Summary:

- Etsy’s current low valuation and stock buybacks provide downside protection. There is potential for significant upside if growth resumes, making the risk-reward favorable.

- Etsy’s large addressable market shows the recent sales weakness isn’t due to saturation.

- Etsy’s new search engine implements a quality score system which aims to improve customer satisfaction & increase repeat buying by promoting high-quality, unique items and good customer service.

- Management is trying to get consumers to think of Etsy earlier in their shopping journey. If they succeed, the firm will reignite growth.

- If Etsy can successfully create a subscription loyalty program, investors will reward it with a higher multiple.

Sladic/E+ via Getty Images

Risk-Reward Favorable

How you view Etsy, Inc. (NASDAQ:ETSY) depends on your perspective. It’s easy to look at the recent past and see lackluster growth since the 2021 pandemic burst. Furthermore, the firm made a terrible acquisition of Depop at the peak of the resale/online spending craze. Etsy stock has fallen so much, it was recently removed from the S&P 500. However, I think the lack of business momentum is more than priced into the stock. The cheap valuation and heightened stock buybacks will protect your downside. If growth resumes, there will be a multiple re-rating, pushing the stock higher. Therefore, the risk-reward makes a lot of sense.

This reminds me of my investment in Match last year. I believed the stock would rally if management turned around Tinder by supporting community health (removing bots & increasing safety). If they couldn’t execute, I thought it had valuation support and strong buybacks to limit my downside. In the end, Tinder didn’t meet my expectations over the next few quarters, but I still made a small profit due to my low entry valuation. I like making money even when I’m wrong. With Etsy, I believe you can own the stock for the next 1-2 years while we wait for growth to re-accelerate. If it doesn’t, you can walk away without a loss (unless there is a recession). If the turnaround goes well, it will be a big winner.

Management Is Barking Up The Right Tree: TAM Not A Limit

When I started researching Etsy, I first looked at what disaffected users and the bears were saying. The main criticism is Etsy is losing its way and becoming just like other online marketplaces. Etsy is supposed to be different from other ecommerce marketplaces because it has a human connection. Each product is unique because it is handmade or hand-selected by the seller. This brings the human connection back to ecommerce which has otherwise become a race to the bottom where commoditized products are sold at the lowest price. Disaffected participants believe the essence of Etsy has deteriorated due to low-quality sellers pushing dropshipped products which are far from handmade.

Getting back to the Match analogy, I believe management failed to reignite Tinder subscriber and user growth because they focused on price increases and marketing instead of community health. Trust and safety need to be paramount to strengthen an online community whether it’s a dating app or a small business ecommerce marketplace. Getting more customers to check out the same broken product and charging them more will help financials in the short run, but won’t improve customer lifetime value. I believe Etsy’s management is taking the right steps to reignite long-term value by promoting community health which I will discuss in future sections.

First, let’s look at the market size to make sure saturation isn’t the issue. I think Etsy has low penetration in a very large addressable market. Consumers don’t shop for handmade items. They shop for items within a category. For example, if a consumer wants a sweater, they want something that looks good and speaks to them. If that sweater, happens to be handmade or designed by an individual artist, then so be it. This is just like how consumers don’t differentiate between online and offline purchases. They just want the best deal and a product that speaks to them. Therefore, the entire categories Etsy competes in are its to take. The personalized aspect of its products being handpicked or designed is a selling point to differentiate them.

Therefore, I think Etsy’s $2 trillion addressable market that management cites is relevant. The current 2% penetration rate doesn’t imply Etsy will get anywhere near full penetration. The point is to recognize, there’s nothing stopping consumers from shopping for more home goods or apparel on Etsy. The company just needs to execute on providing a healthy community focused on high quality items where trust & safety are at the forefront. Furthermore, 30% of women and 10% of men in the US & the UK have shopped on Etsy in the past year. There are over 100 million formerly active buyers Etsy can reactivate if the firm makes it easy to find quality products with a personalized touch.

Focus On Quality: Enforce The Rules

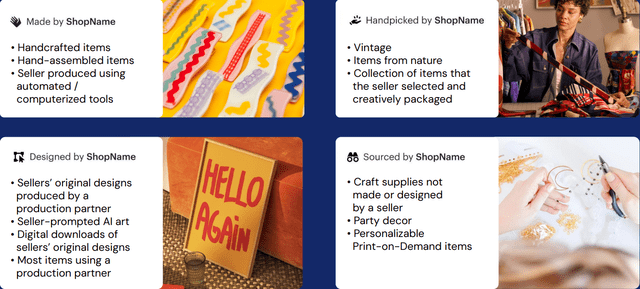

To be clear, Etsy doesn’t allow dropshipping on its platform outside of craft and party supplies. Dropshipping is selling products from a third-party supplier without customization or changes to the product. Etsy also doesn’t allow reselling items the seller didn’t make outside of craft and party supplies, vintage items that are handpicked, and personally selected gift baskets. Etsy sellers can use production partners if the seller designed the item or the buyer customized it.

Of course, rules don’t matter if they aren’t effectively enforced. Etsy has recently increased its enforcement to solidify the integrity of the site. Etsy cares more about improving the buyer’s experience than adding new low-quality sellers. The platform already has 7 million sellers with over 100 million listings. Sellers that break the rules can be eliminated without significantly hurting gross merchandise sales (“GMS”).

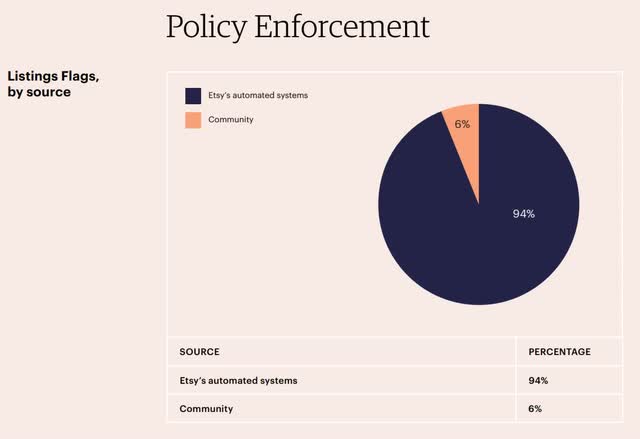

According to Etsy’s 2023 Transparency Report, the firm removed 4x the number of listings for violating the handmade policy that it did in 2022. Users saw content that violated this policy 60% less than they did in 2022. As you can see in the chart, 94% of listing flags came from the automated system which is necessary due to the sheer scale of the problem. Allowing some products to slip by would temporarily increase GMS by a small amount, but degrade the platform long term.

Etsy 2023 Trust & Safety Report

In 2024, Etsy instituted creativity standards to show off which part of the process sellers are involved in. It’s worth noting that The Verge completely misrepresented this policy with the headline “Etsy loses its ‘handmade’ and ‘vintage’ labels as it takes on Temu and Amazon.” In fact, Etsy’s goal with its new creativity labels is to show off how sellers’ products are made with better descriptions to differentiate from Amazon.com, Inc. (AMZN) and PDD Holdings Inc.’s (PDD) Temu. If you are researching this topic, let it be known the policy is the exact opposite of that headline.

The new four categories are “made by,” “designed by,” “handpicked by,” and “sourced by.” Handmade products are in the “made by” category and vintage products are “handpicked.” Etsy elevated its differentiation by adding two new categories. The slide below details the specifics of how products fit into each category. The Verge headline misrepresented this change because of the emotional response it generates from sellers and buyers who are very passionate about keeping Etsy homemade to support small businesses. This passion highlights how important the marketplace is to the community of people who want to keep ecommerce personal and authentic.

Entirely New Search Engine

Etsy completely re-engineered its search engine to push quality unique items. Search is Etsy’s most important function because the marketplace has over 100 million items. Furthermore, these products don’t map to a catalogue or have a stock-keeping unit (“SKU”) which makes the search more challenging for Etsy than other stores.

The average search result yields over 1,000 listings. Buyers only have the patience to look through a few listings. Instead of trying to optimize for as much GMS as possible, Etsy is trying to surface the highest quality products even if they don’t perfectly meet the search requirements. The goal here is to increase customer satisfaction to raise lifetime value instead of just trying to generate a sale on that search. Etsy’s engineers needed to spend a lot of time to make sure this new algorithm didn’t hurt GMS (they succeeded in testing).

The new search algorithm launched in early September. Since the goal wasn’t to increase GMS right away, investors might miss the improvement when they don’t see better topline results in Q3. The results will be seen in the financials over the intermediate term. While we can’t see higher GMS, we can see how the service is working. There has been a 50% decline in searches where a high percentage of listings seen on the first page are from one seller. There has been a 70% reduction in the number of searches that have two or more nearly identical products. These enhancements are increasing the visibility of more shops. Small- and medium-sized shops had their share of search impressions increase by almost 30%.

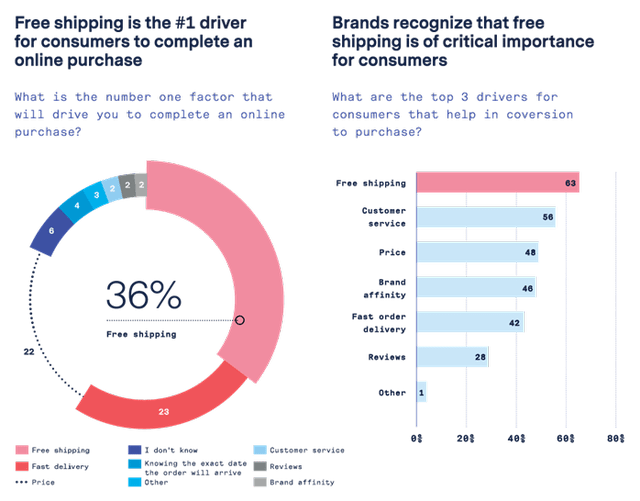

Increasing the quality weighting encourages sellers to provide better service. Let’s look at the specific components of quality. One of the most important changes Etsy is pushing is cheaper shipping. Consumers hate paying for shipping. As you can see from the survey I found, 36% of consumers said free shipping is the #1 driver for them to complete an online purchase. Etsy isn’t pushing for free shipping here, but it is setting a $6 limit. If normal-sized items cost more than $6 to ship in the US domestically, they won’t be promoted in search.

It’s pretty simple, sellers should raise product prices and lower shipping prices. Consumers have almost an irrational hatred towards paying for shipping even though there’s obviously no such thing as “free shipping.” Someone needs to pay for it. It’s usually the buyer just paying a higher price for the item (hidden shipping cost). When Etsy asks consumers why they haven’t shopped more on its marketplace in surveys, the first answer is they don’t have a need for it because they don’t think it will have what they are looking for. The second-most common answer is shipping is too expensive.

Besides shipping costs, the quality score takes into account shipping time, review ratings, the photography of the item, and the refund policy. Consumers are sometimes hesitant to buy from small businesses on Etsy because of inconsistent refund policies. This quality score enforces having a customer-friendly return policy. Furthermore, sellers can see their quality score and the score on each item to incentivize quality improvement which will get them a higher search ranking. Charlie Munger is famous for saying, “show me the incentive, and I will show you the outcome.” Now sellers are more incentivized to give good customer service. This will increase repeat buying.

This quality search algorithm fits hand in glove with the firm’s existing Star Seller program. To recap, Star Sellers get a badge on their page and have a greater chance of being featured. This gives them more web traffic and higher sales. To become a Star Seller, sellers must answer shoppers’ questions within 24 hours, have a 4.8 rating or higher, ship orders on time with tracking/use an Etsy label, and have at least five sales worth $300 in the recent quarter. Essentially, quality search reinforces the Star Seller program’s goal which is to promote quality service/products.

Getting Buyers To Think Of Etsy Earlier

One of Etsy’s biggest problems in recent years has been shoppers only going to Etsy after they figure out what they want. For example, someone might want to buy a specific Halloween costume on Etsy. Etsy wants to expand its share of customers’ wallets by having them go to the platform before they know what they want. For example, visiting it in the early stages of planning a Halloween party before shoppers know exactly what they need. Etsy is putting themed suggestions under the search bar (such as Halloween shop) to develop this shopping muscle memory. It is also curating products on its home page, but curation is still in its infancy. This will likely be the next push in 2025. The firm will use a combination of machine learning and human picks to highlight items that push toward this wider discovery shopping experience.

The firm recently created a Gift Mode to help customers figure out what they should buy for friends/family. The app also includes gift lifts to organize potential purchases for each event (birthdays/holidays). The gifting market is $200 billion; Etsy has about 1% of it. Personally, I’ve used Etsy for gift-giving numerous times because it feels more genuine when you get someone something unique and handmade. You don’t want to buy someone the cheapest commodity product you can find at the store.

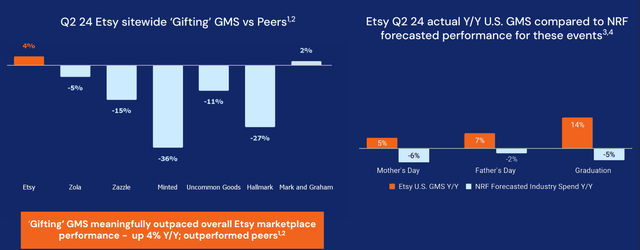

Etsy had 4% growth in gifting sales in Q2 which doesn’t sound impressive, but the firm claims its competitors mostly had declines as you can see below. Furthermore, individual holiday spending beat NRF forecasts. Better macro conditions will show us how much growth these changes catalyzed.

Etsy is pushing its sellers to make videos that show how they make their products. This highlights the personal touch that differentiates its marketplace from other mass-produced commoditized ecommerce websites. As you can see below, these videos show products in the “made by” category. This counteracts TikTok’s push into social commerce. There’s nothing more authentic than seeing a product made by hand by a small businessperson. TikTok can’t compete with this.

On that note, in 2023 Etsy launched a program which lowers fees for sellers who generate sales on their own channels (e.g., business cards & social media posts). The Etsy Share & Save program gives sellers an instant refund of 4% off the eligible order total in their Etsy Payment account balance. This is fair because the main reason for being on Etsy is to generate impressions from buyers. The second-biggest reason is that sellers benefit from the trust & safety implicit in the Etsy brand.

Loyalty Program In Beta

You would think Etsy would already have a strong subscription-based loyalty program since the marketplace was founded in 2005. Amazon and many other ecommerce sites have mature subscription bases. However, it’s not as simple to create a loyalty program with mostly small artisans. The Etsy Insider loyalty program launched in beta mode (invite only) this week. Etsy sent invites out to occasional buyers to see how the program’s benefits impact their shopping patterns.

This program isn’t exactly reinventing the wheel. It offers free shipping on millions of domestic items, discounts, and first-access merchandise. The goal is to increase repeat buying by making Etsy the marketplace subscribers start their shopping journey on. This gets us back to the point of Etsy wanting to be top of mind when consumers have an idea of what they are looking for, but not specific items yet. This creates a new shopping habit and increases spending per visit.

The test won’t cost the firm money because they aren’t offering free shipping to habitual buyers who spend so much money on the service that they would cause shipping costs to explode. I view this beta test as a way to figure out a starting price point for a loyalty program and which benefits shoppers want to be included in it the most. Etsy stock will get a higher valuation if this program is successful because investors love recurring revenues.

Pushing App Downloads

Just like with the loyalty program, it’s surprising that Etsy hasn’t been pushing app downloads as much as it could have in prior years. Etsy still has room to increase buyer app download penetration (peers have much higher penetration). Forty percent of GMS comes from the app, but substantially less than 40% of traffic comes from it. This shows app users spend much more than mobile web/desktop users. Sixty-eight percent of GMS in 2023 came from purchases made on mobile devices. Ideally, almost all of these purchases will come via the app.

The firm will be making two changes to increase downloads. It is going to put its experiments on the app first instead of the mobile web. Management wants to make the app the best place to shop. Secondly, Etsy will be pushing mobile web users to download the app by increasing friction on the web. I’m sure this will annoy shoppers, but sometimes firms need to aggressively nudge customers to do something to increase their lifetime value. Think of Spotify annoying listeners into trying podcasts. Etsy needs to get shoppers to think of it at the start of their buying journey. The best way to do this is to have them download the app.

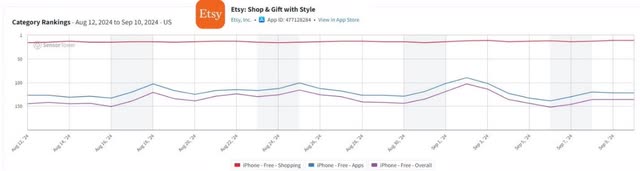

Etsy’s app has a very strong rating on the Apple App Store. It has an average score of 4.9 stars with 5.9 million ratings and is an Editors’ Choice. In the past month, it has ranked between 16th and 11th place in the iPhone free shopping category. I don’t see much of an impact on app downloads/usage from the search algorithm change in the first few days of September which is a positive.

We are currently in the Halloween shopping season which is important for crafting, decorating, and costumes. Obviously, the most important months will be November & December due to holiday shopping.

Marketing Changes & Website Data

Etsy wants to be top of mind when consumers make a purchase. The best way to get there is to create a safe and secure marketplace. I don’t think marketing alone can turn the business around, but it’s key that it works in sync with product enhancements. In its annual report, the firm likes to say it only generates 20% of its GMS from performance marketing, meaning 80% comes from organic brand awareness. However, that’s a bit disingenuous since it spent $162 million in 2023 on brand awareness advertising. That was 26% of its budget last year.

Etsy shifted even more to performance marketing and away from brand marketing this year. In Q2, performance spending was up 31% year over year and brand spending was down 26%. I’m curious about what percentage of GMS will come from performance marketing in 2024 since there has been less brand awareness spending. I grant management’s point that the Etsy brand is ubiquitous. According to a 2023 survey, Etsy had 90% aided brand awareness among consumers in the UK and US. Etsy is trying to use marketing to grow awareness in key shopping categories like gifting. Only 10% of US buyers named Etsy as a place to shop for gifts in 2023. Let’s see how the push towards gifting this year impacts that survey when it’s updated.

The specific type of performance marketing Etsy is pushing the most this year is mid-funnel social media marketing on Facebook and Instagram. The firm is moving away from TV branding ads and Google product listing ads (“PLAs”). PLAs have historically had high a conversion rate. As I stated, the new marketing goal is to bring people into the marketplace who have a generalized need. For example, Etsy wants to target people on social media who are planning a baby shower. The new discovery tools will help shoppers figure out what they want to buy for the baby shower on the Etsy platform.

As you can see above, in August, Etsy’s website had 423 million visits which is below eBay Inc.’s (EBAY) 630.1 million. Etsy’s August visits were up 2.3% from July, which outperformed eBay which had a 0.4% decline. 60% of traffic came from mobile and 40% came from desktop. Etsy is the 26th most popular website in America, 74th globally, and ninth in the SimilarWeb Marketplace category. Just like with app downloads/usage, I don’t see much of an impact from the search update on web traffic as compared to eBay in early September.

Etsy’s Moat Described By An Unsatisfied Seller

In doing my research on Etsy, I have discovered some disaffected sellers who ironically have provided great explanations of the marketplace’s power. Etsy recently changed its policies to no longer allow artisanal sex toys to be sold on the marketplace. This was likely to make it easier to police the website and avoid a scandal. One of the sellers who had their products taken down gave a great quote which shows the power of Etsy’s competitive advantage.

“If I want to find products that are handmade – unless I knew of their existence beforehand through Etsy – finding them is incredibly difficult.”

They called Google advertising “prohibitively expensive” and said products from small businesses are often buried in search results. Even a seller who was angry with an Etsy policy admitted there is basically no other option for small businesses making handmade items. That’s a wide moat.

High Interest Rates Hurt Etsy

It’s obvious that Etsy was helped a lot by the pandemic because online shopping increased during lockdowns, spending rose because of the stimulus checks, there weren’t any shortages on its marketplace, and advertising got cheaper because in-person consumer product/service companies stopped marketing. Furthermore, sellers had extra time on their hands and a need for cash. $875 million worth of fabric face masks were sold on the platform from April 2020 to April 2021.

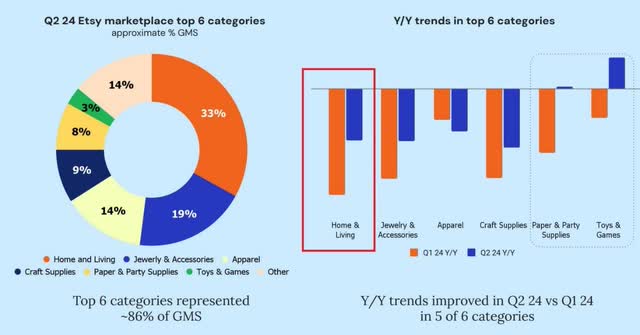

Before delving deeper into the company, I didn’t realize how much Etsy has been hurt by the weak housing market (caused by high rates). Home & living represented 33% of Etsy’s GMS in Q2 2024. As you can see below, this category had a sharp drawdown in 1H 2024. The recent decline in interest rates is likely helping the housing market. This could have a trickle-down positive impact on the home & living category.

Stock Valuation & Capital Allocation

Whether you think Etsy is cheap or fairly valued depends on your growth projections over the next few years. Since I think we will see double-digit EPS growth from 2025-2027 (barring a recession), I think it’s cheap. The stock trades at 10.9x 2025 non-GAAP EPS estimates. From 2025 to 2027, EPS is expected to grow 7.7%, 9.4%, and 7.3%. Value investors like to subtract stock-based compensation from adjusted earnings and look at GAAP results. The firm had $74.7 million in stock-based compensation in Q2 (TTM $284 million).

It trades at 24.7x TTM GAAP earnings which is high if you don’t expect much growth. One problem with TTM GAAP results is net income had a $7.2 million hit in Q2 due to a retroactive non-income tax expense. Of course, there’s always a challenge with using trailing results to value a company. On the positive side, about 90% of adjusted EBITDA was converted into free cash flow in the past year. The stock trades at 10.3x trailing FCF which is cheap even for a low growth firm.

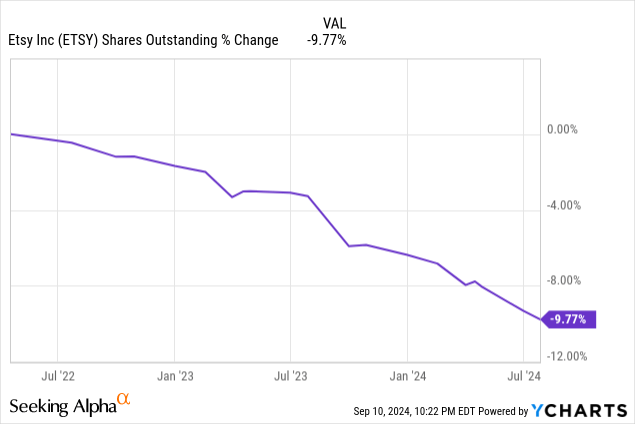

The current CEO has been at the helm for 7.5 years. However, the current CFO is retiring. I doubt the company will look for a CFO with different capital allocation plans. The company has been aggressively buying back shares in the past couple of years. As you can see below, even with its stock-based compensation, shares outstanding have declined by about 9.8% in the past 2.25 years. The decline rate will probably increase in the next few years if the stock stays this cheap. From 2017 to 2023, the firm used over 60% of its FCF to buy back shares. In 2023, it used 87% of its FCF on buybacks. In the first half of 2024, it used 154% of FCF which is unsustainable.

The firm has $1.1 billion in cash/short-term investments and $2.3 billion in long-term debt. The firm’s TTM adjusted EBITDA is $764.5 million which means its net debt leverage ratio is about 1.6x. Management could borrow money to buy back shares or do a large acquisition, but I don’t think that’s a smart idea.

The last acquisition was a disaster in my opinion. The firm spent $1.625 billion in mostly cash on Depop in 2021. This was the peak of the resale ecommerce bubble during the pandemic. I wish they would have at least used expensive Etsy stock to do the deal. I could have told management this was a bad idea because, in June 2021, I said ThredUp was a sell. The resale website’s stock is down 96% since then. I don’t like the business model of reselling used inexpensive clothing. Plus, I think the industry is too competitive. Regardless, I expect modest growth from Depop in the coming years; it doesn’t hinder my bull thesis on Etsy (it’s too small to do so).

Risks To The Thesis

Etsy was able to withstand competition from Amazon Homemade which wasn’t the Etsy killer some people feared. Even though Etsy dominates the homemade small business ecommerce category, it still has fierce competition from new & resale ecommerce websites along with physical stores. Etsy competes with all clothing retailers which sell cheap fast fashion items. Etsy needs to show it’s worth spending extra money on homemade/vintage apparel. Furthermore, in the home & living category, Etsy competes with Home Goods which is owned by The TJX Companies, Inc. (TJX). TJX is probably one of the best-run retailers in the world.

Etsy is very susceptible to a recession because their products are discretionary and often priced at a premium. There is nothing more discretionary than the $64 I spent on homemade pickles and homemade apple butter on Etsy (even though they tasted amazing). Inflation is coming down which is great for the consumer. Unfortunately, the US labor market is weakening (hiring down 3.7% year over year in July) and consumers are tapped out. The US personal savings rate was only 2.9% in July which was one of the lowest readings in history even though high interest rates incentivize people to put money in savings accounts.

Etsy management likes to talk about how 2021 pulled forward demand. That is true, but I don’t think you can keep making the same excuse in 2024. There could be a deeper issue with the marketplace that I’m not seeing. Maybe the change the firm made to its search function won’t increase customer lifetime value as I expect it to. It’s possible none of the changes I discussed move the needle enough to re-accelerate sales growth.

There is a small political risk that the de minimis rule that goods worth less than $800 can enter the US duty-free goes away. However, I don’t think changes will hurt Etsy. If anything, they will help Etsy because bipartisan legislation has been introduced to prevent large companies like SHEIN and Temu from using the rule as a loophole to avoid taxes. In all likelihood, nothing will get done in the near term. I doubt legislators will look to punish small businesses on Etsy, but there could be unintended consequences from a new law. Lowering the threshold from $800 would be a negative. However, if anything it should be raised because there has been a lot of inflation since 2016 when it was last adjusted.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.