Summary:

- I used to be bullish on Etsy, but now I think its upside potential is too muted to justify the risk.

- Even at 8x forward free cash flow, which seems like a bargain, I believe Etsy’s growth challenges diminish its long-term appeal.

- Etsy’s competition with giants like Amazon makes it hard for the company to stand out and maintain steady growth.

- I think Etsy should focus on paying down its debt and potentially seeking a take-private buyer, rather than continuing stock repurchases without clear growth prospects.

georgeclerk

Investment Thesis

Etsy (NASDAQ:ETSY) is one of those stocks that look optically a terrific bargain. Priced at 8x forward free cash flow, it’s undoubtedly cheap. But I now update my thesis to discuss that although I used to be bullish on ETSY, I now believe that cheap alone won’t make this investment compelling.

Today, I believe that its upside potential is rather muted and the risk-reward is roughly balanced. All in all, I believe that there are better opportunities elsewhere.

Rapid Recap

In my previous analysis back in June, I said,

Etsy isn’t a blemish-free investment thesis, but overall much of the concerns have already been priced in.

The bull case can be surmised down to 2 considerations. Etsy’s active customers are up 1.9% y/y, showing that demand for its offering isn’t dissipating. This fact can’t be disregarded.

Secondly, even though I don’t specialize in these kinds of setups like Etsy, where a likely outcome is the stock being bought out, I certainly have seen enough times these low-growth names getting bought up at around at approximately 12x to 14x forward free cash flow, for businesses with a lot less growth and even declining revenues.

As mentioned already, there are a lot of moving parts, but I believe that the bulk of negativity has already been priced in, but none of the hope. Hence, I remain bullish here.

Author’s work on ETSY

With another quarter of earnings results on which to base my judgment, I now believe that I was too optimistic on Etsy. And I now believe that its prospects are fairly priced. Here’s why I changed my mind.

Etsy’s Near-Term Prospects

Etsy is an online marketplace where independent sellers offer unique, often handmade or vintage, to buyers. The platform stands out for its focus on creative and personalized items, distinguishing itself from larger e-commerce sites with mass-produced goods.

Etsy’s value proposition is rooted in “keeping commerce human,” offering a more personal shopping experience where buyers can find one-of-a-kind items crafted by small business owners.

In the near term, Etsy is leaning heavily into initiatives to reignite growth. The company is focused on enhancing the customer experience by making shopping easier and more personalized, together with investments in its mobile app.

Etsy is also launching a loyalty program to boost repeat purchases and exploring AI tools to improve product discovery.

However, Etsy’s growth has slowed in recent quarters. Case in point, its gross merchandise sales dropped 2.1% y/y, reflecting challenges in gaining traction. Meanwhile, one positive aspect was that the number of active buyers held steady at 92 million, which is particularly bullish as Etsy now focuses on increasing purchase frequency and deepening engagement, targeting its loyal recurring customers more effectively, as potential drives of its revenue growth rates.

With this balanced background in mind, let’s now discuss its fundamentals.

Etsy’s Revenue Growth Rates Fizzle Out

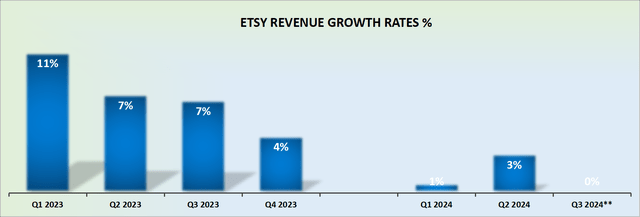

ETSY revenue growth rates — author’s work

In my previous analysis, I said,

Today, I’m not even sure that mid-single-digit growth rates are on the cards. There’s no doubt that the business is struggling for traction. And generally speaking, I know from experience that in most cases, businesses without topline growth have no place in public markets.

But if you think about it, Etsy’s comparable growth rates will naturally start to improve in another 2 quarters. Yes, the business’ growth rates are meager, but it’s a business with some growth left, and as such, it isn’t completely dead, particularly given its attractive free cash flows.

At its core, I believed that Etsy’s growth rates were moderating, but at the same time, I had expected that the business’ growth rates would remain stable.

However, this no longer appears to be the case. As it stands right now, Etsy is struggling to maintain its growth in a highly competitive e-commerce landscape, where consumers have numerous online alternatives.

While I previously expected that Etsy’s growth rates would stabilize, recent trends suggest otherwise.

The company faces mounting pressure from larger competitors, with Amazon (AMZN) being its biggest rival. Amazon’s vast marketplace, superior logistics, and diverse product offerings make it a formidable competitor, attracting consumers who might otherwise have shopped on Etsy for similar items. As a result, Etsy is finding it increasingly challenging to stand out and sustain growth in this environment. However, as you know, Amazon is not the only player in this space either.

With this context in mind, let’s now discuss its valuation.

ETSY Stock Valuation — 8x Forward Free Cash Flow

Etsy is focused on squeezing out all the cost inefficiencies, with the goal of moving up its EBITDA line to around 30%. While its outlook currently points to around 27% for the quarter ahead, I’ve presumed that Etsy will reach the high target of 30% EBITDA margins next year.

This would perhaps translate into $870 million of EBITDA in 2025. Now, we know that Etsy has minimal need for capex, so its free cash flow may end up around $840 million.

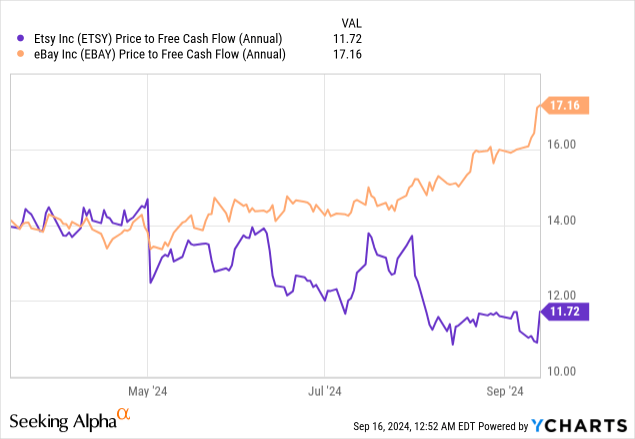

Therefore, Etsy is priced at 8x forward free cash flow, a figure that immediately strikes one as a bargain.

After all, there are not many marketplace-like businesses I know in the US public markets priced at anything even below double digits to free cash flow.

And yet, the big obstacle in the way of this business being able to return substantial cash to investors is the fact that Etsy has around $1.3 billion of net debt.

Yes, Etsy is able to repurchase its stock. But those share repurchases are only valuable to its shareholders if the business has a path to increase its intrinsic value. Otherwise, Etsy is just prolonging the inevitable outcome.

For my part, I believe that the best conclusion for Etsy would be if it used all its free cash flow to pay down its debt and then find a take private buyer, where its shareholders would find a suitable exit price.

The main problem, though, is that paying back its debt could take around 3 years, at which point the business’ could be even a smaller version of itself, so that the exit price for shareholders could be even lower than its current market cap price.

The Bottom Line

Although paying 8x forward free cash flow is undeniably a very cheap multiple for a company like Etsy, I’m not convinced that the stock’s upside potential outweighs its downside risk.

The growth challenges it faces in a highly competitive e-commerce landscape, along with the pressure from larger players like Amazon, make it difficult to see a clear path to significant value creation.

While Etsy’s free cash flow is attractive, I remain uncertain about whether the long-term risks justify the investment at this point. Therefore, despite the low multiple, I don’t believe it’s a compelling opportunity for me.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.