Summary:

- Etsy’s Q1 results disappointed with meager revenue growth and a decline in gross merchandise sales.

- Management’s outlook for FY24 suggests a potentially weaker second half recovery than initially expected.

- The implementation of a new seller set-up fee may hinder marketplace expansion and generate little incremental revenue.

- Though trading at a cheap multiple of revenue, ETSY’s poorer growth setup will make it challenging to stage a rebound.

georgeclerk

So far, this earnings quarter, more tech companies have experienced disappointments rather than victories. Included in this unfortunate group is Etsy (NASDAQ:ETSY), which has struggled to regain investor confidence in the wake of a post-COVID cooldown in demand.

Recently, Etsy was able to reinvigorate hopes for growth in late 2023 and early 2024 as the company noted that it expected GMS (gross merchandise sales, the sum total of all goods sold on the Etsy platform) to accelerate in the second half of 2024, on top of growing revenue on top of GMS growth.

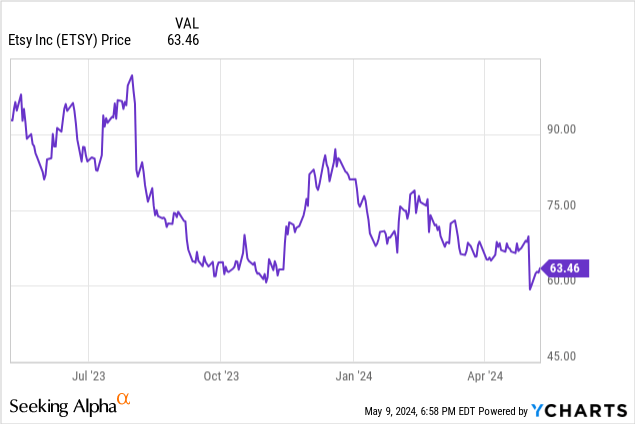

While it is still expecting a similar result for FY24, Q1 results reduced a lot of investors’ conviction on the stock, which fell post-earnings. Year to date now, Etsy has pulled back more than 20%, technically putting it in bear market territory.

I last wrote a neutral article on Etsy in March, when the stock was trading in the low $70s. Since then, after reading through the company’s Q1 results and observing shakiness in the recent trends, I’m downgrading Etsy to bearish.

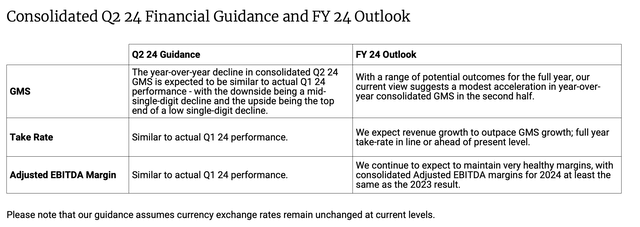

The first thing to note: management made a slight, but noticeable, change in the outlook language for FY24, particularly around GMS. Take a look at the latest outlook below:

Etsy outlook (Etsy Q1 earnings release)

The company previously said about GMS: “We currently expect the first quarter to be our low point in year-over-year growth in GMS and revenue, as we begin to see the expected benefits of our Etsy marketplace product and marketing investments kicking in starting in the second quarter.” The new comment about a “modest acceleration” in the second half points to the possibility of a much weaker recovery, especially as Etsy pinned a lot of Q1 disappointments on a softer macroeconomy.

Potentially not helping the situation: Etsy also just implemented a new $15 seller set-up fee. Billed as a fee that helps Etsy check against seller fraud, the company also mentioned in tests that the new fee resulted in a slowdown in new seller sign-ups. Etsy has been struggling to grow its buyer and seller marketplace base since the COVID pop: and this fee may generate very little incremental revenue to offset costs, but with the net result of stifling marketplace expansion.

It’s not all bad news for Etsy’s latest product rollouts. The company plans to launch a loyalty program for frequent buyers in the back half of the year, which may help retention and purchase frequency (it’s possible, at least for buyers of large purchases, that there may be some purchase deferral in today’s results as buyers wait for this loyalty program to be rolled out to get credit for their purchases). It has also improved its search query capabilities and added a new Gift mode for consumers to be able to send gifts to others. Unfortunately, these initiatives are unlikely to combat natural growth deceleration in the wake of a tough macro environment that has been especially punishing to sellers of home goods (which saw a lot of demand pull in to the COVID period, when many people were moving households to get out of the city and have more space).

The one offset to the negative news: Etsy is, at the very least, much cheaper after this year’s declines. At current share prices in the low $60s, Etsy trades at a market cap of $7.42 billion. After we net off the $1.05 billion of cash and $2.28 billion of debt on Etsy’s most recent balance sheet, the company’s resulting enterprise value is $8.65 billion.

Against this year’s revenue consensus of $2.79 billion (+2% y/y), in line with the company’s guidance of revenue outpacing GMS declines, the stock trades at 3.1x EV/FY24 revenue. And if we apply the company’s guidance of maintaining at least flat adjusted EBITDA margins to FY23 (implying a 27% margin), its EBITDA multiple is 11.5x EV/FY24 adjusted EBITDA.

This isn’t a slam-dunk value stock yet, especially as GMS growth is persistently negative. Overall, I think Etsy will continue to find it challenging to overturn its slow-growth reputation, and a rebound this year is unlikely. Steer clear here.

Q1 download

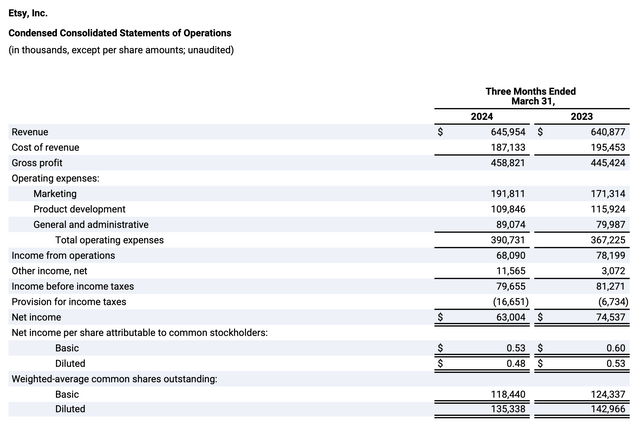

Let’s now go through Etsy’s latest quarterly results in greater detail. The Q1 earnings summary is shown below:

Etsy Q1 results (Etsy Q1 earnings release)

Etsy achieved a meager 0.8% y/y revenue growth to $646.0 million, which landed slightly below Wall Street’s expectations of $646.5 million, or 0.9% y/y growth. The big concern, however, was on GMS: which fell -3.7% y/y to $2.99 billion. On a constant currency basis, results were even worse, with a 4.1% y/y decline. The company had guided to a low single digit decline in Q1, and while it’s debatable whether a 4% decline is “low” or “mid” single digits, it’s clear that the market wasn’t impressed with Etsy’s showing.

The company is blaming the slowdown squarely on macro conditions: and in particular, conditions overseas. Per CEO Josh Silverman’s remarks on the Q1 earnings call:

To that point, while U.S. unemployment is low and inflation data is mixed, consumer sentiment remains depressed, which some speculate can be attributed to the very high cost of money. Consumer wallets remain squeezed so there’s often a little left after paying for food, gas, rent and child care. And there’s significant data indicating that the largest e-commerce platforms have primarily been able to grow by selling everyday essentials at very low prices.

Macroeconomic conditions also continue to be quite challenging in our other top markets, the U.K. and Germany. These headwinds are real, do not appear to be abating and are impacting our sales. Stiff headwinds mean that our product and marketing initiatives have to work even harder to drive growth. In the first quarter, we shipped meaningful improvements to the customer experience, positively impacting GMS. Just not enough to offset the headwinds to our baseline business performance.”

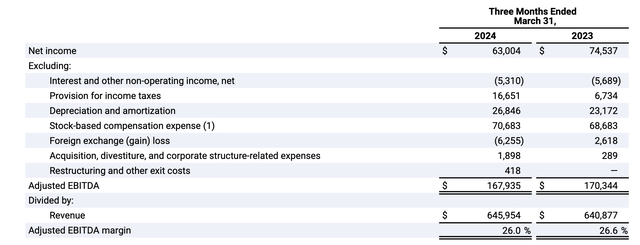

Unfortunately, Etsy’s slowdown in top-line metrics was also accompanied by a contraction in profit margins. As shown in the chart below, adjusted EBITDA declined -1.5% y/y to $167.9 million, representing a 26.0% margin: 60bps worse than in the year-ago Q1.

Etsy adjusted EBITDA (Etsy Q1 earnings release)

The company notes that while it gained structural costs from employee and headcount efficiencies, higher advertising spend on the Super Bowl was a factor in dragging margins down (which, apparently, did little to offset softer top-line growth). It also noted that Etsy’s acquired subsidiaries, including Depop, represented a 300bps drag on margins.

Key takeaways

In my view, with disappointing growth results in Q1 potentially driving a harbinger for lower-than-expected second half acceleration, Etsy is structurally challenged heading into the remainder of 2024. I’d prefer to sell this stock and move to the sidelines.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.