Summary:

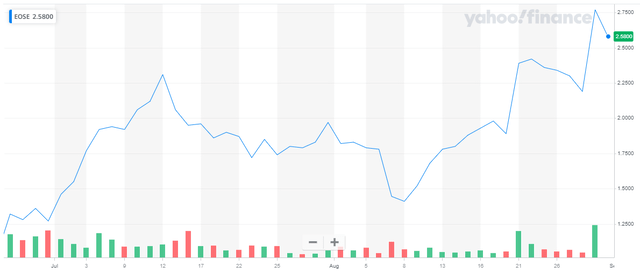

- Eos Energy Enterprises’ shares are up by more than 100% over the past three months as market participants applauded the recent funding agreement with a subsidiary of Cerberus Capital Management.

- Last week, shares rallied to new year-to-date highs after the company met a first set of performance milestones governing the Cerberus term loan facility.

- As a result, the company was provided an additional $30 million tranche under the up to $210.5 loan facility.

- While the company remains a show-me story, last week’s milestone achievements have been encouraging.

- With near-term funding secured and the company’s first automated production line apparently meeting early performance requirements, I am upgrading Eos Energy Enterprises’ common shares from “Sell” to “Hold” and apologize to readers for a bad call.

Young777/E+ via Getty Images

Note:

I have covered Eos Energy Enterprises, Inc. (NASDAQ:EOSE, NASDAQ:EOSEW) previously, so investors should view this as an update to my earlier articles on the company.

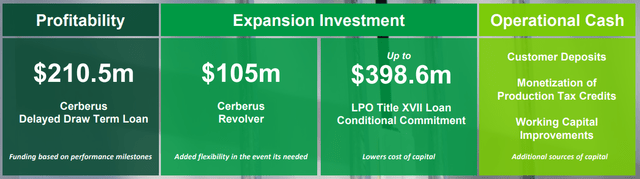

Three months ago, I downgraded shares of controversial zinc-based energy storage solutions provider Eos Energy Enterprises, Inc., or “Eos Energy,” to “Sell” after the company agreed to assign an up to 49% equity stake to an affiliate of Cerberus Capital Management LP (“Cerberus”) in exchange for a highly conditional and very expensive loan facility.

However, taking a look at the recent performance of the company’s shares, it is high time to admit to an exceptionally bad call:

Yahoo Finance

For market participants, satisfaction of the company’s near-term funding needs by an high-profile private equity investor has been clearly outweighing resulting dilution.

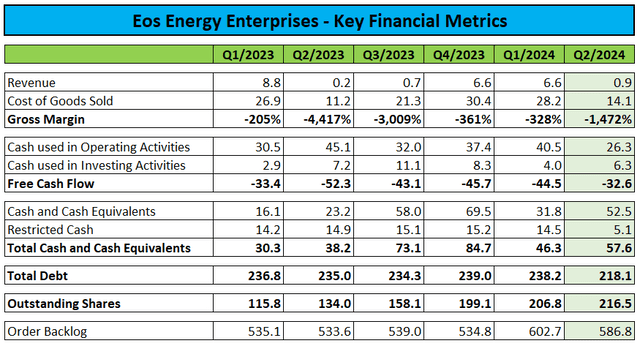

Earlier this month, Eos Energy reported Q2/2024 with both revenues and earnings per share missing consensus expectations:

Company Press Releases / Regulatory Filings

However, cash usage was lower than in previous quarters and liquidity was up, mostly due to the initial $75 million funding under the new Cerberus loan facility.

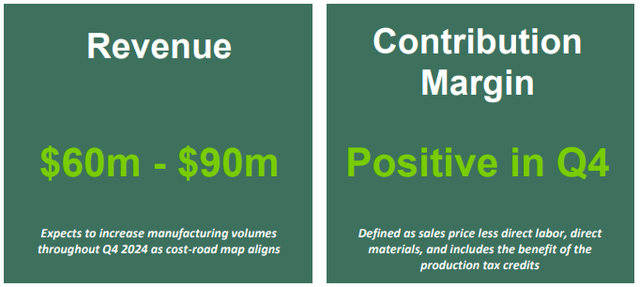

The company reiterated its full-year revenue target of $60 million to $90 million, which after H1 sales of just $7.5 million appears to be an ambitious goal:

Company Presentation

During the questions-and-answers session of the conference call, management also provided an update on the company’s efforts to close on an up to $398.6 million conditional loan guarantee provided by the Department of Energy (“DoE”) twelve months ago:

(..) I think around closing the DOE loan, it’s important for everyone to realize that we had a major change in the capital structure of this company a little over 30 days ago, which have required us to go back and work through (…) some of the terms and conditions on the loan.

And we continue to work on that with the DOE LPO along with Cerberus. And you know, one of the things that we’re really working on with them is the inter creditor agreement. Now that a new creditor has come in and we were able to retire the Atlas debt as part of the service financing.

We meet regularly with the DOE and in fact, the team will be in Washington next week to continue that work. And we’re confident that we’ll be able to close that loan here in the future and we’ll just continue to work on that while at the same time.

Given these issues, the loan is unlikely to fund in the near term.

Last week, Eos Energy announced the achievement of a first set of performance milestones, thus unlocking an additional $30 million tranche under the Cerberus loan facility.

The achieved milestones include objectives related to the Company’s automated production line, materials cost-out, improvements in Z3 technology performance and backlog/cash conversion. Among the key accomplishments, Eos has successfully achieved production cycle times of less than 10 seconds while exceeding first pass yield targets in the high 90s on its first state-of-the-art battery manufacturing line, a significant milestone that positions the company for future profitability. (…)

The remaining two tranches may be drawn in the amounts of $65 million and $40.5 million, respectively, following the October 31, 2024, and January 31, 2025, testing dates upon the achievement of the applicable performance milestones.

Assuming the company will also meet the remaining milestones, Cerberus would be entitled to receive the equivalent of 155.4 million new common shares, thus representing a 33.0% stake in Eos Energy.

Should the company fail to meet additional milestones, Cerberus’s stake could increase to up to 45%.

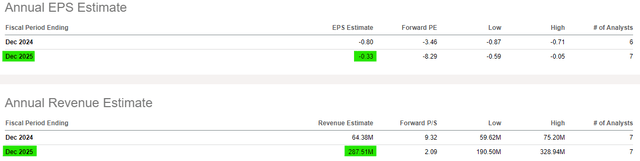

On a fully diluted basis, Eos Energy’s market capitalization calculates to $1.26 billion, but with revenues and profitability expected to ramp up exponentially next year, valuation becomes less of concern:

Seeking Alpha

However, the company will have to meet additional milestones by October 31 and January 31 in order to draw further upon the Cerberus loan and ramp up commercial production to levels sufficient for achieving profitability.

Company Presentation

Bottom Line

Eos Energy Enterprises’s common shares have rallied by more than 100% over the past three months as investors have been cheering the funding agreement with Cerberus.

While the company remains a show-me story, last week’s achievement of the first set of performance milestone has been encouraging.

With near-term funding secured and the company’s first automated production line apparently meeting early performance requirements, I am upgrading Eos Energy Enterprises’ common shares from “Sell” to “Hold” and apologize to readers for a bad call.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.