Summary:

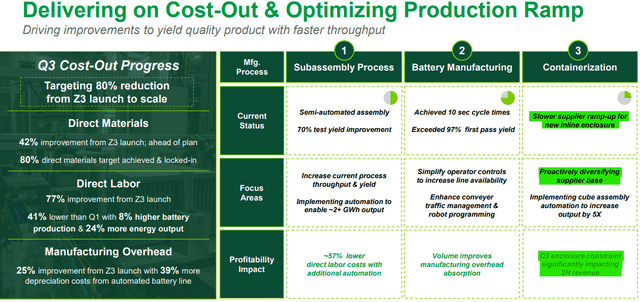

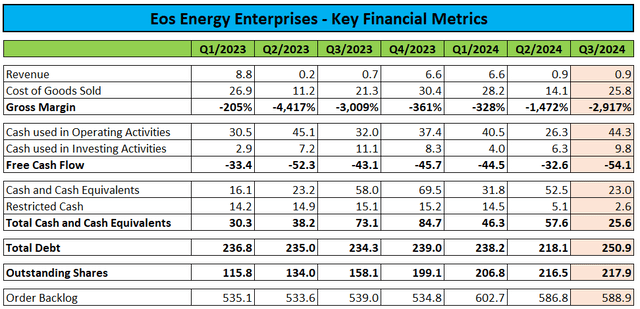

- Eos Energy Enterprises reported disappointing Q3/2024 results, with revenues falling well short of consensus expectations and record-high cash usage.

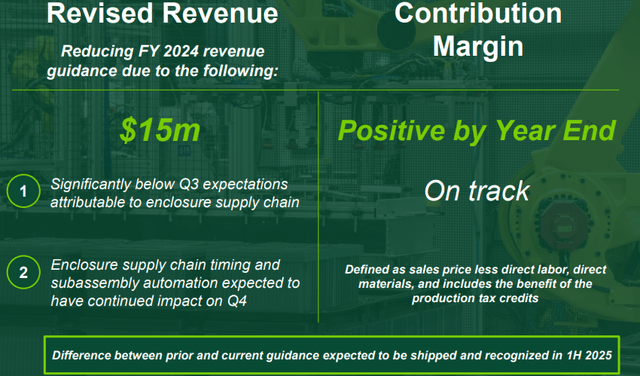

- A supply chain issue will continue to impact sales in the near-term. As a result, management has lowered full-year expectations significantly.

- The sales underperformance resulted in a covenant breach under Eos Energy’s new credit facility with Cerberus Capital Management, but the company managed to secure a waiver.

- Eos Energy now expects the much-touted DOE loan to fund before year-end, albeit at a somewhat lower scale.

- With potential near-term catalysts ahead, investors should consider giving Eos Energy Enterprises the benefit of the doubt for now.

Young777/E+ via Getty Images

Note:

I have covered Eos Energy Enterprises, Inc. or “Eos Energy”(NASDAQ:EOSE, NASDAQ:EOSEW) previously, so investors should view this as an update to my earlier articles on the company.

Last week, controversial zinc-based energy storage solutions provider Eos Energy Enterprises reported disappointing Q3/2024 results, with revenues falling well short of consensus expectations and record-high cash usage:

Company Press Releases / Regulatory Filings

In the press release, the company blamed a supply chain issue for the shortfall (emphasis added by author):

Revenue totaled $0.9 million, lower than expected, as the Company experienced an acute supply chain delivery delay in receiving new Z3 inline enclosures from a key supplier. The supply chain delay had a significant impact on revenue for the quarter. This delay has had no adverse impact on Eos’ total committed backlog and the Company is actively working with customers on updated delivery schedules.

As a result, management was required to reduce full-year sales expectations from the previous $60-$90 million range to a measly $15 million. However, the company expects to ship the delayed orders in the first half of next year.

Adding insult to injury, the revenue shortfall resulted in Eos Energy violating the minimum consolidated revenue covenant governing the company’s much-needed credit facility recently provided by a division of Cerberus Capital Management (“Cerberus”) as outlined in more detail in the company’s quarterly report on form 10-Q:

The Company is required to remain in compliance with certain quarterly financial covenants under its Credit Agreement. These financial covenants include, as defined in the Credit Agreement, (a) Minimum Consolidated EBITDA, (b) Minimum Consolidated Revenue, and (c) Minimum Liquidity (collectively, the “financial covenants”).

As of September 30, 2024, the Company was in compliance with all financial covenants and non-financial covenants, except for the September 30, 2024 Minimum Consolidated Revenue financial covenant. The Company secured a waiver of non-compliance from Cerberus for the quarter ended September 30, 2024.

The Company expects it may be unable to remain in compliance with the Minimum Consolidated Revenue financial covenant beginning December 31, 2024, absent the Company’s ability to secure a waiver or amend the Credit Agreement. In the event the Company is unable to comply with the financial and the non-financial covenants as of December 31, 2024, and the Company is unable to secure another waiver, Cerberus may, at its discretion, enter into a forbearance agreement with the Company and/or exercise any and all of its existing rights and remedies, which may include, among other things, asserting its rights in the Company’s assets securing the loan. Moreover, the Company’s other lenders may exercise similar rights and remedies under the cross-default provisions of their respective borrowing arrangements with the Company.

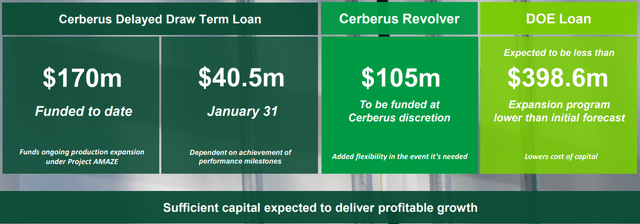

However, Cerberus agreed to waive the covenant breach and provide access to an additional $65 million under the facility following the company’s most recent set of milestone achievements.

While Cerberus has provided a waiver, the private equity giant abstained from amending the terms of the facility, likely to keep its options open in case of further underperformance next year.

In addition, the company claimed important progress in securing funding from the Department of Energy (“DOE”) as discussed by management on the conference call:

(…) we have made significant progress in working with the DOE over the last couple of months as we move closer to closing and funding on the previously announced DOE loan commitment. This loan provides reimbursement for previous eligible capital and operating expenditures associated with Project Amaze, as well as funding additional manufacturing capacity at a lower cost of capital than the Cerberus Revolver.

Depending on the final timing of the first advance, we expect to receive between $50 million and $60 million before funding certain DOE reserve accounts and then we will be able to continue to submit additional eligible costs for reimbursement every few months as we continue to build out Project Amaze.

A lot of progress has been made on this loan since we last spoke to you. Working alongside Cerberus, we have reached agreement on all of the significant loan documents with the DOE and are currently awaiting final approvals.

However, the final size of the loan is expected to be below the $398.6 million conditional loan guarantee provided by the DOE last year:

It’s important to note that the size of the loan is expected to be reduced somewhat as and you may recall Joe explaining this in previous quarters, some of our shakedown and operating costs are coming in lower than previously anticipated.

In addition, with the Cerberus capital getting us closer to profitability, we just don’t expect to need as much additional capital as we were thinking when we originally applied for the loan.

According to statements made in the earnings press release, the company expects the loan to fund before year-end.

Please note that Eos Energy has to meet additional performance milestones by January 31 in order to draw down the final $40.5 million tranche under the Cerberus facility while funding of a proposed $105 million revolving credit facility remains solely at Cerberus’ discretion.

Consequently, there are two potential near-term catalysts to watch for investors:

- Funding of the DOE loan (expected before year-end)

- Achieving additional milestones under the Cerberus credit facility (expected by January 31)

Both events have the potential to move the stock significantly. As a result, investors should consider looking beyond last week’s disappointing sales guidance.

Bottom Line

Eos Energy Enterprises reported underwhelming Q3/2024 results and lowered full-year expectations significantly due to supply chain issues.

The sales underperformance resulted in a covenant breach under the company’s new Cerberus credit facility. However, the lender provided a waiver with demanding concessions.

On a more positive note, Eos Energy managed to meet a second set of performance milestones, thus enabling an additional $65 million drawdown under the Cerberus facility.

In addition, management expects the much-touted DOE loan to fund before year-end, albeit at a reduced scale.

With two potential catalysts ahead, investors should consider giving Eos Energy Enterprises the benefit of the doubt for now.

Consequently, I am reiterating my “Hold” rating on the shares.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.