Summary:

- Energy Transfer’s acquisition of WTG Midstream enhances its pipeline network and boosts distributable cash flow.

- ET has shown strong growth in EBITDA and distributable cash flow, driven by strategic acquisitions, with a 20% EBITDA increase and 31% DCF surge in Q2???24.

- High insider ownership aligns executive interests with unitholders, and raised FY 2024 guidance reflects confidence in continued EBITDA and DCF growth.

- Energy Transfer trades at a favorable enterprise-value-to-EBITDA ratio of 7.9X, which is below its industry peers, making it an attractive investment option for income investors.

ZU_09

Energy Transfer (NYSE:ET) is a well-run midstream partnership with very solid distribution coverage that has an eye especially on acquisition-driven EBITDA and distributable cash flow growth. Energy Transfer in July closed the acquisition of WTG Midstream which added another 6,000 miles of gas gathering pipelines to its extensive pipeline network. Energy Transfer has improved its distribution coverage profile in the last year and offers a well-supported 8% yield. I believe Energy Transfer provides dividend investors with a relatively low-risk distribution that is set to grow in the years ahead.

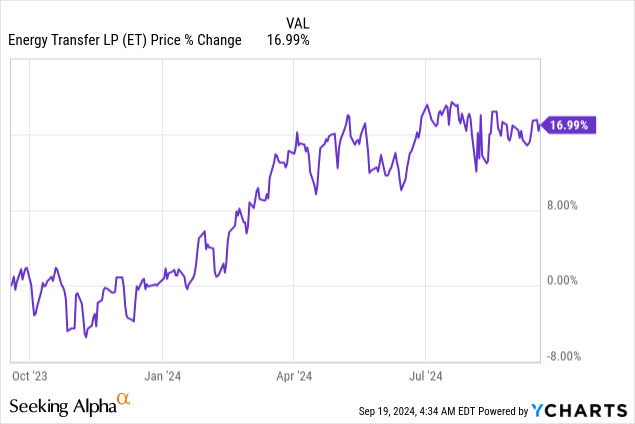

Previous rating

I rated shares of Energy Transfer a hold in September 2023 after the midstream firm announced the acquisition of another pipeline company, Crestwood Equity Partners, last year, mainly due to valuation reasons. Since then, shares of Energy Transfer have repriced 15% higher, in large part because Energy Transfer posted significant acquisition-driven cash flow gains since last year. I continue to see Energy Transfer as a solid yield and distribution growth investment option for investors, especially those that value safe distributions.

Strong growth in key metrics such as EBITDA and DCF

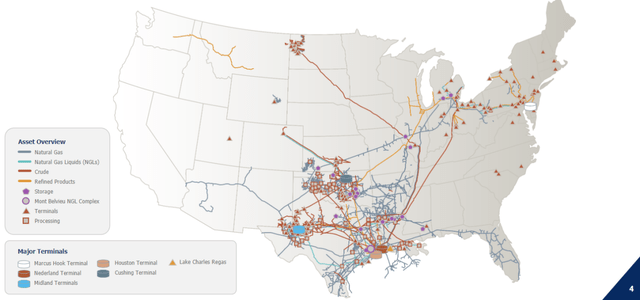

Energy Transfer is one of the largest pipeline companies in the U.S. with a pipeline network of 130,000 miles and considerable storage facilities throughout the country. As a major energy midstream firm, ET helps producers bring their energy raw materials to end-markets by funneling them through major transportation and processing hubs as well as to export facilities at the Gulf Coast.

Energy Transfer

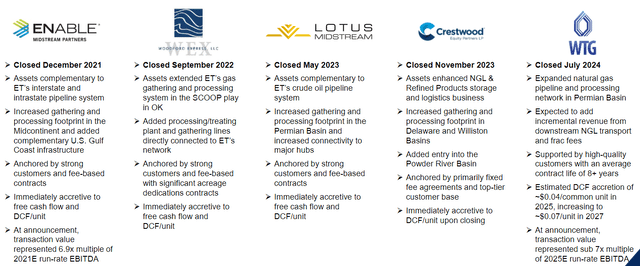

Energy Transfer just completed the acquisition of WTG Midstream for which the midstream company paid $3.25B in a stock-and-cash deal. The deal was made to boost Energy Transfer???s position in the Midland basin and contribute positively to distributable cash flow.

Energy Transfer has been very active in terms of acquisitions in the last several years, scooping up gathering and processing assets in the Permian, Delaware and Williston basins as a means to grow its EBITDA and DCF. A key investment criteria for Energy Transfer was cash flow accretion and Energy Transfer has seen a significant increase in its distributable cash flow as a result of its past acquisitions.

Energy Transfer

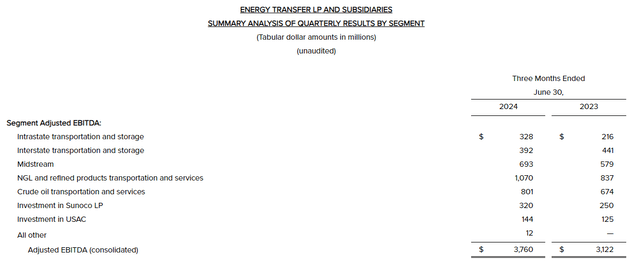

Energy Transfer has benefited from considerable growth in its EBITDA and distributable cash flow in the last year, due to the acquisition effects that I just discussed. Energy Transfer generated adjusted EBITDA of $3.76B in Q2???24, showing 20% year-over-year growth. The majority of Energy Transfer???s adjusted EBITDA comes from its NGL business (29%), followed by the crude oil transportation segment (21%) and its midstream services (18%). Smaller EBITDA contributions are made by inter- and intrastate transportations and by subsidiaries such as Sunoco.

Energy Transfer

The most important figure, adjusted distributable cash flow — which I use to calculate ET???s coverage ratio — surged 31% year-over-year to $2.04B in Q2’24, mainly due to acquisitions. Energy Transfer also achieves significant excess distribution coverage (see below) and the degree of excess coverage has increased over the last year as well: from 1.6X to 1.9X. The main reason for this is that Energy Transfer???s distributable cash flow grew by a factor of 2.6X faster than its distribution.

| $ millions | Q2’23 | Q3’23 | Q4’23 | Q1’24 | Q2’24 | Y/Y Growth |

| Adjusted EBITDA | $3,122 | $3,541 | $3,602 | $3,880 | $3,760 | 20% |

| Distributable Cash Flow For ET Partners | $1,544 | $1,984 | $1,928 | $2,353 | $2,038 | 32% |

| Transaction Adjustments | $10 | $2 | $102 | $3 | $1 | -90% |

| Adjusted Distributable Cash Flow | $1,554 | $1,986 | $2,030 | $2,356 | $2,039 | 31% |

| Distributions (Limited And General) | $975 | $984 | $1,062 | $1,071 | $1,096 | 12% |

| Distribution Coverage Ratio | 1.59 | 2.02 | 1.91 | 2.20 | 1.86 | – |

(Source: Author)

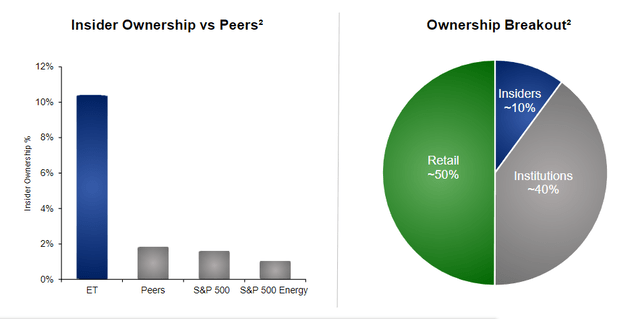

High insider ownership and interest alignment

Insiders at Energy Transfer invested more than $460M into Energy Transfer???s units since the beginning of FY 2021, resulting in strong interest alignment between the company???s executives and its unitholders. About 10% of the partnership???s units are now owned by the company???s key personnel.

Energy Transfer

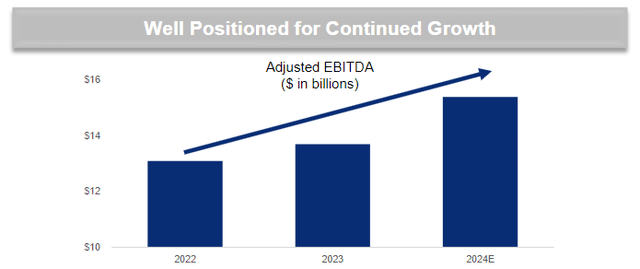

Raised guidance

Since Energy Transfer has been so busy in snatching up other pipeline assets (and their associated earnings potential), the midstream firm raised its FY 2024 outlook for EBITDA and DCF in the last quarter: Energy Transfer now projects $15.3-15.5B compared to $15.0-15.3B in the first fiscal quarter. Approximately 90% of this EBITDA is expected to be derived from pre-determined fees.

Energy Transfer

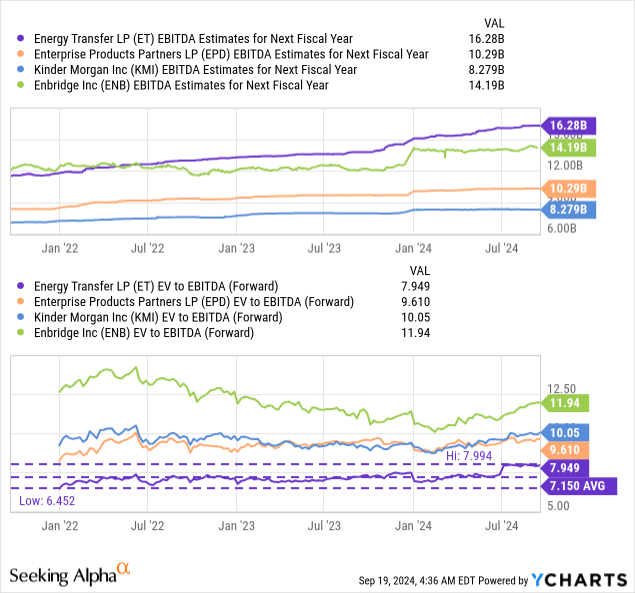

Energy Transfer???s valuation compared to midstream rivals

I like Energy Transfer for a number of reasons, especially its ability to put together accretive acquisition deals. Energy Transfer is currently trading at an enterprise-value-to-EBITDA ratio of 7.9X which makes it slightly cheaper than the average midstream company in the industry group. This industry group includes Enterprise Products Partners (EPD), Kinder Morgan (KMI) and Enbridge (ENB), all of which offer similarly well-supported distributions. Enterprise Products Partners is my favorite investment right now — A Fat 7% Yield And An Acquisition Catalyst — because EPD is growing through acquisitions as well and providing durable distribution growth.

The industry group average enterprise-value-to-EBITDA ratio is 9.9X and given that Energy Transfer has seen such strong growth in its DCF and improving distribution coverage in the last year, I expect the company’s unit price to converge upon the industry group average over the long term. This would give units of Energy Transfer a potential fair value in the neighborhood of $20, implying approximately 26% revaluation potential.

Risks with Energy Transfer

Energy Transfer is a fossil fuel-focused midstream energy giant, and therefore exposed to potentially adverse regulations as far as the expansion of new pipelines are concerned. This could seriously limit the company???s long term distributable cash flow and distribution potential. What would change my mind about Energy Transfer is if the partnership were to see a decline in its distribution coverage profile or failed to grow its pipeline footprint without the help of acquisitions.

Final thoughts

Energy Transfer???s thirst for acquisitions does not seem to be exhausted yet, and the midstream firm has put up some impressive growth numbers in terms of its EBITDA and distributable cash flow in the second quarter. Energy Transfer has very solid distribution coverage and has managed to grow its safety margin as its DCF has grown faster than its distribution. The acquisition-focused growth strategy is paying off for Energy Transfer and units are cheap-based off of EBITDA. I see a favorable risk profile and upgraded my unit rating to buy considering Energy Transfer’s significant increase in DCF and EBITDA since my last coverage.

Analyst???s Disclosure: I/we have a beneficial long position in the shares of EPD, ET, ENB, KMI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.