Summary:

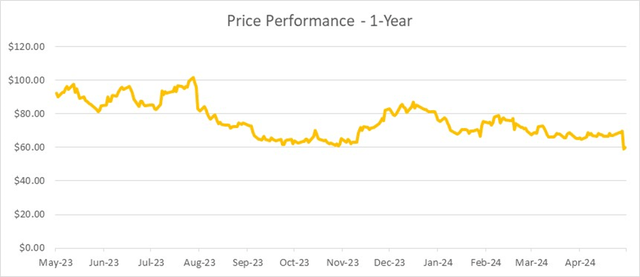

- Etsy’s shares dropped 20% after announcing lower-than-expected earnings and revenue.

- CEO attributes poor performance to pressure on consumer discretionary spending and removal of listings.

- Despite the large fall in price, there is still significant risk to be seen at the current share price given the lack of meaningful announcements to combat pressured consumer spending.

Robert Way

I believe that Etsy (NASDAQ:ETSY) is overpriced and that a correction could occur within the next 12 months due to less than expected growth from gift mode, continued pressure in consumer discretionary spending, and increased competition from more affordable alternatives who will seek to take Etsy’s market share as they actively ban millions of sellers from there platform, some unjustly.

Shares of Etsy were down roughly 20% in after-hours trading after the firm announced poor first-quarter results. To summarize, normalized EPS weighed in at $0.96 per share, short of analysts’ consensus of $1.00 per share. Revenue also fell slightly below expectations at $646 million, compared to the Street’s expectations of $647 million.

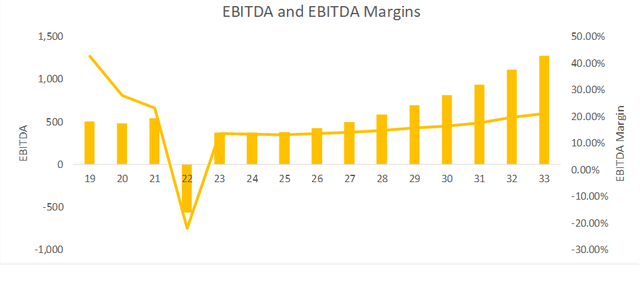

CEO Josh Silverman claimed this was largely due to increased pressure on consumer discretionary spending, as well as the removal of millions of listings in an attempt to combat violators of their handmade policy. Silverman then maintained guidance for annual revenue growth to outpace GMS growth, and EBITDA margins at least similar to FY 23.

Despite the large fall in price, there is still significant risk to be seen at the current share price given the lack of meaningful announcements to combat pressured consumer discretionary spending. Silverman did not make any major announcements to satisfy investors’ concerns, but insisted that company will continue to let “Etsy be Etsy”.

A Quick Recap

Beyond metrics falling short of Wall Street’s estimates, Silverman announced positive results from their Superbowl marketing campaign to raise awareness of their new Gift Mode, where shoppers can look for gifts for a specific person, rather than looking for a particular item. “The Gamer”, “The Music Lover”, and “The Adventurer” are some personalities you can choose from in this AI-powered feature. Silverman stated the Superbowl commercial made 100 million impressions, and are seeing a 200% increase in conversation volume around Etsy and Gifting.

Sell-side analysts seemed particularly concerned with poor GMS numbers, seeing as GMS weighed in at a 4% YoY decline. Analysts from Canaccord Genuity and Loop Capital inquired about the possibility of keeping up with Chinese competitors and whether or not GMS will improve throughout the year. Silverman exhibited a lack of confidence in reassuring analysts that GMS would come out positive at year-end and that, at best, GMS might even out at the end of FY 24.

Other concerns analysts raised were over the outpacing of sellers to buyers for 12 quarters in a row, and the potential issue of improving search capabilities as a result. Silverman is hoping their new security fees and removal of tens of thousands of sellers for violation of their handmade policy will resolve this. However, a quick google search shows that many real sellers who have been making handcrafted products on Etsy for years are being unjustly banned as well.

These concerns have validity that lead to the lower price after earnings, but a deeper analysis of management’s commentary combined with observation of industry and macroeconomic events shows cause for further concern with this stock.

A Deeper Dive

As a reminder, Silverman attributed low Q1 performance to increased pressure on consumer discretionary spending. Since earnings were announced, economic troubles have continued and the fed is less likely to provide relief in the form of rate cuts. While some recent news has emerged of higher than expected unemployment and dovish comments from the fed, it is very likely we will not see any rate cuts until September or November of FY 24, with the aftermath of less pressure on consumer discretionary spending not being felt until FY 25. Rather than adopt their platform to survive in this pressured consumer spending environment, the company seems to maintain its belief that Etsy’s differentiated strategy from Chinese counterparts sets it apart and will allow it to continue to profit during harder economic cycles. However, the numbers in their Q1 earnings certainly do not suggest that is the case.

Furthermore, management stated the removal of millions of listings from Etsy contributed 50 bps to the GMS decline. While a majority of these removals were most likely non-handmade products, there were many sellers who were wrongfully removed despite having genuine handmade products. While some of these sellers will communicate with customer support to reinstate their accounts, many will turn to alternate options, such as Amazon, Chinese websites, or making their own seller website.

Why Could a Fall Occur?

While Gift Mode from Etsy may seem like an innovative idea, it is actually a reinvented one. Online retailer UncommonGoods made a similar move in 2017 with “Sunny”, an AI-driven gift guide that receives inputs of who you are shopping for, and provides product suggestions. Another direct competitor, Amazon, has a similar function with their “Find a Gift” feature, which makes it seem like Etsy is simply playing catch-up. While the company also plans on rolling out a loyalty program and building its user base on its app, I simply think it is too little too late for Etsy to stay competitive with other firms trying to take market share.

With a struggling consumer, lack of innovation, and the active removal of thousands of genuine sellers from its platform, Etsy will likely continue to struggle in the future. While management and analysts seem to think Etsy will be able to rebound, these key indicators I have mentioned paint an ugly picture for Etsy’s future. A look into how this might impact their operations in the next ten years and how that might affect their current valuation illustrates this.

A Look into the Future

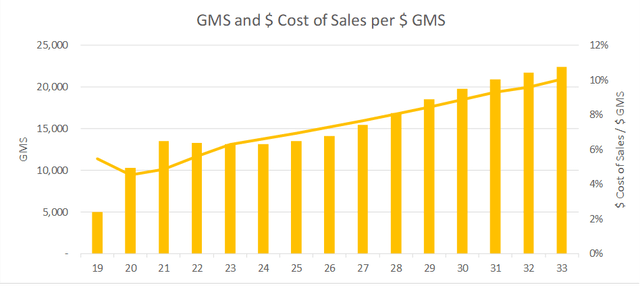

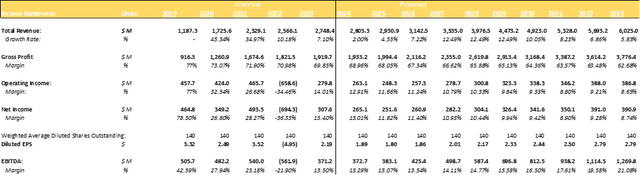

The company announced results largely in line with market expectations, so my forecasts for future periods have not been updated. I see Gift Mode helping Etsy flatten out GMS for FY 24, based on company-disclosed announcements. This contributes to helping Etsy continue to grow GMS in future periods. I see revenue growing to ~$4 billion by FY 33, behind of consensus estimates. Annual results for FY 24 will largely be in-line with company guidance.

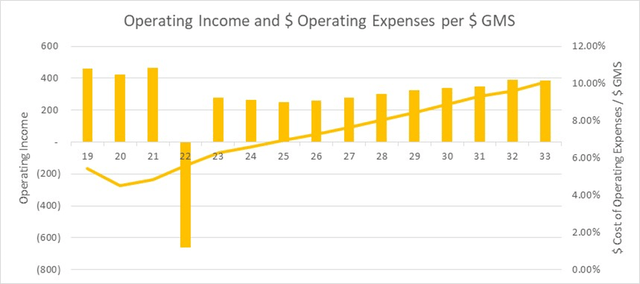

I see potential for slight gross margin contraction going forward, as Etsy has historically had cost of sales outpacing revenue growth. I expect this trend to continue in the future at a similar rate to historical years. In terms of operating expenses, it seems the company has put a greater emphasis on marketing and development, based on management commentary. I believe this trend continues in the future.

Assumptions:

GMS

I predict revenue growth to be 0% in FY 24, given the company’s guidance. In FY 25 I anticipate a slightly larger 2.5% growth in GMS, considering potential purchasing increase from Gift Mode and expanded consumer discretionary spending. By FY 27 I expect GMS growth to expand to 9.5%, which is the long term expected growth rate in GMS from FY 24 to FY 29 according to Statista.

Marketplace and Services Revenue

I predict revenue growth to be 2% in FY 24, given the company’s guidance. In FY 25 I anticipate a slightly larger 5% growth in revenue, considering potential purchasing increase from Gift Mode and expanded consumer discretionary spending. By FY 27 I expect revenue growth to expand to 12%, in line with broader anticipated growth in consumer discretionary spending.

Cost of Sales

Given my assumption that cost of sales will outpace revenue growth, I see cost of sales continue to grow by 2-3% more than revenue.

Operating Expenses

In years where the firm does not expand its sales force, I assume the firm can decrease its operating expenses as a % of GMS by 10%. Historically, in years where the company has expanded their marketing and development costs, this percentage has been higher. My estimate sits more on the conservative side, as management seems to be focused on increasing operating efficiency.

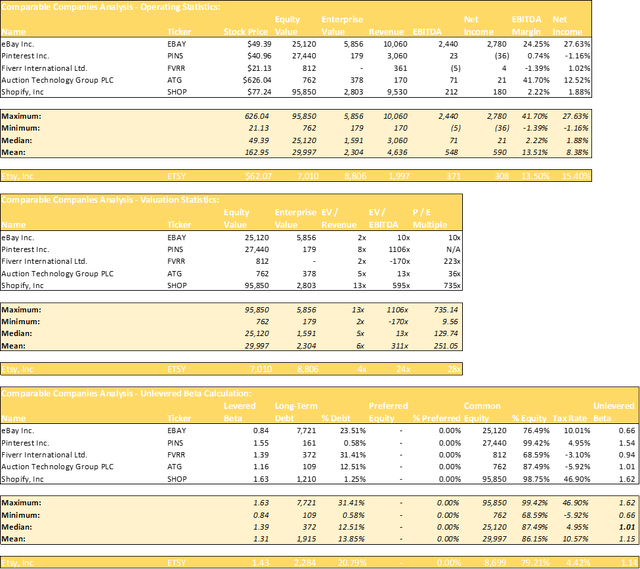

Comparable Companies

Since all of these companies generate revenue and most are profitable, I view revenue and EBITDA multiples as meaningful. I place less weight on P / E multiples, given the wide range of valuation for firms in the E-commerce industry. The median EV / EBITDA multiple is currently 13x. Given that Etsy’s revenue, EBITDA, and EBITDA margins all exceed the median metrics of those for the comparable public companies, I think that EBITDA multiples more in-line with at least the median of the set are justified. The median EV / Revenue multiple is currently 4x. Given that Etsy’s revenue exceeds the median metrics of those for the comparable public companies, I think that revenue multiples more in-line with at least the median of the set are justified.

The DCF

I have forecasted Etsy’s P&L as follows:

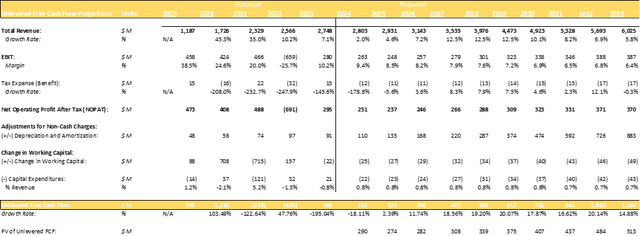

I then calculated Unlevered Free Cash Flow as follows:

Assumptions:

Discount Rate

8.51%, based on the firm’s capital structure, WACC for comparable public companies and targeted capital structure in-line with comparables.

Terminal Value

Long-Term Free Cash Flow Growth Rate of 0%, or, alternatively, a Terminal EBITDA Multiple of 12.0x.

Other: End-of-year Convention used

The Output

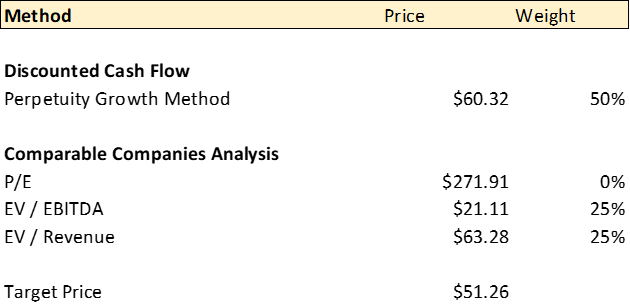

DCF, Comparable Companies Analysis

Given the relevance of comparable companies analysis to the company’s valuation, I placed a weight of 25% on the EV / EBITDA and EV / Revenue multiples target prices, with the remainder being placed on the discounted cash flow analysis.

After Etsy’s drastic drop, the market now values Etsy at $7 billion in equity value. Adding debt & financing leases and subtracting out the company’s cash converts this to an enterprise value of around $9 billion. I see the stock falling a further 17% given my base-case assumptions. My target share prices are as follows:

Bull Case

$91.07, based on a revenue, cost of sales, and operating expenses CAGR of 11%, 11%, and 7%, respectively, through FY 33.

Base Case

$51.26, based on a revenue, cost of sales, and operating expenses CAGR of 8%, 11%, and 8%, respectively, through FY 33.

Bear Case

$33.90, based on a revenue, cost of sales, and operating expenses CAGR of 7%, 11%, and 8%, respectively, through FY 33.

Could Etsy Prove Doubters Wrong?

The following represent the greatest risks to my investment thesis:

Better than Anticipated Growth from Current Initiatives- It is possible that revenue increases by a significant amount from Gift Mode, the loyalty program, and transitioning more users to the app. would make it difficult for Etsy to grow revenues by the conservative percentages I have assumed.

Rebound in Economy – My analysis relies on a struggling consumer economy throughout FY 24 and into FY 25. If spending unexpectedly increases in this time frame, it will increase GMS growth by more than my forecasts.

Potential Ban of TikTok – Currently, TikTok is suing the U.S. government to prevent enforcement of a bill passed recently to force ByteDance to sell the app or have it banned from the U.S. While exact numbers do not exist, it is likely that TikTok’s shop platform is taking significant market share from Etsy. If the app ends up being banned, Etsy could see a large influx of shoppers and sellers alike.

Conclusion

In light of this DCF analysis, I am confident Etsy could see another price drop within the next 12 months. It would be wise to stay away from buying the stock at its current valuation. To provide some ideas for a time horizon, keep an eye out for news regarding the ban of TikTok, as their shop platform serves as a direct competitor to Etsy. Additionally, I will be watching how the numbers look from Gift Mode’s contributions throughout the year. Finally, I would pay attention to any economic data on consumer spending, as a rebound in these metrics could cause GMS to bounce back.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.