Energy Transfer: Strong Q1 2024 Shows The Company’s Growth Story Continues

Summary:

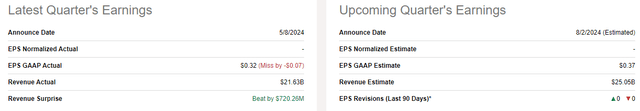

- Energy Transfer LP reported mixed earnings results for Q1 2024, beating revenue expectations but missing on earnings.

- Despite the earnings miss, the market remained unfazed, and the stock continued to steadily move upward.

- Energy Transfer’s growth trajectory has been driven by substantial merger and acquisition activity, and the company plans to continue growing through strategic acquisitions.

- The company’s debt and interest expense continues to increase, but its growing cash flow appears sufficient to continue to cover it.

- The company should not have any trouble maintaining its current 7.82% yield.

Arctic-Images

On Wednesday, May 8, 2024, giant midstream master limited partnership Energy Transfer LP (NYSE:ET) announced its first quarter 2024 earnings results. At first glance, these earnings results were mixed, as Energy Transfer managed to beat the expectations of its analysts in terms of top-line revenues but still missed on earnings:

The market generally appeared to be rather unfazed by the earnings miss, which is a surprise considering that most companies that announced earnings misses during the past few weeks have been punished severely. The trend has been so prevalent that Zero Hedge even did an article about it a week or so ago. In the case of Energy Transfer, however, the market seems to be taking this in stride, as the Thursday trading session following the announcement of the company’s earnings shows nothing out of the ordinary:

The stock has generally continued to steadily move upward over the past week, which is a continuation of the trend that we have seen for this company over the past year. As has been the case with many names in the midstream sector, Energy Transfer has substantially outperformed the broad-market S&P 500 Index (SP500) over the past year:

One reason why the market is seemingly unaffected by Energy Transfer’s earnings miss is that net income is not really a good measure of performance for a midstream company. These companies are very capital-intensive and thus have considerable depreciation and amortization expenses that reduce their net income but have no impact on the amount of cash entering into their bank accounts. The most important thing for a midstream company is cash flow, and Energy Transfer delivered very strong year-over-year cash flow growth.

Overall, what we see here is a continuation of Energy Transfer’s growth trajectory over the past few years, which has been driven by substantial merger and acquisition activity. The company stated in its conference call that it intends to continue to grow its business through strategic acquisitions going forward. This should overall turn out to be beneficial for the company’s limited partners who are along for the ride.

Earnings Results Analysis

As I stated in a recent article:

It is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis.

Here are the highlights from Energy Transfer’s first quarter 2024 earnings report:

- Energy Transfer brought in total revenues of $21.629 billion in the first quarter of 2024. This represents a 13.87% increase over the $18.995 billion that the company reported in the prior year quarter.

- The company reported an operating income of $2.380 billion in the reporting period. This represents a 15.42% improvement over the $2.062 billion that the company reported in the year-ago quarter.

- Energy Transfer moved an average of 6.102 million barrels of crude oil per day through its pipeline infrastructure during the most recent quarter. This set a new volume record for the company and represents a 44.0% increase over the 4.238 million barrels of crude oil that the company transported per day in the corresponding quarter of last year.

- The company completed its Trunkline Pipeline backhaul project, which increased the total amount of natural gas that the company’s pipeline infrastructure can move by 400 million cubic feet per day.

- Energy Transfer reported a net income attributable to partners of $1.240 billion for the first quarter of 2024. This represents an 11.41% increase over the $1.113 billion that the company earned in the first quarter of 2023.

The first thing that anyone reviewing these highlights will notice is that Energy Transfer posted year-over-year improvements in every measure of financial performance. One of the reasons for this is that the volume of resources moving through the company’s pipelines increased compared to the prior year quarter. We can clearly see in the highlights the increase in crude oil volumes, but this was not the only product that saw an increase in transported volumes:

|

Business Unit |

Q1 2024 |

Q1 2023 |

YoY Change |

|

Intrastate Natural Gas (BBtu/d) |

14,177 |

14,697 |

-3.54% |

|

Interstate Natural Gas (BBtu/d) |

17,665 |

16,818 |

+5.04% |

|

Natural Gas Gathering Pipelines (BBtu/d) |

19,922 |

19,750 |

+0.87% |

|

NGL Transportation (MBbls/d) |

2,087 |

1,984 |

+5.19% |

|

Crude Oil Transportation (MBbls/d) |

6,102 |

4,238 |

+44.0% |

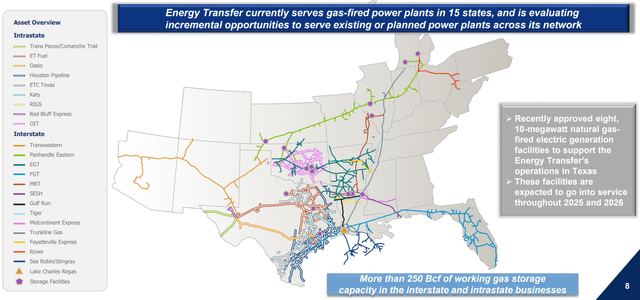

As can be seen in the chart above, the only pipeline system that saw lower volumes in the first quarter of 2024 compared to the same period of last year was the intrastate natural gas pipeline unit that mostly just moves natural gas throughout the state of Texas. While not a complete asset map, Energy Transfer did provide a snapshot of its pipeline system in its First Quarter 2024 Investor Presentation that should provide a basic idea of which pipelines fall into which system:

Overall, the company’s transported resource volumes did increase year-over-year as the increases through the interstate pipelines, natural gas liquids pipelines, and crude oil pipelines more than offset the slight year-over-year decline in the intrastate pipeline system.

I explained the company’s basic business model in my last article on Energy Transfer:

In short, Energy Transfer enters into long-term (usually five to fifteen years in length) contracts with customers under which the company provides transportation for the customer’s hydrocarbon products using its network of pipeline infrastructure. In exchange, the customer compensates Energy Transfer based on the volume of resources that the partnership handles, not on their value.

This business model should make it straightforward to see why an increase in transported volumes would result in Energy Transfer’s revenues and cash flow increasing relative to the year-ago period.

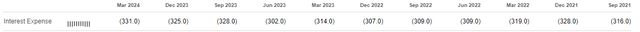

There were a few reasons why the company saw this substantial increase in volumes. One of the major reasons is that the production of both crude oil and natural gas in the Permian Basin has been increasing over the past year. The U.S. Energy Information Administration makes this apparent in this chart:

U.S. Energy Information Administration

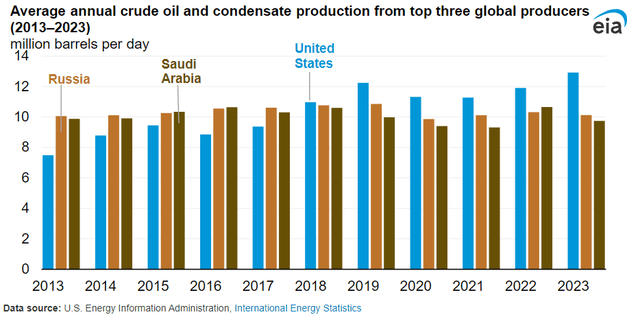

To a certain extent, this goes against the narrative that oil and gas production has been increasing in the United States during the post-pandemic period. After all, the only area that has seen any significant production growth over the past year has been the Permian in West Texas. Areas such as the Anadarko Basin, Eagle Ford Shale, and Haynesville Shale have all experienced declining production. Then again, in 2023, the United States did beat its former production record that was set in 2019:

U.S. Energy Information Administration

Thus, the reports that came out boasting about “record production” in 2021 and 2022 were inaccurate. I mentioned this in various previous articles. We do see though that the nation did manage to set a record finally in 2023, but that was only due to the production growth that was delivered by the Permian Basin. Most other regions in the United States have been either stagnant or declining in terms of hydrocarbon production.

As we can see in the map above, Energy Transfer has substantial pipeline assets in the Permian region as well as throughout Texas as a whole. Thus, it stands to reason that any increase in production in the Permian Basin will result in Energy Transfer experiencing volume growth. After all, the upstream producers need to contract with somebody to get their production to the market, and the only logical choices would be companies that already have a substantial infrastructure presence in the area. The upstream producers in the Permian certainly do not want to wait for years for somebody to construct new capacity when they can secure already existing capacity from a company like Energy Transfer that already has it.

Another major reason for Energy Transfer’s year-over-year growth was the November 2023 acquisition of Crestwood Equity Partners. The company first announced this acquisition in August of that year, stating:

Crestwood’s system includes gathering and processing assets located in the Williston, Delaware and Powder River basins, including approximately 2.0 billion cubic feet per day of gas gathering capacity, 1.4 billion cubic feet per day of gas processing capacity and 340 thousand barrels per day of crude gathering capacity. If consummated, this transaction would extend Energy Transfer’s position in the value chain deeper into the Williston and Delaware basins while also providing entry into the Powder River basin. These assets are expected to complement Energy Transfer’s downstream fractionation capacity at Mont Belvieu, as well as its hydrocarbon export capabilities from both its Nederland Terminal in Texas and the Marcus Hook Terminal in Philadelphia, Pennsylvania.

Energy Transfer consummated this acquisition in mid-November 2023. As such, all the capacity and infrastructure that Crestwood Equity Partners formerly possessed began working for Energy Transfer at that time. It should be fairly obvious why this would grow the company’s revenue and cash flow figures when compared to the prior year quarter. After all, the company did not own these assets in the first quarter of 2023 so it could not derive any revenue from them.

Growth Prospects

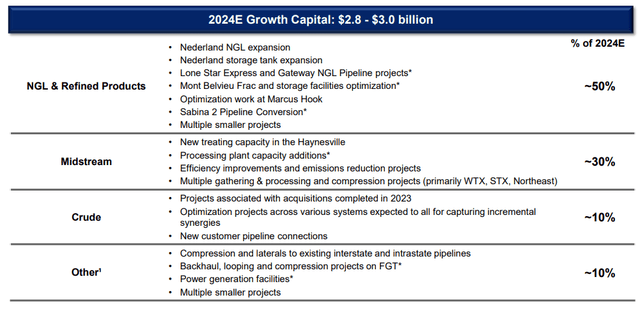

The growth that was seen in the first quarter of 2024 is not the end of Energy Transfer’s growth story. In fact, the company still has a number of growth projects under development at various stages:

Energy Transfer has approximately $2.8 billion to $3.0 billion budgeted for these various projects this year. That does not necessarily mean that all of these projects will come online this year, though. The company has not actually provided a timeline of completion for any of these projects, which is disappointing. However, in a few cases, it is not surprising because some of these projects such as the construction of new treatment capacity and processing plant capacity additions are likely to be ongoing projects that will slowly come online in parts over an extended period. For the most part, we can count on these projects to steadily grow the company’s revenue and cash flow over the next few years as they each come online.

The company did add a few new growth projects in the first quarter of 2024, which are shown in the chart above. Obviously, these projects would not have been discussed in any of my previous articles about Energy Transfer, so we should probably take a look at them today.

The first of these new projects is the conversion of the Sabina 2 Pipeline, which Energy Transfer acquired earlier this year. From the earnings press release:

In the first quarter, the Partnership commenced conversion of the Sabina 2 Pipeline, which was acquired in early 2024, to provide additional natural gasoline service between its Mont Belvieu NGL Complex and its Nederland Terminal.

The company has not provided any more information about this project at this time. However, based on the company’s stated objective of using this pipeline to move natural gasoline between Mont Belvieu and the Nederland Terminal, it is almost certainly located in East Texas. After all, Mont Belvieu is just east of Houston and the Nederland Terminal is just a bit to the northeast of that facility.

Energy Transfer also announced a project meant to increase the amount of natural gas liquids that it can move from the Permian Basin to Mont Belvieu. From the earnings press release:

Energy Transfer recently approved two projects to de-bottleneck its NGL pipelines from the Permian Basin to Mont Belvieu that are expected to provide more than 90 MBbls/d of incremental NGL takeaway capacity from the Permian Basin, as well as increase its deliverability into Mont Belvieu to over 1.3 million Bbls/d.

As was the case with the previous project, Energy Transfer does not provide any further information about this one. However, a likely conclusion here is that both of these projects are being driven by the rising demand for natural gas liquids from various foreign nations. The burgeoning demand for these products abroad is driving Energy Transfer’s customers to want to increase their exports and meet this demand. As such, they are pushing the company to increase its transportation capacity to meet this demand.

We do not know when these new projects will be completed, and thus it is uncertain when we will start to see their impact on Energy Transfer’s revenue or cash flow. However, it is very likely that the company already has contracts in place that ensure that the new capacity that it is adding will be cash flow positive and benefit the company and its investors.

Investors who hold Energy Transfer’s common units should be pleased with the developments here, as it is very nice to see that the company is not resting on its laurels and continues to have more growth opportunities.

Financial Considerations

As I stated in a previous article:

It is always important to analyze the way that a company finances its operations before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. The repayment of this debt is usually accomplished by issuing new debt and using the proceeds to repay the maturing debt because very few companies have sufficient cash on hand to completely repay all of their debt as it matures. This process can cause a company’s interest expenses to increase in certain market conditions.

Over the past year or so, we have seen a number of news headlines expressing concern over the impact that today’s high interest rates will have on those companies that need to roll over their debt. After all, the federal funds rate today is at the highest level that has been seen in twenty years, and long-term interest rates are not really too far off that level. Thus, any company that needs to roll over its debt today will almost certainly pay a higher interest rate than at any time in the recent past.

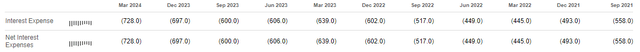

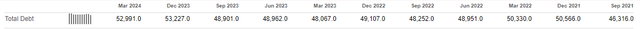

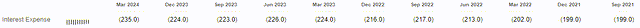

Unfortunately, Energy Transfer is one of the few midstream companies that has been adversely affected by rising interest rates. As we can see here, the company’s interest expenses have increased substantially from the levels that it had in late 2021 and early 2022:

As clearly shown, Energy Transfer’s net interest expense was $728.0 million in the most recent quarter, a 30.47% increase from the $558.0 million that it paid in the third quarter of 2021. This was partially due to an increase in the company’s debt load, as it went from $46.316 billion to $52.991 billion over the same period:

This is only a 14.41% increase, though, so clearly the company’s effective interest rate is increasing. To a certain extent, this cannot be helped, as some of this debt was acquired to allow the company to conduct the various acquisitions that it completed over the period shown in the table. After all, while both the Enable Midstream and Crestwood Equity Partners acquisitions were all-stock deals, they still resulted in Energy Transfer assuming the debt of both companies. Energy Transfer’s statement of cash flows also shows that during most of the past eleven quarters, it issued more debt than it repaid. That suggests that the company has also been borrowing money to fund some of its capital projects.

Overall, though, Energy Transfer does differ from several other midstream companies regarding its financing during the post-pandemic period. For example, the interest expenses paid by both MPLX (MPLX) and Enterprise Products Partners (EPD) have barely budged since 2021. For example, here are the interest expense figures for MPLX over the same period shown above:

That is an 18.09% increase in interest expense for MPLX.

Here are the comparable figures for Enterprise Products Partners:

Enterprise Products Partners only experienced a 4.75% increase in its interest expense over the past eleven quarters. Thus, Energy Transfer’s interest expenses are rising much more rapidly than either of its two largest partnership peers.

The fact that Energy Transfer’s interest expenses have been rising more rapidly than its peers is not necessarily the end of the world, however. After all, if the things that it is purchasing with its debt generate enough cash flow to cover the interest payments and incremental operating expenses while still leaving a profit left over, then the company’s equity holders are still better off. As such, let us take a look at how well the company is carrying its debt.

In my last article on Energy Transfer (linked earlier), I explained how we can judge the company’s ability to carry its debt:

The most important thing for our analysis though is to determine how well the company can carry its debt. The usual way that we judge this is by looking at the company’s leverage ratio, which is also known as the consolidated debt-to-adjusted EBITDA ratio. This ratio basically tells us how many years it would take the company to completely pay off its debt if it were to devote all of its pre-tax cash flow to that task.

As of March 31, 2024, Energy Transfer had a consolidated debt load of $52.991 billion. The company reported an adjusted EBITDA of $3.880 billion for the most recent quarter, which works out to $15.520 billion annualized. This gives the company a leverage ratio of 3.41x based on its annualized adjusted EBITDA, which is very reasonable. This is very much in line with the 3.45x ratio that the company had at the start of the year, and it is also well below the 5.0x ratio that Wall Street analysts consider to be reasonable. Thus, we probably do not need to worry about the company’s debt too much, despite the concern that may arise just from looking at its interest expenses.

Distribution Analysis

Energy Transfer announced a quarterly distribution of $0.3175 per common unit, which will cost the company approximately $1.071 billion. The company had a distributable cash flow of $2.353 billion for the quarter, so its distribution coverage ratio is 2.19x.

Investors have nothing to worry about regarding the company’s distribution. Wall Street analysts usually consider a distribution coverage ratio of 1.20x or higher to represent a distribution that is sustainable over the long term. Admittedly, it is possible that management will cut the distribution anyway, that does not seem likely right now. Indeed, the company’s management currently appears to be more committed to increasing the distribution than reducing it.

Energy Transfer has a forward distribution yield of 7.82% at the current price, which is reasonably in line with its peers:

|

Company |

Current Yield |

|

Energy Transfer |

7.82% |

|

Enterprise Products Partners |

7.26% |

|

MPLX |

8.14% |

Energy Transfer also continues to satisfy the 7% yield preference that we have here at Energy Profits in Dividends.

Conclusion

In conclusion, Energy Transfer’s first quarter 2024 results were quite decent as they showed the company’s recent growth story playing out in a big way. We can certainly see the effects of the acquisitions that it has made over the past year in these results. It is also very nice to see that the company’s growth story has not stopped yet, and it is likely that it will continue to look for strategic acquisitions as well as proceed with the development of its own projects. The fact that the company’s debt and interest expenses keep increasing in the current environment is somewhat concerning, but Energy Transfer is having no difficulty carrying its debt and its finances look decent.

Overall, Energy Transfer continues to look like a good way to get a 7.82% yield today.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MPLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article was originally published to Energy Profits in Dividends on May 9, 2024. Subscribers to the service have had since that time to act on it.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!