Summary:

- Elliott Management increased its stake in Etsy, Inc. to 5M shares, as per its 13F filing, signaling confidence in Etsy’s long-term potential amidst current investor pessimism.

- Although Etsy sees a decline in GMS and Active Buyers on the platform, it is investing in strategic initiatives like an app revamp, improved search, and loyalty program to boost purchase frequency.

- Meanwhile, its Gifting GMS is a bright spot as it grows above expectation, representing a higher share of Total GMS. With holiday season in the corner, gifting GMS should continue to rise steadily.

- Although the management has yet to translate its initiatives into tangible results, I believe the favorable FY25 comps environment should be favorable, driving sizable upside for the stock.

RgStudio/E+ via Getty Images

Introduction & Investment Thesis

I last wrote about Etsy, Inc. (NASDAQ:ETSY) in August, where I upgraded my rating from “hold” to “buy” as I believed that an improving macroeconomic environment and a robust product roadmap should set the company management to guide for GMS (Gross Merchandise Sales) acceleration in the second half of the year.

However, that was not the case, as GMS continued to decline in its Q3 FY24 earnings, driven by macroeconomic factors and mindshare events such as general elections in Europe and in the US and Hurricane Helen. As a result, the stock declined more than 18% since the time of my writing, underperforming the S&P 500 Index (SP500).

However, the latest 13F filing from Elliott Management showcases that the fund has upped its stakes in Etsy to 5.00M, accounting for 1.4% of its portfolio. At the same time, Etsy is also now in the Top 10 holdings in the firm.

There is no doubt that Etsy is seeing a decline in both GMS and Active Buyers, which has deeply dampened investor sentiment. However, the management is taking active steps to reposition the company towards long-term success. It is focusing its product investments on revamping its app experience to boost downloads, improving its Search algorithm to showcase greater diversity across users and sellers, and testing a loyalty program called “Etsy Insider” in beta to assess its impact on purchase frequency and size.

While these initiatives have yet to translate into tangible results, its GMS for gifting is a bright spot, as it is growing better than expected and representing a higher share of overall GMS compared to the same time last year. As Etsy continues to add several product improvements, along with rolling out physical Etsy gift cards in over 20,000 stores, it looks well positioned for the holiday season, especially as it doubles down on its niche market of “support small,” “originally made,” and “handcrafted goods.”

With investor pessimism so deep, I believe Elliott Management sees opportunity where the company is up against a favorable comps environment in FY25. As a result, I believe that the stock is attractively priced at its current levels, thus reiterating my “buy” rating with a price target of $73.

Three initiatives that can help Etsy turn around its business as Elliott Management increases stake

With Etsy shares down 36%, Elliott Management upped its stake in the company to 5M shares, accounting for 1.4% of its portfolio, putting it in the Top 10 list of all holdings. However, as the company suffers from ongoing GMS shrinkage from a tough macroeconomic environment, there are several initiatives that Etsy management has taken to reposition the company to succeed long-term while differentiating itself from the mass retailers of the likes of Amazon (NASDAQ:AMZN), Walmart (NYSE:WMT) and Temu, owned by Chinese e-commerce giant PDD (NASDAQ:PDD), among others.

While the company is yet to translate its strategic initiatives into tangible results, Elliott Management is taking a larger bet on the possibility of a turnaround.

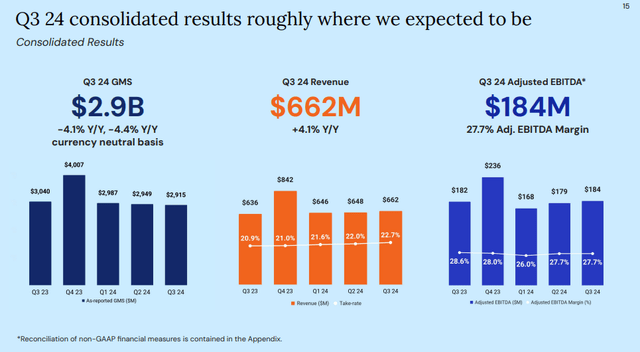

Most importantly, even though GMS declined 4.1% YoY, it still managed to grow its revenues by 4.1% YoY to $662.4M, driven by growth in both its Marketplace and Service segments. In the Marketplace segment, a higher take rate of 22.7% (compared to 20.9% in the previous year) contributed to the 3.3% YoY growth rate, while Etsy Ads were the primary driver of Service revenue growth of 6.2% YoY.

Q3 FY24 Earnings Slides: Trend of GMS, Revenue and Adjusted EBITDA

In an environment where mass retailers are focused on slashing prices to capture a larger share of the customer wallet, Etsy is doubling down on improving the overall buyer and seller experience on the platform that supports its niche market of “supporting small,” “originally made,” and “handcrafted goods.”

Allow me to elaborate on the three key initiatives that, I believe, will play a key role in the potential turnaround for the company.

First, Etsy is in the process of revamping its app homepage to allocate more screen real estate to inspire new shopping missions, especially for those who arrive without a clear idea of what they are looking for. During the earnings call, the management shared that the lifetime spend of a buyer increases by 40% when they download the app, yet less than half of their GMS is transacted on the app, leaving plenty of whitespace to drive growth. So far, the company has been experimenting to prompt more shoppers to download the app mid-journey, along with driving paid ads and optimizing its presence on the App Store. As they get more users to download the app, it should lead to a higher frequency of visits and higher spend per customer, as long as they are inspired along their buying journey to the ultimate purchase.

This brings me to Etsy’s second initiative. They are improving engagement within Search to better expose their Buyers to the breadth of offerings by retraining their search algorithms and adding indicators of high-caliber listings such as shipping charge, seller’s return policy, and shop’s level of customer service. So far, Etsy has seen an increase in the number of four and five-star buyer reviews and a decrease in both the number of reviews that are three stars or lower and buyer refund requests. While on one hand, improved buyer experience should lead to higher purchase frequency, Etsy has also given sellers more agency by launching the Etsy Search Visibility page within the Seller dashboard. That allows sellers to improve their position in search while tracking the improvements in real time.

Finally, turning our attention to Etsy’s third initiative, it is centered on boosting loyalty. They invited a targeted group of US buyers to join their new buyer-fee based Etsy Insider Loyalty program that offers free domestic shipping and discounts on selected items, along with other benefits. While the program is still in beta, Etsy will be testing it further to determine its impact on purchase frequency over time, as it helps them build a more in-depth relationship with the buyers.

Etsy setting itself to be the destination for gifting, even though Active Buyers and GMS per buyer decline

However, despite the company making investments to drive user growth and frequency of purchase on the platform, its Active Buyers declined 0.7% YoY to 96.7M, while GMS per Active Buyer also shrank 3.4% YoY to $123.

Meanwhile, the company managed to reactivate 6.4M buyers, which grew 5.6% YoY, as they expanded their spend on performance channels, particularly within Paid Social, which is having a positive impact so far.

Despite the highly mixed environment in which Etsy is operating, they were able to drive better than expected GMS growth for gifting, which now represents a higher share of overall GMS compared to the same time last year. With the management’s focus on making Etsy the destination for gifting, the company has added several product improvements during the quarter to help buyers browse and discover unique gift ideas, while tripling the number of gift ideas available to buyers.

At the same time, Etsy also rolled out physical Etsy gift cards at more than 20,000 stores in the US. Although gift cards represent less than 1% of their total GMS, I believe they are well positioned for the holiday shopping season this year. The ongoing product innovation helps set Etsy apart from other retailers as the destinations to discover and buy something special and unique rather than cheap and mass-produced.

The Profitability landscape is mixed

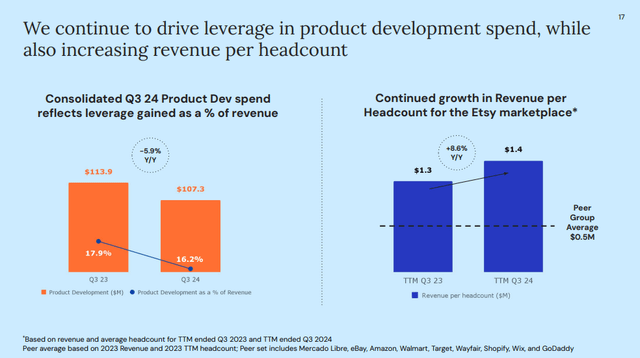

Shifting gears to profitability, Etsy generated $183.58M in Adjusted EBITDA, which grew just 0.8% YoY. However, Adjusted EBITDA margins shrank 90 basis points YoY as a result of slower revenue growth. Meanwhile, the management is driving leverage in product development spend while increasing revenue per headcount, as can be seen below, which offsets its Marketing spend amounting, which is growing faster than total revenue growth at 29.7% of Total Revenue.

Q3 FY24 Earnings Slides: Driving leverage through product development spend and revenue per headcount

However, ultimately investor sentiment will be revived when the company can attract a growing number of buyers with relevant commercial intent. That should translate into higher purchase frequency and size, enabling the marketplace to thrive and unlock operating leverage in the process.

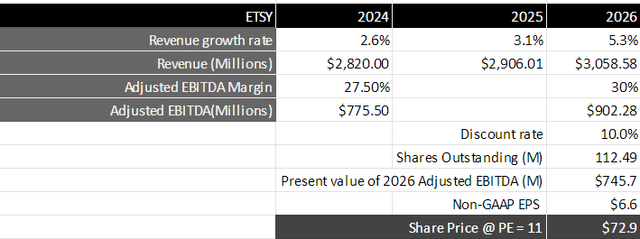

Revisiting my valuation

With the management guiding for full-year FY24 GMS to decline in the low single digit, I will take the consensus estimates into account, where revenue is expected to grow roughly 2.6% YoY to $2.82B. Moving forward, if Etsy sees a turnaround in its business given its strategic initiatives to revamp the app, improve the quality of Search and boost loyalty, we should see Active Buyers grow from current levels with higher purchase frequency and sizes. However, given that level of pessimism in the market, I will take the more cautious approach of taking low to mid-single-digit revenue growth over the next 2 years as per consensus estimates, which will translate to $3.05B by FY26.

From a profitability standpoint, the management is projecting an Adjusted EBITDA Margin of 27.4-27.7% for FY24. Assuming that Etsy can expand its operating leverage by 100 basis points every year into the next two years, especially as GMS per buyer improves along with increasing leverage from product development spend, it should generate $902M in Adjusted EBITDA. This would be equivalent to $745M when discounted at 10%.

Taking a 0.5-0.6 times the price-to-earnings multiple of the average S&P 500, given the slower growth in projected revenue during this period of time, we arrive at a P/E ratio of 11, which will translate to a price target of $73. This is an upside of 43% from its current levels.

My final verdict and conclusions

I believe the investor pessimism has gone highly extended at this point.

There is no doubt that Etsy has yet to translate its strategic initiatives into higher purchase frequency and order volumes per buyer, as it improves its App Experience to encourage more downloads, augments Search with greater diversity across items and sellers, and expands its loyalty program.

However, the pessimism has taken the stock to such a level that it ignores that its FY25 comps look quite favorable. While there are unknowns whether Etsy will successfully reposition itself in its niche of “support small,” “originally made,” and “handcrafted goods,” given the competitive landscape and a discerning customer, I believe that Elliott Management has correctly identified the magnitude of potential upside from a risk-reward perspective.

As a result, I will reiterate my “buy” rating with a price target of $73, which represents an upside of 43% from its current levels.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I am Amrita and I write primarily about growth software stocks.

I recently joined The REIT Forum and if you are looking for more investment ideas like this one, get them exclusively at The REIT Forum with access to our subscriber only portfolios.