Summary:

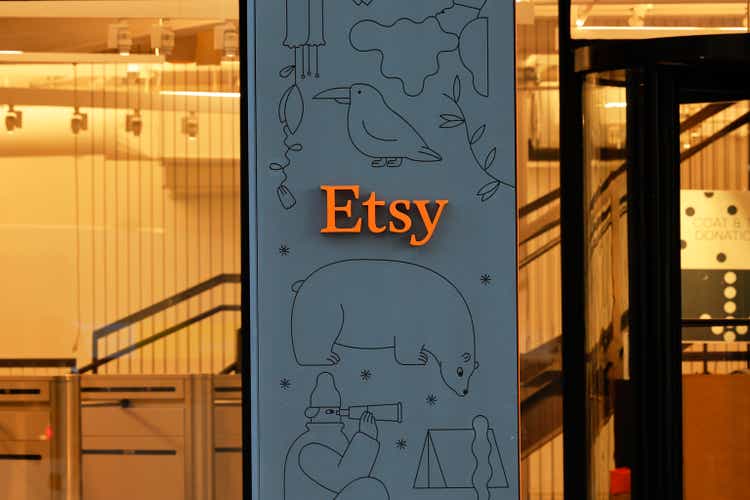

- Etsy’s stock has corrected somewhat this year, making it a potential investment opportunity.

- The company has maintained high profit margins and is expected to see a return to growth in Q2.

- Etsy has a larger buyer base and higher average spend per buyer since pre-pandemic, making it a strong competitor in the e-commerce market.

Michael M. Santiago

Most tech stocks, alongside the S&P 500, are at multi-year highs driven by enthusiasm for AI and hope for a more benign Fed rate policy. But amid such expensive conditions in the market, I’m on the hunt for stocks that have less downside risk and have already corrected somewhat this year.

Etsy (NASDAQ:ETSY) is one of these names. The arts-and-crafts e-commerce website has sunk more than 10% year to date, with losses picking up after the company posted a mixed Q4 earnings quarter in late February. We had hoped to see positive GMS trends exiting Q3 sustain into Q4; alas, this turned out not to be true.

I last wrote a bullish opinion on Etsy in November, when the stock was trading in the high $70s. In my view, the combination of a slightly lower share price helps to offset the more negative GMS trends we’ve observed exiting Q4, and I remain bullish on Etsy’s prospects for the remainder of the year.

Two things underpin my optimism. First: Etsy is maintaining very high profit margins despite kicking up its marketing spend. It ran successful holiday campaigns that helped to drive accelerating GMS growth during the Q4 holiday season. It has already begun spending to boost brand awareness, and the company believes that it is poised for a return to growth starting in Q2 of this year.

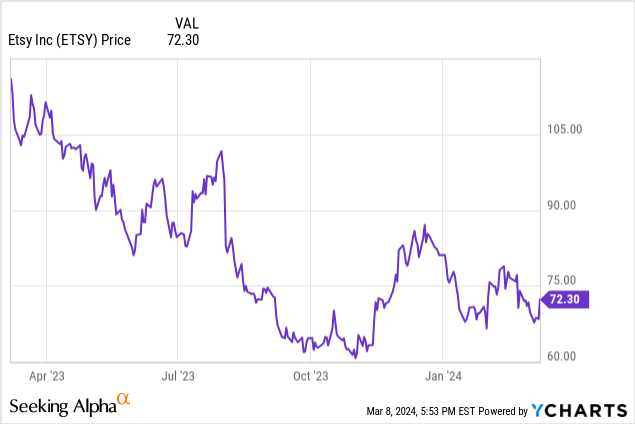

Second: we have to recognize that Etsy is a much larger platform now than pre-pandemic; put another way, the company has managed to retain much of the growth it experienced during COVID.

Etsy vs. pre-pandemic (Etsy Q4 earnings deck)

As shown in the chart above: the buyer base has doubled, the number of repeat and habitual buyers has skyrocketed, and average spend per buyer is also up more than 20% since pre-COVID.

Beyond this, here’s a reminder of the other core bullish drivers for Etsy:

- Rich profit margins. Etsy regularly posts adjusted EBITDA margins nearing 30%, which is a nice concession for a company whose top-line growth has slowed to the single digits.

- New buyer trends still remain well above pre-pandemic levels. Though certainly a niche site, Etsy continues to draw a following, with ~6 million net-new active buyers added per quarter. Reactivated buyers are also high, allowing Etsy to shift the focus of its marketing spend to retention rather than new customer acquisitions.

- Seller fees are still below the competition. Though Etsy seller fee increases trigger immediate ire, it must be noted that Etsy’s 7.5% fee is still less than eBay, Amazon, and Poshmark. Fees for these sites vary by category, but generally average around ~10% or more of final sales prices.

All in all: don’t lose hope in Etsy just yet. We’re hoping to see marketing investments pay off in mid-2024 and help Etsy to deliver revenue growth on top of a very profitable existing core business.

Q4 download

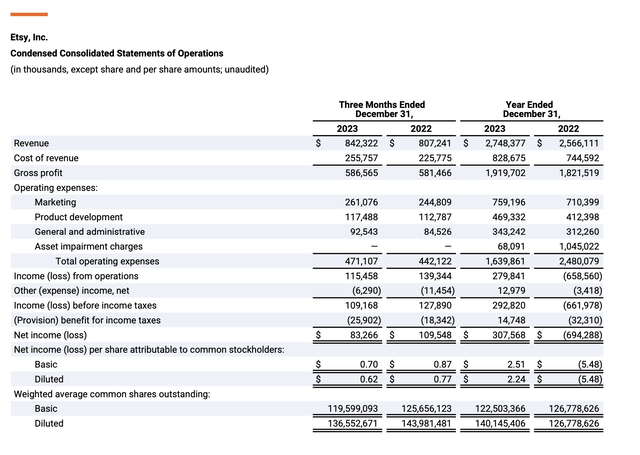

Let’s now go through Etsy’s latest quarterly results in greater detail. The Q4 earnings summary is shown below:

Etsy Q4 results (Etsy Q4 earnings deck)

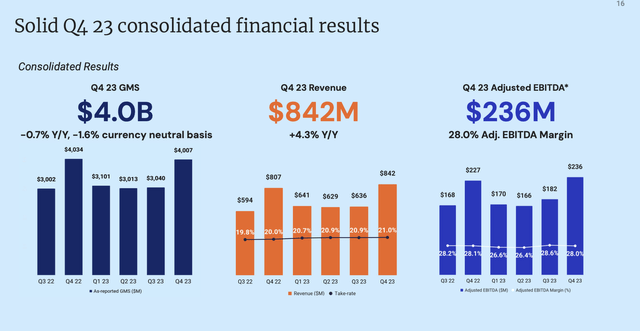

Revenue grew 4.3% y/y to $842.3 million, ahead of Wall Street’s $827.2 million (+1.8% y/y) by an impressive 250bps margin. While revenue came in ahead of expectations, disappointment centered around GMS, which declined -1.6% y/y on an FX-neutral basis – disappointing as Etsy had briefly returned to ~1% growth in Q3.

Etsy Q4 highlights (Etsy Q4 earnings deck)

Yet the company also noted strong holiday performance, with GMS up ~4% around Cyber Monday. The company especially believes that gifting through the Etsy platform will be a meaningful driver of growth going forward, with an annual U.S. opportunity of over $200 billion.

Note that the company has excelled at bringing back “lapsed buyers” into the platform. Per CFO Rachel Glaser’s remarks on the Q4 earnings call:

Our year-over-year Etsy marketplace GMS trendline improved in November and December following the challenging October that we described on our November call, bringing results in ahead of our internal expectations. International markets were once again a bright spot, with Etsy marketplace GMS, excluding U.S. domestic, up 4% year-over-year in the fourth quarter. The growth was led by positive trends in the UK, and strength in the Netherlands, Switzerland, and Austria, with largely flat trends in Germany […]

U.S. active buyer trends continue to improve. International buyer growth remains strong. And we had 6% growth in buyers who identify as male. We added over 8 million Etsy marketplace new buyers in the fourth quarter, up over 40% from the fourth quarter of 2019. And we reactivated nearly 10 million lapsed buyers, a record number, up 13% year-over-year, and up 122% from 2019.”

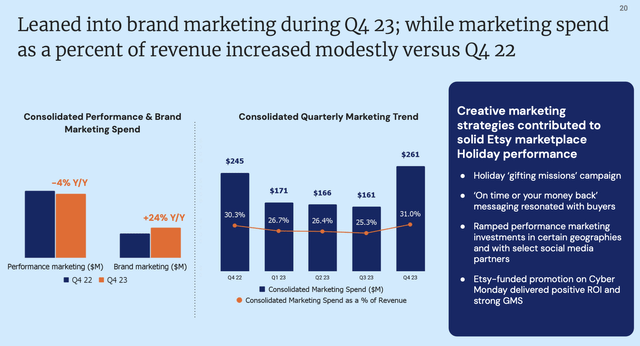

And as previously mentioned, the company is ratcheting marketing spend back up. Etsy spent $261 million on marketing in Q4, up 7% y/y and representing 31.0% of revenue, up 70bps y/y.

Etsy marketing spend (Etsy Q4 earnings deck)

Despite this, the company managed to maintain roughly flat adjusted EBITDA margins at 28.1%.

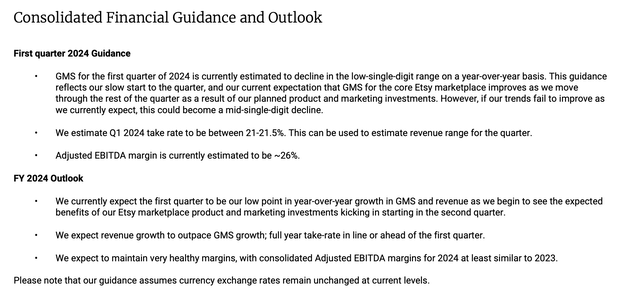

The company’s FY24 guidance statement, shown below, showcases the company’s expectation that “product and marketing investments [will kick] in starting in the second quarter”:

Etsy outlook (Etsy Q4 earnings deck)

It’s worth noting as well that Etsy is expecting to “at least” maintain its adjusted EBITDA margin of 27% in FY24, despite the uptick in marketing spend that will hopefully re-ignite GMS growth. It may get better before it gets worse for Etsy as it expects continued single-digit declines in GMS in Q1, but investors have an opportunity now to buy on the dip.

Key takeaways

With hefty profitability, a buildup in its buyer base, marketing investments to yield fruit in 2024, and a differentiated e-commerce platform that still beats competitors on seller fee structures, there’s a lot to like about Etsy heading into the remainder of the year. Use the post-earnings dip as an opportunity to buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ETSY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.