Summary:

- Eos Energy Enterprises reported weaker-than-expected Q3 results and lowered previously communicated expectations for full-year revenues and bookings.

- With commissioning of its fully-automated manufacturing line having been delayed to Q2/2024, the company is likely to miss current 2024 revenue expectations by a mile again.

- Closing and initial funding of the company’s recently secured DOE-guaranteed loan is not expected to incur before Q2/2024 either, thus resulting in the requirement to raise additional capital.

- Given limited access to the corporate debt markets, equity holders will likely have to prepare for additional near-term dilution from sales of newly-issued shares into the open market.

- Given poor execution and the overhang from the requirement to raise additional equity, investors should avoid the shares until the company starts delivering on its promises.

PhonlamaiPhoto

Note:

I have covered Eos Energy Enterprises Inc. (NASDAQ:EOSE, NASDAQ:EOSEW) previously, so investors should view this as an update to my earlier articles on the company.

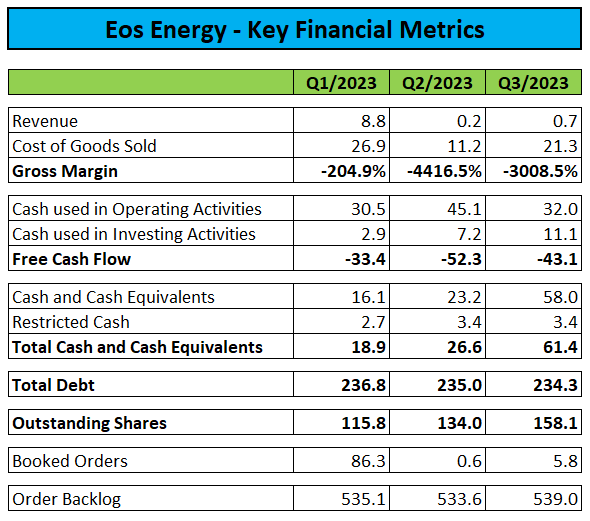

After the close of Monday’s regular session, controversial zinc-based energy storage solutions provider Eos Energy Enterprises, Inc. or “Eos Energy” reported weaker-than-expected third quarter results and lowered previously communicated expectations for full-year revenues and order bookings.

Regulatory Filings

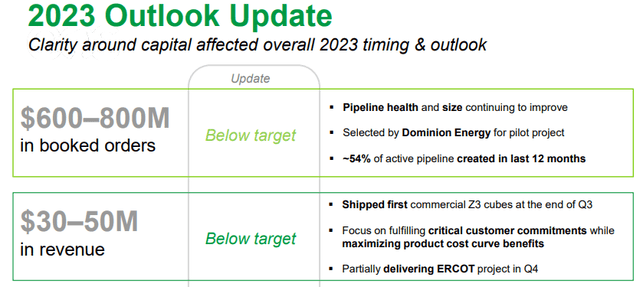

With no material product orders secured for the second quarter in a row, the company now expects to fall short of its original $600 million to $800 million bookings target.

Adding insult to injury, full year revenues will also come in below the stated $30 million to $50 million goal.

On the conference call, management attributed the poor order bookings to a number of issues (emphasis added by me):

For our booked order target, we expect to come in below the previously announced outlook. As we have stated, we believe there are three things that customers are waiting on before committing to a booked order; One, certainty around our financing; two Z3 cycling data from the field and three, formal and final guidance from the IRAs 10% domestic content bonus credit.

While the company recently secured an almost $400 million conditional loan guarantee commitment from the Department of Energy (“DOE”), gathering sufficient field performance data of the company’s new Z3 battery product will apparently take more time.

Regarding the revenue miss, management alluded to issues with the company’s current, semi-automated manufacturing line (emphasis added by me):

As we have gained more visibility into the last quarter of the year, we made the strategic decision to focus on stabilizing the manufacturing line, partially delivering a key customer commitment and then reducing the Q4 production plan in anticipation of the cut-in of a number of product cost out modifications in Q1, which should result in lower unit costs. This decision will result in some revenue being recognized in early 2024 rather than the fourth quarter.

(…) the primary purpose of the semi-automated line was to optimize the manufacturing process while delivering on critical customer commitments. As a result of balancing these priorities, we expect our 2023 revenue to come in below our previous $30 million to $50 million guidance.

Perhaps even more concerning, management will no longer “focus on individual quarterly metrics” going into 2024:

So rather than focus on individual quarterly metrics as we go into 2024, we’re looking at 2024 as a ramp year. And we’ll talk about this more in December, but we will ramp into production and ramp into the line and do that in a way that’s prudent and effectively use capital.

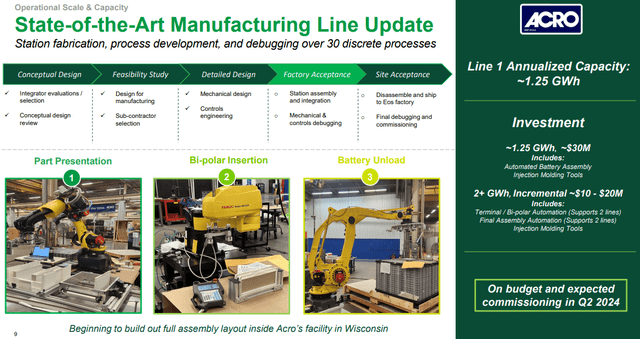

But the bad news doesn’t end here as commissioning of Eos Energy’s fully-automated production line has been delayed by at least another quarter to Q2/2024 and considering the company’s less-than-stellar execution so far, investors would be well-served to prepare for additional delays.

Moreover, closing and initial funding of the DOE-guaranteed loan is not expected before Q2/2024 either as the company has not yet met certain technical, legal and financial conditions. In addition, further due diligence to the satisfaction of the DOE must be completed before definitive agreements will be executed.

The issue has resulted in the requirement to raise additional capital which management intends to satisfy with a combination of debt and equity.

However, the company is already heavily indebted and selling even more shares into the open market would result in substantial, additional dilution for equity holders, particularly given the recent 80%+ drop in the stock price.

Bottom Line

Eos Energy Enterprises, Inc. reported another set of disappointing quarterly results and no longer expects to meet previously-communicated full year revenue and bookings targets.

In addition, commissioning of the company’s fully-automated manufacturing line has been delayed to Q2/2024 which in combination with management’s comments of 2024 being a “ramp year” is likely to result in Eos Energy missing consensus revenue expectations of $223.5 million by a mile again next year.

With closing and initial funding of the DOE loan not expected to occur before Q2/2024 either and limited access to the corporate debt markets, equity holders will likely have to prepare for further, substantial near-term dilution from additional sales of newly-issued shares into the open market.

Given the issues discussed above, investors should avoid Eos Energy’s common shares until the company starts to deliver on its promises.

However, considering the recent 80%+ sell-off in the shares, I have abstained from assigning an outright “Sell” rating to the stock.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

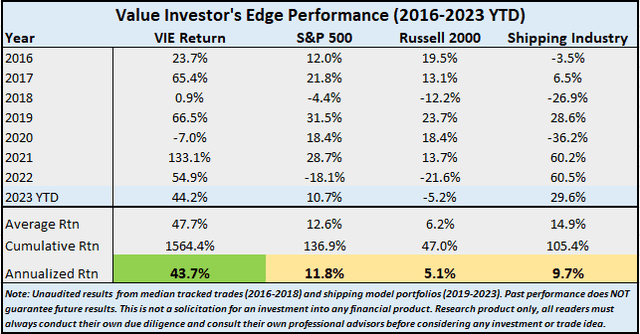

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.