Summary:

- Since I published my bull thesis on Energy Transfer early this year, the stock has delivered ~ 14% in total returns.

- This might raise the question of decreased attractiveness and at least partially exhausted upside.

- Looking at the underlying fundamentals, there is a strong evidence that ET has still the necessary characteristics to deliver juicy returns going forward.

- Also, a P/E of 10x coupled with sector-level tailwinds support this.

- In this article, I elaborate on the key items of Q4 2023 results and other recent ET related dynamics, providing a justified basis on my bullish stance on ET stock.

bjdlzx

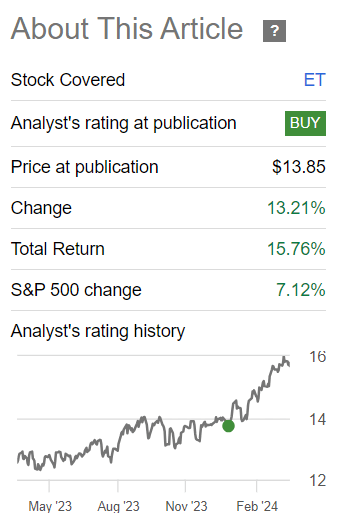

Early this year I wrote an article about Energy Transfer (NYSE:ET) providing several arguments why, in my view, the then-current dividend yield of 9.1% was fully backed by robust fundamentals and in general why the probability of experiencing a similar event as in 2020, when ET cut the dividend, is extremely unlikely. So, the combination of a very enticing dividend and improving cash generation warranted a buy from me.

Since the publication of the article, the stock has rewarded investors nicely, and as a result of some multiple expansion, the dividend yield has plummeted to ~ 8%.

Seeking Alpha

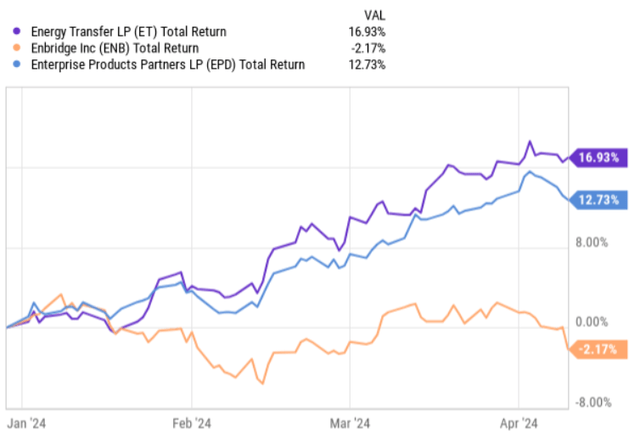

Compared to other widely popular peers, we can see that ET has managed to register a clear alpha (on a YTD and total return basis).

Theoretically, one might question whether now is the time to trim down a bit on ET’s position to allocate some of these profits into other interesting value plays, which have not lately experienced as notable multiple expansion as in ET’s case.

For example, as some of my readers have probably noticed, I have recently turned very bullish on Enbridge (NYSE:ENB) due to significant progress on the balance sheet end and expanding EBITDA generation. Looking at the chart above, one might contemplate on deemphasizing conventional energy infrastructure exposure from stocks (like ET) that have lately surged higher and allocate these proceeds into ENB to warrant seemingly a better upside (without tilting portfolios too much in this particular space).

However, in my opinion, ET has actually become a more attractive investment and embodies the necessary aspects for investors to actually consider adding incremental capital to the position.

Here is why.

Thesis update

The most recent earnings deck revealed several interesting dynamics, which clearly support the bull case going forward.

All in all, the results came in strong, where operationally, ET managed to deliver record volumes across its four main business segments. For example, the crude oil transportation volumes increased 39% relative to Q4, 2022, beating the previous record volume in a notable fashion. Similarly, NGL fractionation and transportation volumes increased 16% and 13%, respectively, over Q4, 2022 – also setting record here.

These solid operational results obviously fed nicely into the quarterly earnings figures. The EBITDA ticked up by almost 6% that also translated to expanded DCF base, which grew by ~ 5% in Q4, 2023 compared to the same quarter in 2022.

Besides the sector-level tailwinds that were associated with the strong commodity markets across the board, there were a couple of ET-specific drivers, which helped the Company achieve so great results. While embedded revenue escalators and effects from the organic CapEx spend did their thing too, the most material ET-specific aspects were the notable M&A transactions. The acquisitions of Lotus midstream and Crestwood equity patterns, which closed in 2023 were immediately accretive to the underlying DCF / per unit, and obviously boosted the overall financial and operational results higher due to the consolidation effects.

Moreover, it is definitely worth underscoring the most recent dynamics on the balance sheet end. While last year ET’s senior unsecured credit rating was upgraded by the S&P to BBB with a stable outlook, in Q4, 2023, ET finally managed to land an upgrade by Fitch to BBB notch as well. So, now ET carries double BBB with a stable outlook rating, which creates more favorable conditions for the Company to tap into cheaper and more flexible debt financing alternatives.

Interestingly, Fitch made such a decision even though ET issued incremental $3 billion of senior notes and $800 million of junior subordinated notes to, among other things, redeem all of the outstanding Series C and Series D preferred shares with a goal to retire Series E units during 2024 as well. This just clearly speaks of the embedded financial resiliency of ET and indicates that there is a decent margin of safety when it comes to maintaining a solid credit rating. Yet, to finish the preferred unit buyback aspect, investors have to now factor in that the quarterly distribution of ~ $150 million to preferred shareholders will now shrink considerably, leaving more capital for shareholder distributions (as the attracted debt proceeds embody lower cost of financing than the preferred units).

With that being said, the base case of conservative approach by ET in managing the balance sheet still remains intact. Tom Long – Co Chief Executive Officer and Director – clearly confirmed this in the most recent earnings call:

As a result of our continued emphasis on strengthening our balance sheet, we’re in the strongest financial position in Energy Transfer history and this will allow us the flexibility to balance pursuing new growth opportunities with further leverage reduction, maintaining our targeted distribution growth rate and increasing equity returns to our unit holders.

Apart from the growing EBITDA and DCF generation levels, it is really the reduction in organic growth capital that helps the Management keep the business on the “de-leveraging path”. The 2024 guidance indicates that the organic growth CapEx will land between $2.4 billion and $2.6 billion (mostly related to NGL and refined products and midstream segments). This is perfectly in line with ET’s long-term strategy of maintaining annual growth capital run rate between $2 billion to $3 billion, which, in the context of historical levels, warrants a sound ground for gradually reducing debt or increasing the distributions to shareholders (e.g., in 2018 and before the organic CapEx revolved more around $5 billion per year).

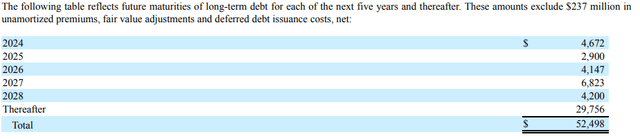

Now, as many of my followers have probably noticed it, I pay a very careful attention to the forthcoming refinancing risks, which could trigger an expansion of interest cost component in case the debt wall is notable with considerably lower cost of financing relative to the market level interest rates at which the Company can attract new borrowings. Against the backdrop of strengthening of higher for longer scenario, this aspect becomes even more critical.

However, in ET’s case I do not see a material risk here since if we take 2024 and 2025 debt maturities, we will arrive at just ~ 14% of the total outstanding borrowings that the Company will have to roll over.

Form 10-K for Energy Transfer LP filed 02/16/2024

Given the combination of Management’s commitment to continue de-risk the balance sheet, successful refinancing so far (e.g., refinanced $225 million of outstanding principal amount at 4.05% with a 10-year maturity during Q2, 2023) and savings on the preferred unit front, ET is nicely positioned to keep the interest cost component stable.

Lastly, ET has also circulated a strong guidance for 2024, setting a target of adjusted EBITDA generation between $14.5 billion and $14.8 billion, which results in an EBITDA growth of more than 7% even after a rather tough comp figure stemming from record performance in 2023.

Part of this will be driven by the synergy capture from the recently integrated acquisitions, organic CapEx assets coming on line as well as the enticing embedded sales bumps. Yet, there is also a strong sector-level component, which provides the necessary tailwinds for growing demand of ET’s infrastructure as the crude oil pushes higher mostly due to global tensions and stronger demand in Europe.

The bottom line

In my humble opinion, Energy Transfer remains a solid buy, even after considering the recent runup in the share price. From the valuation perspective, the multiple is still cheap at a P/E of 10x and the dividend is still very enticing at 8%.

If we factor in the recent financial dynamics, the improvements (e.g., double rating of BBB, growing DCF and gradual reduction of debt and preferred units) and the assumed momentum significantly boost the ET’s attractives, outweighing the potential negatives from higher share price. Moreover, the risk that could come from strengthening of higher for longer scenario is not that relevant in ET’s case as the near-term maturities are relatively immaterial and the recent refinancings show that the Company is really able to tap into very cheap sources of debt capital (where ET will enjoy even better conditions as now it is double rated with a continued focus on shrinking the debt portion in its balance sheet).

For all of the aforementioned reasons, ET is still an attractive buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.