Summary:

- In recent weeks, Energy Transfer unitholders have enjoyed a big price runup. Over the past month, units are up ~17 percent.

- Post-3Q fundamentals remain very strong. However, units are approaching my fair value estimate.

- YTD balance sheet debt jumped to $59 billion from $52 billion. Has management gone on a spending spree?

- What’s the go-forward business narrative?

- All questions are answered here.

wolv

Recently, several Seeking Alpha readers asked me for an updated report on Energy Transfer LP (NYSE:ET). Over the past month, common unit prices advanced nearly 20 percent. There’s particular interest in a post 3Q2024 earnings unit price valuation analysis and a refresh on the current debt leverage ratio mechanics.

In this article, we will cover both those topics and take a brief look at the forward business narrative.

Investment Thesis

My long-term Energy Transfer investment thesis remains intact:

-

The balance sheet is sound; debt and leverage are now well-managed.

-

The current cash distribution is readily covered by distributable cash flow.

-

The go-forward business setup is positive; there are several years of solid growth projects ahead.

- The Energy Transfer franchise is strong. Operations span and scope is nearly impossible to duplicate.

However, after years of material undervaluation, the units now are approaching Fair Value.

Unique Financial Considerations

Energy Transfer spent years simplifying the business. Currently, all the businesses have been consolidated into ET common units. Nonetheless, pulling apart the financial statements is not entirely straightforward. There remain several intersections whereby corporate accounting and the actual business don’t overlay neatly.

Specifically, three items need to be reconciled:

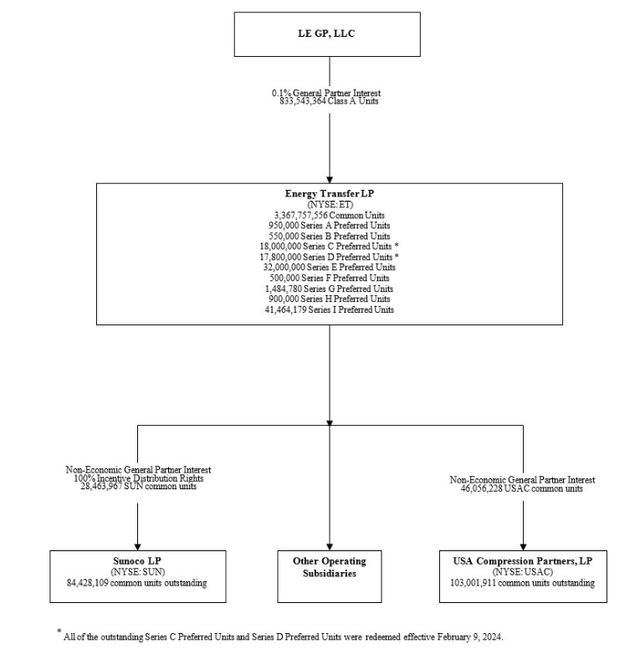

Bakken Pipeline (aka DAPL)

Energy Transfer owns 36.4 percent of the Bakken Pipeline. Despite being a minority owner, Energy Transfer has a measure of control due to the governance structure and being the pipeline operator. Despite being non-wholly owned, Bakken Pipeline is a fully consolidated subsidiary.

Sunoco LP (SUN)

Sunoco LP is a fuel distributor and operates a network of retail facilities. Energy Transfer is the non-economic General Partner and owns about 34% of the total units outstanding. The GP has controlling interest in the company. SUN financials are fully consolidated.

USA Compression Partners (USAC)

USA Compression provides standardized, large horsepower compression facilities for the pipeline industry. Energy Transfer is a non-economic General Partner and owns about 44% of the total units outstanding. The GP has a controlling interest in the company. USAC financials are fully consolidated.

What This Means

These business units are rolled up into ET financial statements. However, when evaluating Energy Transfer, attributing all the debt and EBITDA from these entities to Energy Transfer distorts actual performance.

Why?

Effectively, the debt is non-recourse to Energy Transfer. As an investor, it is therefore reasonable to back it out when performing debt and valuation analysis.

Case-in-point: since the beginning of this year, ET balance sheet debt rose to $59.3 billion from $51.5 billion, or $7.8 billion. However, debt directly attributable to Energy Transfer rose to $50.4 billion from $48.5 billion, or less than $2 billion.

Most of the balance sheet debt increase was due to Sunoco LP incurring an additional ~$3.8 billion debt. That debt is non-recourse to Energy Transfer.

Following the same logic, the EBITDA generated by these businesses shouldn’t all be credited to Energy Transfer.

Non-wholly owned subsidiary (i.e., DAPL) EBITDA is best apportioned on a pro-rata basis.

For Sunoco LP and USA Compression Partners, booking actual cash distributions received by Energy Transfer is preferable instead of crediting total EBITDA.

Armed with this perspective, let’s move on.

Energy Transfer Debt Leverage

Debt leverage is defined as adjusted debt to adjusted EBITDA.

Several years ago, the credit rating agencies pressured management to lower debt leverage or risk a credit downgrade. Energy Transfer management got the memo. Currently, ET is rated ‘BBB’: comfortably investment-grade.

Management calls out a 4.0x to 4.5x debt leverage target.

If one simply “cookbooks” debt-and-EBITDA from Energy Transfer’s financial statements, the result is a 3.9x leverage ratio:

ET balance sheet debt $59.3 billion/ET TTM EBITDA $15.2 billion = 3.9x

That sounds good; unfortunately, it’s inaccurate.

Each rating agency determines debt leverage a little differently, but here’s the basic concept:

Adjusted Debt includes:

-

100 percent of Energy Transfer debt and operating lease liabilities

-

ET preferred stock is considered 50 percent debt

-

Bakken Pipeline debt is backed out and 36.4 percent of it is added back in

-

USAC debt is backed out

-

Sunoco LP debt is backed out

After making the appropriate modifications, Adjusted Debt is $51.6 billion.

Adjusted EBITDA includes:

-

TTM EBITDA through mid-year; after mid-year utilize full-year management EBITDA guidance

-

subtract adjusted EBITDA for non-wholly owned subsidiaries; add back Energy Transfer’s proportionate share

-

subtract USAC adjusted EBITDA; add back USAC cash distributions to ET

-

subtract Sunoco LP adjusted EBITDA; add back Sunoco LP cash distributions to ET

Post-modifications, Adjusted EBITDA is $12.45 billion.

Therefore, Energy Transfer’s current debt leverage ratio is $51.6 billion/$12.45 billion = 4.1x

The aforementioned input data may be found via the Energy Transfer investor website or SEC filings.

Updated Energy Transfer Fair Value Estimate

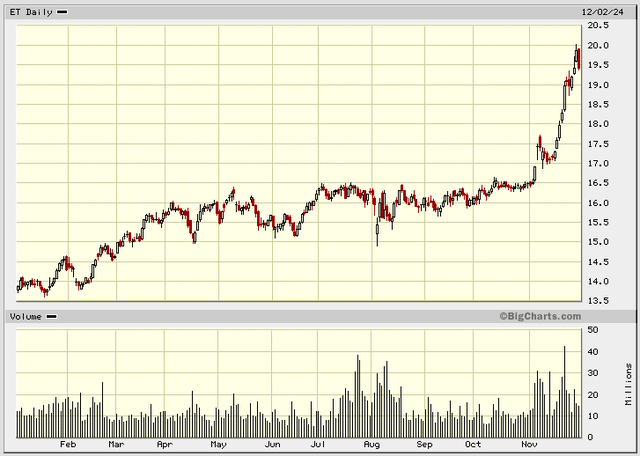

Year-to-date, Energy MLPs have enjoyed a good run. Energy Transfer units have been no exception.

Energy Transfer: YTD Price and Volume

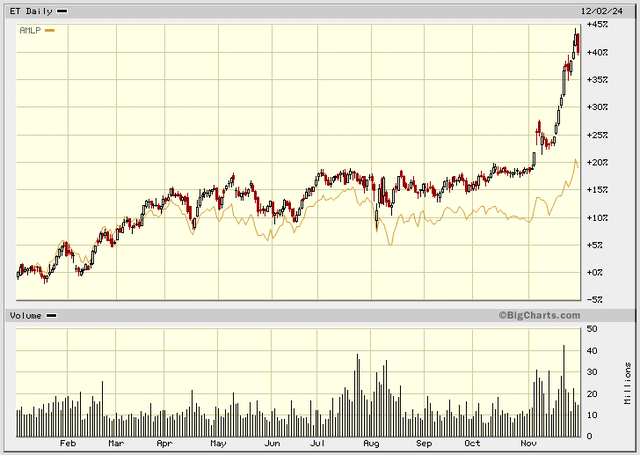

Indeed, ET common has outpaced the Alerian MLP ETF (AMLP):

Energy Transfer: YTD Price and Volume v Alerian MLP ETF

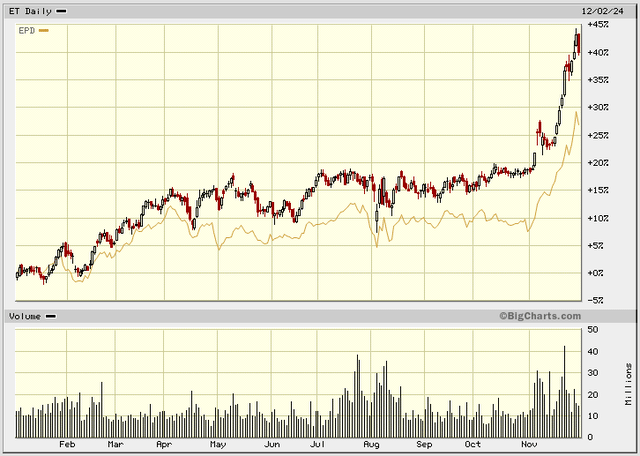

Indeed, Energy Transfer units have outperformed bellwether Enterprise Products Partners (EPD) handily.

Energy Transfer: YTD Price and Volume v Enterprise Products Partners

However, price without valuation is incomplete, peer comparison non withstanding.

Energy Transfer FVE

I believe EV/EBITDA to be the best valuation methodology for most energy pipecos. The metric includes a number of key inputs:

-

market cap (including preferred stock)

-

net debt

-

non-controlling interests

-

adjusted EBITDA (the coin-of-the-realm for energy pipeline cos)

Price-and-Distributable Cash Flow multiples provide reasonable valuation estimates, too. However, EV/EBITDA includes a richer set of inputs.

Important Considerations!

Simply lifting raw figures from Energy Transfer financial statements will not provide accurate valuation results.

What needs to be adjusted?

Well, since Enterprise Value includes debt, ET debt offsets as outlined earlier should be employed: Bakken Pipeline, USAC and SUN debt should be backed out. In addition, preferred stock market cap should be included in EV.

Running the arithmetic, here’s the output:

EV/EBITDA = $130.1/$15.4 = 8.4x

Note: I used $19.50 per unit for ET common pricing. Market cap inputs may change daily.

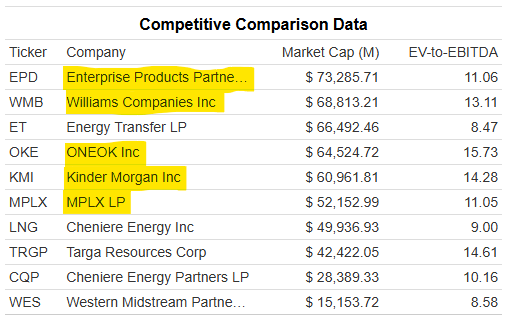

Here’s a table summarizing current EV/EBITDA for peers. Those with a market cap greater than $50 billion are highlighted in yellow. These include Enterprise Products Partners, The Williams Companies (WMB), ONEOK (OKE), Kinder Morgan (KMI), and MPLX LP (MPLX):

gurufocus.com

For energy pipecos with a market cap greater than $50 billion, the average EV/EBITDA ratio is ~13x.

Analysis and Current FVE

On its face, Energy Transfer EV/EBITDA is low man: 8.4x versus the 13x peer group average.

Nonetheless, while the ET valuation multiple remains low end, I wouldn’t get overly aggressive.

Why?

There’s another sidebar fair value marker I watch for high-yield energy pipecos:

I seek a current cash distribution yield at least 300 bps greater than the 10-year treasury note. This provides a reasonable factor of safety versus no-risk treasuries.

Currently, Energy Transfer’s cash distribution yield is 6.6 percent. The T-note rate is 4.2 percent. That’s not enough of a cushion.

Given peer valuation, I am willing to assign a 9x EV/EBITDA multiple to ET units: the highest marker since 2018. However, a combination of the cash distribution yield versus treasuries and caution in the face of geometrically rising prices suggests a soft “Buy” rating.

9x EV/EBITDA indicates a $22 FVE. New investors may wish to open a small starter position, then wait-and-see.

The Forward ET Narrative: Constructive!

Overall, the third quarter 2024 earnings report and conference call were quite positive.

The Crestwood and WTG acquisitions are complete. I expect these bolt-on deals to be integrated successfully.

Crude volumes are up smartly.

Construction of the Nederland NGL export facilities continues to progress on-time and on-budget.

However, the big story seems to be forward demand for natural gas. Why? To power AI datacenters, as well as to harden the electric power grid’s general reliability.

On the conference call, Co-CEO Tom Long offered the following remarks:

We have had requests to connect to approximately 45 power plants that we do not currently serve in 11 states that in aggregate could consume gas loads up to 6 Bcf per day. In addition, we have had requests from over 40 prospective datacenters in 10 states. These datacenters in aggregate, could consume gas loads up to 10 Bcf per day. Some of these may be behind the electric meter for reliability purposes.

For perspective, Energy Transfer moves about 30 BCF/day natural gas via its pipelines.

When asked about how much of the potential volumes may ultimately move via ET, management was realistic. Co-CEO Mackie McCrea spoke about Energy Transfer getting its “fair share,” but requiring projects to meet “our rate of return hurdles.”

In addition, management expects the incoming administration to be far more constructive towards the use of natural gas.

I also expect the Lake Charles LNG export project to get renewed life after construction permits are renewed for international export facilities.

Meanwhile, Energy Transfer signed a preliminary contract with a consortium consisting of Technip Energies and KBR for the construction of a LNG plant.

ET also has a bevy of other projects, in various stages of development, to keep the growth pipeline humming along.

I view the setup to be optimistic, constructive, and positive.

Notably, at the end of the 3Q earnings conference call, Tom Long shared a series of candid remarks about the industry. After several years being vilified, management is looking forward to a rational, reasonable regulatory climate. The outgoing administration has not been friendly to the energy business. Indeed, the sector thrived in spite of Washington, not because of it.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own careful due diligence before making any investment decision. This article is not a recommendation to buy or sell any stock.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.