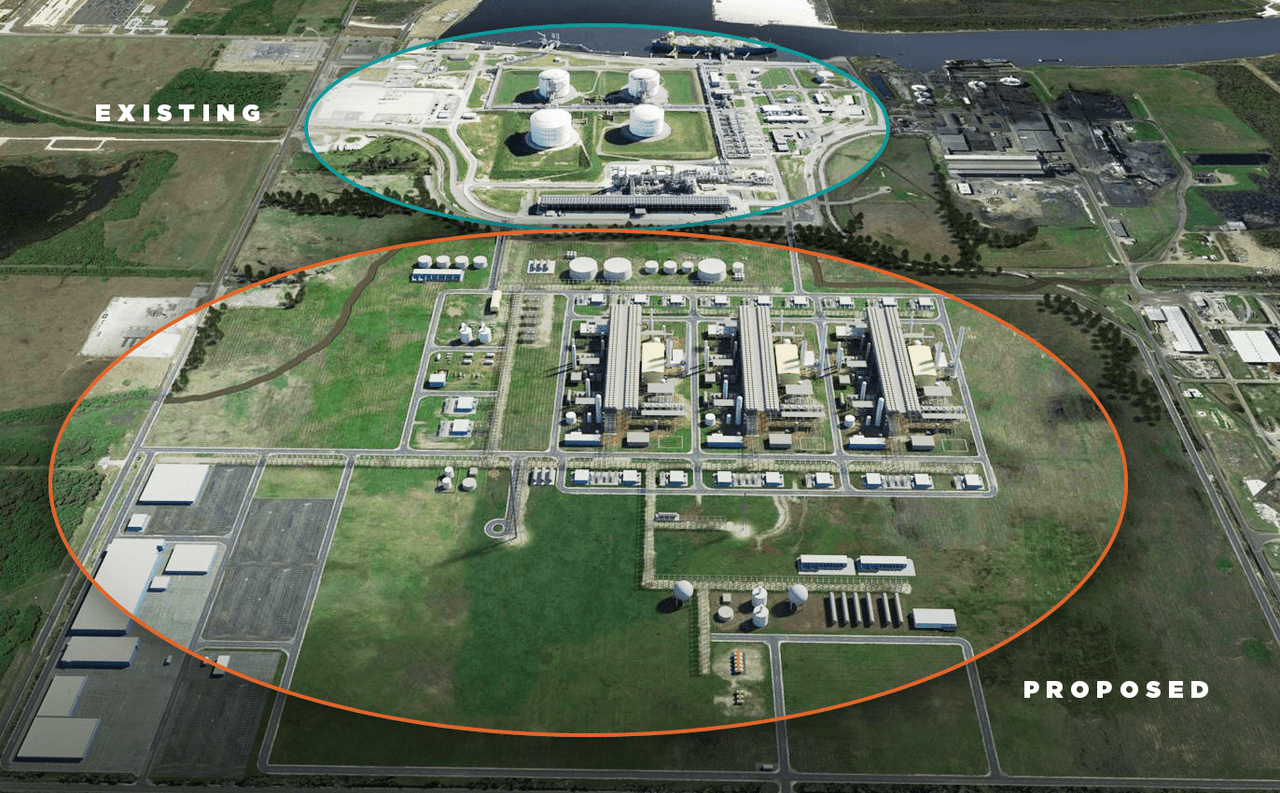

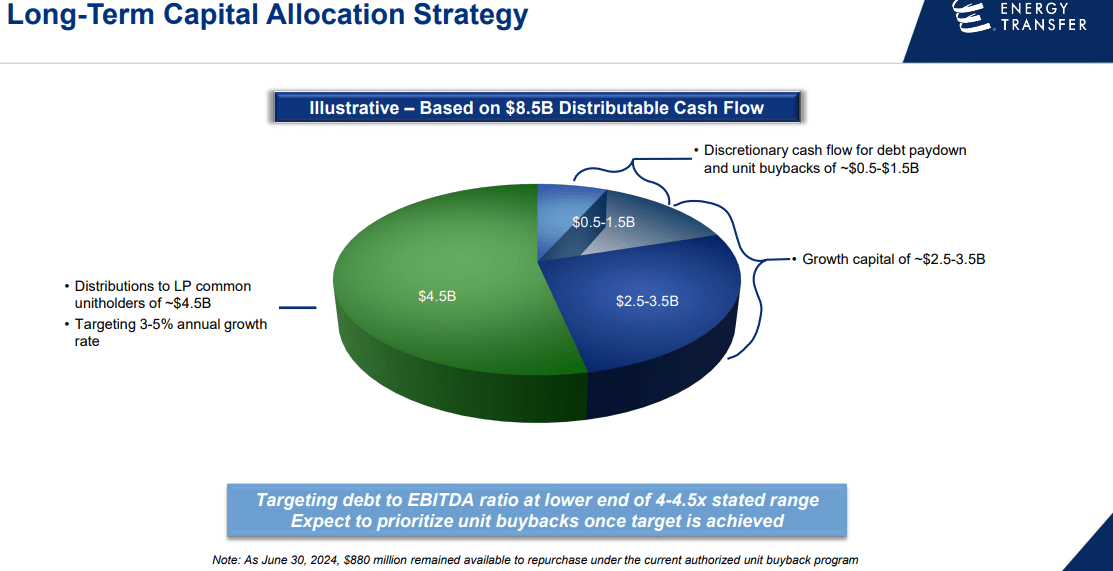

Strategically, the company may allocate $2.9 billion as growth CapEx in 2024 targeting NGL and Refined Products and Midstream segments. Core projects include the expansion of the Nederland Terminal’s NGL export capacity (slated for mid-2025) and the addition of a 165K barrels per day fractionator at Mont Belvieu (by Q4 2026). These projects may uplift Energy Transfer’s fractionation capacity to >1.3 million barrels per day. In the Permian Basin, upgrades to three processing facilities and the ongoing construction of the 200 million cubic feet per day Badger processing plant may lead to incremental processing capacity. The newly completed 30-mile pipeline connecting Midland to Cushing adds another 100K barrels per day of crude transportation capacity. These advancements are boosting Energy Transfer’s market (supply side) and operational readiness on energy demand.

Investor Presentation Dec 2024

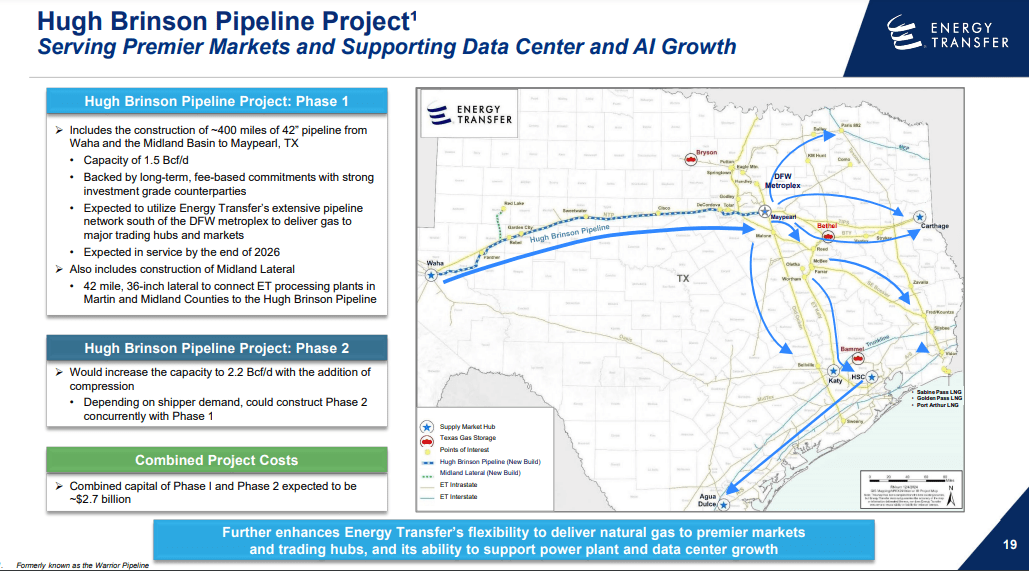

Focusing on the energy demand, Energy Transfer’s natural gas infra may benefit from evolving demand trends in power generation and data center development. The company has fielded requests to connect to ~45 power plants in 11 states with a combined potential gas load of 6 Bcf per day. Additionally, over 40 prospective data centers across 10 states can consume up to 10 Bcf per day. This scale of emerging opportunities is coming from AI-driven energy demand and grid reliability requirements. Similarly, Energy Transfer’s extensive natural gas pipeline network, spanning from Arizona to Florida and Texas to Michigan supports the company’s capability to seize growing demand with its ongoing investment in 10-megawatt natural gas-fired electric generation facilities with the first unit may be operational by Q1 2025.

Finally, the company’s balance sheet provides stable liquidity to fund this organic growth while maintaining its leverage targets and increasing returns to unit holders. The adjusted EBITDA guidance for 2024, projected at $15.4 billion, supports its cash stability.

Underutilized Pipeline Capacity May Pressure Bottom Line

Energy Transfer operates a massive pipeline network with clear issues related to underutilized capacity. During the Q3 call, management admitted to significant unused capacity across some pipelines. While the Warrior project may leverage underutilized assets, the admission that these pipelines were built with expectations of serving 8–10 Bcf/day of gas suggests a solid planning mismatch. Instead, current flows have been hampered by shifts in producer priorities to more profitable shale plays elsewhere. This overbuild reflects a structural inefficiency that creates a drag on operational profitability.

Here, Idle and underused capacity represent sunk costs with constant maintenance and OpEx that reduce margins. Further, the upside from projects like Warrior, relying on incremental demand from data centers and power plants to fill gaps in capacity, injects uncertainty into top-line projections and valuations. Further, the absence of a diversified strategy to maximize ROIs on the sprawling network is leaving ET vulnerable to regional demand shifts. Despite announcing new projects (like the Delaware processing plant), ET reduced its growth CapEx guidance for the year by $200 million. While this move means cost discipline, it also reflects ET’s difficulty in deploying capital across a fragmented project portfolio.

Investor Presentation Dec 2024

Additionally, while ET claims to maintain hurdle rates for returns on all projects, the heavy reliance on synergistic benefits (like integrating downstream assets and existing infra) raises questions about standalone project profitability. Management’s focus on unquantified “synergistic revenues” suggests that some ventures may struggle to hit return benchmarks without ancillary benefits. This issue may dilute the return on invested capital (“ROIC”) and limit ET stock’s valuation upside.

Finally, the optimism regarding the Lake Charles LNG project hinges on positive policy changes. The project offers upside potential, but its long timeline and dependency on variables outside ET’s control introduce risks. Delays and unfavorable policy shifts could hit ET’s balance sheet hard and tie up huge capital that could be deployed elsewhere.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.