Summary:

- Etsy thrived during the pandemic as consumers flocked to online shopping, but as economic conditions worsened, shares plummeted over 80% from their peak.

- Despite the stock’s decline to 2018 levels, Etsy’s revenues have increased 4.5x, margins have expanded, and earnings have quadrupled.

- Management is implementing strategies like a loyalty program and “Gift Mode” to increase customer engagement and drive gross merchandise sales.

- With shares trading at 11x earnings and a fortress balance sheet, the current valuation presents a strong buying opportunity for long-term investors.

Robert Way

Thesis

E-commerce platform Etsy (Nasdaq:ETSY) was undoubtedly one of the biggest winners during the Covid-19 pandemic. With people confined to their homes and unable to spend on experiences or travel, many resorted to online shopping. Flush with stimulus checks, consumers flooded Etsy with purchases, doubling its marketplace size almost overnight. However, this heyday didn’t last forever. As the macro environment deteriorated and consumers tightened their wallets, Etsy began to crack.

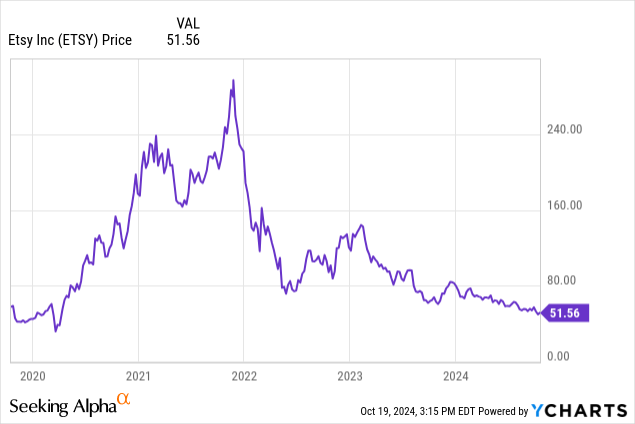

Fast forward to today, investors have written Etsy off for dead, with shares down over 80% from their 2021 peak. Looking at the stock chart, you would expect the company to be permanently impaired and on its way out. However, this couldn’t be farther from the truth. Trading at $51 per share, Etsy has returned to price levels seen in 2018. The difference? Revenues are up 4.5x, margins have expanded, and earnings have increased 4x.

So why does Mr. Market continue to punish Etsy? As is often the case, markets tend to overreact in both directions, swinging from one extreme to another without settling on a middle ground. Was Etsy overvalued during the pandemic at 60x earnings? Absolutely. However, trading at 11x earnings today, levels typically reserved for Utilities, is wildly exaggerated.

As consumer discretionary spending picks up and sentiment gains momentum, I expect Mr. Market to change his tune. Management has a variety of levers to pull, including a new loyalty program and Gift mode, which should serve as key catalysts for kickstarting growth. Once Etsy demonstrates that it can grow gross merchandise sales (GMS), its primary metric, at a mid-single-digit clip, I expect a multiple re-rating closer to the sector median of 18x. In the meantime, the company’s highly attractive, asset-light business model and fortress balance sheet will enable management to continue heavily repurchasing shares at this incredibly cheap valuation.

With the holiday season right around the corner and expectations at their lowest, even the slightest positive developments could spark a rally in shares. Not to mention, with nearly 15% short interest, such a rally could result in a massive short squeeze. Rather than sitting on the sidelines, I see the current valuation as a “pound the table” buying opportunity for long-term investors and have started aggressively adding shares at these levels.

Company Background

Founded in 2005, Etsy is a two-sided online marketplace focused on selling handmade or vintage items and craft supplies. When I think of Etsy, I picture things like custom jewelry, engraved cutting boards, and handmade candles.

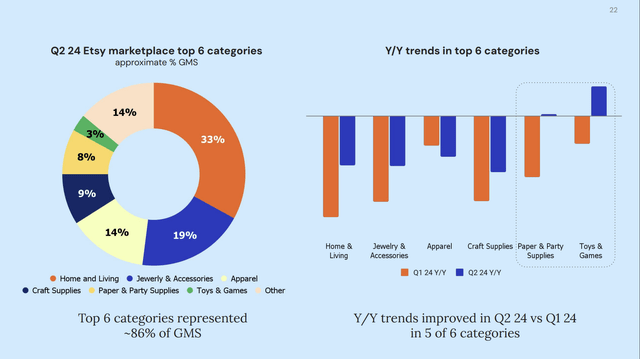

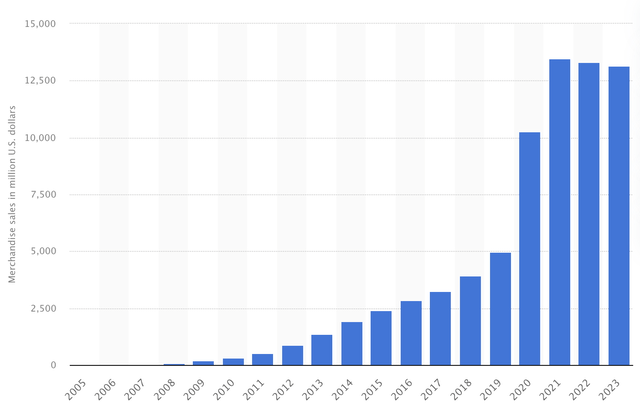

In FY2023, Etsy generated $13.2 billion in gross merchandise sales (GMS), a decrease of 1.2% year-over-year. The breakdown of GMS included Home and Living at 35% ($4.6 billion), Jewelry and Accessories at 20% ($2.6 billion), Apparel at 15% ($2 billion), Craft Supplies at 10% ($1.3 billion), Paper and Party Supplies at 5% ($600 million), and Toys and Games at 5% ($600 million). While the core Etsy marketplace accounts for nearly 90% of GMS, the company also owns Reverb, a musical instrument marketplace, and Depop, a fashion resale platform, accounting for 7.1% and 4.6%, respectively. With nearly 92 million active buyers, 9 million active sellers, and over 120 million items for sale, Etsy ranks as the third most popular e-commerce site in the U.S.

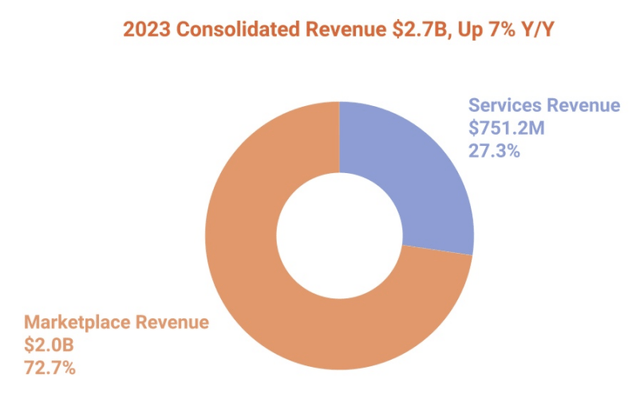

Etsy has one of the most unique, attractive business models I’ve encountered in my research. The asset-light structure requires little to no capital expenditures, as there are no warehouses or inventories. Instead, Etsy simply acts as a facilitator between sellers and buyers, earning fees for its services. The company’s consolidated take rate (essentially Etsy’s share for every dollar spent) is 22%. Over 70% of Etsy’s revenues come directly from the marketplace, which includes transaction fees, payment processing fees, and listing fees. The remaining 27.3% is generated from optional services such as on-site advertising and shipping labels.

The cost of revenues really only consists of payment processing and cloud infrastructure fees, resulting in gross margins north of 70% and adjusted EBITDA margins of around 28%. It doesn’t get much better than that, folks.

Moving to management, CEO Josh Silverman is certainly a jockey worth betting on. Silverman is well-known for his turnaround capabilities, having held top positions at eBay (NASDAQ:EBAY) and previously serving as CEO of Skype, where he attracted 300 million new users, doubled revenues, and tripled profits during his tenure. His appointment as CEO of Etsy marked a significant inflection point for the company, which was fending off activists and facing potential acquisition by private equity as it struggled to manage costs. Within months of taking over in 2017, Silverman obsessed with cutting costs, laying off nearly a quarter of the workforce, and rapidly transforming the company’s financial model.

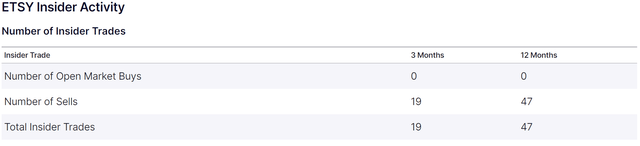

My only knock on management is that I would like to see more insider transactions at these depressed prices. In the last twelve months, there have been 47 insider sales with zero open market purchases and only 1% of shares held by insiders. Other than that, this is as sound of a management team as it comes.

Etsy Post Pandemic

As I mentioned earlier, Etsy’s stock performance during the pandemic makes total sense. E-commerce boomed, jumping 55% during COVID-19, as consumers found themselves flush with stimulus cash and had virtually nothing else to spend it on. If you look at the stock chart, Etsy is a near mirror image of another pandemic fallen angel, Paypal (NASDAQ:PYPL), which I’m also heavily invested in. The point is that these conditions were an anomaly.

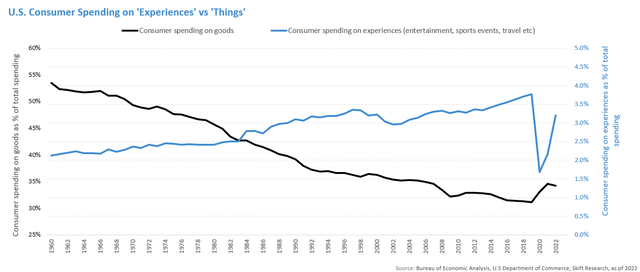

As we emerged from the pandemic, the demand for material goods took a backseat to what we now refer to as “revenge travel.” The pent-up demand for travel and experiences resulted in a 30% increase in consumer spending on foreign trips and live entertainment. Unless it was a custom shirt made for Taylor Swift’s Eras Tour, consumers were not touching it.

At the same time, inflation peaked at 9.1% in June 2022, prompting consumers to tighten their spending on non-essential goods. For a company like Etsy, which is as discretionary as you can get, this shift toward essential spending and value was the worst-case scenario. Simply put, when consumers are worried about the price of milk or gas, they’re not splurging on custom engraved cutting boards. Unfortunately, the discretionary nature of Etsy’s business leaves management with limited levers to pull during downturns in consumer spending.

Despite these challenges, there is a silver lining. In 2023, Etsy achieved nearly the same gross merchandise sales as during the pandemic peak ($13.16 billion compared to $13.49 billion, a mere 2.5% decline).

Statista, Etsy Investor Relations

This suggests that despite the loss of pandemic tailwinds and a downturn in consumer spending, Etsy has maintained its share. To me, this indicates that Etsy’s challenges are cyclical rather than structural. That’s the key. Importantly, this includes recovering from pandemic-related sales losses, such as the $875 million fabric face mask sales from 2020 to 2021. The ability to replace these lost revenues in this macro environment is super impressive.

So, while the stock price may imply that Etsy is on the verge of going out of business, this is simply not the case. Etsy is still growing at a solid mid-single-digit clip, with margins largely intact. With many headwinds subsiding and as we enter a rate-cutting cycle, I expect consumer discretionary spending and sentiment to pick up. After a few more strong retail sales reports like September’s big beat come in, I don’t expect this pessimism to last much longer.

Re-Accelerating Growth

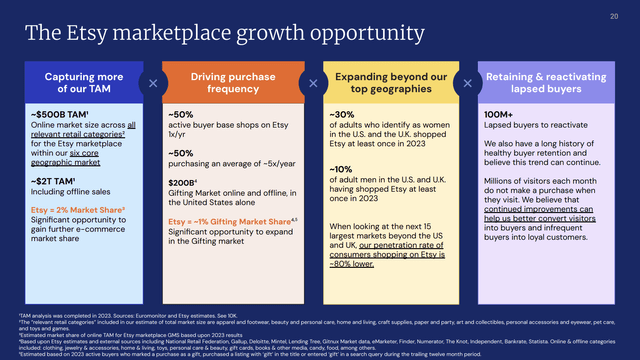

Rather than waiting for consumer discretionary spending to pick up, management has identified a handful of levers to help kickstart growth. One of the most impactful initiatives is “Gift Mode,” which uses artificial intelligence to help shoppers find the perfect gift. By entering details about the recipient, such as relationship, occasion, and interests, Etsy provides a list of gift options tailored to over 200 recipient personas, like “The Cat Lover” or “The Mom.” Shoppers can even include a “gift teaser,” featuring a gift note and a sneak peek of the item. The initiative is aimed at increasing consideration among buyers, as only 12% of U.S. shoppers identified Etsy as a gift destination. Rather than being an afterthought for shoppers who can’t find what they’re looking for, Etsy aims to be at the top of the buyer’s consideration set. “Gift Mode” has already shown promising early results, with 27% of marketplace sales tied to gifting growing by 4.1% this past quarter. Bigger picture, this represents a tremendous opportunity, as the average American spends about $1,600 annually on gifts within a total addressable market of $200 billion, of which Etsy currently holds 1%.

Additionally, Etsy launched its first loyalty program, “Etsy Insider.” While still in beta, the program features benefits such as free domestic shipping, discounts, and early access to merchandise, all for a price comparable to a “latte” (likely around $5 per month). The goal of the loyalty program is centered around frequency, specifically converting repeat buyers (those who shop 3-4 times annually) into more lucrative habitual buyers. Once consumers invest in the program, they are likely to seek value from it, solidifying Etsy as a top consideration. Given that half of Etsy’s buyer base only makes one purchase a year, the success of this loyalty program could be a significant driver of re-accelerating GMS growth.

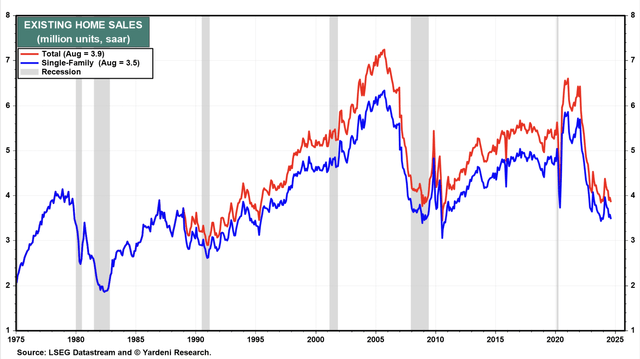

Aside from increasing frequency and consideration, another key tailwind that I feel is overlooked is the recovery of the housing market and its implications for Etsy. Over 35% of Etsy’s sales come from the Home and Living category, which saw low single-digit declines in FY2023.

LSEG Datastream, Yardeni Research

The segment has faced a barrage of challenges over the years, with industry peer Wayfair (NYSE:W) calling the current slowdown in the home goods category unprecedented. CEO Niraj Shah even claimed that “Our credit card data suggests that the category correction now mirrors the magnitude of the peak to trough decline the home furnishing space experienced during the great financial crisis.” As we enter this easing cycle and mortgage rates begin to normalize, the frozen housing market should begin to thaw out. As it gains momentum, I expect Etsy’s Home and Living category to return to solid growth and reap the benefits. Whether it’s a customized doormat for a new home, furniture, or welcome gifts, Etsy stands to be a huge beneficiary.

With these operational initiatives and macro tailwinds combined, I expect Etsy to grow at a mid-single-digit clip over the next couple of years. This outlook is likely conservative, given Euromonitor’s estimate of a compound annual growth rate of 8% in global e-commerce revenue in Etsy’s core markets through 2027. In the long run, I expect Etsy to lean in on international expansion, where transactions yield higher payment fees, and work on building awareness among adult men, as only about 10% of adult men in the U.S. and UK shopped on Etsy in 2023. Once this return to steady growth becomes obvious to Mr. Market, a multiple re-rating closer to industry peers at 18x is on the table.

Competition and Industry Consolidation

One of the main knocks against Etsy lately is the rise of competition, which I find a bit puzzling. This echoes the narrative from 2017, when bears claimed the business had reached its ceiling and that Amazon (NASDAQ:AMZN) Handmade would take it out of business. Fast-forward to today, Etsy has grown its gross merchandise sales nearly fourfold, and Amazon Handmade is obsolete.

Yet, here we are again, with investors fixated on the exact same narrative: Etsy has peaked, won’t return to growth, and faces intensified competition. There’s one key factor this thesis overlooks: Etsy isn’t interested in competing with e-commerce giants. Okay, obviously, Etsy still competes for the wallet share of consumer discretionary spending. I will certainly concede that. However, Etsy has recognized a key competitive advantage that its industry peers lack. Unlike Amazon or Walmart (NYSE:WMT), Etsy isn’t forced to compete on the basis of price or fulfillment speed. This is because, instead of offering identical, commoditized products, which are typically sourced from the same mass manufacturers, Etsy has carved out a narrow niche for handmade and customized goods.

This unique positioning essentially shields Etsy from the price-driven competition and “race to the bottom” mentality that has become so common. Consumers are willing to wait a bit longer for delivery or pay a premium for handmade, locally sourced products.

So, rather than recklessly engaging in price wars (which they would never win), Etsy has begun leaning into what makes it unique. They are placing a greater emphasis on showcasing sellers and the human connection behind their products. To me, this is a perfect example of a company preserving long-term health over chasing short-term profits, a strategy that will pay off exponentially. By resisting the urge to replicate its peers through price cuts or perks like free shipping, Etsy is preserving what makes it special and maintaining its market premium. That’s key.

In the long run, I expect the trend of commoditization in e-commerce to lead to consolidation within the industry. With so many players offering identical products and services, the notion that they can all survive is unrealistic. Until then, Etsy stands out as the top alternative to these commoditized markets and continues to build upon what makes them unique.

Balance Sheet and Capital Allocation

Rarely do you find a company with such an attractive financial model and a strong balance sheet trading as if it’s going out of business. Luckily, while the market continues to be fixated on the timing of a return to growth, investors seem to have overlooked Etsy’s financial position. The company holds $1 billion in cash and cash equivalents, with gross debt of $2.29 billion. With no maturities until 2026, Etsy has found itself in an extremely flexible position. Thanks to its highly cash-generative and capital-light model, Etsy has converted nearly 90% of its adjusted EBITDA to free cash flow over the past twelve months.

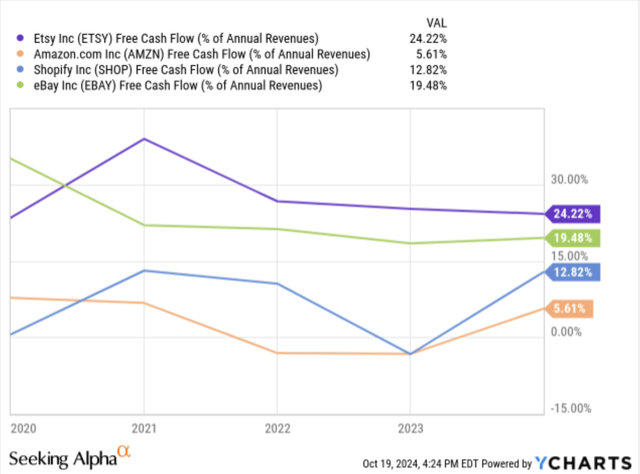

This translates to 24.2% free cash flow as a percentage of sales, well above industry peers. Most importantly, this strong free cash flow generation provides management with the runway necessary to complete the turnaround.

While the ability to generate free cash flow is great, what’s key is how management utilizes it. Etsy has outlined three key priorities for capital allocation: core investments in organic growth, selective acquisitions, and share repurchases.

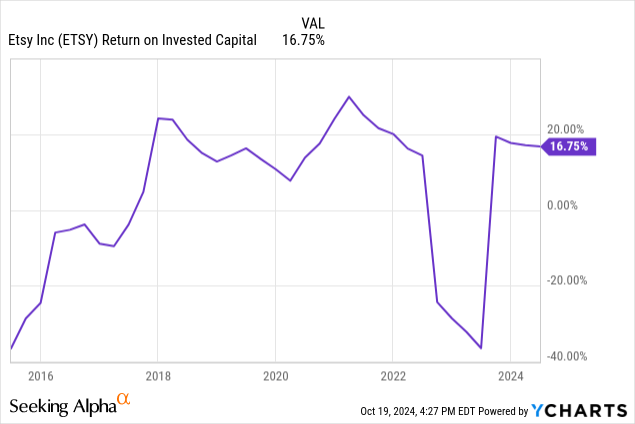

Management has consistently demonstrated an ability to generate excess returns, especially from organic investments, achieving a return on invested capital of 16.75%. Whether it be improving Etsy’s algorithm, launching the paid loyalty program, or introducing “Gift Mode,” management has a solid track record of delivering internally.

However, the track record for external investments is less impressive. Etsy’s acquisition of Depop in 2021, the height of the e-commerce boom, came at a hefty price of $1.625 billion, valuing the company at 23x price/sales. A subsequent $1 billion impairment charge in Q3 2022 confirmed our suspicions that it was a massive overpay. While the vision of building a “House of Brands” was understandable, the timing raises questions about management’s ability to pursue strategic acquisitions at reasonable valuations. Personally, I would prefer management to focus on organic growth and, most importantly, return capital to shareholders.

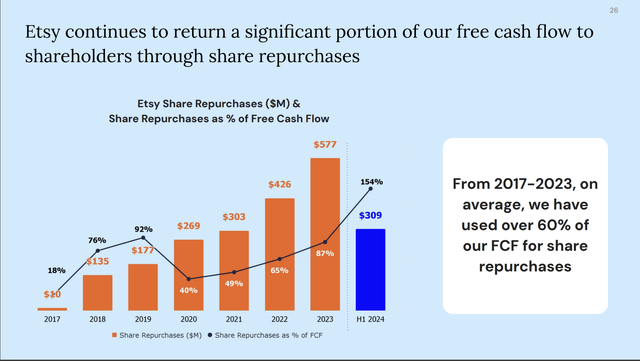

As Etsy enters this maturity stage, the focus has shifted from offsetting dilution to opportunistically repurchasing shares at attractive valuations. For investors, this is great news. Currently, there is $416 million remaining under the $1 billion share repurchase program. Given the current valuation, I suspect we may see a new repurchase authorization announced with Etsy’s Q3 report.

From 2017 to 2023, management utilized over 60% of free cash flow for buybacks, a figure that has significantly expanded to nearly 90% during FY2023 and an impressive 154% in H1 this year. If management continues this pace throughout the back half of the year, we could see over $600 million in buybacks. Considering Etsy’s current valuation and financial flexibility, I actually expect management to utilize the full amount under the current authorization, implying a little over $700 million in buybacks this year. Assuming an average repurchase price of $70 per share (a deliberate premium), this would reduce shares outstanding by about 10 million, or 8.4%

While I don’t expect the pace of these repurchases to be sustainable, a conservative estimate would suggest an annual reduction in the 3% range. This will provide a solid backstop for steady earnings growth. Until this becomes obvious, both investors and management can take advantage of Mr. Market’s short-sightedness.

Valuation

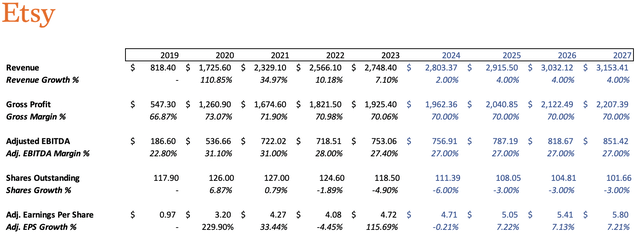

Etsy Investor Relations, Author’s Calculations

Starting with top-line revenues, I projected 2% growth this year, which is in line with analyst estimates. This was followed by an expansion to 4% top-line growth through FY2027. Given the expectations for global e-commerce growth at 8% and the improving macro environment in Etsy’s core markets, this is likely conservative. I estimated gross margins to remain at 70% through FY2027, consistent with Etsy’s five-year average of 70.63%. For adjusted EBITDA margins, I projected 27%, which is in line with management’s guidance for FY2024, and will maintain this level through FY2027.

In terms of share repurchases, I forecasted a 6% reduction this year, followed by a 3% reduction in subsequent years. With no debt maturities until 2026 and strong free cash flow generation, I expect the bulk of FCF to be allocated to share buybacks.

Assuming an effective tax rate, interest expense, and D&A consistent with historical averages, I calculated an adjusted earnings per share of $5.80 by FY2027. Applying an 18x multiple to these projected earnings, in line with the sector median, yields a share price of $104, implying a double from current levels. Over three years, this boils down to a compound annual growth rate of 27%.

Risks

While I am very bullish on Etsy’s turnaround, there are always risks to consider with every investment. Some of these include:

- Slowdown in consumer spending: Situated at the far end of the consumer discretionary sector, Etsy is highly sensitive to shifts in consumer sentiment and spending. Any prolonged downturn could significantly impact its revenue growth.

- Increased competition: Although I believe most concerns about competition, the e-commerce industry is undeniably competitive. Etsy’s inability to offer competitive pricing or fulfillment speed could hinder its growth.

Conclusion

While investors remain fixated on Etsy’s timeline for a return to growth, I believe they are missing several key points. For those who can see the forest through the trees, Etsy’s current risk/reward profile looks to be a compelling opportunity. As the macro environment gradually improves and Etsy’s operational improvements bear fruit, I expect the narrative surrounding Etsy to flip. Until then, management will continue to aggressively repurchase cheap shares, and I will accumulate shares as well. I’m rating Etsy as a “Strong Buy” with a price target of $104.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ETSY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.