Summary:

- Despite fluctuations, Etsy, Inc. revenue growth rates have stabilized, with Q1 2024 likely representing the low point.

- The company’s net debt position, while noteworthy, doesn’t pose a significant obstacle to value creation, especially given its projected improvement in EBITDA margins.

- With the stock priced at an attractive 11x forward free cash flow, there’s potential for upside once Etsy demonstrates sustained growth and effectively leverages its financial strength.

svetikd

Investment Thesis

Etsy, Inc. (NASDAQ:ETSY), the marketplace for connecting buyers with sellers offering unique supplies, is cheaply valued. That’s the bull case. Meanwhile, the bear case declares that this business today operates as a shadow of its former self.

What’s more, with intense competition from multiple players, together with a balance sheet that carries a fair amount of debt, there just isn’t a lot of room to significantly increase its capital return program in the very near term.

On the other hand, Etsy does make a significant amount of free cash flow, which means that in a few quarters’ time, Etsy will be in a better position to steadily and significantly increase its capital return program.

To sum it up in a sentence, ETSY is cheaply valued. The stock is not blemish-free, but there’s a lot to like.

Rapid Recap

Back in November, I said,

[…] my argument when it comes to Etsy is that the time to be bearish on this stock has come and gone.

Ultimately, I declare that paying 15x forward earnings is not a stretched valuation whatsoever. Yes, there are some pesky detractions to the bull case, such as its lackluster growth rates. But even considering those detractions to the bull case, I still believe there’s a positive risk-reward to this name.

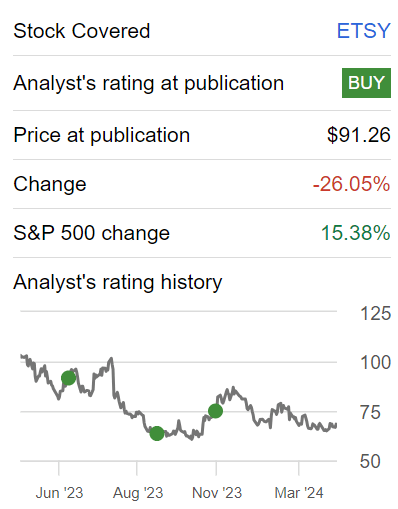

In hindsight, I’ve been bullish on this stock for a year, and I’ve had nothing to show for it.

Author’s work on ETSY

In fact, on the contrary, I’ve been bullish on Etsy this past year, and the stock is down 26% while there’s been a raging bull market elsewhere, with the S&P 500 (SP500) up 15%.

However, during this time, Etsy’s fundamentals have stabilized, while its valuation has significantly contracted. Therefore, I’m not going to throw the towel in yet. Here’s why I’m still bullish on Etsy.

Etsy’s Near-Term Prospects

Etsy’s near-term prospects are being driven by its strategic initiatives aimed at enhancing the customer experience. Over the past few years, Etsy has experienced significant expansion in various key metrics, including gross merchandise sales, number of sellers, active buyers, revenue, and EBITDA. Even though this expansion hasn’t been overly steady. But I’m getting ahead of myself.

Etsy has positioned itself as a leading destination for unique, handmade, and personalized items, and it resonates strongly with consumers seeking meaningful purchases.

The problem, though, is that Etsy faces challenges amidst intense competition from established e-commerce giants such as Amazon (AMZN), and Walmart (WMT), as well as rapidly growing and emerging players like Temu of PDD Holdings (PDD). These competitors have been rapidly expanding their market share and leveraging their vast resources to attract consumers with aggressive pricing strategies and expedited shipping options.

Given this background, let’s now delve further into its financials.

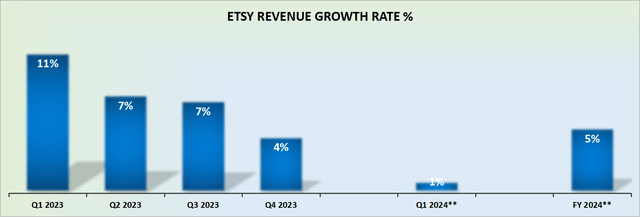

Revenue Growth Rates Have Stabilized

Etsy’s revenue growth rates have stabilized. That’s the good news. Q1 2024 is likely to mark the low point of its growth rates in the near term. The problem here, and what’s weighing on the stock, is that Etsy’s growth rates are ephemeral.

In the best case, Etsy will deliver mid-single-digit growth rates in 2024. What’s more, a significant proportion of this revenue growth is driven by easier comparables with the prior year, combined with a small increase in its take rate.

Further, investors recognize that without a significant amount of revenue growth, this company will simply remain a shell of its former self and struggle to command a large premium on its stock. In other words, a cheap stock, that will stay cheap. And with that segue out of the way, that’s where we head this discussion next.

ETSY Stock Valuation — 11x Forward Free Cash Flow

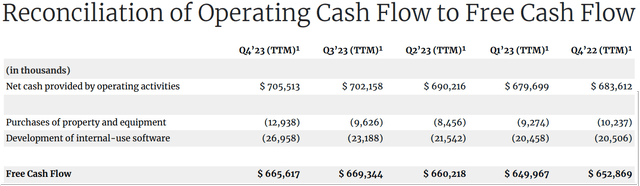

Etsy has a net debt position of approximately $1.1 billion. For a business with a market cap of $8 billion, this implies that nearly 15% of its market cap is made up of net debt. Naturally, this is not the strongest position for a business to be in to be able to unlock pent-up value. That being said, it’s not an overly cumbersome financial position, either.

Etsy guides for its EBITDA margin line to improve relative to 2023. This is, for the most part, being driven by an approximate 70 basis point increase in its take rate.

Consequently, this implies that Etsy is on a path towards $850 million by the time it exists in Q4 2024.

Given that Etsy doesn’t have significant capex requirements, I believe that this means that Etsy will be able to deliver approximately $750 million of free cash flow by the time it exists in Q4 2024, as a forward run-rate. A forward run-rate is an estimate looking ahead over the next 4 quarters.

Therefore, the stock is being priced at 11x forward free cash flow. That’s undoubtedly the bull case pure and simple.

On the other hand, I know better than most that cheap stocks have a propensity to remain cheap. Accordingly, I suspect that Etsy will need to work through the next few quarters and generate enough cash on its balance sheet, so it can be in a position to significantly repurchase a needle-moving amount of its shares.

The Bottom Line

In conclusion, Etsy presents an interesting investment opportunity, albeit with its fair share of challenges.

Despite fluctuations in growth rates, Etsy’s revenue trajectory has stabilized, with Q1 2024 likely marking the low point of 2024. However, the company’s ability to command a premium valuation hinges on its ability to sustain meaningful revenue growth over the long term. From a financial perspective, Etsy’s net debt position, while notable, does not pose a significant impediment to its long-term capital return program.

With the stock priced at 11x forward free cash flow, there’s potential for upside once Etsy, Inc. demonstrates stable growth.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.