Summary:

- I believe buying Etsy at 10x forward free cash flow is a fair entry point.

- Despite Etsy’s significant debt, its substantial and stable free cash flow makes it an attractive investment.

- If Etsy reduces its debt, it could become an even more attractive acquisition target, boosting its overall valuation.

grinvalds

Investment Thesis

Etsy (NASDAQ:ETSY) isn’t a blemish-free investment thesis, but overall much of the concerns have already been priced in.

The bull case can be surmised down to 2 considerations. Etsy’s active customers are up 1.9% y/y, showing that demand for its offering isn’t dissipating. This fact can’t be disregarded.

Secondly, even though I don’t specialize in these kinds of setups like Etsy, where a likely outcome is the stock being bought out, I certainly have seen enough times these low-growth names getting bought up at around at approximately 12x to 14x forward free cash flow, for businesses with a lot less growth and even declining revenues.

As mentioned already, there are a lot of moving parts, but I believe that the bulk of negativity has already been priced in, but none of the hope. Hence, I remain bullish here.

Rapid Recap

Back in April, I said,

To sum it up in a sentence, ETSY is cheaply valued. The stock is not blemish-free, but there’s a lot to like.

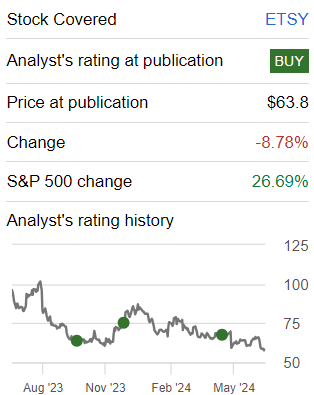

Author’s work on ETSY

I’ve been bullish on ETSY for some time. And thus far, we can clearly see that my recommendation has significantly underperformed the S&P 500.

And while I’m not the kind of person to double down on my conviction when I’m proven wrong, I strongly believe that there’s way too much negativity priced in now.

Why Etsy? Why Now?

Etsy is an online marketplace that connects buyers with independent sellers offering unique, handmade, and vintage merchandise. It serves as a platform for entrepreneurs to reach a large audience, providing tools for marketing these products.

In Q1 2024, Etsy reported an increase in active buyers to a record-high of 91.6 million, up 1.9% y/y, despite a challenging economic environment. This growth indicates that there is still potential for expansion within the business.

ETSY Q1 2024

The sustained high number of active buyers informs me there’s still demand for Etsy’s platform. Investors can fully disregard the share price and whatever else. If there’s demand for a company’s offering from its customer base, this is all the insight one needs to remain long the stock.

That being said, needless to say, Etsy faces several headwinds too. The broader economic climate remains tough, with consumers living with tight budgets.

These conditions require Etsy to push harder on marketing initiatives to drive growth.

On top of that, other challenges include the impact of increased competition, who offer everyday essentials at lower prices, which further complicates the investment thesis.

Given this background, let’s now discuss its fundamentals.

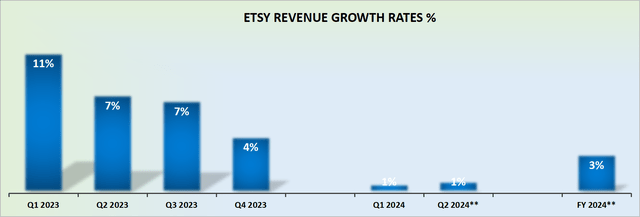

Etsy’s Revenue Growth Rates May Soon Improve, Slightly

In my previous analysis, I said,

Etsy’s revenue growth rates have stabilized. That’s the good news. Q1 2024 is likely to mark the low point of its growth rates in the near term. The problem here, and what’s weighing on the stock, is that Etsy’s growth rates are ephemeral.

In the best case, Etsy will deliver mid-single-digit growth rates in 2024. What’s more, a significant proportion of this revenue growth is driven by easier comparables with the prior year, combined with a small increase in its take rate.

Today, I’m not even sure that mid-single-digit growth rates are on the cards. There’s no doubt that the business is struggling for traction. And generally speaking, I know from experience that in most cases, businesses without topline growth have no place in public markets.

But if you think about it, Etsy’s comparable growth rates will naturally start to improve in another 2 quarters. Yes, the business’ growth rates are meager, but it’s a business with some growth left, and as such, it isn’t completely dead, particularly given its attractive free cash flows.

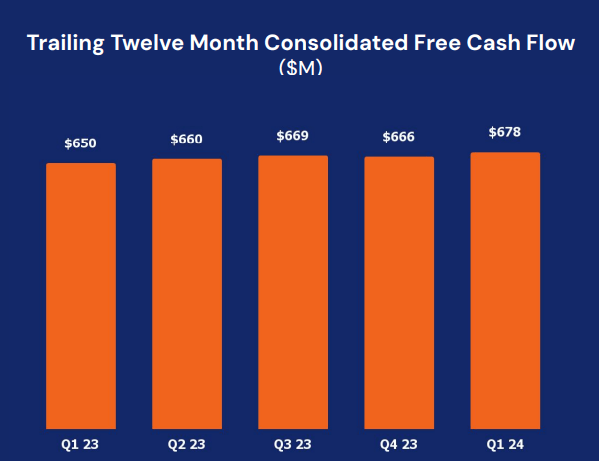

ETSY Stock Valuation — 10x Forward Free Cash Flow

ETSY Q1 2024

Etsy makes a considerable amount of free cash flow. And what’s more, the free cash flow is stable. Over the next twelve months, I suspect that Etsy could make $700 million of free cash flow.

Now, the one aspect where Etsy comes up short is that the business carries about $1.3 billion of net debt. Hence, I believe that Etsy’s best outcome would be if management decided to stop buying back its stock and worked to pay off its debt more aggressively.

Even though I recognize that “academically” the equity’s risk-premium is higher and the repurchases make more sense. But I also know that having too much debt on its balance sheet also increases the risk-premium on the stock.

Hence, by paying down some of its stock, this would lead to Etsy trading at a higher multiple. And perhaps, this would also lend itself towards Etsy being more “shoppable” to a private equity firm.

The Bottom Line

In conclusion, purchasing Etsy at 10x forward free cash flow represents a fair entry point, acknowledging the business’s substantial free cash flow generation.

Despite the notable concern of its $1.3 billion net debt, which masks the bull case, the current valuation appears reasonable. This is especially true given the stable and significant free cash flow, and the potential for improvement in revenue growth rates in the near term.

Reducing the debt load could further enhance Etsy’s attractiveness, potentially making it a more appealing target for acquisition and ultimately supporting the bullish perspective.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.