Summary:

- Energy Transfer is poised to benefit from a Trump Administration due to pro-energy policies, less regulation, and increased domestic energy production.

- ET’s extensive infrastructure, recent acquisitions, and growing export capabilities position it well to handle increased energy volumes and capitalize on global demand.

- Despite high debt, ET’s strong revenue, undervaluation compared to peers, and a 7.5% yield make it an attractive investment for capital appreciation and income.

- Risks include high debt, potential lawsuits, and fluctuating oil prices, but the bullish energy landscape and ET’s strategic position outweigh these concerns.

PM Images

There are certainly going to be winners and losers over the next 4 years, and while I think a Harris Administration would have been better for shareholders of upstream producers, Energy Transfer (NYSE:ET) should benefit more from a Trump Administration. Energy infrastructure companies operate pipelines running across the country, which are a necessity in everyday life. After the election was called for Former President Trump, Mackie McCrea (ET co-CEO) said that the outcome would bring a breath of fresh air to the oil and gas industry. President Trump’s energy policies are very bullish for the overall landscape of the oil and gas sector as he believes in less regulation, less red tape, and producing enough liquid gold to be energy-dependent in addition to supplying other parts of the world. I have been bullish on units of Energy Transfer for a long time, but I am even more bullish now, and if there was a rating that exceeded very bullish, that is what I would select. My prediction is that President Trump’s policies will cut both ways for the oil and gas industry, as his pro-energy stance could negatively impact the price per barrel for oil if production exceeds where the output is today. This is why I am favoring companies like ET. As more energy is produced, ET’s infrastructure will become more important, and they should see increased revenue as more energy sources flow through their system. ET has made several acquisitions along the way and operates one of the largest energy infrastructure companies, which cannot be replicated. ET continues to increase the quarterly distribution, and I believe we will see a new normal in 2025 with units exceeding $20.

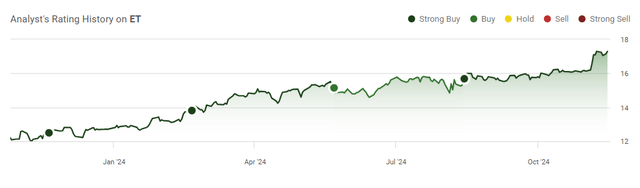

Following up on my previous article about Energy Transfer

As I indicated in the opening, I have been bullish on ET for a long time, and I am not jumping on the bandwagon now that a more favorable administration toward the oil and gas industry will be taking over in January. I wrote my previous article on ET in the middle of August (can be read here), and since then, its units have increased by 10.62%. The S&P 500 has climbed 7.87% over this period, and when ET’s distribution is accounted for, the total return is 12.71%. I had discussed why I felt units of ET were undervalued and how ET was an indirect play in the A.I. boom. I am following up with a new article as we have more economic data, an upcoming administration change, and new earnings from ET. I still believe there is a lot of value to be unlocked for units of ET, and my previous assessment could be a bit light on what I considered their fair value to be. I am very bullish heading into the winter and believe that ET’s units will continue to appreciate and the distribution will continue to grow.

Risks to investing in Energy Transfer

While I am very bullish on ET, and a more favorable administration is expected to be more friendly toward the oil and gas sector, there are still risks to investing in Energy Transfer. Building and maintaining an energy infrastructure isn’t cheap, and many expand through acquisitions. ET has $59 billion in long-term debt on its balance sheet, with a net debt position of $59.77 billion. Over the trailing twelve months (TTM) ET has paid $2.97 billion in interest expenses, and based on their prior history, there is a decent chance they will either tap the debt markets again or issue new shares to continue expanding through acquisitions. Fed Chair Powell just delivered a new speech and indicated that the economy has been strong as economic output grew by more than 3% last year. He specifically indicated that the economy is not sending a message that reducing rates to their target rate needs to be done in a hurry. This could mean that a December rate cut is off the table and that the timeline on the Fed Dot Plot changes as to when a 3% target is reached. Keeping rates higher for longer is negative for ET because they have a tremendous amount of debt on the balance sheet, and a higher rate environment isn’t bullish for business expansion. Other business risks include lawsuits, unexpected oil spills, and the possibility of declining oil output. If the amount of energy that is produced stateside declines, it will negatively impact ET’s revenue. If ET experiences malfunctions in its pipeline infrastructure, large amounts of oil and gas could find their way into local environments, triggering investigations and lawsuits. Just because President Trump is coming back to the Oval Office doesn’t mean oil and gas companies have carte blanche, and it’s not a free ride to appreciation. Please do your own research and consider the risk factors before investing in ET or other energy companies.

K-1 Tax Package

The purpose of a K-1 form is for each partner to report their share of a business’s gains, losses, and distributions to the government. MLPs issue a Schedule K-1 to its investors. To read more about Schedule K-1 please click here. ET does issue a k-1 tax package, so please read through the implications and talk to a tax professional about how it can impact you during tax season. ET’s K-1 tax information can be read by clicking here.

Energy Transfer operates one of the largest energy infrastructure companies in North America, and the incoming administration should be very bullish on their business.

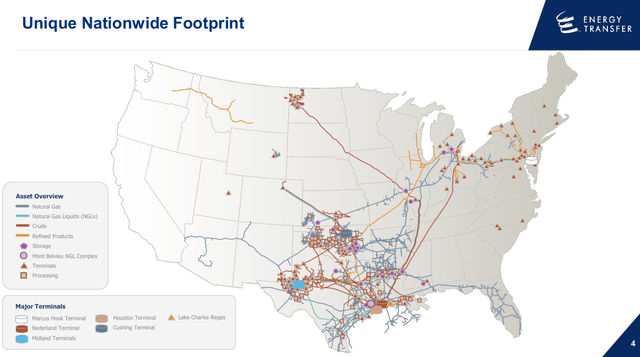

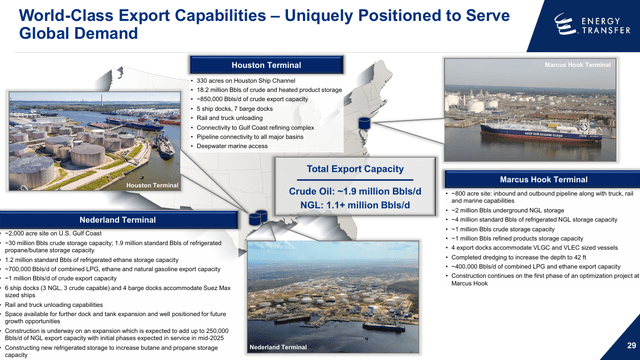

After ET’s latest acquisitions of Crestwood Equity Partners, Enable Midstream, and SemGroup, ET has grown into an energy conglomerate that owns and operates 125,000 miles of pipeline, terminalling services, storage capacity, fractionation services, liquified natural gas ((LNG) regasification and bi-coastal export facilities. ET’s export facilities reach over 80 counties and territories globally, while its vast network of energy infrastructure makes it a reliable resource for upstream producers to move their traditional sources of energy from point A to point B. We’re currently in an environment where the stateside upstream producers are extracting more than 13 million bpd from their drilling operations. This has caused ET’s volumes in Q3 to increase dramatically YoY. ET has experienced a 25% increase in crude transportation, a 49% increase in crude exports, natural gas liquids (NGL) fractionation volumes increased by 12%, and NGL exports increased by 3% YoY. There is a scenario where we experience an energy renaissance in the oil and gas markets, and ET is positioned to benefit for at least the next several years.

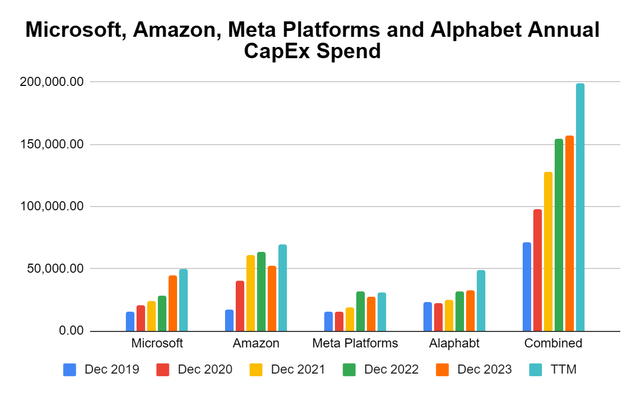

The demand for energy continues to grow, and the landscape has changed due to the large demand from data centers. According to CBRE, the North American data center inventory grew by 24.4% YoY in Q1 as 807.5 MW of new power supply was added. North Virginia was the number 1 market due to all the government agencies, as 391.1 MW of new supply was added due to cloud and A.I. infrastructure demands. In the first half of 2024, the power supply grew YoY by 1,100.5 MW while under-construction activity increased in primary markets by 69% YoY to 3,871.8 MW. The largest companies in the world are not slowing down on their CapEx spend, and the combination of Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL) (GOOG), and Meta Platforms (META) have grown their annualized CapEx allocation by 180.69% ($128.21 billion) over the past 5-years. From listening to their earnings calls, it doesn’t seem like CapEx spending is going to slow down in 2025 as building out cloud and A.I. infrastructure remains a top priority.

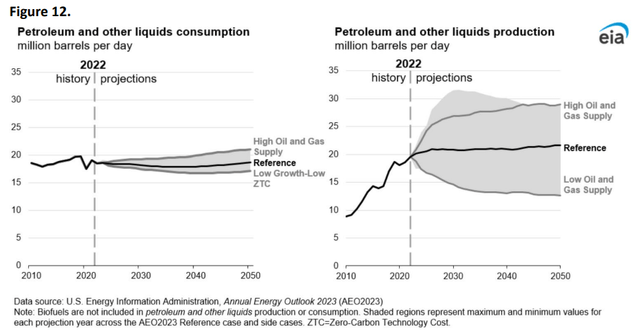

Steven Fiorillo, Seeking Alpha

Reuters has already reported that the incoming administration has drafted executive orders to exit the Paris Accord. It’s likely that President Trump will reverse the executive order that President Biden signed on his first day in office to revoke the permit for the Keystone XL Pipeline, which was expected to create an additional 730,400 bpd of crude throughput from Canada, connecting additional basins to American infrastructure and providing a conduit to Gulf Coast exporting facilities. On Southern Company’s (SO) Q2 conference call, they discussed having close to 200 projects in their pipeline over the next decade, with 40% being data centers. SO expects that roughly 80% of the new electricity they will bring online will be allocated toward data centers. In the latest Annual Energy Outlook published by the EIA they provided 3 scenarios for traditional energy production through 2050, and this was prior to the A.I. boom. It’s likely that when the new report comes out, we will trend closer to the high oil and gas supply scenario as the demand for energy has changed dramatically, and President Trump believes that we need to extract more oil and gas to meet the growing global demands for energy.

I think that the global energy landscape combined with an administration led by President Trump is very bullish for ET. Reuters reported that the European Union was considering replacing Russian LNG with American LNG. To do that, upstream drillers need to drill, transport, convert natural gas to LNG, and export. ET can take care of everything from transporting to exporting. ET completed a MMcf/d expansion to the Orla East processing plant while completing the construction of a 30-mile crude pipe that provides 100,000 Bbls/d crude throughout from terminals in Texas to Oklahoma. ET also got approval to construct its 9th fractionator at Mont Belvieu, which will increase its capacity by 165,000 Bbls/d. ET acquired WTG Midstream Holdings in July, which added 6,000 miles of natural gas pipeline infrastructure and 9 gas processing plants with a capacity of 1.5 Bcf/d. ET also signed a preliminary contract to construct its proposed Lake Charles LNG plant in Louisiana. ET is already one of the leading exporting companies for crude and NGLs. As the demand for energy increases on a global scale, I think that ET will benefit from increased drilling stateside as the demand for American energy grows domestically and internationally. ET is connected to all the major markets, and the bottom line is that as more oil and gas is extracted from the ground to, more oil and gas will need to be transported, treated, and stored. The Trump Administration won’t be standing in the way of upstream producers drilling, and ET’s asset base should be more in demand over the next several years.

Energy Transfer could get a boot to their margins from a lower rate environment

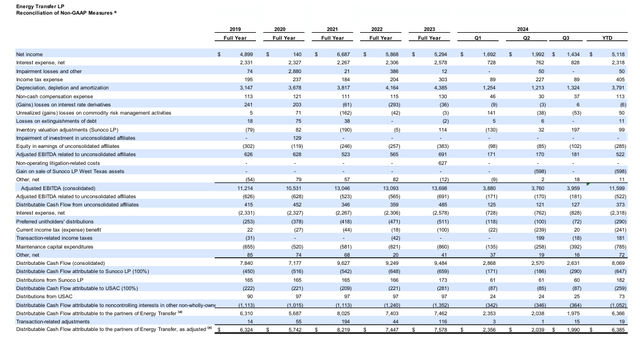

Despite what Fed Chair Powell just said, the long-term goal of getting rates to 3% hasn’t changed. ET has $59 billion in long-term debt. In 2023, they paid $2.58 billion in interest expenses, and in the first 9 months of operations, they have already spent $2.32 billion in interest expenses. In January 2024, ET issued $1.25 billion of 5.55% senior notes due 2034 in addition to $1.75 billion of 5.95% senior notes due 2054 and $800 million of 8.00% fixed-to-fixed reset rate junior subordinated notes due 2054. ET continued to issue debt at high rates during the highest rate environment in over a decade. Over the next several years, ET should be able to tap the debt markets, issue new debt with lower interest rates, and use the proceeds to eliminate its higher interest rate debt. Over the TTM, ET has generated $5.06 billion in net income, and their operating income was $9.07 billion. There is a large spread caused by interest expenses between the two, and a lower rate environment may help ET improve its margins, but the ramifications may not be factored into the current valuation.

Energy Transfer still looks inexpensive compared to its peers

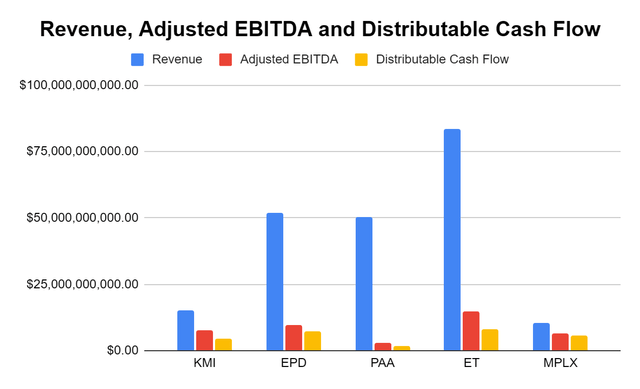

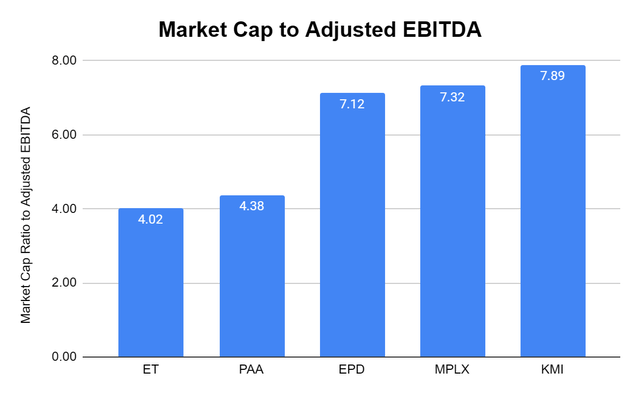

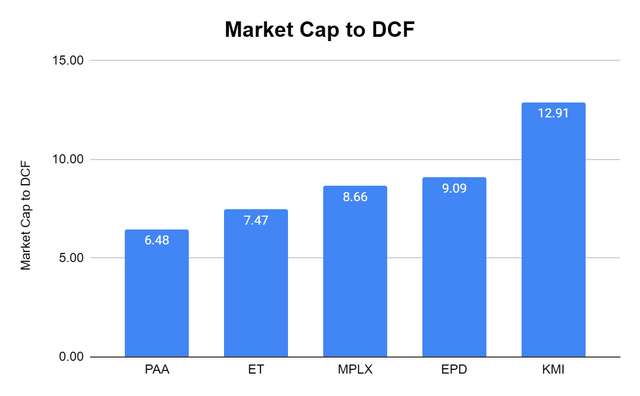

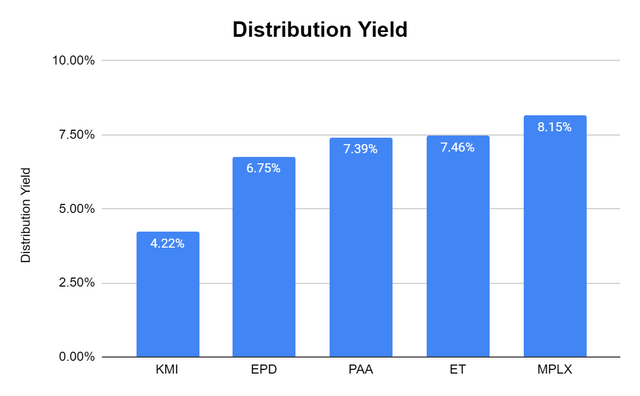

I normally compare ET to Enterprise Products Partners (EPD), Plains All American (PAA), and MPLX LP (MPLX) for MLPs, and I add Kinder Morgan (KMI) because of their large pipeline network. After comparing them across several critical metrics, I believe that ET is still undervalued. ET is generating the largest amounts of revenue, Adjusted EBITDA, and distributable cash flow (DCF) in the peer group and trades at a low valuation.

Steven Fiorillo, Seeking Alpha

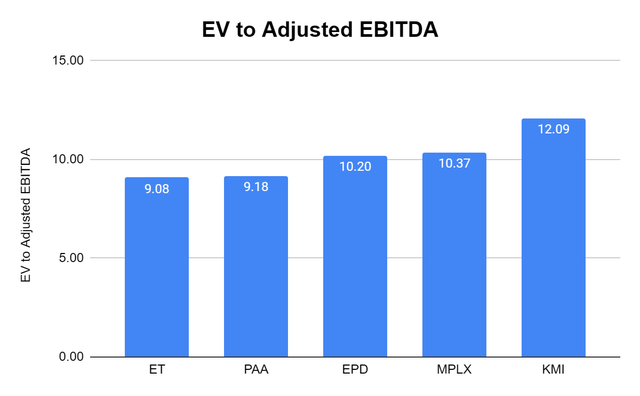

When I look at the enterprise value and market cap compared to the amount of Adjusted EBITDA being generated, ET has the lowest valuation. ET trades at 9.08 times its Adjusted EBITDA on an enterprise value basis, compared to a peer group average of 10.19 times. If I use market cap, ET trades at 4.02 times its market cap, while the peer group average is 6.15x. The market is continuing to discount ET based on the amount of Adjusted EBITDA it produces.

Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha

ET also trades at a discount to the amount of DCF it generates. ET trades at 7.47 times its DCF, which is under the peer group average of 8.92 times. EPD, which produces a similar amount of DCF, is getting a valuation of 9.09 times its DCF and also significantly exceeded ET when I looked at the valuations based on Adjusted EBITDA.

Steven Fiorillo, Seeking Alpha

While units of ET have appreciated by over 25% in 2024, it still yields 7.5% as ET is paying $1.29 in annualized distributions. The peer group’s average distribution yield is 6.79%, and ET has the 2nd highest yield in the group. I think that investors are getting a strong yield with a growing distribution at a low valuation when investing in ET. When I look at these metrics, ET still looks undervalued despite units appreciating in 2025.

Steven Fiorillo, Seeking Alpha

Conclusion

While the energy industry may be excited about the incoming Trump Administration, the last time he was in office, the price of crude spent a lot of time below $60. The combination of easing regulations and OPEC+ increasing production could lead to a decline in oil prices. There is no question that the demand for energy is increasing as the largest companies in the world continue to spend tremendous amounts on building out cloud and A.I. infrastructure. I am very bullish on ET, as I believe energy infrastructure companies will be the largest beneficiaries over the next 4-years within the energy industry. ET has dual coastal export facilities and operates one of North America’s largest energy infrastructure companies. ET trades at a low valuation, yields around 7.5%, and should see increased volumes of energy flowing through its network. I think there is still a lot of room for ET to run, and it is a strong candidate for capital appreciation and income generation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET, EPD, KMI, AMZN, GOOGL, META, SO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.