Summary:

- Eos Energy Enterprises has seen a strong share price growth and impressive revenues of $9 million in 2023 so far.

- The company is expanding its product portfolio and targeting key markets with its revolutionary zinc battery technology.

- EOSE has secured a conditional loan guarantee commitment of $398.6 million from the Department of Energy, but profitability remains a challenge.

Petmal/iStock via Getty Images

Investment Rundown

Eos Energy Enterprises, Inc. (NASDAQ:EOSE) has demonstrated a strong performance in the share price growth this year, yielding an over 100% return. Revenues for 2023 so far now stand at an impressive $9 million. This substantial increase in revenue can be attributed to several key factors. Firstly, the growing demand within the energy storage industry has played a pivotal role in driving EOSE’s top-line growth. Furthermore, the company’s effective management has enabled it to ramp up production while securing a higher volume of orders. EOSE’s robust backlog of orders, totaling over $500 million, underscores the promising outlook for the company. The vast majority of the revenues were generated in the early parts of 2023 and the last quarter showed just $0.2 million in revenues. The reason for the small amount being generated comes from the company transitioning manufacturing to the Eos Z3 energy storage systems, which are creating some holds on the output. In my last article about the company I had them as a hold and I continue to see them as such as long as the bottom line remains negative. EOSE has a very promising future if they can capitalize on the over $500 million backlog of orders they have managed to build up so far.

Company Segments

EOSE has made significant strides in the field of energy storage with the development of Znyth, a revolutionary zinc battery designed to address some of the inherent challenges associated with traditional lithium-ion batteries. Znyth represents a paradigm shift in energy storage technology, offering a range of advantages that have garnered considerable attention.

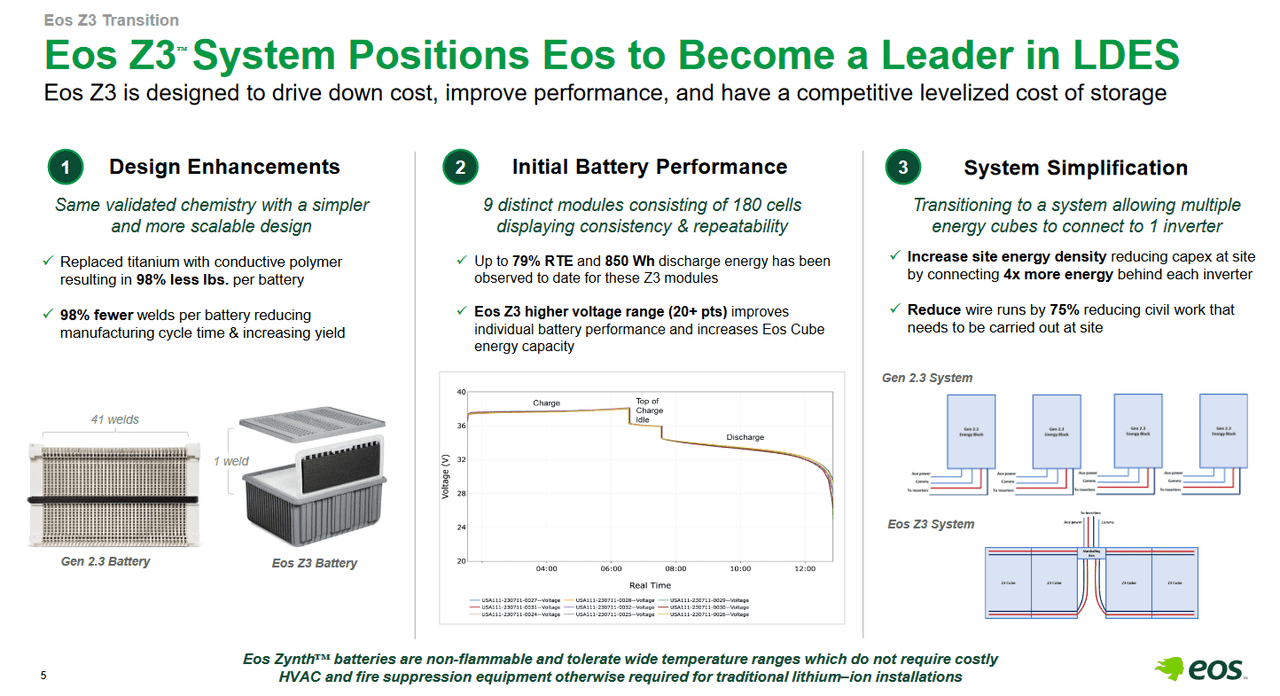

Company Product (Investor Presentation)

The company is positioning itself to be a leader in their space quite quickly as EOSE is expanding its product portfolio and engaging in key, demanding markets. The Eos Z3 is designed to help drive better margins for the business and still yield an improvement above competitors’ products. EOSE is also aiming to ensure they have a very cost-effective product on the market that can be easily scalable as well.

One of the more significant news recently from the company has to be the announcement of “Project Amaze” which is valued at $500 million. It’s an expansion program to help scale the annual production to 8 GWh storage capacity, with the year 2026 as a goal in mind.

EOSE has achieved a significant milestone with the Department of Energy’s conditional loan guarantee commitment of $398.6 million. This commitment underscores the company’s promising trajectory in the energy storage sector and highlights its potential to contribute to a more sustainable and resilient energy landscape. While this conditional loan guarantee is a noteworthy accomplishment, it’s essential to recognize that the actual disbursement of funds in the near term may not be imminent. Several undisclosed technical, legal, and financial conditions must still be met by EOSE to fulfill the requirements for this funding. This further increases the risk that EOSE will have to dilute shares to keep the ship afloat, so to speak.

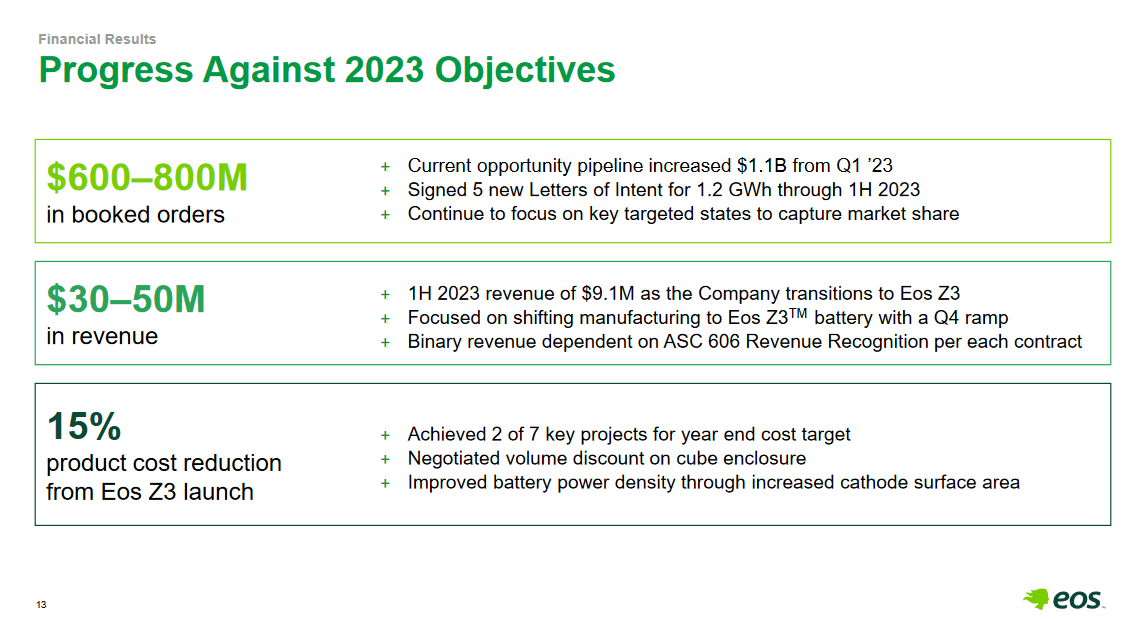

2023 Targets (Investor Presentation)

Looking at the targets the company has set, it seems that the target for $600 – $800 million will be achievable this year for sure if Q3 shows the same numbers as Q2. If all goes well, then I think EOSE will end up with a backlog of around $700 million for the quarter. Then the challenge comes in acting on this and starting to generate stronger earnings and revenues. This is still something the company needs to do, and I think it could be some time until EOSE manages to tick off significant amounts from the backlogs.

Risks

One of the primary considerations when evaluating EOSE’s investment prospects is the company’s current lack of profitability. While EOSE operates within the promising realm of renewable energy, its ability to generate sustained profits remains to be determined, and establishing a definitive timeline for achieving profitability can be challenging.

Investing in companies that have not yet turned a profit can be a double-edged sword. On the one hand, these companies may offer significant growth potential and the opportunity to capitalize on emerging trends in the renewable energy sector. However, on the other hand, the absence of profitability raises questions about the company’s financial stability, cash flow management, and its ability to navigate market fluctuations.

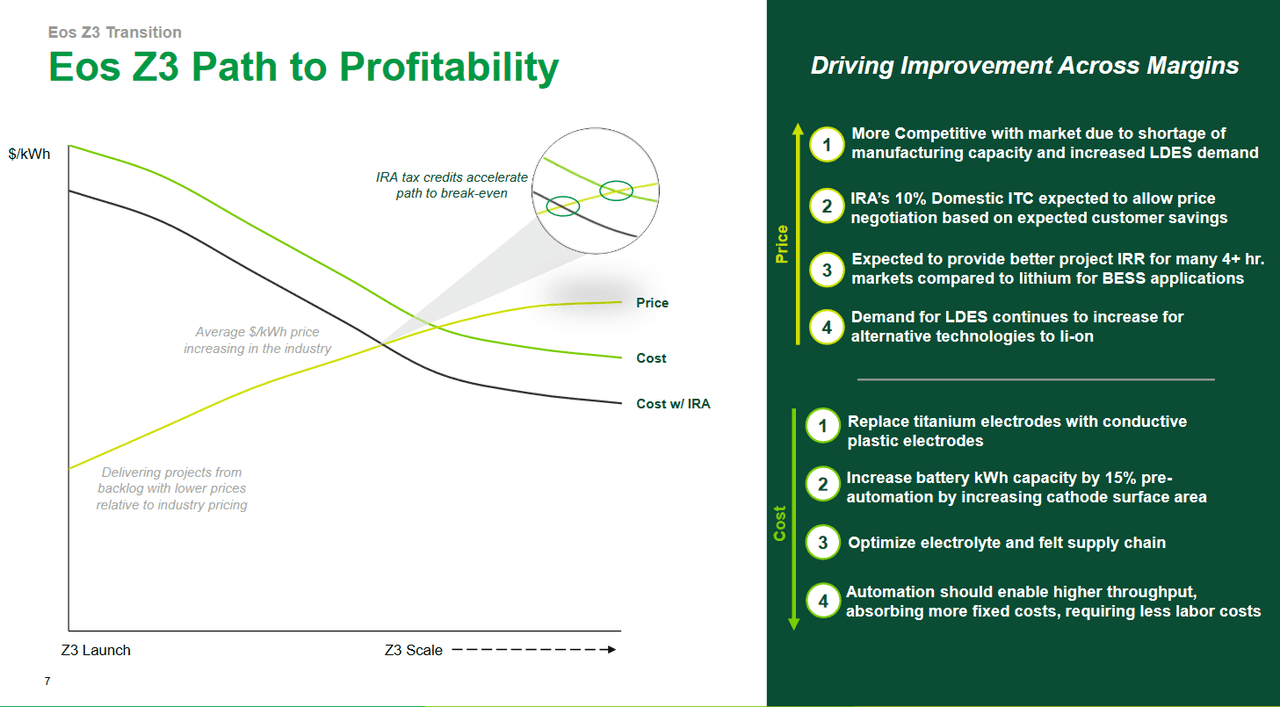

Profitability (Investor Presentation)

Understanding the value proposition for shareholders in a non-profitable company like EOSE can indeed be a challenging puzzle. In the absence of a positive bottom line, assessing the potential benefits for investors becomes more complex. EOSE’s struggle to generate free cash flow further adds to the intricacy of its financial landscape, necessitating share dilution as a means to raise capital for its operations. What makes for some optimism though is the quick increase in the order backlogs for the business, which in the last quarter grew by $86 million. That is nearly a sixth of the entire market cap of the business and goes to show that demand is still very much there for the product.

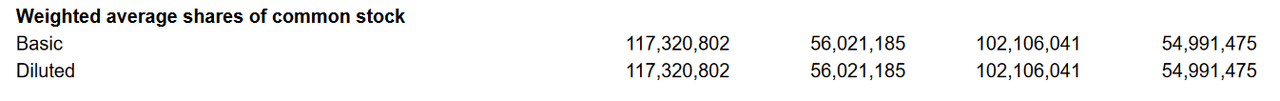

Shares Outstanding (Earnings Report)

Investors should know that the shares outstanding have increased by over 100% in just the last 12 months, though, which is putting a lot of pressure on the share price to go down and reflect these practices.

Industry Comparison

The energy storage space is still quite new, so it’s no wonder that companies like EOSE still have negative or poor margins. Looking at a company like Microvast Holdings, Inc. (MVST) it seems that they have come a further way in terms of growing revenues. The TTM revenues are over $200 million and the company trades at a p/s of just 1.1. That to me indicates a pretty good price based solely on the sales multiple. It’s important to know that MVST still lacks a profitable bottom line and isn’t expected to achieve one until perhaps 2024 or 2025 at least. Estimates vary wildly for the business, but I think that MVST seems to be the better option in terms of getting a more established and well-known brand within the industry.

Final Words

EOSE has gotten some good news recently in that they have managed to facilitate another nearly $400 million in loans from the DOE. However, I still find it likely that shares will be diluted to fund operations. The switch and transition of the manufacturing capabilities resulted in the last quarter showcasing very small amounts of revenues. However, the backlogs grew very strongly by over $86 million in the quarter. I think that EOSE remains interesting to hold for the long term, but I won’t be issuing a buy rating until I see consistent positive net margins being posted. For the moment, I am sticking with my hold rating for EOSE.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.