Summary:

- Eos Energy’s stock is at risk of falling below the $1 minimum requirement for a NASDAQ listing.

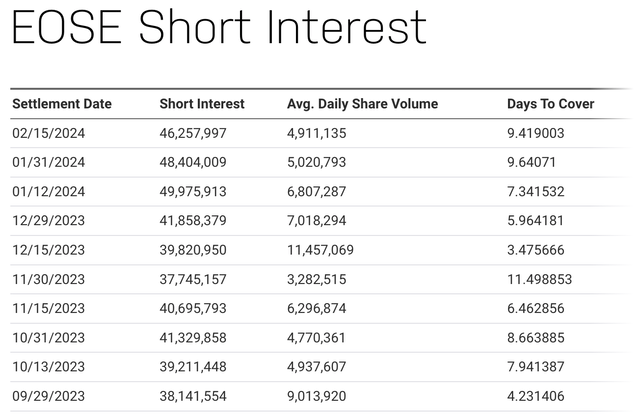

- The market is pricing in significant credit risk with high short interest at 28% of EOSE’s diluted weighted average shares outstanding.

- A growing commercial pipeline and potential government support form reasons to be bullish, but liquidity and dilution issues pose significant risks.

MarkHatfield/iStock via Getty Images

Eos Energy (NASDAQ:EOSE) currently sits just 4 cents above the $1 minimum requirement for tickers listed on the NASDAQ following a sustained collapse in its common shares since the long-duration energy storage upstart completed its go-public SPAC transaction in November of 2020. Short interest in the ticker is high at 46 million shares, around 28% of EOSE’s diluted weighted average shares outstanding of 165.2 million at the end of its fiscal 2023 fourth quarter. EOSE’s relentless downward price action implies the market materially ramping its pricing of a credit default event.

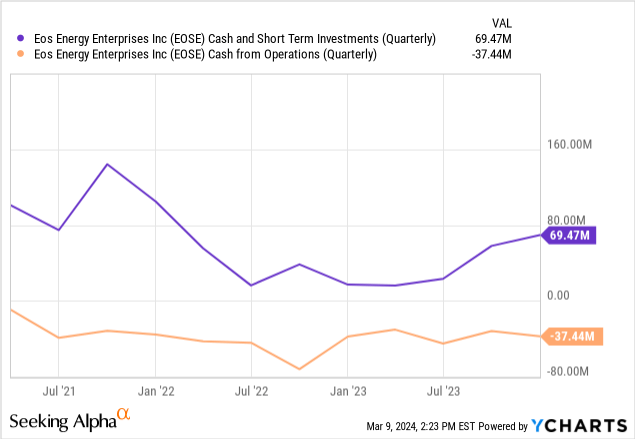

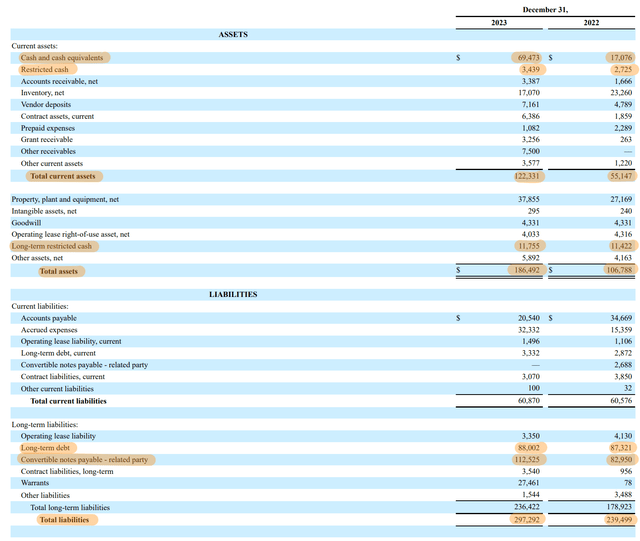

The commercial prospects of EOSE’s zinc-powered aqueous liquid battery module are important but less relevant in the near term if the fundamental solvency of the firm is at risk. Total cash and cash equivalents at the end of the quarter stood at $69.5 million with another $15 million in restricted cash available. This short-term liquidity figure has actually been on the rise with cash and cash equivalents seeing growth from a low of $16.1 million reached in the first quarter of 2023, a ramp that has been built on the back of consecutive equity raises that have become increasingly desperate.

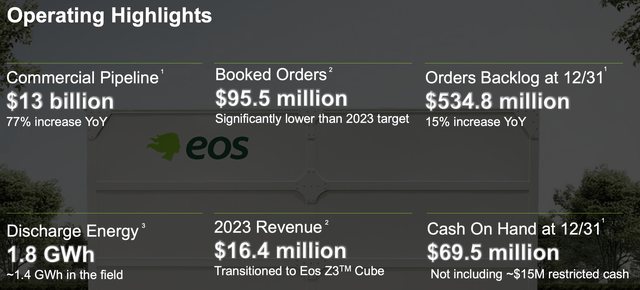

Eos Energy Enterprises Fiscal 2023 Fourth Quarter Presentation

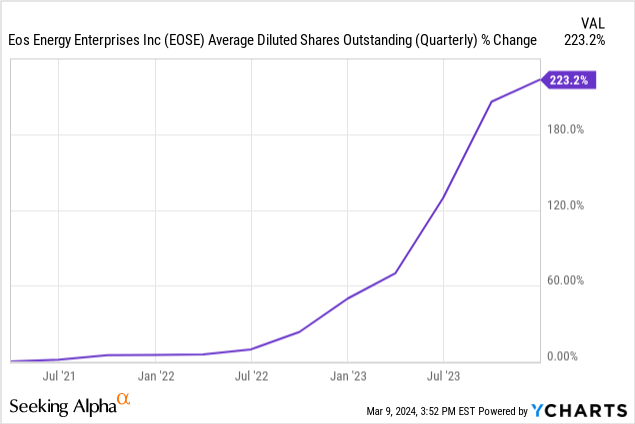

At risk here is a commercial pipeline EOSE placed at $13 billion at the end of its fourth quarter, this pipeline grew by 77% over its year-ago quarter with EOSE seeing booked orders of $95.5 million and an order backlog of $534.8 million. EOSE has had to issue a ton of convertible debt, warrants, and new shares to bridge its liquidity gap with a current market cap of $210 million and negative total equity.

Bears, Dilution, And The Energy Storage Opportunity

Nasdaq

Against a backdrop of losses and dilution, the significant short interest is not abnormal. EOSE is operating in a market set for material growth and being buffeted by significant government support from the current White House Administration. Liquidity could find a boost in the form of a $400 million Title 17 loan from the Department of Energy Loan Programs Office. The loan, which EOSE has conditional approval for, would enable the construction of up to four production lines for its non-lithium ion Eos Z3 zinc-based battery energy storage systems for utility-scale applications.

However, it’s important to note that specific legal, financial, and technical conditions must be met before the LPO grants final approval for the loan, and it’s now seven months since EOSE received conditional approval. Li-Cycle (LICY) received conditional approval for a $375 million LPO loan in February 2023 but has yet to get final approval and has since seen its liquidity and stock price collapse. EOSE is issuing a ton of new shares with its outstanding share count up 223% over the last three years alone, an annual rate of dilution that’s a remarkable 74%. The company launched a $50 million public share offering in December, selling 34.48 million shares and accompanying common warrants to purchase one share of common stock for $1.45 per share.

Eos Energy Fiscal 2023 Fourth Quarter Form 10-Q

To be clear, EOSE went for heavy dilution of its existing shareholders against a market cap already sitting at record lows. This is a position forced by a tough balance sheet with total assets that at $186.5 million were less than total liabilities of $297.3 million for negative total equity of $111 million at the end of the fourth quarter. EOSE held a total debt balance of $208.9 million at the end of its fourth quarter with the bulk of this formed from convertible notes set to create downstream dilution.

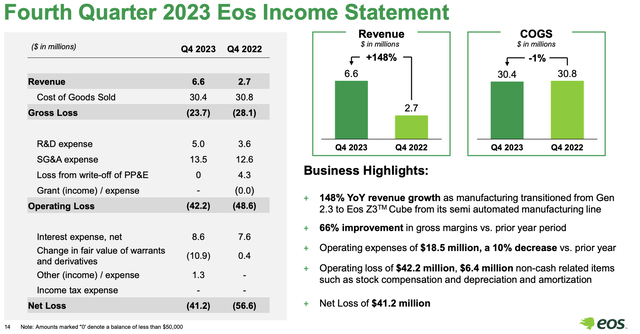

Eos Energy Enterprises Fiscal 2023 Fourth Quarter Presentation

The promise here is that EOSE will be able to secure the LPO loan in the second quarter and dramatically ramp up the sales of Eos Z3 against its orders backlog. Revenue during the fourth quarter grew 148% year-over-year with its cost of goods sold dipping by 1% over the same time frame. The company also saw a 66% improvement in gross margins versus its prior year. Net loss at $41.2 million improved significantly from a loss of $56.6 million a year ago albeit with cash burn from operations that at $37.4 million was essentially flat versus a year ago. I’m wary of recommending a stock as a buy or hold against the promise of potential liquidity from the government despite underlying operations that do not seem commercially viable. EOSE will face liquidity pains if cash burn from operations continues to reflect its historical range with further dilution required against an uncertain timeline for the LPO loan. A potential move below $1 is likely if the LPO loan is not closed in the second quarter.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.